The American AI myth fades, and the risk of "triple kill" in stocks, currencies, and bonds rises

Industrial Securities believes that the shortcomings of the United States in key AI areas are becoming apparent: the imbalance between electricity supply and demand restricts development, the total number of STEM talents is far lower than that of China, de-globalization compresses data scale, and the advantage in computing power faces electricity bottlenecks. Although there are short-term policy supports, they come at the cost of sacrificing the credibility of the US dollar. In the medium to long term, the logic of AI hegemony may be falsified, and coupled with the shaking of the global hegemony system, the risk of a "triple kill" in US stocks, bonds, and currency is significantly increasing

Key Points

Recently, the AI concept sector in the US stock market has adjusted, and the disadvantages of the US in key AI fields have expanded. Coupled with the long-term shaking of the global hegemony system, this outlines a potential change in the US economy and financial markets. This series of changes not only impacts the market's optimistic expectations for "AI hegemony" but also hides the rising systemic risks in the financial market.

The US stock market's AI sector has significantly cooled, and the market myth is beginning to fade. Recently, the Nasdaq index fell more than 3% in a single week, with the market value of core AI companies represented by NVIDIA collectively declining, including a drop of over 7% for NVIDIA. The valuation of AI concepts has become excessively inflated, far exceeding the market value proportion of the top ten companies during the internet bubble era. Behind the "AI myth" lies enormous uncertainty, as 95% of generative artificial intelligence investments have yet to yield actual returns for companies.

In the four key areas of AI development, the US's shortcomings are prominent, and its advantages are under pressure. In the energy infrastructure sector, the imbalance between electricity supply and demand is prominent, with AI data centers driving a surge in electricity demand, while the supply side is affected by aging infrastructure, slow construction processes, and inappropriate policy regulation, leading to continuous increases in electricity prices; in the talent sector, the total number of STEM graduates in the US is far lower than that in China, and it heavily relies on foreign talent; in the data sector, the "America First" oriented de-globalization policies have compressed the potential data scale available for AI training; in terms of computing power, although the US currently leads, it faces power bottlenecks, while China is rapidly catching up through initiatives like "East Data West Computing" and domestic chip replacements, which may gradually weaken the US's long-term computing power advantage.

Market Impact: In the short term, although there is still monetary easing as a hedging measure, the risk of a "triple kill" in US stocks, bonds, and currencies is clearly rising in the medium term. In the short term, the US government's fiscal intervention and the Federal Reserve's liquidity support can partially offset the downward pressure on US stocks, but essentially at the cost of sacrificing some dollar credit. From a medium to long-term perspective, the fundamental logic supporting "AI hegemony" may be falsified, and once global doubts about the US's dominant position intensify, it may trigger a systemic revaluation of its asset prices. Coupled with the chaotic domestic and foreign affairs of the current US government, the core support for dollar credit is further weakened, and the risk of a "triple kill" in the financial market will significantly increase.

Main Text

The US stock market's AI sector cools, and the market myth begins to fade

Recently, the AI concept sector in the US stock market has undergone adjustments. From November 3 to 7, the Nasdaq index fell more than 3%, with the market value of core AI companies collectively declining, including a drop of over 7% for NVIDIA. The valuation of AI concepts has become excessively inflated, with the current "seven giants" of the US stock market accounting for about 35% of the S&P 500's market value, while during the internet bubble era, the total market value of the top ten companies in the S&P 500 only accounted for 23% of the total market value of the index. Behind the "AI myth" is significant "uncertainty": 95% of generative artificial intelligence investments have basically not brought returns to companies; although OpenAI's valuation has reached $500 billion, its revenue in the first half of 2025 is expected to be about $4.3 billion, while its net loss is as high as $13.5 billion.

In core supporting areas of AI, the US's shortcomings are prominent, and its advantages are under pressure

Energy, algorithms/talent, data, and computing power are the four core support areas for AI development. The United States has obvious disadvantages in some areas and faces challenges even in its advantageous fields.

Firstly, under the U.S. system, the energy infrastructure (especially electricity supply) is difficult to enhance, which restricts the development of the AI industry. On the demand side, electricity consumption continues to rise, with AI data centers being the core driving factor. According to the U.S. Energy Information Administration (EIA), electricity consumption in the U.S. is expected to grow by 4% in 2024 compared to 2019, and the subsequent demand increase will continue to expand. The Lawrence Berkeley National Laboratory estimates that the demand for AI-related GPU servers will drive data center energy consumption to reach 176 TWh in 2023, accounting for 4.4% of total electricity consumption in the U.S., and this proportion may rise to 12% by 2028. On November 12, Anthropic announced it would invest $50 billion to build data centers, further confirming the sustained demand for electricity from the AI industry.

