On the last trading day of this week, U.S. tech stocks finally welcomed a bottom-fishing opportunity, but "the key is to watch next week."

On Friday, core AI stocks such as NVIDIA and Oracle saw funds bottom-fishing, helping the Nasdaq achieve its largest intraday reversal since April. Next week, NVIDIA's earnings report (with implied volatility reaching a new high for the year) and delayed economic data (including the September employment report) will be crucial, determining the outlook for AI trading and the Federal Reserve's rate cut expectations in December. Analysts say, "Only data confirming economic growth and stable inflation can be considered a true recovery."

This week, U.S. stocks experienced a dramatic trend of first declining and then rising. The significant drop in the first four trading days was met with a technical rebound on Friday, as funds flowed into tech stocks, allowing the Nasdaq to recover its losses. However, next week's Nvidia earnings report and a series of delayed economic data will be crucial.

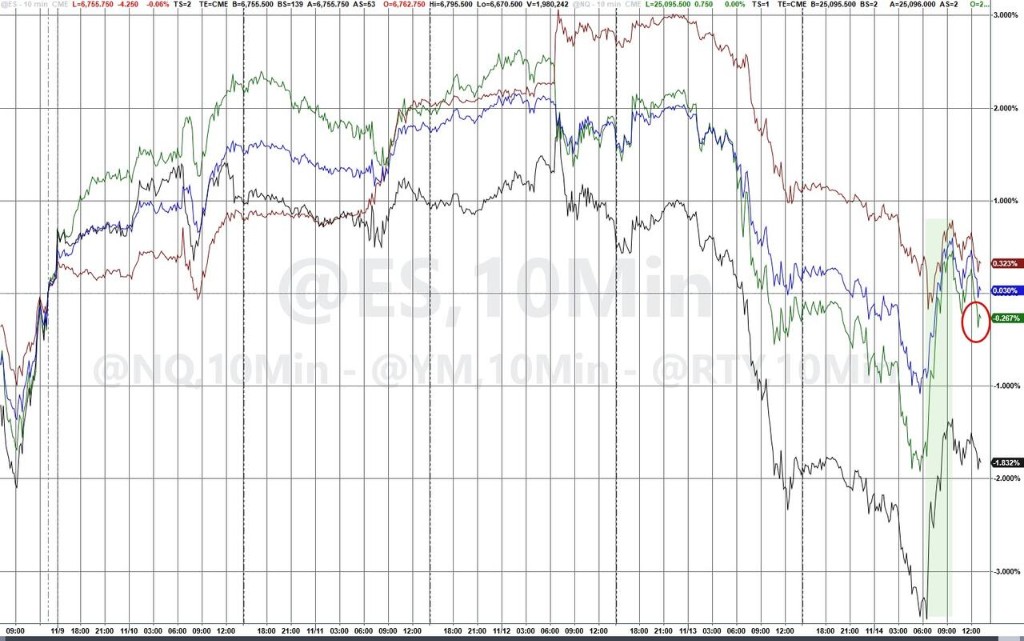

After the market opened on Friday, core AI stocks like Nvidia and Oracle fell to levels attractive enough to draw in bottom-fishing funds, leading to a rapid rebound in stock prices. The Nasdaq, which had once dropped 1.9%, closed up 0.1%, marking the largest intraday reversal since April. The S&P 500 index rose slightly by less than 0.1% this week, the Nasdaq fell 0.5%, and the Dow Jones increased by 0.3%.

In addition to funds bottom-fishing tech stocks, technical factors also supported the rebound of major indices like the Nasdaq on Friday. As shown in the chart below, the Dow Jones, Nasdaq, and S&P 500 indices all rebounded after touching their 50-day moving averages. Meanwhile, the small-cap index found support after testing its 100-day moving average.

However, the sustainability of this bottom-fishing action remains in doubt. Melissa Brown from SimCorp pointed out, "A true rebound may have to wait until government data starts being released again, allowing investors to better understand the economic and inflation situation. But this will only be a real recovery if the economy continues to grow and inflation no longer rises," she stated.

Next week's quarterly earnings report from Nvidia (November 19) will be a key indicator to test whether there is still upside potential in AI trading. At the same time, a series of delayed economic reports, including the September employment data scheduled for release on November 20, will influence market expectations for the Federal Reserve's December meeting. Analysts believe that the uncertainty surrounding the Fed's interest rate cut prospects, intertwined with the controversy over tech stock valuations, poses multiple challenges for the market.

