Housing rents saw the largest decline in fifteen years. Is U.S. inflation about to collapse in October?

A series of unofficial data indicates that U.S. inflation in October may cool sharply. The core reason is that housing rents fell by 0.31% month-on-month, marking the largest decline in fifteen years, shaking the biggest pillar of the CPI. At the same time, commodity prices have significantly slowed due to increased discounts from retailers. Although Goldman Sachs' model predicts that core CPI remains resilient, the weak trends in rents and durable goods have led the market to begin anticipating that the Federal Reserve may shift to a dovish stance

A series of unofficial data indicates that U.S. inflation in October may be experiencing an unexpected sharp cooling, primarily driven by the largest monthly decline in housing rents in fifteen years. This trend challenges previous market expectations of sustained high prices and may provide new grounds for the Federal Reserve to shift towards a more dovish policy stance.

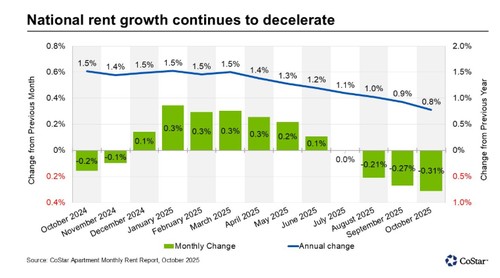

In the context of a potential delay in the official Consumer Price Index (CPI) report from the U.S. Bureau of Labor Statistics (BLS) due to a government shutdown, investors are closely monitoring various alternative data. Among them, the most notable is a report from the real estate data company CoStar, which shows that rents fell by 0.31% month-on-month in October, marking the largest decline in the past fifteen years.

Meanwhile, inflationary pressures in other areas also seem to be easing. According to price tracking data from OpenBrand, the inflation rate for durable goods and personal items has significantly slowed in October due to increased discounts from retailers. Signs of slowing inflation are becoming increasingly widespread, introducing new variables into market expectations for the Federal Reserve's December interest rate meeting.

These real-time data paint a picture of accumulating deflationary pressures, particularly in the housing sector, which accounts for about one-third of the CPI basket. If this trend is confirmed in official data, it will have profound implications for financial markets, especially for those investors betting that interest rates will remain high for an extended period.

Commodity price growth slows, retailers increase discounts

The latest price data suggests that U.S. retailers may be losing pricing power. According to OpenBrand, due to increased discounts from retailers, the growth of consumer goods prices in the U.S. significantly slowed in October. The prices of commodities and personal care products tracked by the agency rose by 0.22% last month, far below the 0.48% increase in September.

Specifically, price growth in several categories has slowed or even turned negative for several months. For example, the price of hair dryers rose by 1.15% month-on-month in August, slowed to 0.82% in September, and then turned to a decline of 1.27% in October. The appliance category, including washing machines and dryers, also showed a similar trend, with prices dropping from a 0.90% increase in August to a 0.86% decline in October.

Part of the reason for the price drop is that retailers have increased promotional efforts to secure market share. The average discount rate in October rose to 20.4%, nearly matching the highest level since July of last year. Michael Metcalfe, State Street's head of macro strategy, commented on the PriceStats data they acquired, stating, "The upward trend in inflation has stalled in October," and he believes that inflation is currently "robust but not alarming."

Core inflation pillar shaken, rental market sounds alarm

The variable that most significantly impacts the inflation outlook is undoubtedly housing rents, which carry the highest weight in the CPI. Due to significant lags in BLS data collection, real-time market data provides investors with a more forward-looking perspective. Current real-time data is sending strong alarm signals Nick Gerli, CEO of Reventure, pointed out, "The current weakness in the rental market is concerning, indicating that there is greater deflationary pressure in housing and the economy than people realize." This view is supported by multiple data points:

- Record drop in rents: According to CoStar data, rents fell 0.31% month-over-month in October, marking the largest single-month decline in over fifteen years.

