Deutsche Bank: Three major pillars are weakening, and the US dollar has entered a downward channel

Deutsche Bank AG's latest report points out that the three cyclical pillars supporting the value of the US dollar—yield advantage, growth exceptionalism, and balance of payments dynamics—are all loosening, indicating that the dollar is entering a downward channel. Investors need to be wary of the risk of a long-term weakening of the dollar and reassess their dollar exposure and hedging strategies in their portfolios. Although the dollar's dominance is difficult to shake in the short term, its value has shown a downward trend

Deutsche Bank AG issued a clear signal in its latest outlook report: the three cyclical pillars supporting the value of the US dollar—yield advantage, growth exceptionalism, and balance of payments dynamics—are all loosening. This indicates that the dollar is gradually entering a downward channel.

This shift is crucial for the foreign exchange market, global asset allocation, and cross-border investment returns. Investors need to be wary of the risks of a long-term weakening of the dollar and reassess their dollar exposure and hedging strategies within their portfolios. The report clearly states that while the dollar's "dominance" is unlikely to be shaken in the short term, its "value" has shown a clear downward trend.

Pillar One: The High Yield Advantage is Disappearing

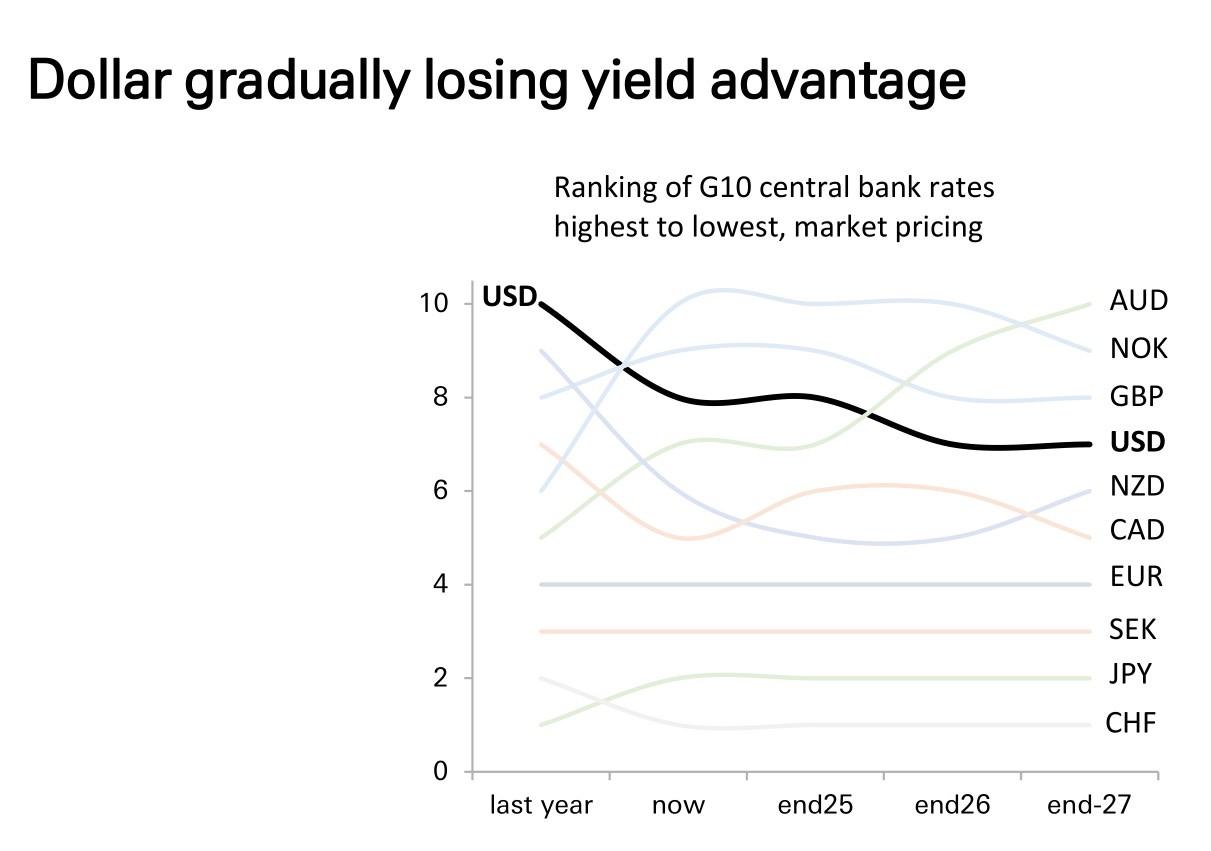

Historically, the dollar's status as a high-yield currency has been a significant guarantee of its strength. According to Deutsche Bank data, the dollar has never experienced a bear market when ranked among the top three high-yield currencies in G10. This has been one of the key factors supporting the dollar exchange rate over the past few years.

However, this core pillar is crumbling. Based on market pricing forecasts for G10 central bank interest rates, the dollar's yield ranking is facing a significant decline. The report's charts indicate that the dollar's interest rate ranking among G10 currencies is expected to gradually drop from its peak "last year" and "now" to a mid-range position by the end of 2026 and 2027. Meanwhile, currencies such as the British pound, Australian dollar, and Norwegian krone are expected to surpass the dollar in yield ranking.

As the Federal Reserve's monetary policy is the primary driver of significant fluctuations in the dollar, the loss of its relative yield advantage removes a key cornerstone supporting the dollar's value.

