Bridgewater cut its NVIDIA holdings by 65% in Q3, halved its positions in Google and Meta, increased its holdings in the U.S. large-cap index, and completely liquidated its emerging market ETF

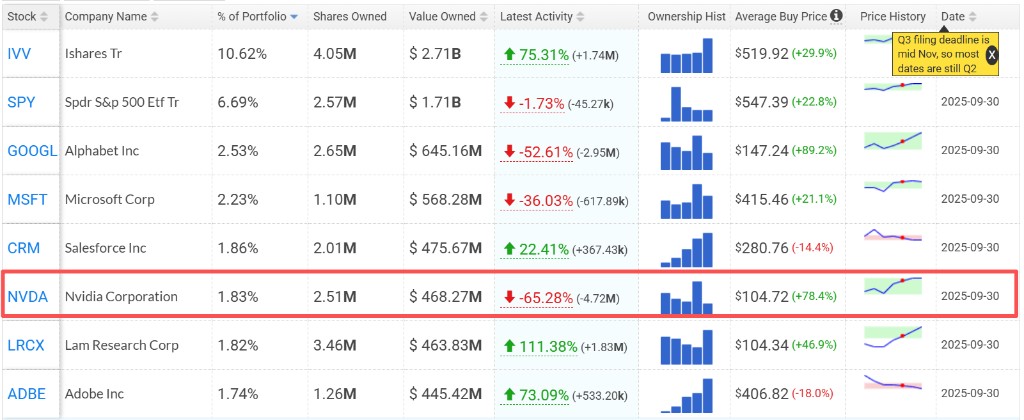

As of September 30, Bridgewater held 2.51 million shares of NVIDIA, a dramatic drop of 65.3% from 7.23 million shares at the end of the second quarter, during which Bridgewater had significantly increased its position in NVIDIA. The holdings in the U.S. large-cap ETF, SPY, surged by 75.3% to 4.05 million shares, accounting for 10.62%, making it the largest holding. Bridgewater reduced its positions in Google and Meta by 52.6% and 48.3%, respectively, and decreased its Microsoft holdings by 36%, while cutting its Amazon stake by 9.6%

As the AI bubble, sovereign debt risks, and the global liquidity turning point approach simultaneously, Ray Dalio's "debt cycle alert" seems to be transitioning from theory to reality.

According to the latest 13F filings, in the third quarter, the world's largest hedge fund, Bridgewater Associates, not only cut its NVIDIA holdings by 65% in one go, but also significantly increased its position in U.S. large-cap index ETFs while cleaning up several emerging market heavyweights—a "risk-averse adjustment" is quietly taking place.

NVIDIA Severely Reduced: Short-term Risks Intensify

The report shows that as of September 30, Bridgewater held 2.51 million shares of NVIDIA, a drastic drop of 65.3% from 7.23 million shares at the end of the second quarter. Just in the recently concluded second quarter, Bridgewater had significantly increased its NVIDIA holdings by over 150%. The sharp turn between the two quarters indicates a clear strategic shift: from "trend following" to "risk management priority."

According to a previous article by Wall Street Insight, Bridgewater founder Ray Dalio recently warned that the global debt cycle has entered a late-stage risk phase, believing that the next financial crisis is more likely to stem from sovereign debt issues rather than traditional market over-speculation. The continuous rise in U.S. public debt, geopolitical tensions, and central bank interventions have collectively heightened systemic risks.

As a major beneficiary of the AI boom, NVIDIA's market value has soared, but Bridgewater's retreat indicates that the fund is reassessing its risk exposure in the tightening fiscal and monetary policy environment.

This reduction stands in stark contrast to other hedge funds, as David Tepper's Appaloosa Management increased its NVIDIA holdings to 1.9 million shares during the same period.

Increased Holdings in U.S. Large-Cap ETFs: Betting on "Stable Growth," Enhancing Hedging

While reducing individual stock risks, Bridgewater significantly increased its allocation to U.S. large-cap ETFs:

-

SPDR S&P 500 ETF (SPY) holdings surged by 75.3% to 4.05 million shares, accounting for 10.62%, making it the largest holding.