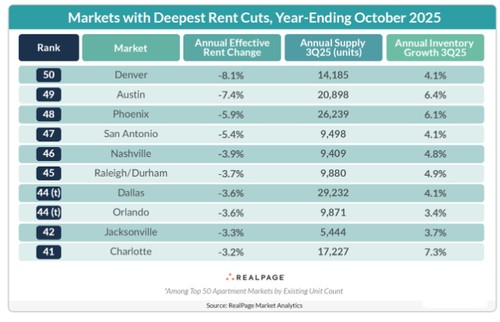

- Significant pullback in some markets: Data from RealPage shows that effective apartment rents (after discounts) in some major markets have dropped significantly year-over-year, with Denver down 8.1%, Austin down 7.4%, and Phoenix down 5.9%.

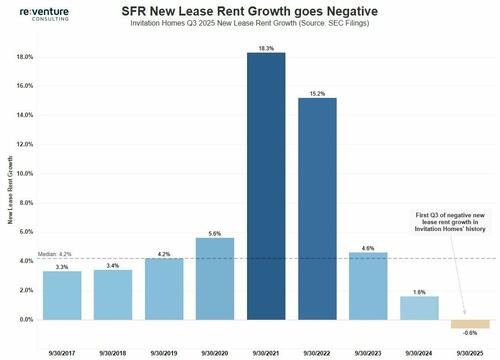

- Single-family home rents weakening simultaneously: Invitation Homes, the largest publicly traded single-family home landlord in the U.S., reported negative rent growth for new leases signed in the third quarter of 2025, marking the first negative growth in the third quarter since the company went public in 2017.

- Future expectations downgraded: Zillow has lowered its rent growth forecast for single-family homes in 2026 to 2.0%, while the forecast for multi-family homes is -0.4%, resulting in an overall growth rate of only about 1.0%.

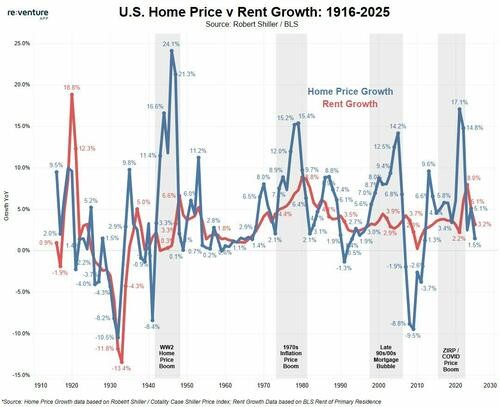

Given that rental prices serve as a long-term "anchor" for overall housing prices, the continued cooling or deflation in the rental market suggests that the overall real estate market is unlikely to rebound and may even face further downward pressure.

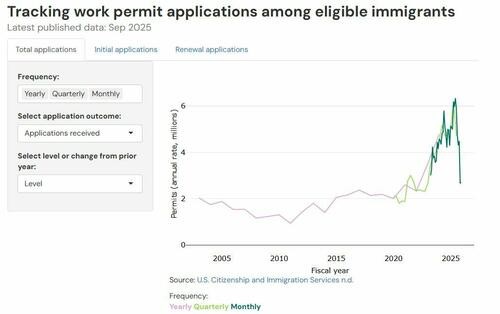

Regarding the sudden drop in rents, some analyses directly link it to a decline in rental demand. Nick Gerli cited data from the Brookings Institution, stating, "A key indicator is the 'number of immigration job applications,' which has decreased by 60% over the past four to five months." Historically, this indicator has shown a strong correlation with rental demand. The weakening demand is believed to be the core reason behind the reversal of supply and demand dynamics in the rental market, ultimately leading to the drop in rents.

Goldman Sachs Model Shows Core Inflation Remains Resilient

Despite clear signs of cooling in rental and some commodity prices, not all data points to an "inflation collapse." Goldman Sachs has provided a more moderate forecast based on its alternative data-driven model.

Goldman Sachs estimates that the core CPI in October increased by approximately 0.24% month-on-month, roughly in line with the official figure of 0.23% for September. The model predicts that prices for used cars (+0.5%) and new cars (+0.3%) will rise, while airfares (+1%) and hotel prices (+1%) will also continue to increase moderately. However, the bank expects a decline in auto insurance prices (-0.3%).

Goldman Sachs' analysis indicates that while some sectors are cooling, certain components of inflation remain robust, and the complexity of the overall inflation outlook requires investors to remain cautious. The market is currently awaiting potentially delayed official data to ultimately assess the true direction of inflation