Tech stocks and digital currencies are being sold off as the U.S. market continues the "risk-off mode" that began this month

The Federal Reserve's expectations for a rate cut in December have significantly cooled, and investors are uneasy about the large amount of economic data set to be released soon. This has triggered a concentrated sell-off of high-valuation technology stocks and momentum stocks, which have seen substantial gains this year, with the Nasdaq index plunging over 2% and Bitcoin falling below $100,000. The core market logic is that, in the context of unclear interest rate prospects, funds are rotating from expensive growth stocks to sectors with safer valuations and more defensive characteristics, exacerbating the market style shift that has already begun this month

The brief optimism brought about by the end of the U.S. government shutdown quickly dissipated, with market focus shifting to a large amount of delayed economic data, uncertainty regarding the Federal Reserve's interest rate cut prospects, and concerns over overvalued tech stocks, leading to widespread selling of high-valued tech stocks and risk assets.

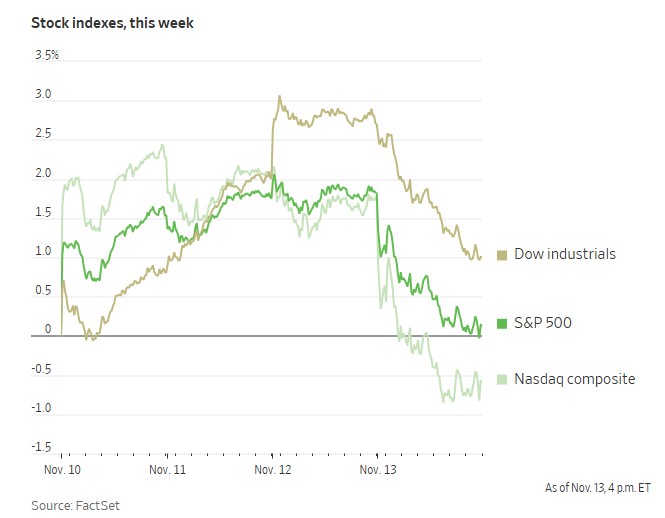

On Thursday, October 13, investors accelerated the sell-off of momentum stocks that had surged significantly this year, turning to safer assets, which caused prices of risk assets to generally decline, with U.S. stocks recording their largest single-day drop in a month.

The three major U.S. stock indices collectively fell during the day's trading, with the tech-heavy Nasdaq Composite Index closing down 2.29%. Tech giants generally declined, with Tesla down 6.64% and Nvidia down 3.58%. The deterioration of risk sentiment also spread to the cryptocurrency market, with Bitcoin falling below the $100,000 mark and Ethereum briefly dropping over 10%.

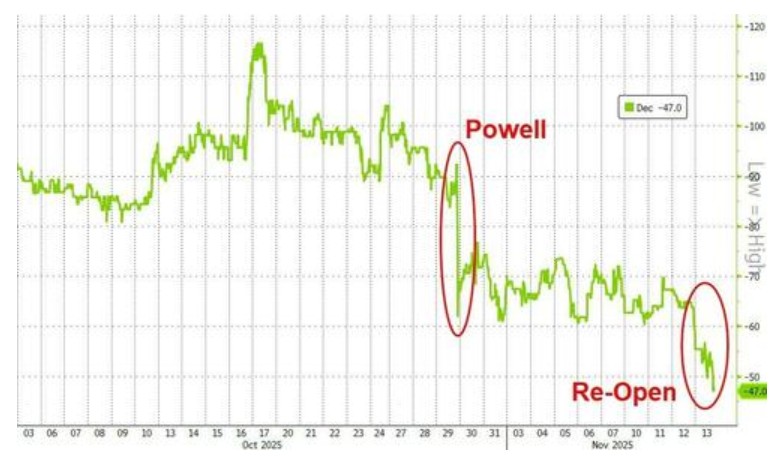

The direct catalyst for this sell-off was the cautious remarks made by several Federal Reserve officials, suggesting that interest rate cuts should be approached with caution. According to data from the Chicago Mercantile Exchange (CME), the probability of an interest rate cut has plummeted from over 70% a week ago to around 50%.