-

iShares Core S&P 500 ETF (IVV) increased its share to 6.69%, ranking as the second-largest holding.

The two ETFs together account for over 17% of the fund's investment portfolio, which is considered "core asset level" weight in Bridgewater's traditional industry-macro portfolio.

The intention behind this adjustment is clear:

The intention behind this adjustment is clear:

-

Reduce industry concentration: Avoid excessive influence of AI and tech stocks on portfolio volatility.

-

Embrace large-cap stable cash flow: In the post-economic cycle phase, the risks of large-cap stocks are more controllable than those of growth stocks.

-

Increase portfolio flexibility: ETFs are more convenient for short-term micro-adjustments and risk hedging.

For Bridgewater, which adheres to a "risk parity + diversification" strategy, this move perfectly aligns with its style of "seeking opportunities in defense."

Liquidating multiple stocks and emerging market ETFs: Accelerating the withdrawal of non-core assets

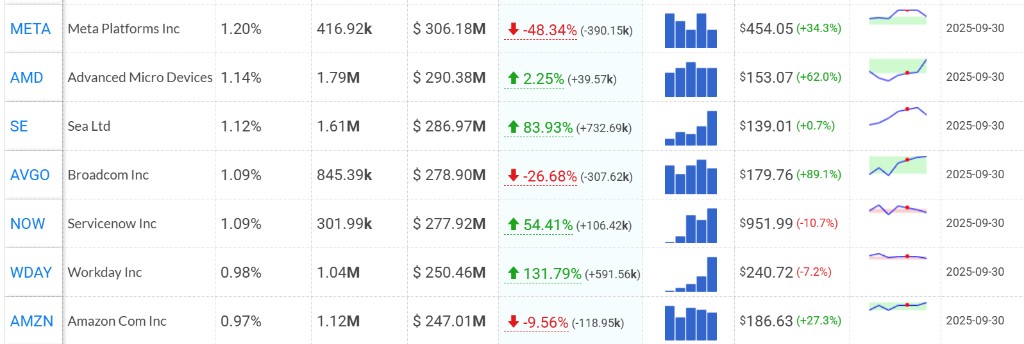

In addition to reducing its holdings in NVIDIA, Bridgewater completely liquidated 10 important stock positions in the third quarter, including Lyft, Spotify, JP Morgan, United Airlines, and Pfizer, while also reducing its positions in Amazon (down 9.56%), Microsoft (down 36.03%), Meta (down 48.34%), and Google (down 52.61%) among the "seven giants."

These companies span multiple industries including finance, pharmaceuticals, technology, transportation, real estate, and resources—Bridgewater's actions clearly indicate a comprehensive "slimming down" of non-core assets, returning to a few high liquidity and high stability targets.

Additionally, from the 13F filings, it can be seen that Bridgewater continues to reduce its allocation to emerging market ETFs, highlighting its concerns about the vulnerability of emerging markets amid global liquidity tightening.

Aggressively increasing positions in certain industries: Netflix, Monster Beverage, Latin American e-commerce MEL

Despite the overall strong "risk reduction" tone, Bridgewater has also made significant increases in several individual stocks, reflecting its Alpha strategy of "seeking undervalued recovery assets":

-

Netflix: Position increased by 896%

-

MercadoLibre (Latin American e-commerce giant): Increased by 1237%

-

Popular / Evercore / Monster Beverage / Exelixis: All saw increases in the range of 1000%—5000%

-

Trane Technologies (HVAC giant): Increased by 5343%

These increases share a commonality: stable earnings, strong cash flow, weak industry cyclicality, and greater resilience during macro fluctuations, with valuations relatively less expensive than tech giants. It is evident that Bridgewater is steering clear of the highly valued and volatile AI sector while "positioning against the wind" in fundamentally solid recovery-type companies