Guotai Haitong Macro: "Counter-cyclical and Cross-cyclical Adjustment" Releases Subtle Signals of Policy Shift, Urgency for Short-term Monetary Easing Has Decreased

Guotai Haitong's macro analysis points out that the tone of monetary policy continues to be moderately loose, emphasizing the combination of counter-cyclical and cross-cyclical adjustments, signaling a subtle shift in policy. The urgency for short-term monetary easing has decreased, with more focus on policy implementation and cross-cyclical reserves. If economic growth pressure increases, there is still room for reserve requirement ratio cuts and interest rate reductions next year, and adjustments to residential loan rates are still possible

Summary

**Overall, the tone of monetary policy continues the spirit of the second quarter report and the Central Political Bureau meeting, emphasizing "implementing a moderately loose monetary policy" and "maintaining reasonable growth in the total financial volume." It is noteworthy that, building on the emphasis on "counter-cyclical adjustment" in previous quarters, the third quarter report further highlights the combination of "counter-cyclical and cross-cyclical adjustments" (the last mention was in the first quarter 2024 monetary policy report), reflecting the requirements of the 14th Five-Year Plan while also signaling a subtle shift in the focus of policy in the short term.

In conjunction with several columns, the central bank, in response to questions such as "Is monetary policy tightening?", "Is financing weak?", and "Are interest rates ineffective?", indicates that the goals of monetary policy are no longer solely focused on short-term counter-cyclical support but will also consider forward-looking arrangements across cycles. This also reflects that the monetary policy framework is transforming, no longer focusing on the rapid growth of total credit scale, but rather on efficiency optimization and structural adjustment to better serve the medium- and long-term goals of high-quality economic development.

We believe that under the controllable pressure of completing the annual economic targets, the urgency for short-term monetary easing has decreased, focusing more on implementing and refining previous policies while considering cross-cyclical policy reserves. If the pressure for stable economic growth increases in the future, there will still be room for monetary policy to lower the reserve requirement ratio and interest rates next year. Moreover, considering the low inflation, China's real interest rates remain historically high, indicating a necessity for further interest rate cuts. In the current context where the room for further reduction in corporate financing costs is limited, there is still space for adjustments in residential loan interest rates.

On November 11, 2025, the People's Bank of China released the "2025 Third Quarter China Monetary Policy Implementation Report," and our interpretation is as follows:

