Multiple positive factors converge, Wall Street makes a full push for the U.S. stock market's "year-end rally"

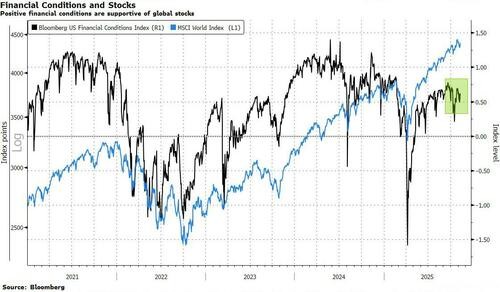

Despite market fluctuations, the end of the government shutdown and expectations of interest rate cuts by the Federal Reserve have provided solid support for the market. Investors are actively positioning themselves for bullish options bets on year-end performance. The resumption of corporate stock buybacks and the inflow of retail funds effectively hedge against systemic selling pressure. Coupled with the significance of NVIDIA's upcoming earnings report as a barometer for AI, multiple positive factors are driving a sustained warming of market risk appetite

Despite recent market fluctuations, a series of strong supporting factors are gathering, whether it is the dawn of fiscal policy, expectations of monetary easing, or capital inflows from enterprises and retail investors, all of which are building a solid downside protection for the market. Investors are actively positioning themselves, betting that the stock market will rise before the end of the year.

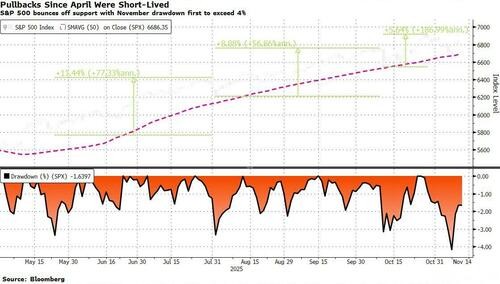

At the beginning of this week, the market welcomed a key positive signal. News about the U.S. government ending the shutdown quickly activated more aggressive buy-the-dip strategies, reversing the downturn seen in early November. According to Bloomberg, the resumption of economic data releases may enhance the market's bets on a Federal Reserve rate cut, providing more ammunition for the bulls.

The core of market sentiment is that traders are determined to achieve a year-end rally, and unless they encounter a severe setback far beyond recent levels, their bullish stance is unlikely to waver.

Andrew Tyler, leading the market intelligence team at JP Morgan, clearly stated: “We are buyers of this decline and maintain our tactical bullish view.” They pointed out that the government resuming operations will be the biggest recent catalyst, which will not only support the current quarter's GDP forecast but may also release more liquidity into the market. Meanwhile, the likelihood of the Federal Reserve cutting rates again in December is increasing, and corporate stock buyback plans are resuming with the end of the earnings season's quiet period.

The cumulative effect of these positive factors is reshaping investors' risk appetite and market technical patterns. Although some systematic strategy funds have recently reduced their positions, strong buying from retail investors and some fund managers provides a robust hedge. The activity in the options market has reached historic highs, showing a strong bullish inclination, while volatility indicators remain moderate. The consensus on Wall Street seems to be that the runway to a year-end rally is being paved.

Policy Benefits as the Primary Catalyst

For investors betting on a year-end rebound, positive signals from Washington are the primary stabilizer. Goldman Sachs partner Richard Privorotsky pointed out: “The resumption of government operations is the primary condition for market stability, and the current betting odds indicate that this is imminent.” He believes that the implicit "put options" provided by the government (i.e., expectations of policy support) are more important than the market's technical washout.

