BREAKINGVIEWS-Second-hand buyouts risk a bit too much excitement

The private-equity secondary market, valued at $200 billion, is evolving with innovative structures attracting less-experienced investors. Secondary transactions are projected to rise from 0.9% to 1.4% of assets under management by 2025, with LP-led deals reaching $54 billion in the first half of 2025. GPs are increasingly engaging in continuation vehicles to manage assets, while new financial structures like preferred equity are emerging. However, the influx of new investors poses risks, as they may end up with underperforming assets.

(The author is a Reuters Breakingviews columnist. The opinions expressed are his own.)

By Liam Proud

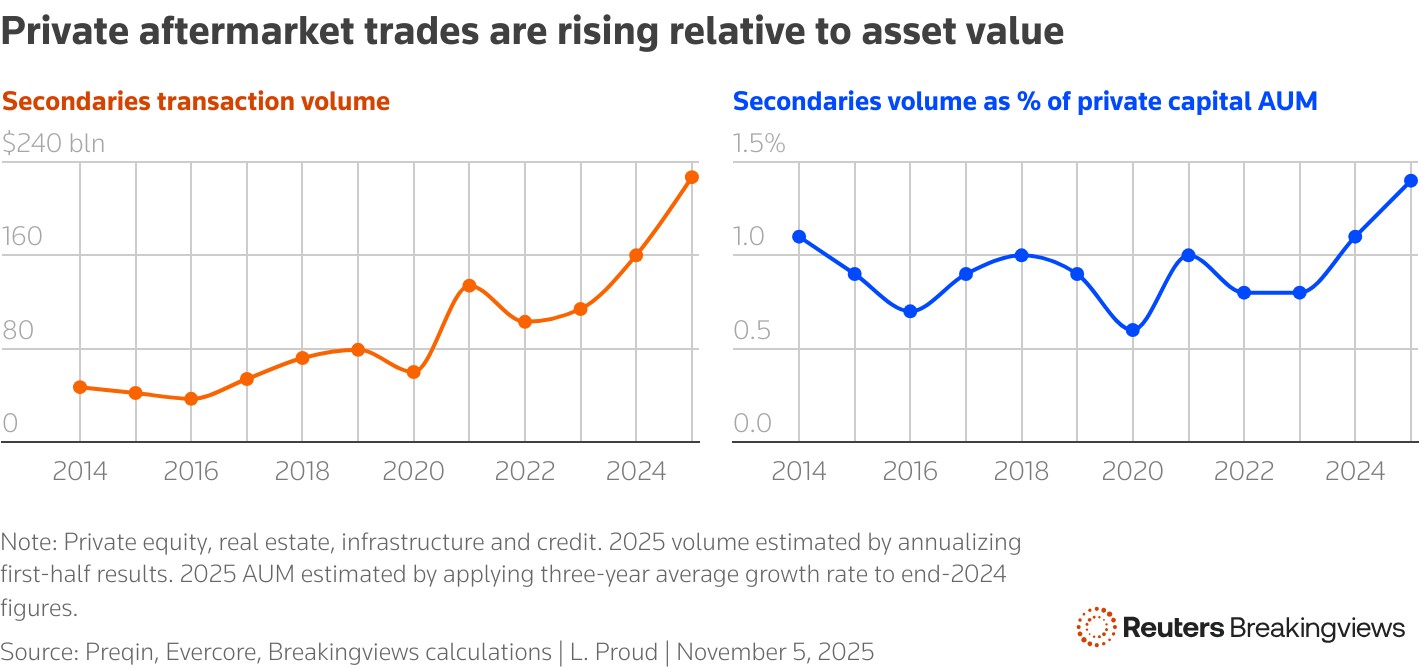

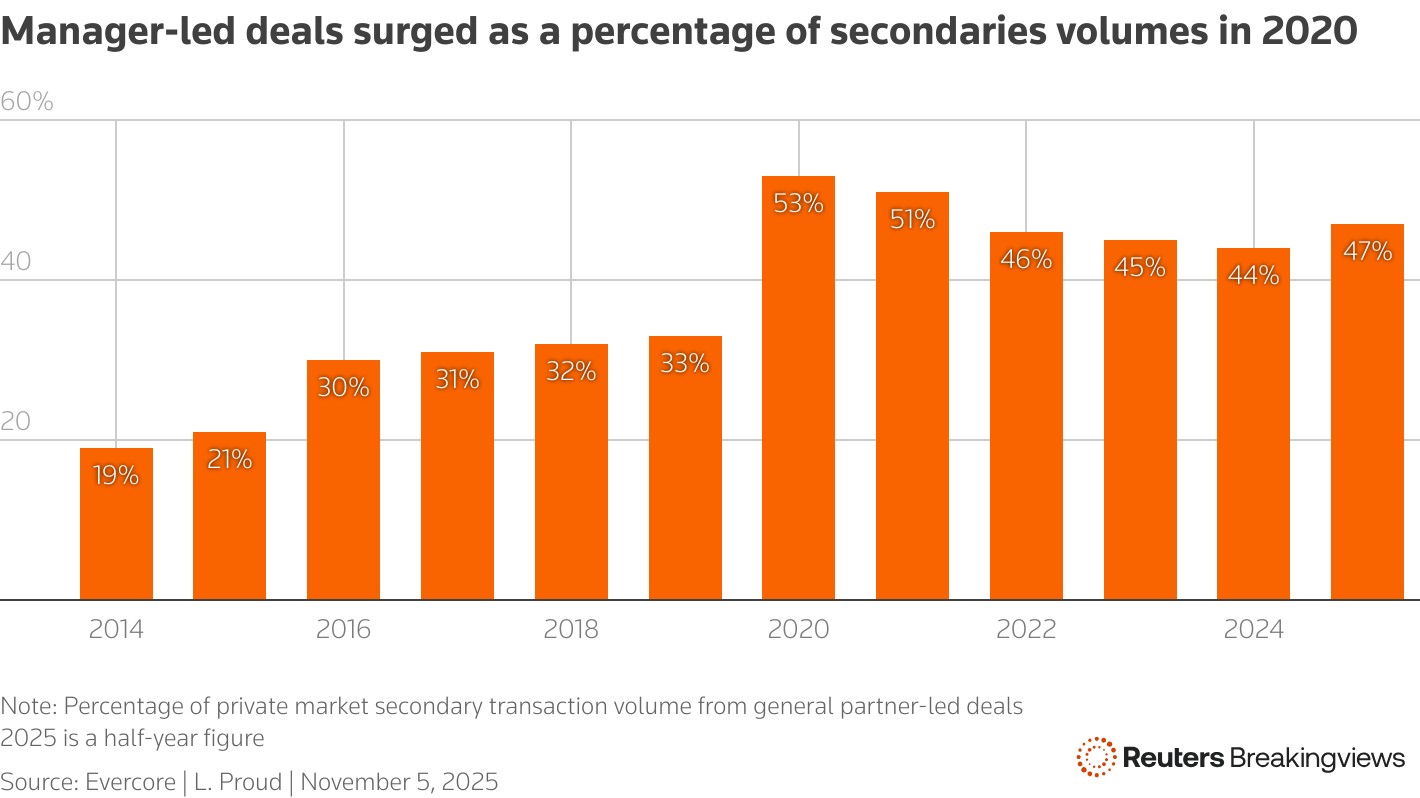

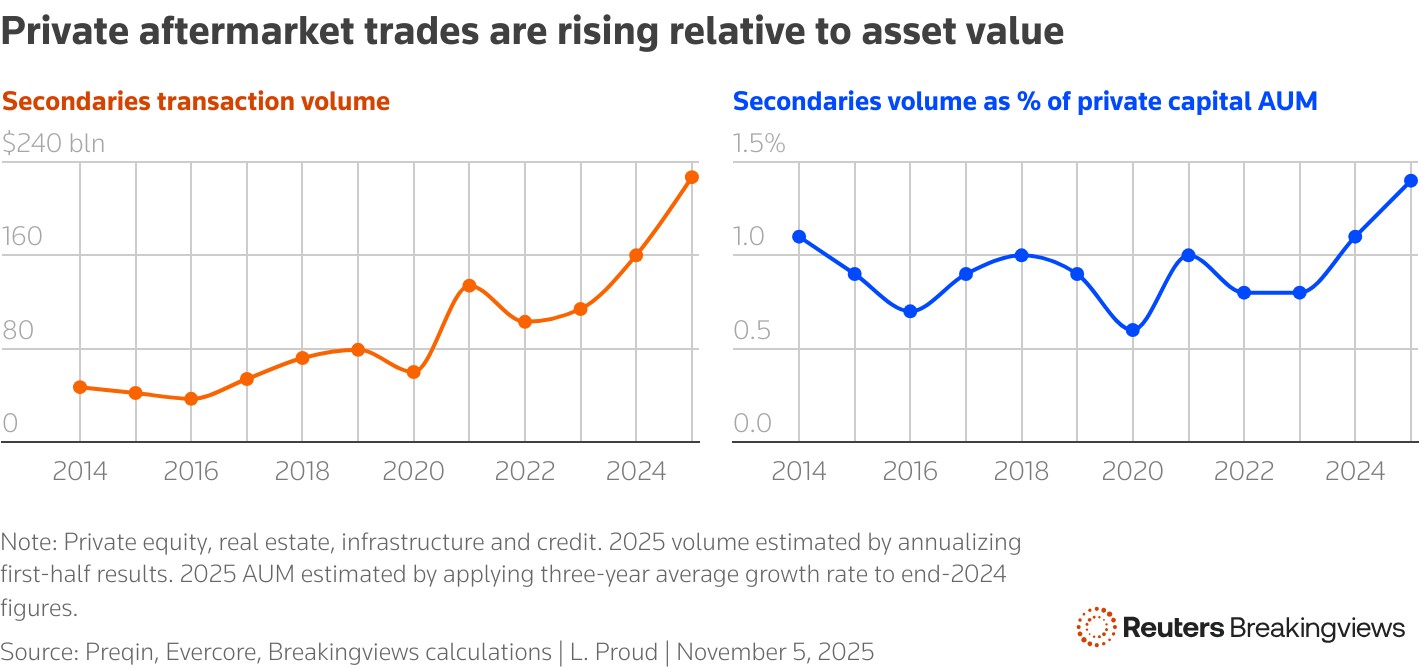

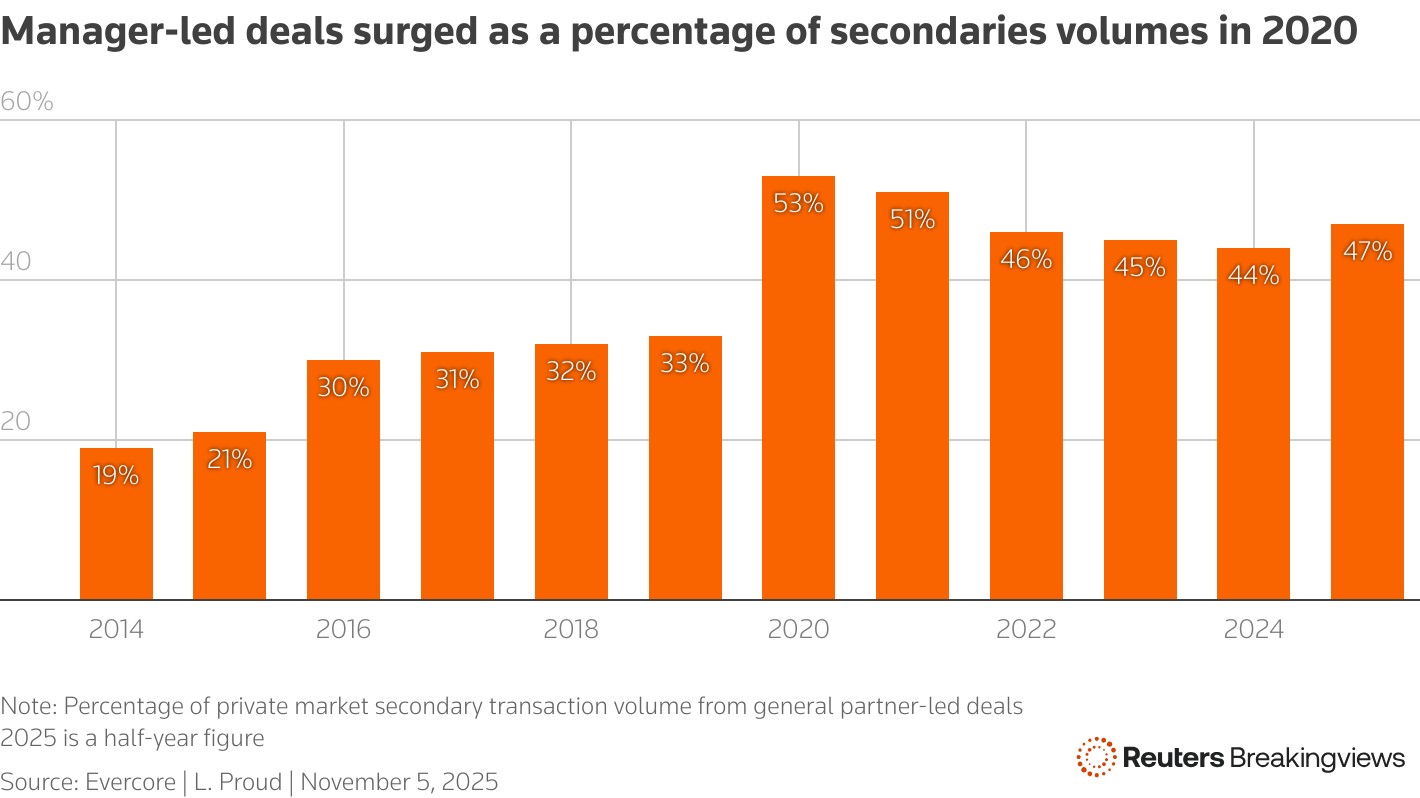

LONDON, Nov 13 (Reuters Breakingviews) - A $200 billion market for private-equity stakes is employing brand-new ideas for dealing in second-hand goods. So much so that an investor who stopped paying attention a decade ago might no longer recognize the oddball structures and novel twists