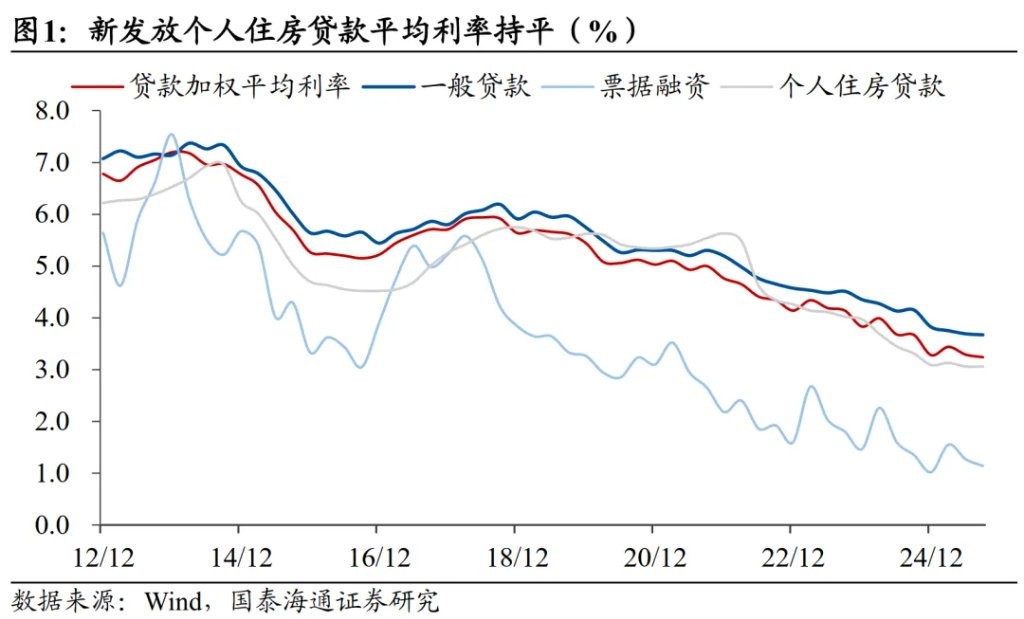

1 Personal mortgage rates remain flat month-on-month

The interest rates on newly issued loans continue to decline, mainly driven by the decrease in corporate financing costs. The central bank announced that the weighted average interest rate of newly issued loans by financial institutions in September 2025 fell by 5 basis points compared to June, with the general loan interest rate decreasing by 2 basis points to 3.67%, and the corporate loan interest rate decreasing by 0.08% to 3.14%; the bill financing rate decreased by 13 basis points to 1.14%. Meanwhile, the interest rate on newly issued personal mortgages in September remained flat at 3.06%, showing a relatively slow decline this year, down only 3 basis points compared to 3.09% in December 2024.

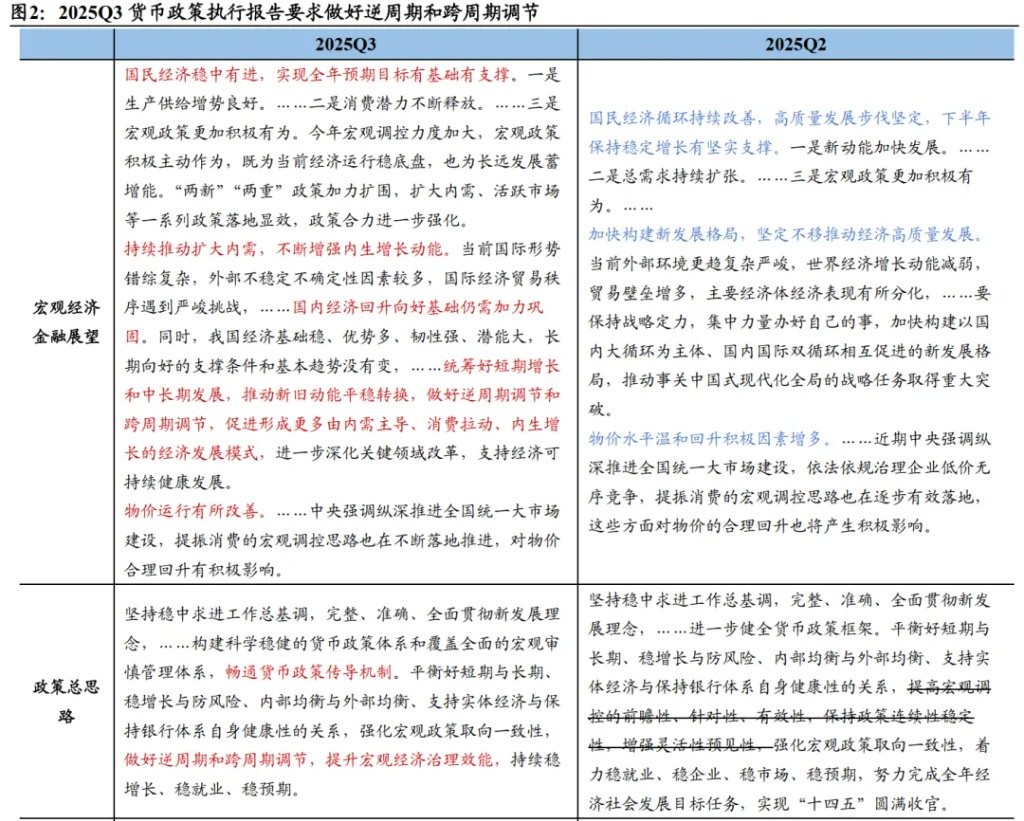

2 Positive tone for the annual economy, emphasizing endogenous growth momentum

The central bank maintains a positive tone for the annual economy. The third quarter monetary policy execution report continues the positive tone from the second quarter regarding the economy, emphasizing that the economy is "steady with progress" and "there is a foundation and support for achieving the annual expected goals." At the same time, the central bank believes that "there are many external instability and uncertainty factors" and "the world economic growth momentum is insufficient," thus we must concentrate our efforts on doing our own things well Compared to the second quarter, the report further emphasizes the importance of expanding domestic demand, stressing the need to "continuously promote the expansion of domestic demand and enhance endogenous growth momentum," and adds "to promote the formation of more economic development models led by domestic demand, driven by consumption, and characterized by endogenous growth." This statement is also highly aligned with the recent requirements of the 14th Five-Year Plan policy.