This view has been echoed by several institutions. JP Morgan believes that the end of the government shutdown will be the biggest positive for the stock market in the short term. Analysts at Spotgamma have also adjusted their strategies, stating, “As the government shutdown is clearly about to end, we are adjusting the risk appetite inflection point for the S&P 500 from 6900 points to 6800 points,” and believe this week will be bullish. In addition to fiscal stimulus, expectations of easing from the Federal Reserve are also injecting a strong dose of confidence into the market. Traders generally expect that the likelihood of a rate cut in December is greater than that of holding steady. **

NVIDIA's Performance Becomes the Focus, Corporate Buybacks Continue

Beyond macro policies, the micro fundamentals of companies have become another key pillar supporting the market, with the performance of tech giants being of utmost importance. The upcoming earnings report from NVIDIA is seen as a critical test. JP Morgan's Tyler team stated that this report has the potential to alleviate market concerns regarding the artificial intelligence theme and provide evidence for excellent growth in corporate revenue and earnings per share (EPS) for this quarter.

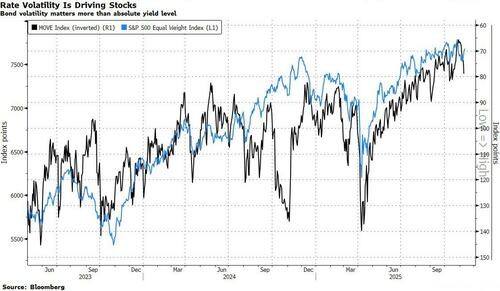

Clearly, NVIDIA's performance has become an important barometer of market sentiment. Tyler and his colleagues warned that if NVIDIA's performance falls short of expectations, combined with factors such as a government shutdown lasting until the end of the year, stock buybacks being executed at a lower-than-expected rate, or a surge in bond volatility, they would abandon their bullish stance. Meanwhile, with the end of the earnings season's lock-up period, the resumption of corporate stock buybacks also provides a stable inflow of funds to the market, which is seen as another safeguard against market downturns.

Systematic Sell-off vs. Retail Buying Battle

Last week's market adjustment revealed the divergence among different investor groups. According to Deutsche Bank data, overall market positioning has dropped to neutral levels, primarily driven by the reduction of positions by systematic strategy funds. The sell-off from these funds has concentrated on momentum strategies, AI-related trades, cryptocurrencies, and heavily shorted stocks.

However, this selling pressure has been offset by two other forces. Analysis shows that retail investors and some fund management sectors have exhibited stronger buying demand, effectively absorbing the selling pressure from systematic strategies.  Charlie McElligott, a cross-asset strategist at Nomura Securities, pointed out that in the past month, volatility control funds alone are estimated to have sold approximately $117.8 billion worth of U.S. stocks. He expects that if the market and large tech stocks can maintain daily volatility within a positive and negative 1% "sweet spot," these systematic funds will engage in meaningful reallocation and buyback, bringing new upward momentum to the market.

Charlie McElligott, a cross-asset strategist at Nomura Securities, pointed out that in the past month, volatility control funds alone are estimated to have sold approximately $117.8 billion worth of U.S. stocks. He expects that if the market and large tech stocks can maintain daily volatility within a positive and negative 1% "sweet spot," these systematic funds will engage in meaningful reallocation and buyback, bringing new upward momentum to the market.

Technical Recovery, Bullish Options Active

After Monday's rebound, the market's technical chart has returned to a bullish pattern. Although risk appetite was impacted last week, it remains strong across multiple indicators. Among them, activity in the options market is particularly noteworthy. The ratio of call options to put options volume (calculated on a rolling one-month basis) has reached historical highs, indicating that investors are actively positioning for bullish trades.

In addition, the surge in volatility and hedging cost indicators that measure market panic has remained relatively moderate and has now returned to summer levels. This indicates that although the market has experienced some fluctuations, overall confidence has not been fundamentally shaken. Investors seem well-prepared for potential downside risks and are firmly focused on the upward opportunities before the end of the year

In addition, the surge in volatility and hedging cost indicators that measure market panic has remained relatively moderate and has now returned to summer levels. This indicates that although the market has experienced some fluctuations, overall confidence has not been fundamentally shaken. Investors seem well-prepared for potential downside risks and are firmly focused on the upward opportunities before the end of the year