Pillar Two: The End of US Growth Exceptionalism

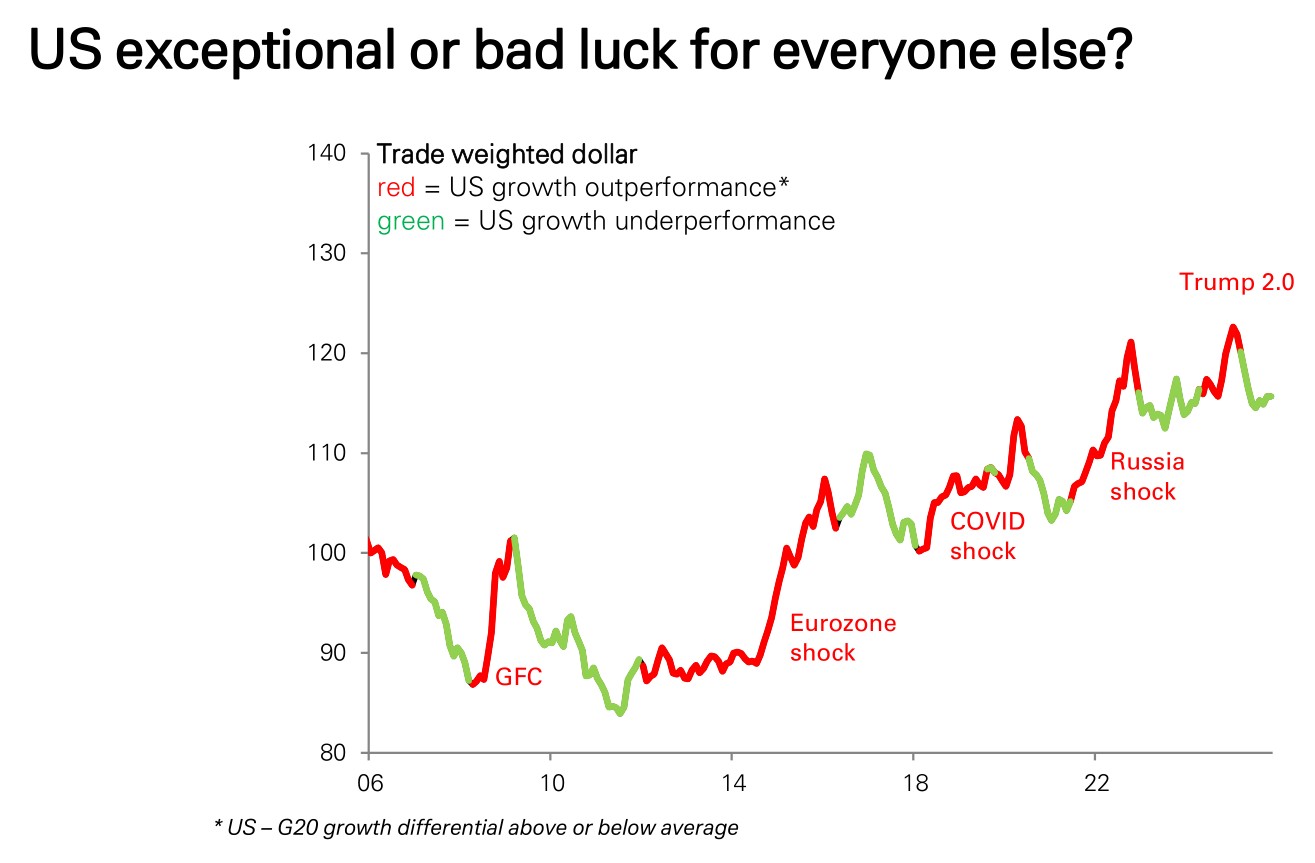

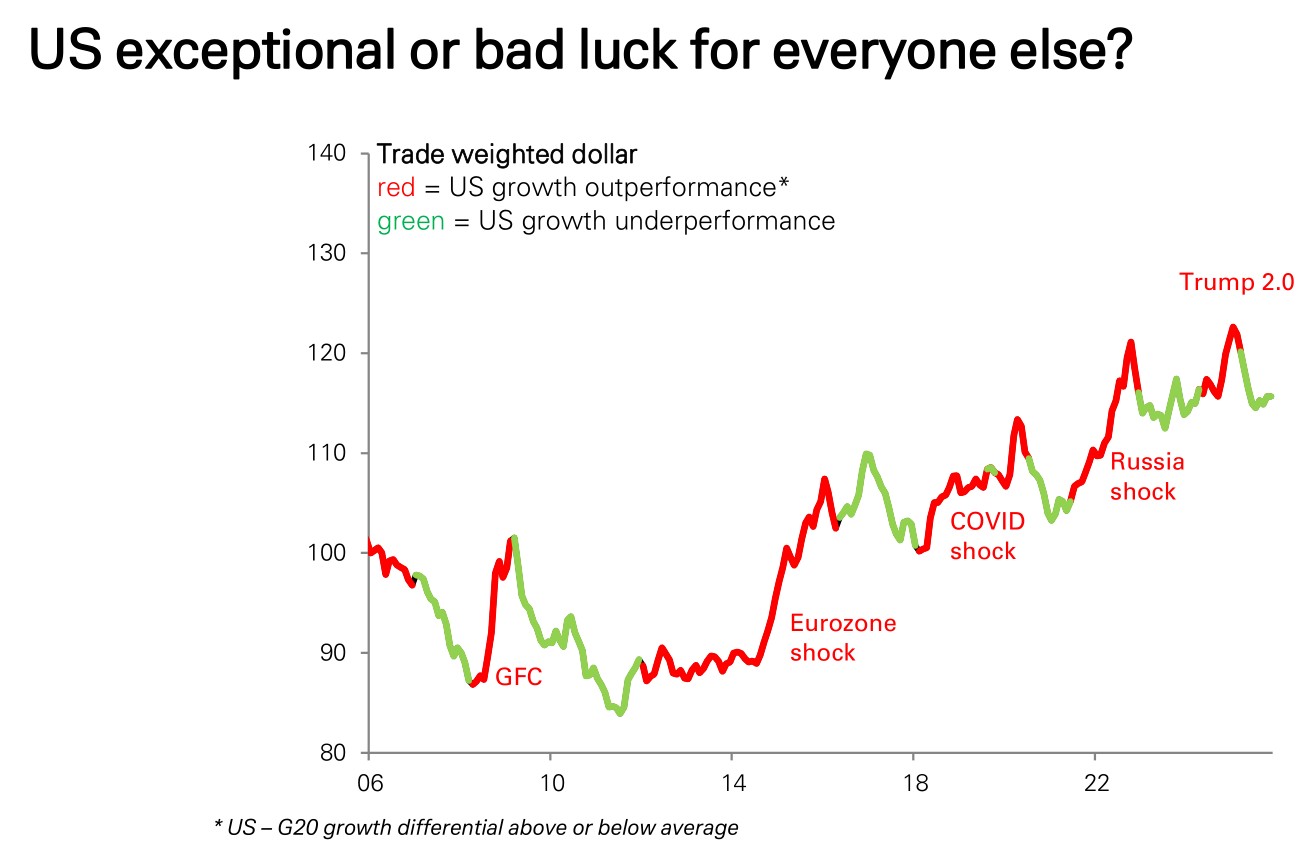

In recent years, the exceptional growth performance of the US economy relative to other major economies, known as "American exceptionalism," has been another powerful driver attracting capital inflows and pushing up the dollar. However, this trend is also reversing.

