The "surge" in large-scale layoff notices, with data continuously "triggering alarms," indicates a sharp downturn in the U.S. job market

The U.S. labor market is experiencing a sharp cooling, with a surge in layoff announcements. In October, the number of layoffs reached 153,000, the highest in over 20 years. The number of WARN Act notifications from Goldman Sachs has also hit a new high since 2016, indicating an increased risk of potential employment recession. Investors are focusing on private sector data, which shows that employment momentum is rapidly declining, reshaping market expectations for the economic outlook and putting new pressure on the Federal Reserve

Latest data from the private sector shows that the U.S. labor market is experiencing a sharp and profound cooling, with the pace of deterioration potentially far exceeding what official statistics can reveal. From a significant surge in corporate layoff announcements to multiple alternative employment growth tracking indicators turning negative, various leading indicators are intensively sending warning signals, suggesting that a potential employment recession may be imminent.

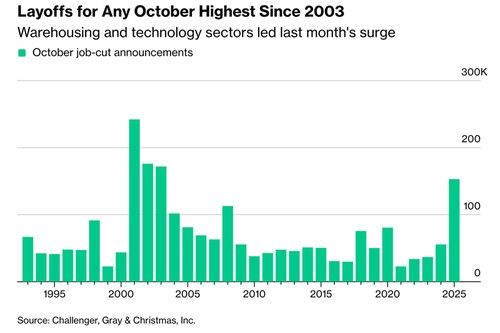

The most striking alarm comes from the surge in corporate layoffs. According to the latest report from Challenger, Gray & Christmas, the number of corporate layoffs in October soared to 153,000, setting a record high for the month in over 20 years. Meanwhile, the number of Worker Adjustment and Retraining Notification (WARN) Act notices tracked by Goldman Sachs also reached a new high since 2016 (excluding the anomalies at the beginning of the pandemic), which are warnings that companies must submit before conducting large-scale layoffs.

These trends are reshaping market expectations for the economic outlook. The employment market, which has remained resilient, has been a key pillar supporting the "soft landing" narrative, and now, the sharp downturn in the labor market has significantly increased the risk of recession. Investors and analysts are increasingly focusing on these high-frequency alternative data to assess the true state of the economy, which also puts new pressure on the U.S. Federal Reserve, as the market begins to question whether it has "fallen far behind the curve" on interest rate cuts.

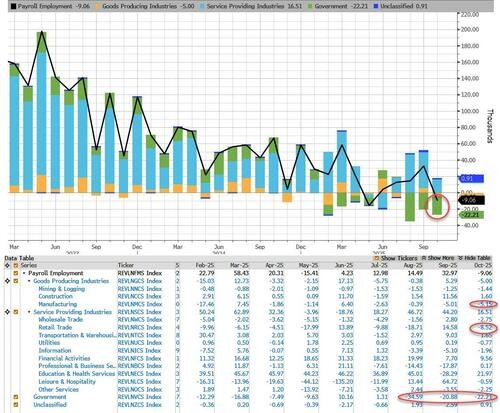

As government data releases may experience delays, market attention has shifted to private sector data released by institutions such as ADP, Revelio Labs, and Goldman Sachs. These data collectively paint a picture of rapidly diminishing employment momentum, contrasting sharply with the official statistics up to August and setting a pessimistic tone for the upcoming official employment report.

Layoff wave hits, multiple indicators signal red lights

The signs of weakness in the labor market are first reflected in the actual actions of corporate layoffs. Challenger's report shows that the layoff rate in October was far above the average level of previous years. Andy Challenger, Chief Revenue Officer of Challenger, Gray & Christmas, pointed out: "Some industries are correcting the hiring boom during the pandemic, but at the same time, the adoption of artificial intelligence, weak consumer and business spending, and rising costs are collectively driving companies to cut expenses and freeze hiring." He also added that employees who are laid off today find it increasingly difficult to quickly secure new positions.

Other high-frequency data also corroborate this trend. According to the latest weekly report released by ADP, in the four weeks ending October 25, private enterprises averaged a reduction of 11,250 jobs per week, which means that in just the second half of October, the private sector may have lost about 45,000 jobs. This is the largest monthly employment decline since March 2023 Another data company, Revelio Labs, also shows a pessimistic outlook in its report. Its data indicates that 9,100 jobs were lost in October, marking the second worst monthly performance of 2025. Although this decline was primarily driven by a reduction in government positions, job losses were also observed in the manufacturing and trade sectors.

Goldman Sachs Multi-Dimensional Tracking: Weak Labor Market Has Become Inevitable

As an investment bank that is highly focused on the market, Goldman Sachs has concluded that the labor market is further softening through its various alternative economic data tracking models. The bank expects that after accounting for the impact of government deferred resignation plans, the official non-farm payrolls for October may record a negative growth of 50,000.