on what was once the preserve of hard-nosed bargain-hunters. This proliferating complexity serves a reasonable purpose. The risk is that it draws in a wave of less-experienced investors, including mom-and-pop tourists, who end up holding the bag for under-pressure private asset managers. In public markets, the volume of buying and selling each year generally matches the value of the underlying stocks. For private markets, however, secondary transactions are just a fraction of overall assets under management (AUM), since it’s tougher to trade in and out of inherently illiquid investments. That’s changing. In aggregate, 1.4% of AUM across buyout, venture capital, private credit, real estate and infrastructure funds will likely change hands on the secondary market in 2025, according to Breakingviews calculations using Preqin and Evercore data. That sounds tiny but is up from 0.9% on average from 2014 to 2024. This “churn rate” could hit 5% or more over time, an investor at Churchill Asset Management wrote last year. One reason is that traditional fund backers – the pension plans, college endowments and so on collectively dubbed limited partners (LPs) – are increasingly comfortable using the secondary market to trim or tweak their overall investment portfolios. The Canada Pension Plan Investment Board, for example, in 2023 offloaded a $2 billion bundle of interests in private equity funds to France-based Ardian, a veteran aftermarket dealmaker. Such LP-led transactions once carried a social taboo, since they typically occur at a 5% to 10% discount to a stake’s face value, implying that either the seller or the underlying investments must be under pressure or underperforming. Now, though, this is just an accepted part of managing an illiquid book. LP-led deal volumes were $54 billion in the first half of 2025 alone, which is roughly equivalent to the full-year total from 2022, Evercore data shows. As the market matured, buyout barons themselves – known as general partners (GPs) – realized the value of trading assets into or out of an existing fund. Once a sliver of the market, GP-led deals surged during the pandemic, accounting for half of total 2020 volume and staying roughly there ever since. These transactions typically involve a manager selling one or more portfolio companies to a dedicated “continuation vehicle,” which the same manager also runs. The goal is to keep prized assets for longer, or defer taking losses on a dud, while giving LPs the right to sell their exposure to a secondaries investor. Last month, for example, PAI Partners orchestrated a giant continuation vehicle for $18 billion ice cream maker Froneri. Such deals have helped get some money back to cash-starved LPs in recent years, as buyout barons toiled to get rid of stuck assets. Meanwhile, some of the biggest buyers of secondary stakes, like Coller Capital, Pantheon, Blackstone (BX.N) and Ares Management (ARES.N) , are getting more creative. They’ve helped to forge aftermarkets beyond buyouts, in private credit, infrastructure and beyond. Within private equity, Britain’s ICG and Neuberger Berman have launched specific funds catering just to GP-led transactions. Assets already in a continuation vehicle are being plucked out and put into another, sometimes dubbed a “CV-squared,” as happened to Accel-KKR’s $1.9 billion software group Isolved. Dealmakers and investors say that they expect, soon enough, the arrival of the “CV-cubed.” Elsewhere, investors like 17Capital have pioneered preferred equity structures that allow LPs to instead raise money against private-capital holdings without selling. GPs are tapping this market, too. Campbell Lutyens data shows that such structured deals are more prevalent in tough years like 2022, when preferred equity hit 10% of total secondaries volumes, suggesting they can help to bridge the gap between wary buyers and sellers eager to avoid a large discount. Another common technique, which achieves broadly the same aim, is to defer the actual payments on LP-led deals. Handing over the money at a later date boosts the annualized return for an investor, allowing them to pay a better headline price. All of this complexity serves a reasonable purpose. As private markets grow ever-more ubiquitous, with unlisted companies and non-bank credit forming an ever-larger chunk of the economy, sophisticated investors will need new ways to manage their exposure. The biggest risk is that LPs’ and GPs’ desperate need for liquidity finds an all-too-willing provider. One danger is that the new money flooding in, which includes funds backed by retail investors, gets stuck with the industry’s duds.