The report points out that over the past two decades, the strengthening of the dollar has often been accompanied by stronger growth in the US relative to other G20 economies, and this "American exception" is often not due to particularly fast growth in the US itself, but rather the emergence of more damaging shocks in other regions globally (such as the European debt crisis, the pandemic, and the Russia-Ukraine conflict). Therefore, whenever there is turmoil in the world and other countries face setbacks, the US appears relatively stronger, and the dollar rises accordingly. In short, the dollar's strength comes more from "others doing worse" rather than "the US being too strong."

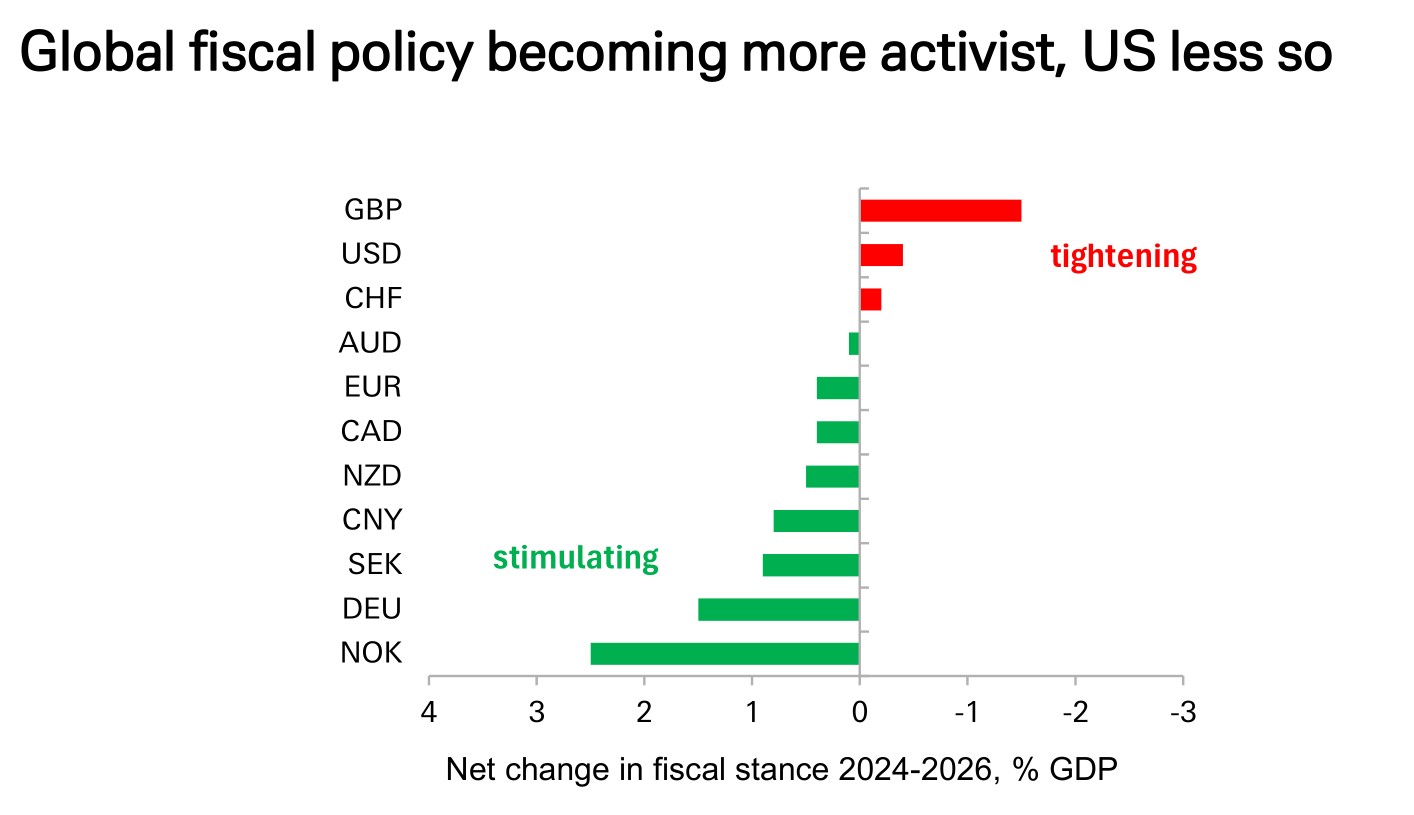

In addition, from the perspective of fiscal policy, global trends are also changing. Data shows that during the period from 2024 to 2026, the fiscal stance in the United States will tighten, while fiscal policies in regions such as the Eurozone and the UK will be more stimulative. This pattern of “more aggressive global fiscal policy, while the U.S. remains relatively conservative” will further weaken the relative growth advantage of the U.S. economy, thereby putting pressure on the U.S. dollar.