Goldman Sachs' analysis reveals deeper structural issues:

Deterioration of Leading Indicators: The bank's newly established layoff tracking model shows that the layoff trend has continued to rise in recent months, surpassing pre-pandemic levels. The number of WARN layoff notices tracked has surged, which is particularly concerning. Historically, WARN notices and Challenger layoff reports typically lead the official initial jobless claims by about two months, suggesting that the currently low initial claims data may soon begin to rise.

Loosening Labor Market: Goldman Sachs' tracking indicators for job vacancies and labor market tightness continue to decline, indicating that market conditions are weaker than what the official data as of August suggests.

Shift in Corporate Attitudes: An analysis of earnings call transcripts from Russell 3000 index constituent companies shows that the proportion of companies mentioning "layoffs" is increasing, especially during the earnings season for the third quarter of 2025, reflecting a pessimistic sentiment regarding future hiring needs.

AI Becomes a New Driver of Layoffs, Recession Risks Significantly Rise

A notable feature of the current wave of layoffs is the significant role played by artificial intelligence. Goldman Sachs' analysis points out that since the release of ChatGPT in November 2022, AI has rapidly become a central topic of discussion regarding workforce numbers in the tech industry. In other sectors, the integration of AI with workforce planning has also significantly accelerated in 2025. Particularly in industries with high AI adoption rates, such as technology, finance, and real estate, companies are increasingly mentioning AI when discussing layoffs.

This technology-driven structural shift, combined with downward pressure from the economic cycle, is significantly raising the risk of future unemployment. Goldman Sachs' quantitative model predicts that the median and average unemployment rates in the U.S. may reach 4.5% in six months, which is 0.2 percentage points higher than the data from August.

More importantly, the model shows that tail risks have sharply increased. Currently, the model predicts that the probability of the unemployment rate rising by 0.5 percentage points or more in the next six months has reached 20-25%, whereas six months ago, this probability was only 10% In other words, even though an employment recession has not fully arrived, the likelihood of its occurrence has significantly increased, especially as more companies initiate large-scale layoffs driven by AI to save costs. Recently, a number of large companies, including UPS, Amazon, General Motors (GM), Paramount, and Ford, have announced layoff plans affecting thousands, if not tens of thousands, of employees, providing a real-world context for the alarms raised by these data models.

Here is an overview of the most notable layoff plans announced by S&P 500 companies so far in 2025:

- October 29, 2025: CarMax cuts about 350 customer service positions due to weak earnings.

- October 29, 2025: Paramount begins laying off 2,000 employees months after merging with SkyDance Media.

- October 29, 2025: General Motors announces layoffs of over 1,700 employees at its plants in Michigan and Ohio due to electric vehicle challenges.

- October 28, 2025: UPS cuts 48,000 jobs in management and operations.

- October 28, 2025: Amazon will lay off about 14,000 corporate employees.

- October 23, 2025: Target lays off about 1,000 employees.

- October 20, 2025: Moen will restructure its Americas division and lay off employees.

- October 1, 2025: General Mills will close three plants, incurring an expense of $82 million.

- September 16, 2025: Ford will lay off up to 1,000 employees at its electric vehicle plant in Germany.

- September 3, 2025: Salesforce's CEO states that the company has cut 4,000 support positions due to smart agent AI.

- August 29, 2025: Ford may cut about 470 jobs at two plants in South Africa.

- August 26, 2025: Kroger lays off 1,000 corporate employees to cut costs.

- July 16, 2025: Walmart cuts hundreds of store support and training positions.

- July 8, 2025: Intel will lay off over 500 employees in Oregon.

- July 2, 2025: Microsoft will cut 9,000 employees in a second round of large-scale layoffs.

- June 5, 2025: Procter & Gamble plans to cut 15% of office positions over the next two years.

- June 2, 2025: Disney continues to lay off hundreds of film and television employees due to industry difficulties.

- May 29, 2025: General Mills states that it will lay off employees as part of a multi-year restructuring plan

- May 21, 2025: Walmart cuts approximately 1,500 jobs from its technology team

- May 13, 2025: Ford Motor Company will lay off about 350 employees in the United States and Canada

- May 13, 2025: Microsoft announces it will lay off 6,000 employees company-wide

- April 29, 2025: After withdrawing investment, UPS plans to lay off 20,000 employees this year

- April 23, 2025: Intel will announce layoff plans this week, with a layoff rate exceeding 20%.

- March 5, 2025: Disney cuts 6% of employees from ABC Network and the entertainment television division

- February 4, 2025: Salesforce announces the layoff of 1,000 employees while hiring artificial intelligence sales personnel

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at your own risk