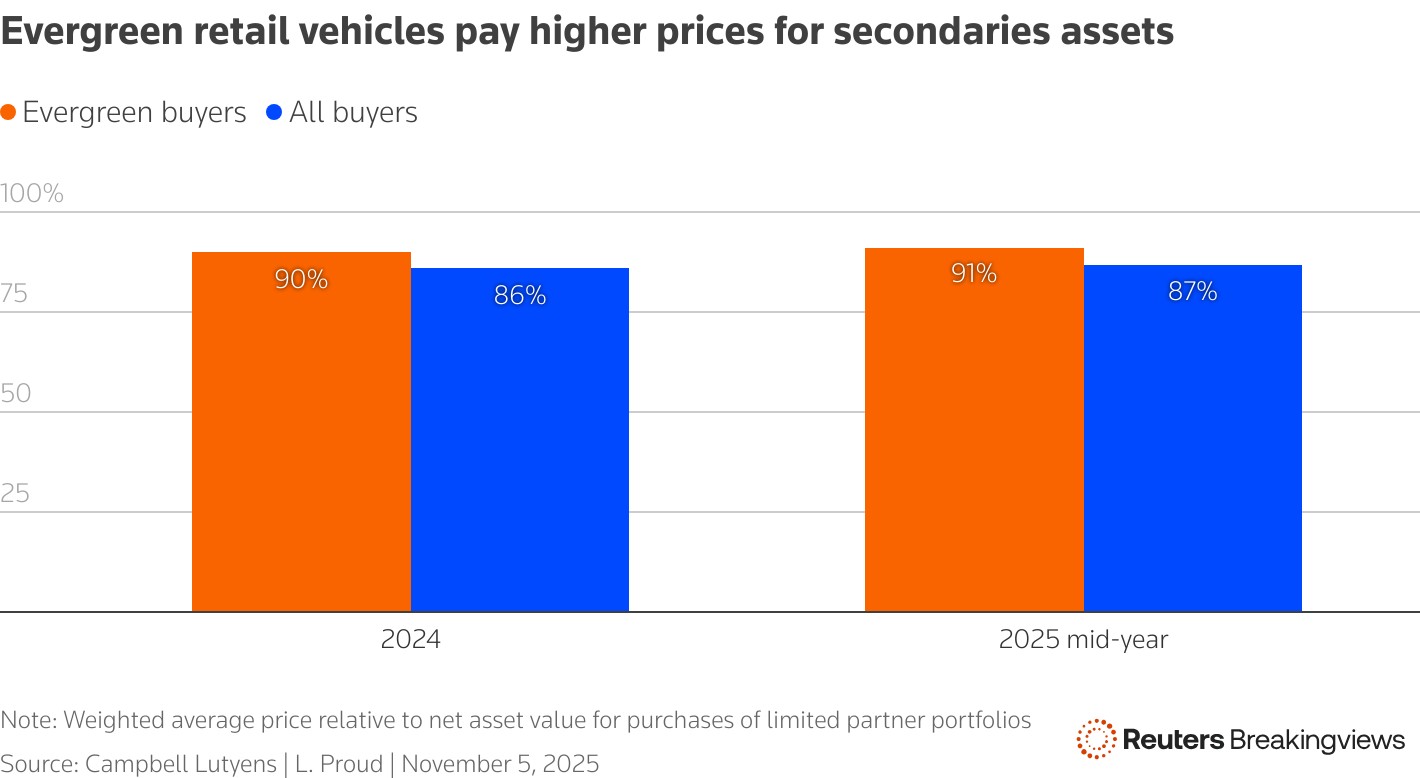

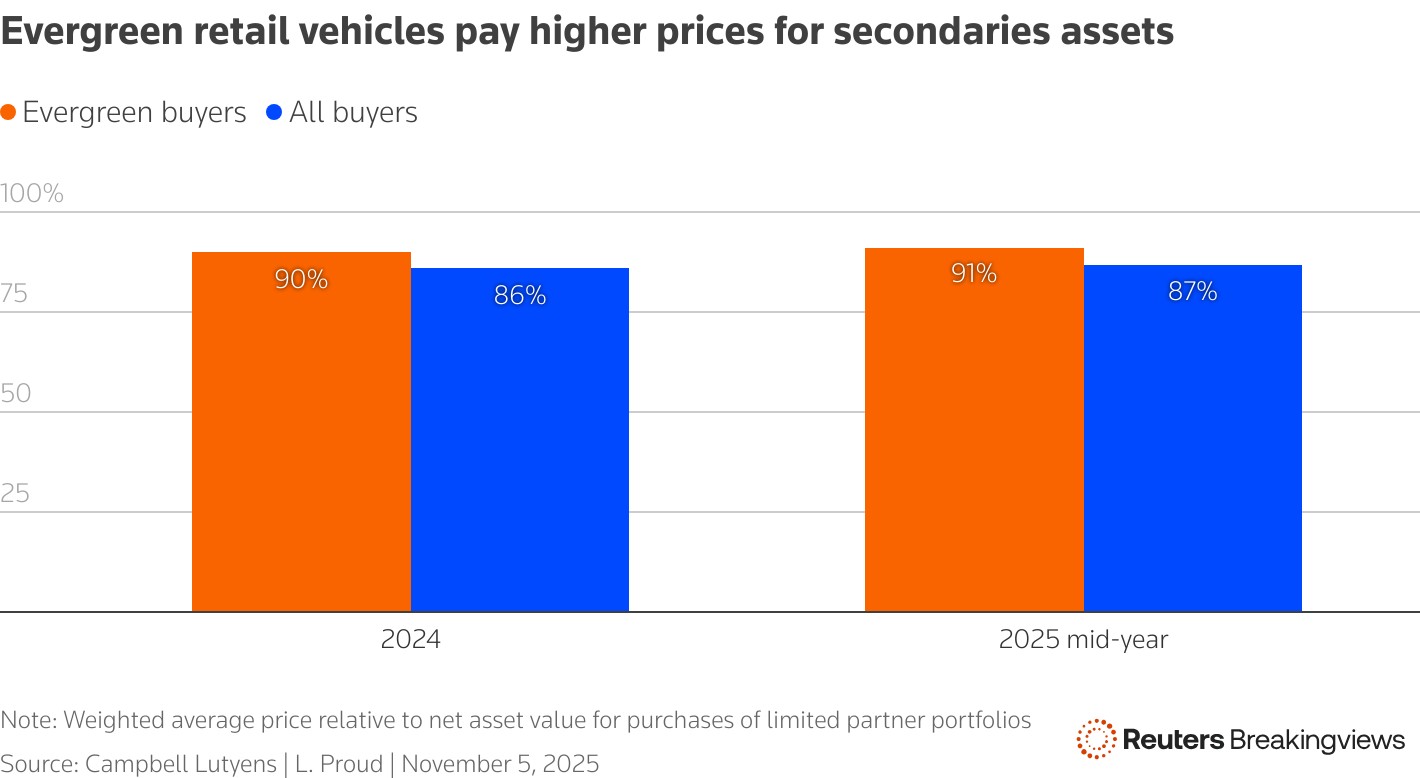

There are worrying signs. Semi-liquid vehicles targeted at individuals have grown at breakneck pace; the secondary market offers a ready opportunity to put this cash to work. These so-called evergreen funds tend to pay 4 percentage points extra, relative to face value, than the wider market for LP fund stakes, based on Campbell Lutyens data. Separately, industry advisers told Breakingviews that some investors worry about the well of high-quality continuation fund assets running dry.