Overall, the report focuses more on consolidating the foundation for recovery and improvement, emphasizing the cultivation of endogenous growth momentum, and adopts a more cautious yet confident attitude towards external challenges.

3 Balancing Counter-Cyclical and Cross-Cyclical Adjustments

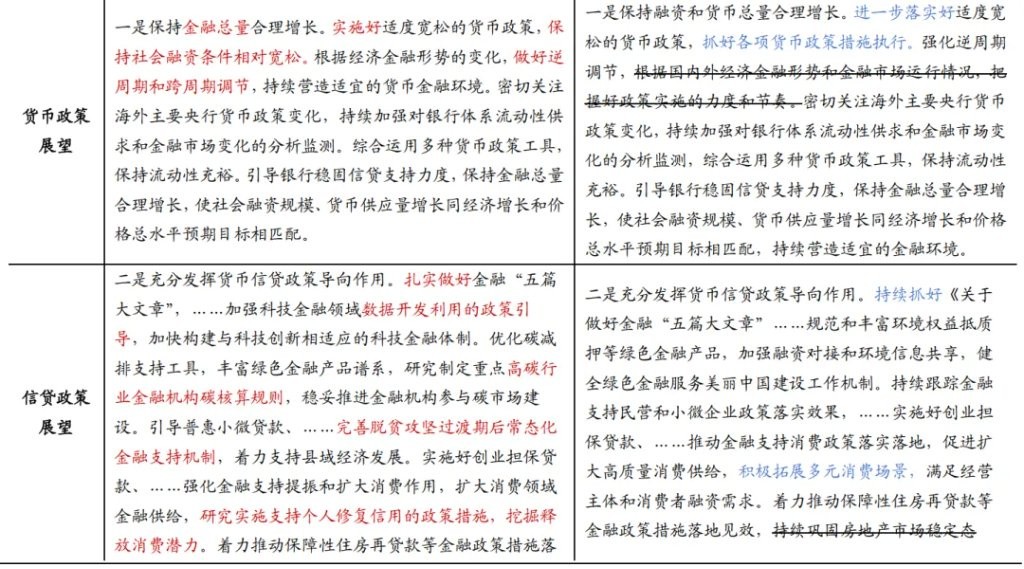

Overall, the tone of monetary policy continues the spirit of the second quarter report and the Central Political Bureau meeting, reiterating the implementation of "moderately loose monetary policy" and "maintaining reasonable growth in the total amount of finance." It is noteworthy that, building on the emphasis on "counter-cyclical adjustments" in previous quarters, the third quarter report further highlights the combination of "counter-cyclical and cross-cyclical adjustments" (the last mention was in the first quarter 2024 monetary policy implementation report), reflecting the recent requirements of the 14th Five-Year Plan and signaling a subtle shift in policy focus in the short term.

Combining several columns, the central bank, in response to questions such as "Is monetary policy tightening?", "Is financing weak?", and "Are interest rates ineffective?", indicates that the goals of monetary policy are no longer solely focused on short-term counter-cyclical support but will also consider cross-cyclical forward-looking arrangements. This also reflects that the monetary policy framework is transforming, no longer focusing on rapid growth in total credit scale, but rather on efficiency optimization and structural adjustment to better serve the medium- and long-term goals of high-quality economic development. In the future, monetary policy will pay more attention to balancing short-term stability and long-term development.

In Column One, "Scientifically Viewing Financial Total Indicators," the central bank explains that the current slowdown in loan growth is a "normal phenomenon," resulting from the diversification of financing structures, and does not indicate monetary tightening or a weakening of financial support. Observing financial totals should focus more on social financing scale and money supply indicators, while recognizing the partial substitution effect of direct financing on credit, avoiding a one-sided perspective of "only loans." Looking ahead, monetary policy will continue to "de-emphasize quantity targets" and focus more on efficiency and structure.

Column Two explains the relationship between base money and broad money, emphasizing that money creation depends on banks' willingness to lend and the financing needs of the real economy, and cannot be determined solely by the central bank's unilateral "injection," indicating that future monetary policy will rely more on interest rate transmission rather than quantity expansion.

