No longer "selling gold"! HSBC: LAOPU GOLD is expected to break free from the gold price cycle and leap to a "Tiffany-style" luxury brand

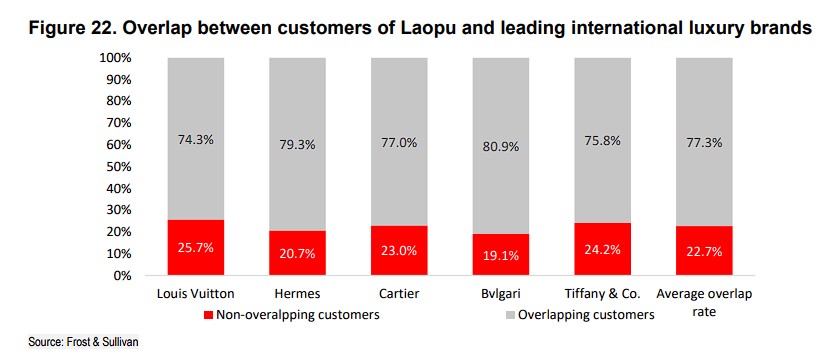

HSBC stated that the growth logic of LAOPU GOLD is shifting from the "golden flywheel" reliant on gold prices to the "brand flywheel" driven by brand strength, which is expected to break free from the cyclical constraints of gold prices. Its market share in China's high-end jewelry market has increased from 10% to 16%, with 77% of customers overlapping with Western luxury brands. The valuation system should be reshaped, and its brand attributes should align it with global luxury giants like Tiffany. Based on the DCF model, a target price of HKD 973.70 is given

As gold prices fluctuate like a sword hanging over one's head, the growth story of LAOPU GOLD is being rewritten. HSBC's latest research report points out that the growth of LAOPU GOLD is no longer supported by the "golden flywheel" of rising gold prices, but rather by the "luxury flywheel" driven by brand power.

On November 12, according to news from the Chasing Wind Trading Desk, HSBC stated in the report that the growth logic of LAOPU GOLD is shifting from the "golden flywheel" reliant on rising gold prices to the "brand flywheel" driven by brand power, craftsmanship, and cultural narratives.

This means the company is expected to break free from the cyclical constraints of gold prices and achieve a leap towards becoming a true luxury brand. Its valuation logic should align with Western luxury giants like Tiffany and Richemont, rather than traditional Chinese jewelers, indicating significant potential for value re-evaluation.

The report also noted that the recent seemingly unfavorable new regulations on gold taxes may actually become a new catalyst for LAOPU GOLD to further erode market share priced by gram.

HSBC stated that this is the first time the bank has covered LAOPU GOLD and has given it a "Buy" rating, with a target price of HKD 973.70 based on a DCF model, representing a potential upside of up to 55% compared to the current stock price (HKD 628.00 as of November 5, 2025).

Growth Myth: The Strong Start of the "Golden Flywheel"

The report pointed out that LAOPU GOLD's stock price has risen nearly 800% since its IPO in June 2024, and its success is primarily attributed to a strong "golden flywheel" effect. The core logic of this flywheel is:

Unique Fixed Pricing Model: Unlike traditional jewelers who price by gram, LAOPU GOLD adopts a "one-price" sales approach.

Rising Gold Prices Catalyze Demand: As gold prices soar, the premium of its products calculated by weight relative to spot gold prices has actually narrowed, greatly stimulating market demand.

IPO Capital Boost: The funds raised from the IPO have allowed it to rapidly expand inventory to meet the surging demand, thus translating into higher sales and faster inventory turnover.

Data shows that driven by this flywheel, LAOPU GOLD's sales are expected to grow eightfold from 2023 to 2025. HSBC stated that this growth miracle is essentially the perfect combination of the upward cycle of gold prices, a unique business model, and capital injection.

Future Engine: The "Brand" Flywheel is Ready to Take Over

HSBC believes that while the "golden flywheel" is powerful, the real long-term value lies in the upcoming "brand flywheel." As gold prices reach a historical high of USD 4,350 per ounce in October 2025, the market is concerned about the risk of a gold price correction. However, LAOPU GOLD has already utilized the opportunities brought by the "golden flywheel" to complete the original accumulation of brand momentum.

The "brand flywheel" consists of several key components:

- Exquisite Craftsmanship and Cultural Narrative: Products integrate elements of traditional Chinese culture with modern aesthetics, emphasizing intangible cultural heritage craftsmanship such as "hammering," "engraving," and "filigree," making them not just gold, but also inheritable artworks.

- High-End Clientele and VIP Services: According to Frost & Sullivan, the overlap rate of LAOPU GOLD's customers with those of the five major international luxury brands is as high as 77.3% The company established a VIP team in 2025, focusing on high-net-worth clients.

- Precise channel expansion: The company insists on opening boutique stores in top shopping centers and currently has 48 stores covering high-end commercial landmarks such as Beijing SKP and MixC. Although the number of stores is not large, its single-store sales efficiency ranks first among all jewelry brands in mainland China.

- Overseas market expansion: The first overseas store was opened in Singapore in 2025, with plans to continue opening 3-4 boutique stores overseas in 2026-27, initiating a strategy of "brand internationalization and market globalization."

HSBC believes that this flywheel will grant LAOPU GOLD strong pricing power, allowing it to gradually shake off the negative impact of gold price fluctuations and grow into the first Chinese local high-end jewelry brand that can compete with international giants like Tiffany and Richemont.

Valuation Logic: Benchmarking Against International Luxury Giants

The report provides extremely optimistic financial forecasts:

- Short-term explosive growth: It is expected that net profit will grow by 218% year-on-year in 2025, with revenue growth of 199%.

- Long-term steady growth: As growth normalizes, it is expected that from 2025 to 2027, the compound annual growth rate (CAGR) of net profit will reach 29.5%, and revenue CAGR will be 23.1%.

In terms of valuation, HSBC's core argument is that LAOPU GOLD's valuation system should be reshaped. Currently, the market may still partially view it as a gold-related enterprise, but its brand attributes should align it with global luxury goods.

- Target valuation: A target price of HKD 973.70, corresponding to a 26.2 times expected price-to-earnings ratio for 2026.

- Peer comparison: The average forward price-to-earnings ratio for global luxury brands is 27 times, while domestic jewelry brands in China are only 13 times. The current valuation of LAOPU GOLD clearly does not fully reflect its potential as a luxury brand.

The Dual Nature of the New Gold Tax Reform Regulations

The report specifically analyzes the risks of the recently focused tax regulations in the market.

On November 1, two departments issued a statement saying that taxpayers who do not sell standard gold through exchanges should pay value-added tax according to current regulations. Starting from November 1, 2025, the input tax deduction for value-added tax on gold purchases will be reduced from 13% to 6%.

HSBC believes that this new regulation may become a catalyst for a new round of the "gold flywheel." Since LAOPU GOLD's "fixed-price" products have higher profits, they can better absorb tax costs. In contrast, traditional jewelers priced by gram must raise prices to pass on costs.

HSBC stated that this will further narrow the price gap between LAOPU GOLD's ancient gold products and ordinary gold jewelry, thereby attracting more consumers to purchase LAOPU GOLD products that possess both artistic value and value preservation attributes, accelerating its market share acquisition