Hillhouse Capital continues to heavily invest in Chinese concept stocks, HHLR increased its position in PDD in the third quarter, newly invested in Baidu, and fully exited JD.com

HHLR Advisors reported a profit of 23.45% in the third quarter, with the total value of its U.S. stock holdings reaching USD 4.1 billion by the end of the third quarter, an increase of USD 990 million from the previous quarter, a growth rate of 32%, with Chinese assets accounting for over 90%

The 13F report shows that HHLR Advisors, a fund management platform under Hillhouse Capital focused on secondary market investments, still has over 90% of its holdings in Chinese concept stocks in the third quarter, continuing to be a core allocation.

According to the report, HHLR Advisors achieved a profit of 23.45% in the third quarter, with a total value of U.S. stock holdings reaching $4.1 billion by the end of the third quarter, an increase of $990 million from the previous quarter, a growth rate of 32%, with Chinese assets accounting for over 90%.

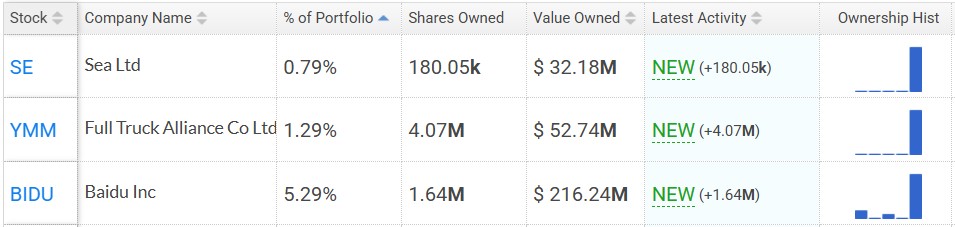

The most notable change is that Baidu has appeared in HHLR's portfolio for the first time and quickly became the sixth largest holding.

At the same time, the institution continued to increase its holdings in its long-term favored e-commerce giants PDD and Alibaba, with PDD remaining the largest holding.

(HHLR Advisors Holdings Heatmap)

(HHLR Advisors Holdings Heatmap)

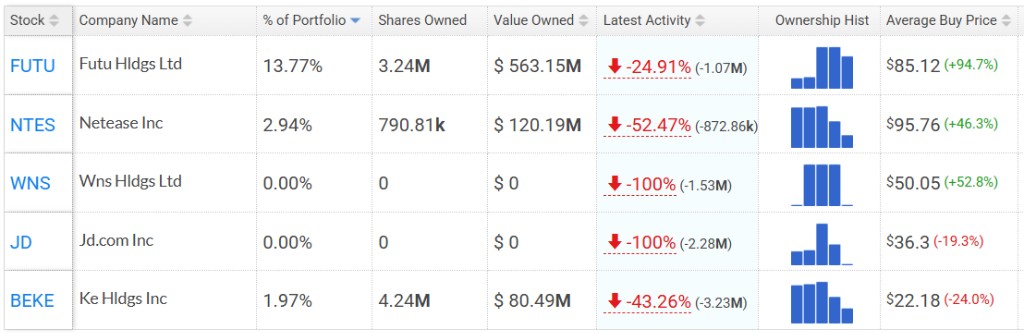

While actively positioning, HHLR also demonstrated proactive yield management. The report shows that the institution reduced its holdings in some companies that have seen significant stock price increases this year, such as Futu Holdings and NetEase, to lock in investment returns.

Increasing Holdings in PDD, Liquidating JD.com

HHLR's portfolio adjustment in the third quarter involved a significant "reshuffle" among the Chinese e-commerce giants.

During the reporting period, the fund increased its holdings in PDD by 1.62 million shares, significantly raising its holding ratio by 23.16%. After this operation, PDD's position as its largest holding was further solidified, with a holding market value of $1.14 billion, accounting for 27.76% of the entire portfolio.

At the same time, HHLR's number of shares in Alibaba surged by 186.13%, increasing by 2.14 million shares, making it the second largest holding of the fund, with a holding market value of $588 million.

In stark contrast to the increased positions in Alibaba and PDD, HHLR completely liquidated its entire holding of 2.28 million shares of JD.com.

This operation indicates that HHLR has made clear choices among the three major e-commerce giants, concentrating funds on companies it believes have more certainty and growth potential.

New Position in Baidu, Layout for Future AI Growth

Establishing a new position in Baidu is another crucial strategic layout for HHLR this quarter, clearly indicating its active embrace of new growth opportunities brought by artificial intelligence.

Data shows that HHLR bought 1.64 million shares of Baidu for the first time, with a holding market value of $216 million, accounting for 5.29% of the portfolio, making it the fifth largest holding.

This move is seen as a forward-looking investment in Baidu's AI commercialization prospects, especially in the long-term potential of generative AI (such as Wenxin Yiyan) and autonomous driving technology Driven by favorable factors such as the acceleration of AI strategy commercialization, Baidu's stock price rose by 54% in the third quarter.

In addition to Baidu, the fund also made small new positions in the digital freight platform Manbang Group (YMM) and the Southeast Asian digital economy company Donghai Group (SE), indicating its exploratory layout outside of core sectors.

Locking in Profits

While increasing its holdings in core assets, HHLR also decisively reduced or completely exited positions in companies it deemed to have unclear growth prospects or high uncertainty, in order to mitigate risks and free up funds for increasing core positions.

During the reporting period, HHLR significantly reduced its stake in the Chinese real estate service platform Beike (BEKE) by 43.26%, reflecting its cautious attitude towards the outlook of the real estate market-related industries.

In addition, the fund also significantly cut its position in NetEase (NTES) by 52.47% and reduced its holdings in Futu Holdings (FUTU) by 24.91%.

According to analysis, these actions may be aimed at locking in profits after a significant rise in stock prices earlier. At the same time, completely exiting non-core positions such as WNS Holdings further reflects its intention to focus the investment portfolio on core competencies