The memory upcycle is "far from over"! Morgan Stanley: Investors should hold memory stocks rather than "timing the market," and be wary of the "sharp rise in costs" for consumer electronics and PCs

Morgan Stanley stated that the strength and durability of the AI-driven memory supercycle may far exceed market expectations. The core driving force has shifted from price-sensitive traditional customers to price-insensitive AI data centers. Recently, server DRAM prices surged by 70%, with spot prices increasing by 336%. Investors are advised to "hold steady" rather than engage in timing trades, favoring memory manufacturers like SK Hynix and Samsung that have pricing power, but remain cautious of the severe cost pressures and profit squeezes facing downstream consumer electronics sectors such as PCs and smartphones

Author: Dong Jing

Source: Hard AI

Morgan Stanley stated that the current super cycle in the memory industry is structural, and its intensity and duration will exceed historical experience. The correct strategy is to embrace memory leaders with pricing power and recognize the severe challenges facing the downstream consumer electronics sector.

On November 12, according to Hard AI, Morgan Stanley sent a clear signal in its latest research report: The AI-driven memory super cycle not only truly exists but its intensity and persistence may far exceed market expectations.

The bank noted that the core driver of memory demand has shifted from traditional customers sensitive to price to AI data centers and cloud service providers that are less sensitive to price. AI inference workloads are becoming the main engine for exponential growth in general memory demand.

Channel quotes are showing unprecedented strength. In just the past two weeks, server DRAM quotes for the fourth quarter of 2025 have surged nearly 70%, and NAND contract prices have also risen by 20-30%.

Morgan Stanley stated that history shows memory upcycles typically last 4-6 quarters. Attempts to "time" the market by capturing tops and bottoms often miss out on most of the gains. In the current fundamentals-driven bull market, "holding steady" is the best strategy for achieving excess returns.

The research report indicated that Morgan Stanley is optimistic about memory manufacturers, believing that companies like SK Hynix and Samsung will experience margin expansion and profit surges due to their strong pricing power. In contrast, the downstream PC, mobile phone, and consumer electronics supply chains will face severe cost pressures and profit squeezes, and caution should be maintained.

AI Reshaping Demand Patterns: This Cycle is Different

Morgan Stanley stated that we are witnessing an unprecedented market structure.

Unlike previous cycles driven by PCs and smartphones, the core of this round of memory demand is an "arms race" centered around AI data centers and cloud service providers. These customers are far less sensitive to price than traditional consumers; they are more concerned about whether they can obtain sufficient computing infrastructure to support the development of their large language models (LLMs) and AI applications.

The report emphasized that inference workloads have become the main driver of general memory demand and are showing a "legitimate exponential growth trend."

Morgan Stanley stated that even if future spending on large language models may consolidate, this sustained demand generated by AI applications will continue to support the strength of the general memory market.

Additionally, although market enthusiasm for HBM has cooled, its production process continues to structurally squeeze traditional memory chip capacity, further exacerbating supply tightness.

Morgan Stanley emphasized that all of this indicates that we cannot view the current cycle through a historical lens. This is a new situation fundamentally altered by a technological revolution.

Unprecedented Quotes: Channel Prices are Completely "Out of Control"

The results of channel surveys are enough to shock any skeptics. In just the past two weeks, the outlook for memory pricing has dramatically improved:

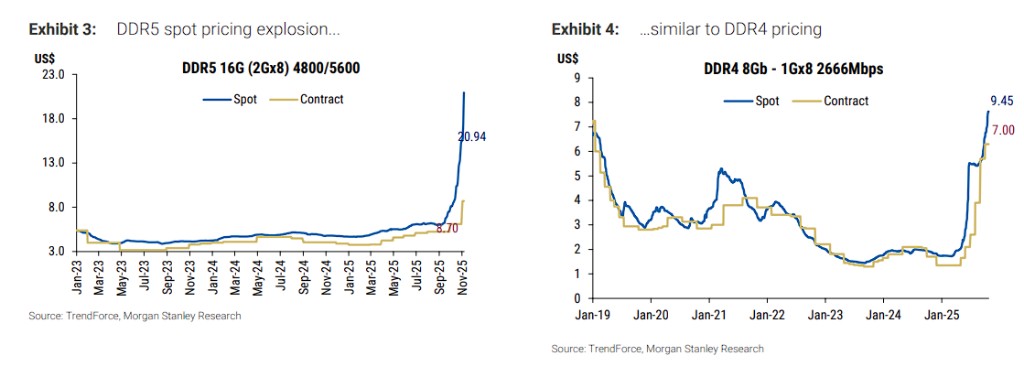

- DRAM prices have soared: The contract quotes for server DRAM in the fourth quarter of 2025 have seen an astonishing increase of nearly 70%, far exceeding Morgan Stanley's previous prediction of 30% Due to concerns about further price increases and supply shortages, customers seem to have no choice but to accept. The quotes for DDR4 have also risen by 50% due to strong demand for network switches in U.S. data centers.

- Spot Market Explosion: The spot price of DDR5 (16Gb) has soared from $7.50 in September to $20.90 currently, an increase of up to 336%. The scarcity of DRAM and NAND has reached extreme levels for secondary customers, distributors, and module manufacturers.

- NAND Completely Out of Stock: NAND, as a key component for AI computing and video storage, is also in tight supply. It is expected that the prices of 3D NAND chips (TLC & QLC) will increase by 65-70% quarter-on-quarter in the fourth quarter. Samsung's transition to 321-layer V8-NAND has limited its production in the first half of 2025, resulting in only a 10% increase in annual shipments.

- Lack of Alternatives: Meanwhile, the order visibility for HDDs (hard disk drives) has extended to 2027, with delivery cycles exceeding two years, but major manufacturers have not actively expanded production capacity. This supply-demand imbalance has caused some demand to overflow into eSSD, further proving the significant supply gap in the entire storage market, leaving customers with no alternatives.

Abandon Timing Fantasies: Investors Should "Hold" Rather Than "Trade"

Research reports indicate that in a highly volatile market, human "negativity bias" often makes us feel fear when stock prices hit historical highs, believing a reversal is imminent.

Morgan Stanley clearly points out that this is a misconception. Memory stocks are hitting new highs due to AI, but that does not mean the rise is over. The report provides clear investment advice:

Spending time in the market is far more important than trying to time the market. The memory cycle itself is full of volatility, rebounds, and pullbacks, which is precisely its inherent characteristic. Investors need to endure this discomfort and always maintain their positions. Because no one can continuously and accurately predict the market.

As the report quotes: "Doing nothing is often the best strategy."

Morgan Stanley states that ultimately, it is earnings that determine stock prices, not valuations or a predetermined moment in history. As long as market skepticism remains, it provides fuel for further price increases.

Winners and Losers: Favor Memory Manufacturers, Beware of Downstream Cost Pressures

In this cost tsunami triggered by memory, the line between winners and losers will be exceptionally clear.

Winners: Memory Manufacturers. Companies with pricing power, such as SK Hynix and Samsung, will directly benefit from price increases, achieving significant profit growth. Morgan Stanley emphasizes that the upward revision of earnings expectations has been one of the strongest factors driving stock price increases this year.

Losers: Memory Consumption Sector. The supply chains of PCs, non-high-end smartphones, and a wide range of consumer electronics will face severe profit squeezes.

Losers: Memory Consumption Sector. The supply chains of PCs, non-high-end smartphones, and a wide range of consumer electronics will face severe profit squeezes.

Companies in these areas will find it difficult to fully pass on the sharply rising memory costs to consumers, which may ultimately lead to demand destruction and a decline in shipments in 2026 and 2027.

Therefore, Morgan Stanley recommends maintaining caution in these sectors—especially in the PC industry. The report mentions that Morgan Stanley has recently downgraded the ratings of several key companies in this sector