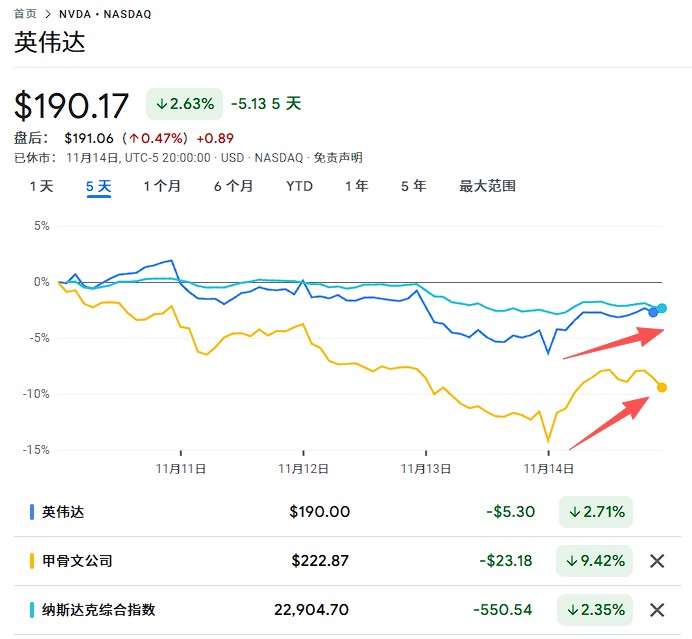

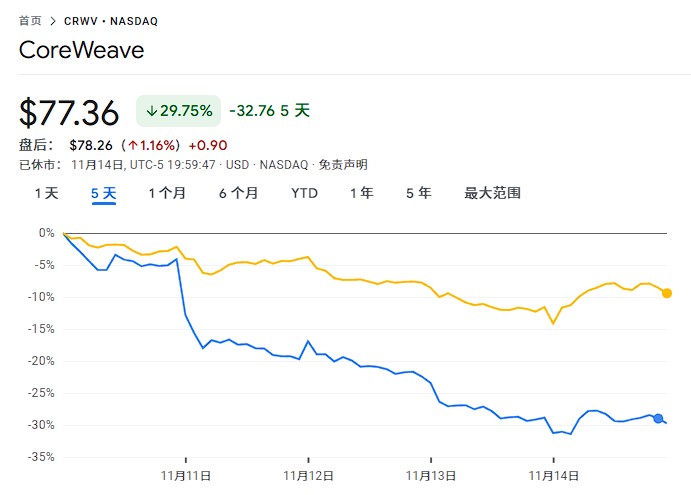

This week, there were clear signs of capital rotation in the U.S. stock market—investors shifted funds from this year's main engine, AI concept stocks, to more defensive sectors like healthcare, materials, and energy. Companies related to OpenAI faced significant declines, with Oracle dropping 6.9% this week and cloud service provider CoreWeave plummeting 26%.

Friday's Bottom-Fishing Action Rescues Tech Stocks

After the market opened on Friday, the selling pressure on tech stocks ultimately triggered buying intervention. The Nasdaq index, which had once fallen 1.9% during the session, quickly recovered its losses and closed up 0.1%.

According to Dow Jones market data, this was the largest intraday reversal for the index since the tariff turmoil in April. The S&P 500 index also reduced its early significant decline, ultimately closing down less than 0.1%, while the Dow fell 0.7%, about 310 points NVIDIA's stock price rebound on Friday afternoon helped it barely close up for the week, providing a relatively stable starting point for its earnings report next Wednesday.

From this week's trend, investors began to withdraw funds from the AI sector, the main driving force of the market this year, and shifted towards more defensive industries. Healthcare, materials, and energy companies led the S&P 500 index.

Meanwhile, companies related to OpenAI faced significant declines. Oracle's stock price fell over 9% this week, and data center cloud service provider CoreWeave plummeted nearly 30%.

Ken Mahoney of Mahoney Asset Management stated:

"We saw a quite noticeable rotation this week, primarily flowing into healthcare and consumer staples, which appear to have bottomed out. This is not what you want to see for AI trades or related stocks."

Daniel Skelly, head of market research and strategy at Morgan Stanley Wealth Management, remarked:

"What has happened in the market recently doesn't even qualify as a tech stock crash, but it may be a sort of valuation clearing for tech stocks."

Next Week Focus on NVIDIA's Earnings Report and Economic Data Flood

NVIDIA's quarterly earnings report next Wednesday will be a key indicator of whether there is still upside potential for AI trades. Options traders expect a 6.2% two-way volatility after the earnings report, the highest implied volatility in a year. Kyle Rodda of Capital.com stated:

"NVIDIA's earnings report will be a huge test for the market and AI trades, potentially alleviating concerns about AI valuations or significantly exacerbating those concerns."

Next week, major retailers like Walmart and Target will also report their earnings, providing insights into consumer spending, a major engine of the U.S. economy.

Additionally, as the U.S. federal government ends its shutdown, investors will face a series of delayed economic reports in the coming weeks, including the September employment data scheduled for release on November 20, which will influence market expectations for the Federal Reserve's December meeting.

Gennadiy Goldberg of TD Securities stated:

"We expect a weak October employment report and controlled core CPI inflation in October, which should resolve the debates within the Federal Open Market Committee and support a 25 basis point rate cut. However, this decision may be contentious, and there will likely be more hawkish dissenting votes."

Despite the cautious tone of Federal Reserve officials this week, Ulrike Hoffmann-Burchardi of UBS Global Wealth Management stated:

"Any decision will ultimately depend on the data. Even if the official October employment report does not include the unemployment rate, wage data should still reflect the health of the labor market well."