Pillar Three: Changes in Balance of Payments Imbalances and Hedging Behavior

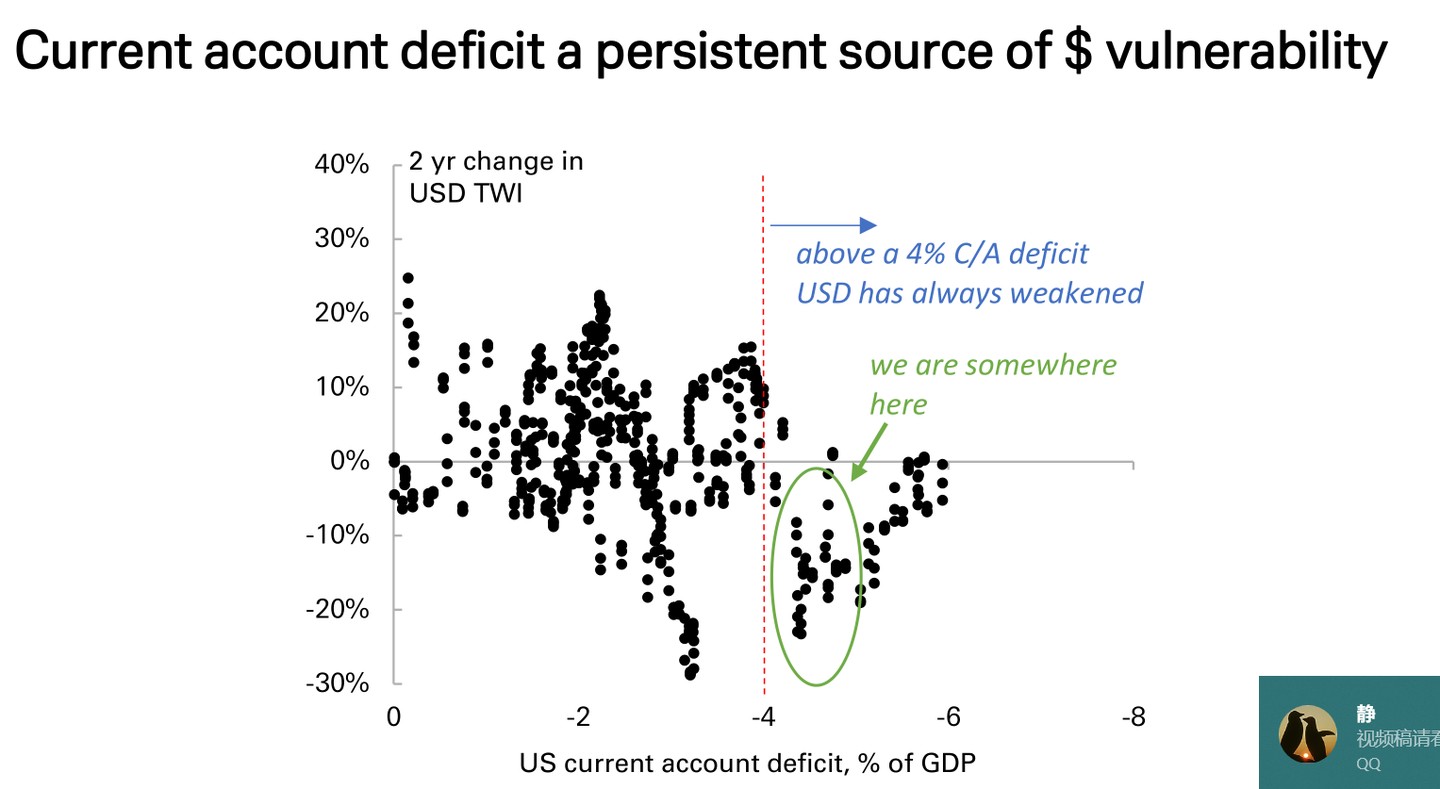

The balance of payments situation in the United States is a long-standing structural weakness. The report emphasizes that the current account deficit is a source of ongoing vulnerability for the U.S. dollar. Historical data reveals a grim pattern: whenever the U.S. current account deficit exceeds 4% of GDP, the dollar invariably weakens. The report's charts suggest that the U.S. is currently near this danger zone.