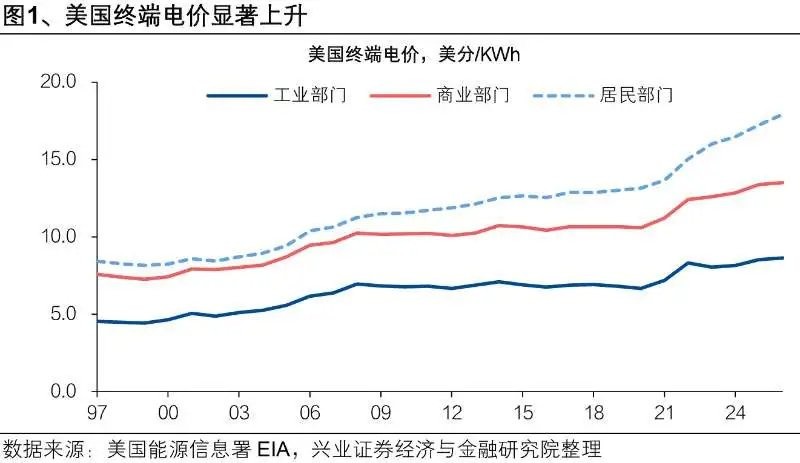

On the supply side, under the U.S. system, which is oriented towards a small government and market economy, the supply capacity of electricity as a public good is difficult to enhance synchronously and has clearly lagged behind demand. On one hand, the existing electricity stock is insufficient, and the supply-demand gap has already emerged, directly reflected in the continuous rise in electricity prices: from 2019 to 2024, electricity prices in the industrial and commercial sectors increased by 20%, and in the residential sector by over 26%. The EIA expects significant growth to continue over the next two years. On the other hand, the supply side faces multiple structural constraints, making it difficult to respond quickly to demand. Infrastructure is severely aging, the connectivity of the three major U.S. power grids is weak, with 70% of transmission lines and transformers operating for over 25 years, and 60% of circuit breakers for over 30 years. The closure of old power plants is faster than the speed of new replacements; at the same time, due to land acquisition, environmental issues, and approval obstacles, a U.S. grid strategy consulting firm pointed out that only 55.5 miles of high-voltage transmission lines were built in the U.S. in 2023, the slowest construction rate since 2010. This has resulted in the U.S. currently having only a few 765 kV lines, with a total length of about 3,200 kilometers, which is only equivalent to the length of one ultra-high voltage line in China, with the rest mostly being 500 kV and below. In contrast, by the end of 2024, China will have already put into operation 22 lines of 1,000 kV and 19 lines of 800 kV ultra-high voltage lines. Additionally, the Trump administration's policies to increase fossil fuel extraction and revoke clean energy-related projects have further widened the supply-demand gap.

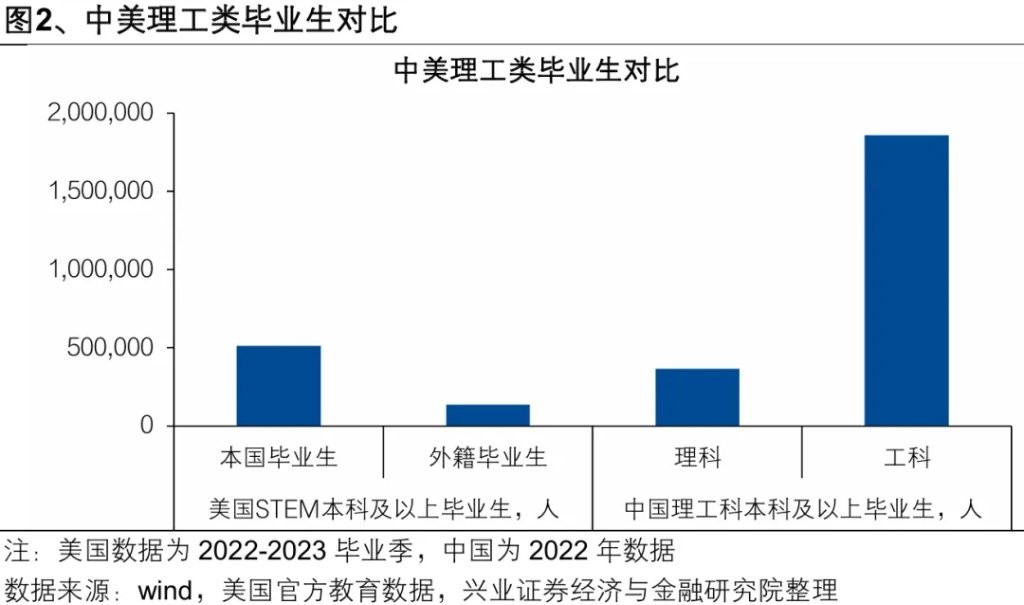

Secondly, in terms of algorithms (talent), the U.S. does not hold an advantage. The updating and iteration of AI algorithms highly depend on high-quality talent. In the 2022-2023 graduation season, there were about 645,000 STEM (Science, Technology, Engineering, Mathematics) graduates at the undergraduate level and above in the U.S., while in 2022, the number of graduates in science and engineering from Chinese universities (ordinary undergraduate and above) exceeded 2.2 million, nearly four times that of the U.S. From a total perspective, the talent quality dividend in the U.S. is not particularly prominent. Moreover, the U.S. relies heavily on foreign talent, with about 1/5 of STEM graduates at the undergraduate level and above being foreign nationals, especially at the master's and doctoral levels, where the proportion of foreigners is close to half