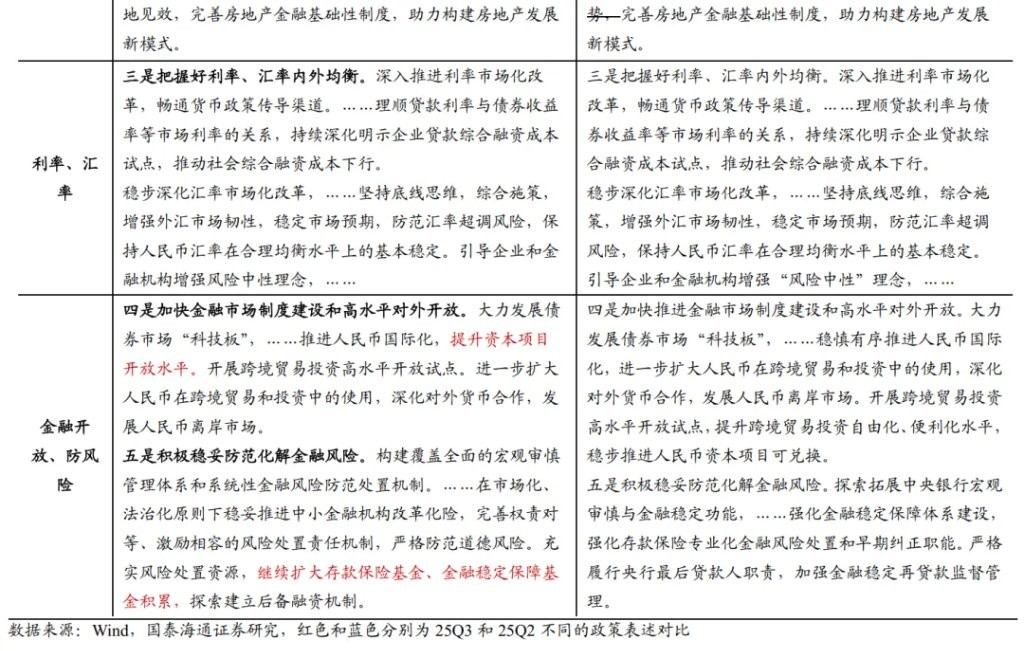

In the column "Maintaining a Reasonable Interest Rate Pricing Relationship," the central bank believes there is currently an issue of "loan rates dropping quickly while deposit rates drop slowly," which compresses bank interest margins and affects their ability to continue lending. The central bank is correcting this through self-regulatory mechanisms and interest rate enforcement to maintain a reasonable interest rate pricing relationship, allowing for smoother interest rate transmission. From a cross-cyclical perspective, preventing banks from excessively lowering rates due to "involution-style" competition and protecting the financial system's ability to continuously support the real economy is a cross-cyclical arrangement for financial stability.

Thus, we believe that under the controllable pressure of achieving the annual economic targets, the urgency for short-term monetary easing has decreased, focusing more on implementing and refining previous policies while considering cross-cyclical policy reserves. However, if the pressure for stable economic growth increases in the future, there will still be room for monetary policy to cut reserve requirements and interest rates next year Moreover, considering the low inflation, our country's real interest rates remain at historically high levels, indicating the necessity for further interest rate cuts. In the context where there is limited room for further reduction in financing costs for enterprises, there is still room for adjustment in loan interest rates for the household sector.

4 Continue to Optimize Credit Structure

Under the requirements of counter-cyclical and cross-cyclical adjustments, the report continues to emphasize the goal of optimizing the credit structure. In addition to continuing to strengthen support for the five major areas of finance, the report also adds requirements such as "expanding financial supply in the consumption sector and researching and implementing policies to support individuals in repairing their credit." It is expected that in the next phase, monetary and fiscal policies to promote consumption are still likely to be introduced, and the recovery of consumption can continue to be observed.

In addition, the interest rate policy and exchange rate policy continue to follow the statements made in the second quarter execution report, with the interest rate side continuing to smooth the transmission chain and guiding social financing costs to stabilize and decrease; on the exchange rate side, maintaining composure, the current exchange rate is basically stable at a reasonable and balanced level, and the structure of monetary policy can "take the initiative."

Risk Warning: Uncertainty of Monetary Policy

Article authors: Ying Jiaxian, Liang Zhonghua, Source: Liang Zhonghua Macro Research, Original title: "Doing a Good Job in Counter-Cyclical and Cross-Cyclical Adjustments — Interpretation of the 2025 Q3 Monetary Policy Report (Guotai Haitong Macro Ying Jiaxian, Liang Zhonghua)"

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at one's own risk