This shift has intensified the market rotation that has been ongoing this month. Reports indicate that investors are taking profits from this year's hottest stocks and shifting towards lower-valued, more defensive sectors, a "risk-off mode" that was vividly reflected in Thursday's trading.

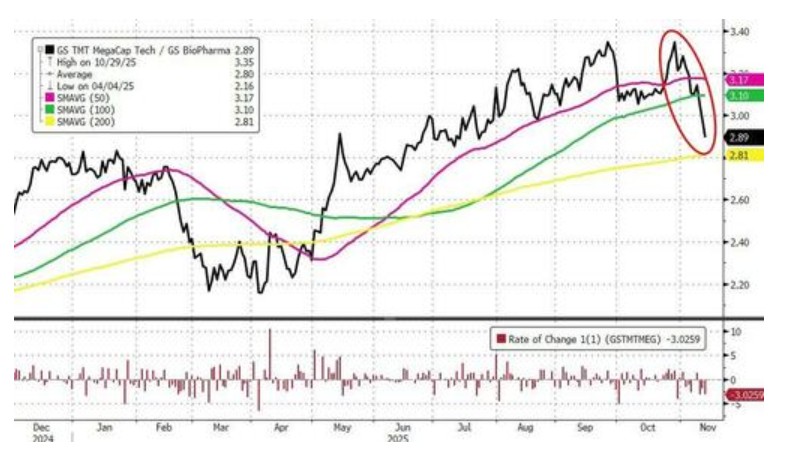

Momentum stocks and AI darlings hit hard, market rotation accelerates: funds flow into consumer and healthcare sectors

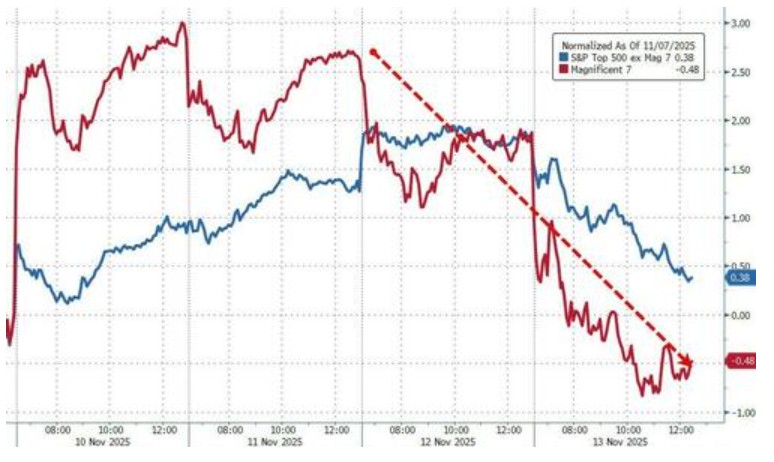

Against the backdrop of a murky interest rate outlook, the momentum stocks and artificial intelligence (AI)-related stocks that have been highly sought after this year have become the hardest hit in the sell-off.

A basket of high-momentum stocks tracked by Bank of America fell 4.7% on Thursday, marking the worst single-day performance since April. AI-related stocks saw particularly significant declines, with Nvidia down 3.58% and Broadcom down 4.29%. Stocks favored by retail investors also did not escape, with Citigroup's basket of popular U.S. retail stocks plummeting 6%.

Over the past three days, the Mag7 stocks have been severely impacted compared to other components of the S&P 500 index.

