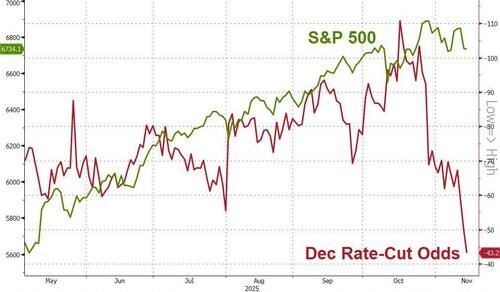

U.S. stock indices vs. interest rate cut probability

Goldman Sachs traders stated that despite the volatility in the momentum/AI thematic sector and the Federal Reserve's continued hawkish stance (the red line in the chart shows that the market currently expects a 43% probability of a rate cut by the Federal Reserve on December 10, while the probability for a rate cut in late October is 98%), the Nasdaq and S&P 500 (green line) closed nearly flat this week, which is hard to believe. However, retail investors have been hit hard, with popular retail stocks and the cryptocurrency market nearly falling into a bear market

Goldman Sachs traders stated that despite the volatility in the momentum/AI theme sector and the Federal Reserve's continued hawkish stance (the red line in the chart shows that the market currently expects a 43% probability of a rate cut by the Federal Reserve on December 10, while the probability for a rate cut in late October is 98%), the Nasdaq and S&P 500 (green line) closed nearly flat this week, which is hard to believe.

However, retail investors have been hit hard, with popular retail stocks and the cryptocurrency market nearly entering a bear market.