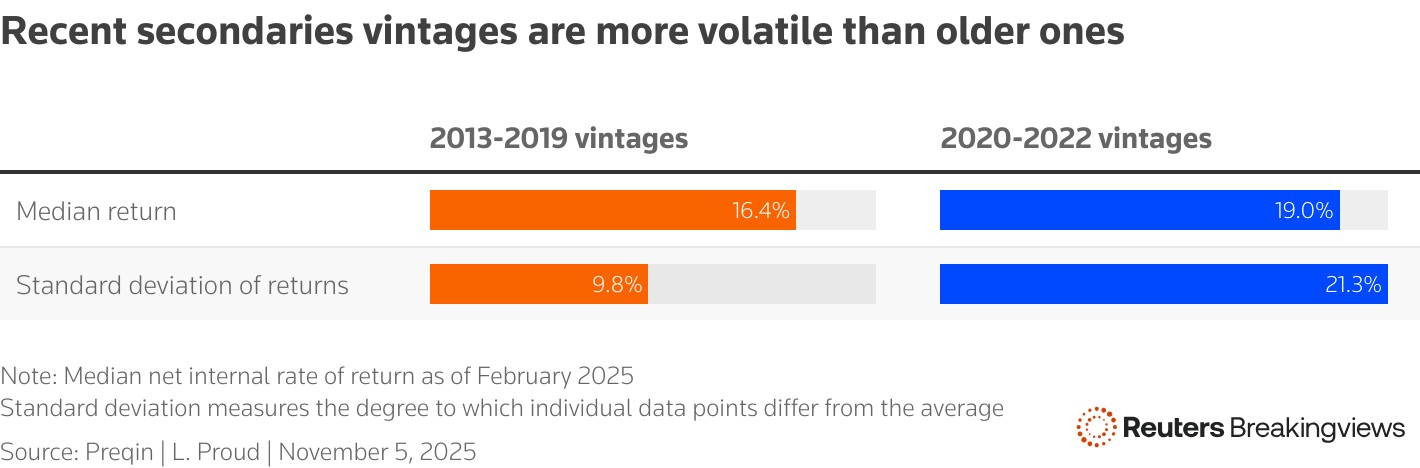

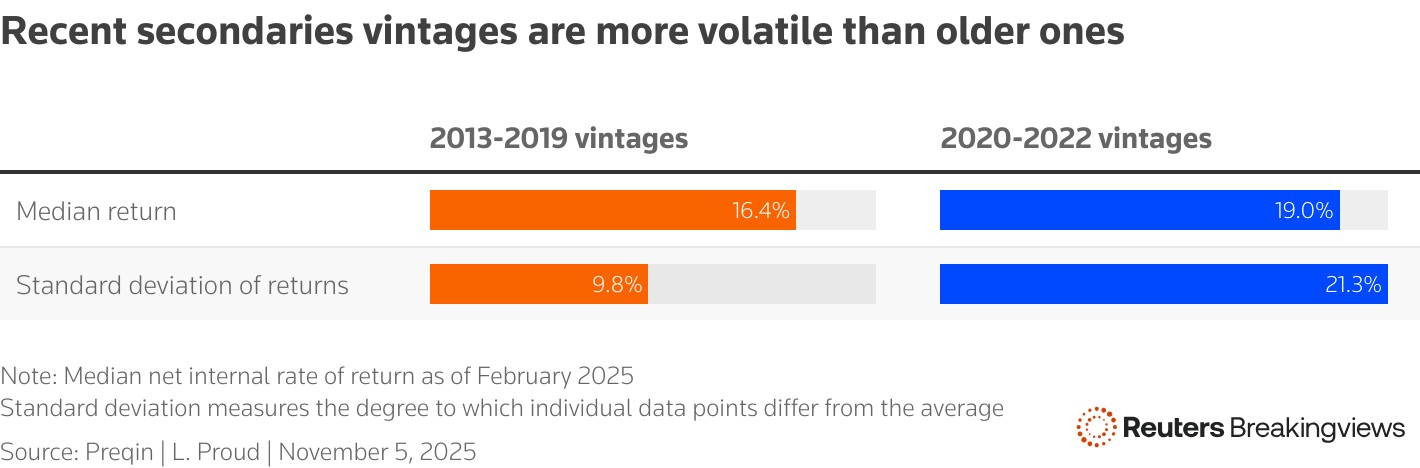

The overall balance of supply and demand still probably favors buyers. Dry powder earmarked for secondaries of about $212 billion in March, according to Preqin, is roughly equal to one year’s worth of deal volume. In the conventional buyout market, by contrast, the ratio is two-to-one. If aftermarket capital is scarce relative to the total universe of possible deals, investors should theoretically have their pick of the best. Yet the secondaries wave could still make for a bumpy ride. The rise of single-company continuation vehicles, which last year accounted for a fifth of total transaction volume according to Evercore, means secondaries investors can get access to trophy businesses, like Hg’s $30 billion Visma. But it also increases their potential exposure to idiosyncratic blowups and makes it harder to gain broad diversification. That should make performance more volatile, undermining the secondary market’s traditional selling point of offering predictably decent returns at low risk of total calamity. Indeed, performance data shows early signs of a reversal. Post-pandemic secondaries vintages are doing well overall, with a 19% median net internal rate of return compared with 16% from 2013 to 2019, Preqin figures show. Yet the gap between the best and worst performers has ballooned. The standard deviation of returns, which measures the degree to which each data point varies from the average, rose to 21% from 10%. The aftermarket is becoming racier by the day – both for better and worse. Follow Liam Proud on Bluesky and LinkedIn.

Private aftermarket trades are rising relative to asset value

Manager-led deals surged as a percentage of secondaries volumes in 2020

Evergreen retail vehicles pay higher prices for secondaries assets

Recent secondaries vintages are more volatile than older ones

Private aftermarket trades are rising relative to asset value

Manager-led deals surged as a percentage of secondaries volumes in 2020

Evergreen retail vehicles pay higher prices for secondaries assets

Recent secondaries vintages are more volatile than older ones

(Editing by Jonathan Guilford; Production by Pranav Kiran)