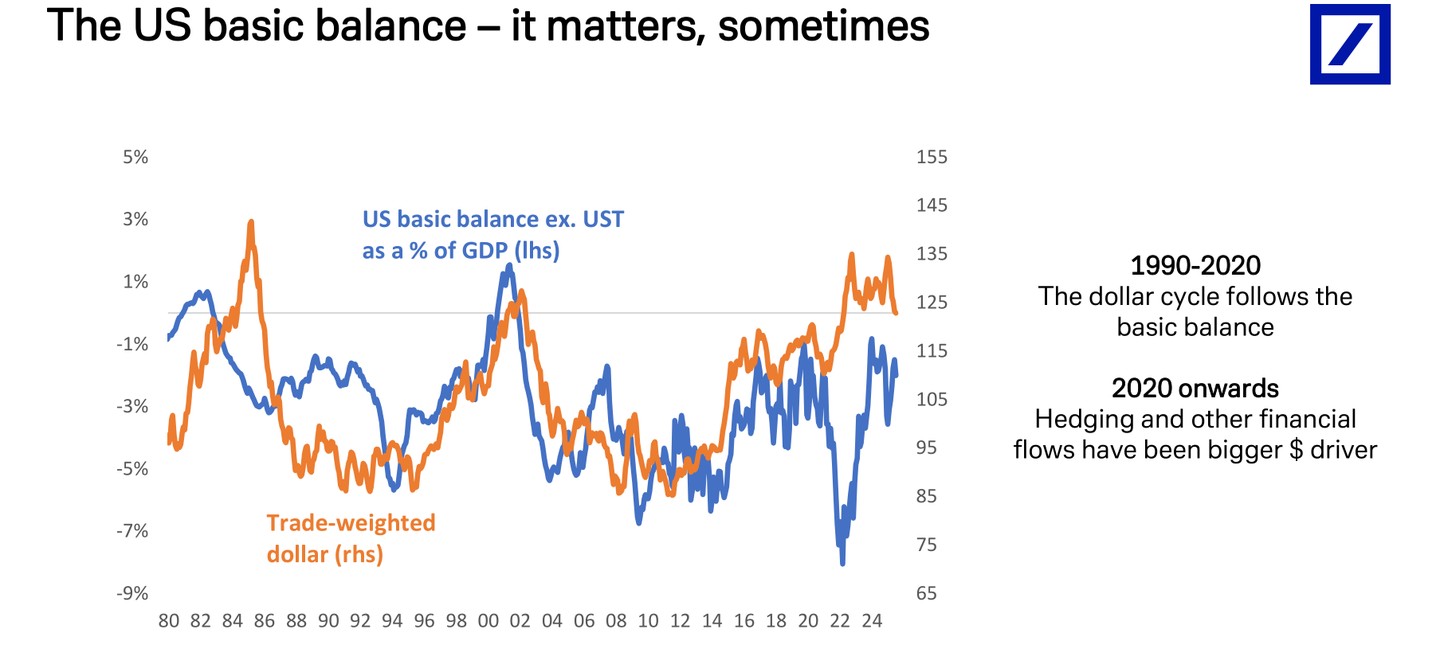

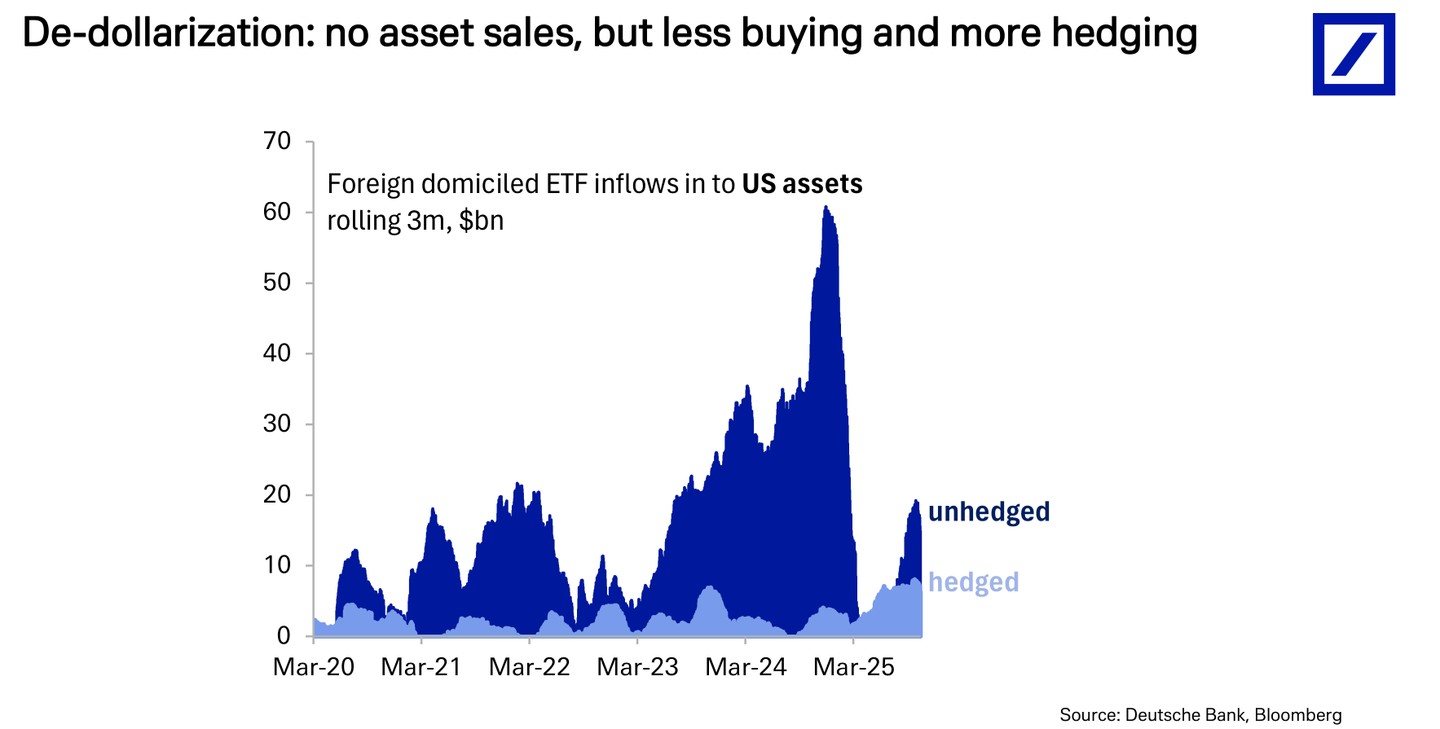

More concerning is the structural change in capital flows. Since 2020, the dominant factors driving the dollar's movement have shifted from traditional balance of payments fundamentals to hedging behavior and other financial flows. Data shows that the behavior patterns of foreign investors when purchasing U.S. assets have fundamentally changed.

Among the foreign ETF funds flowing into U.S. assets, the inflow of “unhedged” funds has been continuously declining, while the inflow of “hedged” funds has been steadily increasing. This means that although overseas investors are still buying U.S. assets, they are increasingly inclined to hedge against the risk of dollar depreciation. This “de-dollarization” hedging behavior itself constitutes downward pressure on the dollar, reflecting the market's pessimistic expectations for the future trend of the dollar.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at their own risk