The U.S. liquidity indicators show signs of "tightening" again, is the market pushing the Federal Reserve to "restart QE"?

The liquidity in the U.S. short-term financing market is showing signs of tightening again, with the key interest rate indicator SOFR and the reserve interest rate spread widening to 8 basis points, indicating that bank reserves are sliding from "ample" to "scarce." This change comes after the Federal Reserve has just concluded its quantitative tightening, and the market expects it will be forced to initiate "reserve management purchases" to inject liquidity, although the Federal Reserve views it as a technical operation, the market has interpreted it as a disguised new round of quantitative easing (QE)

The U.S. short-term financing market, after experiencing a brief stabilization, is once again showing signs of tightening liquidity, raising questions about the effectiveness of the Federal Reserve's recent intervention measures. The rebound of key interest rate indicators is intensifying speculation that the Federal Reserve will be forced to expand its balance sheet again, a move interpreted by some market participants as a new round of "quantitative easing" (QE).

The latest development is that the secured overnight financing rate (SOFR), a key benchmark for financing costs, has recently seen a significant rise, with its spread over the Federal Reserve's interest on reserves (IOR) widening to 8 basis points. This marks a return to a tense financing environment that had previously been easing.

This change occurred shortly after the Federal Reserve Board ended quantitative tightening (QT) two months early at the end of October to alleviate market pressure. The latest market response indicates that reserves within the banking system may be sliding toward "scarcity" levels, thereby putting pressure on the Federal Reserve for further action. Market participants are closely watching whether the Federal Reserve will announce the initiation of "reserve management purchases" to inject more liquidity into the financial system.

Although the Federal Reserve's decision to end QT had temporarily alleviated the most severe repo market freeze since the outbreak of the COVID-19 pandemic, restoring some stability to the market, the current tense situation suggests that potential liquidity challenges may be more persistent than expected.

SOFR Sounds the Alarm Again

After the Federal Reserve announced the halt of QT at the end of October, SOFR had briefly retreated, nearly aligning with the interest on reserves, but the recent surge has disrupted this calm. The widening spread between SOFR and IOR is a key signal for measuring pressure in the money market.

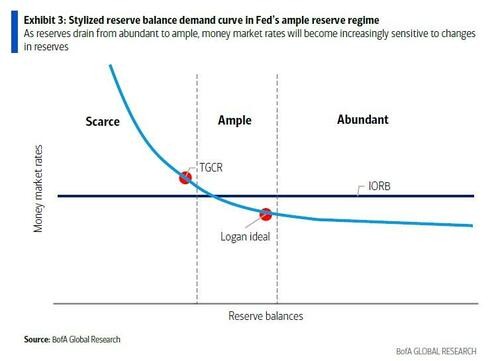

According to analysis from Goldman Sachs' repo trading department, not only has SOFR risen, but the tri-party repo rate has also recently rebounded to about 0.8 basis points above the interest on reserves. Based on the framework outlined by Bank of America analyst Mark Cabana, these interest rate indicators being above IOR typically means that bank reserves have moved away from "ample" or even "plentiful" levels and are beginning to enter the "scarce" range.

"Reserves Are No Longer Ample"

Regarding the reasons behind the rise in financing rates, Goldman Sachs FICC trader Chris Horvatin shared his observations in a report. He noted that recent statements from Federal Reserve officials have been quite "confusing," as they stated that reserves are no longer "plentiful," yet still "slightly above ample levels."

Horvatin interprets these remarks as implying that "reserve management purchases" will be the next step in the Federal Reserve's balance sheet normalization process. This means that the Federal Reserve's balance sheet may soon begin to grow again. This view aligns with that of Bank of America's Mark Cabana, who had previously accurately predicted the Federal Reserve would end QT early and believes the Federal Reserve should purchase short-term government bonds at a pace of $75 billion to $100 billion per month To supplement reserves.

The Federal Reserve is closely monitoring two key indicators

Chris Horvatin believes that the timing for the Federal Reserve to re-expand its balance sheet (SOMA portfolio) will depend on "several factors," two of which are particularly critical.

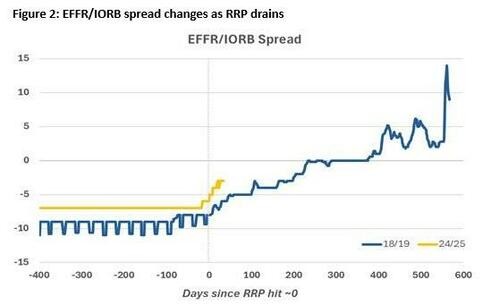

The first is the relationship between the effective federal funds rate (EFFR) and the interest on reserves balances (IORB). Looking back at the situation from 2018 to 2019, when the EFFR began to consistently exceed the IORB, the Federal Reserve decided to slow down quantitative tightening (QT). Horvatin believes that the current market is showing clear signs of tension, and it is expected that the spread between the EFFR and IORB may further narrow by the end of the year.

The second is the continued use of the standing repurchase facility (SRF). The use of the SRF is seen as a clear signal that reserves are at a scarce level. According to statements from New York Fed President Williams and officials Lorie Logan, Hammack, and Perli, the Federal Open Market Committee (FOMC) clearly wants to stress test this new tool. Data shows that after a brief pause, the SRF tool has recently re-emerged with daily usage. Goldman Sachs expects that as dealers optimize their balance sheets before the end of the year, financing demand will increase, and the frequency of SRF usage may further rise.

Market bets on Fed's balance sheet expansion

In summary, the current tension in the financing market is the result of multiple factors working together. These include the ongoing QT continuing to drain liquidity (officially stopping only on December 1), market expectations for the Federal Reserve to soon announce "reserve management purchases," and the Fed's readiness to allow the SRF tool to play a larger role during the transition period of reserve levels.

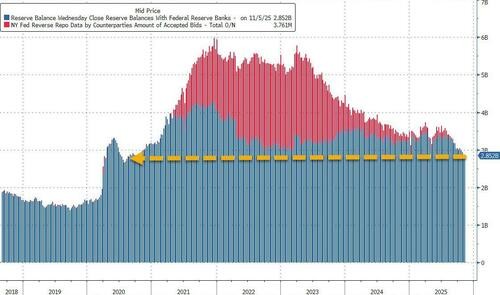

Currently, the level of bank reserves in the United States has fallen to its lowest point in five years. The Federal Reserve hopes that the transition from "abundant" to "scarce" reserves can proceed smoothly, but market signals indicate that this process may be bumpy. Now, the only unresolved question is what factor will trigger a "blow-up" first, forcing the Federal Reserve to take more decisive action.