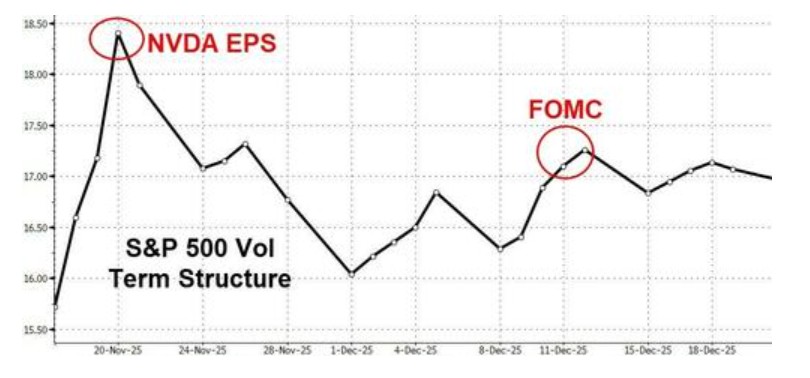

Among them, Nvidia has been consolidating for most of the past four months as investors digest all AI-related news, with the company set to release its latest financial report on November 19.

Additionally, "Cathie Wood's" ARK Innovation ETF and VanEck Social Sentiment ETF both fell over 5%. A basket of stocks tracked by Goldman Sachs, consisting of companies with market capitalizations over $1 billion that are most shorted, also dropped 5.5%, indicating that the market sell-off is widespread

The U.S. stock market is accelerating rotation and style switching while selling off large technology stocks, with funds beginning to flow significantly into the healthcare and consumer staples sectors.

Goldman Sachs' trading department pointed out that hedge funds are currently using the healthcare sector to hedge against the correlation risks brought by the weakness in artificial intelligence. The Health Care Select Sector SPDR Fund (XLV) has risen for the ninth consecutive trading day, once again becoming the best-performing sector today (excluding the energy sector). Hedge funds are actively buying stocks in this sector, but have yet to see long-term investors follow suit.

Mark Malek, Chief Investment Officer of Siebert Financial, stated:

You see people still investing in stocks, but they are rotating from those high-growth, higher-valued stocks to those that may be seen as safer and cheaper.

Despite this, investors remain optimistic about the long-term prospects of AI-related stocks, but are concerned about their excessively high valuations in the short term, prompting some to take profits.

Interest rate cut expectations waver, Fed officials sound "hawkish"

The market's reassessment of the interest rate path is the core driving force behind this sell-off. Traders in the swap market currently estimate the likelihood of a rate cut in December at about 50%, a significant drop from 72% a week ago.

Recent statements from several Federal Reserve officials have reinforced the market's cautious sentiment. St. Louis Fed President Alberto Musalem stated that, given inflation remains above the 2% target, officials should be cautious about further rate cuts. Minneapolis Fed President Neel Kashkari mentioned in an interview that he did not support the last rate cut and has not yet made a decision on the policy path for December. Cleveland Fed's Beth Hammack also pointed out that monetary policy should maintain "some degree of restrictiveness."

Matt Maley, Chief Market Strategist at Miller Tabak + Co., analyzed:

The commitment to lower rates is why many investors are willing to overlook the high valuations of momentum stocks. Now that this commitment has become less persuasive, investors are cutting their exposure to these expensive stocks. Michael O’Rourke, Chief Market Strategist at JonesTrading, also pointed out that if the pace of interest rate declines does not meet expectations, stock price-to-earnings ratios will need to contract to adapt to the new outlook, leading to sell-offs.

A "Data Deluge" is Coming, Markets on High Alert

After the U.S. government shutdown lasted for 43 days, another uncertainty facing the market is the impending "data deluge."

Investors are concerned that a large amount of delayed economic data could trigger significant market volatility and overturn investment decisions made based on incomplete information. Mina Krishnan, multi-asset portfolio manager at Schroders, stated:

We have been in the dark for the past 40 days, and now we will see a massive influx of data all at once.

Although U.S. President Trump has signed a temporary funding bill, it remains uncertain whether key economic reports (especially the employment data for October) will be released in full. This data is crucial for the Federal Reserve's assessment of labor market conditions and inflation trends, and its outcomes will directly impact future interest rate decisions, keeping investors on high alert ahead of the data release