Third, in the data field, "America First" has shaken the institutional foundation of its openness, leading to an expansion of its relative disadvantages. The training of large artificial intelligence models relies on massive amounts of data, which comes from digital records of people's daily behaviors such as clicks, searches, payments, and uploads. The population size can be seen as a "natural resource" for this type of data; the larger the population, the richer the "resource." The U.S. has a domestic population of about 340 million, but the previous globalization expansion of Silicon Valley internet giants has allowed it to access behavioral data for training that far exceeds its domestic population size. For example, the European Union (excluding the UK) has about 450 million people, Japan has about 120 million people, and the combined population of the U.S., Europe, and Japan exceeds 900 million. However, since 2018, Washington has accelerated "de-globalization" guided by "America First," erecting trade barriers in the digital field, which has led other economies to increasingly emphasize data localization. Against this backdrop, the potential population size available for data training for U.S. internet giants may face contraction, making it difficult for their model iterations to keep pace with economies that have larger populations.

Fourth, in the computing power field, the U.S. currently leads in the short term, but its advantages will weaken in the medium to long term. Currently, the U.S. AI computing power is at the global forefront, with its high-end AI computing power accounting for about 74% of the global total, while China accounts for about 14%. The U.S. is attempting to maintain this advantage through chip export restrictions to China; for example, in early November 2025, Trump explicitly stated that the sale of NVIDIA's latest Blackwell chips to China would be prohibited. However, the blockade has instead forced China to accelerate its catch-up, with the domestic AI chip localization rate expected to rise to 40% by 2025. Power shortages have become a core bottleneck for the expansion of U.S. AI computing power, with some data centers facing wait times of up to 7 years to connect to the power grid. In contrast, China is achieving precise matching of clean energy and computing power demand through the "East Data, West Computing" project, continuously improving its domestic chip ecosystem. In the computing power race, China has adopted a differentiated strategy, leading the world with 230 AI clusters, surpassing the U.S.'s 187. At the same time, China is continuously improving its computing power utilization efficiency, achieving similar performance with lower computing costs through algorithm optimization and computing architecture innovation. The power bottleneck in the U.S. is unlikely to be resolved in the short term; while technological blockades can delay, they cannot stop China's independent innovation. Coupled with China's advantages in application scenarios and policy support, the U.S.'s computing power advantage over China may gradually weaken in the medium to long term, and the competitive landscape of computing power between China and the U.S. may undergo new adjustments.

Market Impact: In the short term, although there is still monetary easing as a hedging measure, the risk of a "triple kill" in U.S. stocks, bonds, and currencies is clearly rising.

In the short term, U.S. policy support combined with Federal Reserve liquidity support may partially hedge the downward pressure on U.S. stocks. The current core narrative of the U.S. stock market's fundamentals is built on expectations of "AI hegemony," which has already acquired a certain "too big to fail" policy attribute for the U.S. In this context, facing the pattern of "U.S. stocks under pressure - U.S. dollar strengthening," if the U.S. government strengthens fiscal intervention and promotes monetary policy easing, it could hedge the downward pressure on U.S. stocks in the short term From a mechanistic perspective, this path essentially provides a temporary "endorsement" for the U.S. stock and even bond markets at the cost of partially sacrificing the credibility of the U.S. dollar.

However, in the medium to long term, as the U.S. global hegemonic system wavers, the risk of a "triple kill" in stocks, bonds, and currencies will significantly increase. The U.S. has long maintained a trade deficit, and the core support for the dollar's credibility stems from its global hegemonic status. As mentioned above, the fundamental logic supported by "AI hegemony" may ultimately be falsified. Once the market begins to question the U.S.'s global dominance and the "gold content" of the dollar, it could trigger a systemic reassessment of its asset prices. At that time, the risk of a "triple kill" in the U.S. financial market will significantly rise. Given the chaotic domestic and foreign affairs landscape during this U.S. administration, this moment may not be far off.

Author of this article: Wang Han, Source: Wang Han Macro Theory, Original Title: "Wang Han of Industrial Securities | The Myth of American AI Fades, Market 'Triple Kill' Risk Rises"