Storage chips are still rising in price! Kioxia has dug a "golden pit"?

On November 14th, the A-share storage chip sector experienced a significant decline due to Kioxia Holdings' performance falling short of expectations, which also led to a drop in U.S. storage chip stocks. Global storage chip prices have risen, but the market shows differing views on the future price trend. Samsung Electronics raised memory chip prices due to strong demand. Kioxia's revenue and net profit were below expectations, resulting in a sharp decline in its stock price

On November 14th, the A-share storage chip sector experienced a significant decline, with multiple stocks such as Baiwei Storage, Jiangbolong, and Purun Co., Ltd. falling more than 10%; there were also 13 stocks that dropped over 7%.

In terms of news, Kioxia Holdings' second fiscal quarter performance fell short of expectations, which not only dragged down U.S. storage chip stocks but also led to a sharp decline in the A-share storage chip sector.

With the development of AI, global storage has entered a new round of high prosperity cycle this year, and storage chip prices have been rising steadily. However, as the global skepticism towards AI grows, there is a divergence in the capital market and industry regarding the future price trend of storage.

It is worth noting that on November 14th, media reported that due to strong demand from data centers and tight supply, Samsung Electronics raised the prices of some memory chips this month, with increases of up to 60% compared to September prices.

Kioxia's Performance Falls Short of Expectations, Storage Concept Stocks Plummet

On November 13th, Kioxia Holdings released its second fiscal quarter financial report, showing revenue of 448.3 billion yen, below the market expectation of 461.1 billion yen, a year-on-year decline of 6.8%; adjusted net profit was only 40.7 billion yen, a sharp drop of over 60% year-on-year, also below the market expectation of 47.4 billion yen.

During Thursday's Tokyo trading session, Kioxia Holdings' stock price only fell by 1.62%, but its U.S. ADR plummeted, triggering a chain reaction in the U.S. storage sector. On November 13th, Western Digital fell by 5.39%, Seagate Technology fell by 7.31%, and Micron Tech fell by 3.25%.

On November 14th, Kioxia Holdings' stock price plummeted after the opening, dropping over 23% in the morning session and briefly hitting the daily limit down.

On November 14th, the A-share storage chip sector opened with a sharp decline, and popular concept stocks fell across the board. By the close, four stocks including Tongyou Technology, Baiwei Storage, Jiangbolong, and Purun Co., Ltd. had fallen more than 10%; 13 stocks including Kangqiang Electronics, Zhaoyi Innovation, Shannon Semiconductor, and Demingli had fallen more than 7%.

Price Increases Not Yet Reflected in Financial Reports

Regarding Kioxia's performance falling short of expectations, reports suggest that this may stem from its fixed-price agreements for supplying mobile NAND chips to Apple. In the context of significant increases in spot prices, this pricing mechanism prevented Kioxia from benefiting from market conditions.

However, industry insiders in the storage sector pointed out that the natural day period corresponding to Kioxia's second fiscal quarter was from July 1st to September 30th (i.e., the third quarter), and storage manufacturers began comprehensive price increases in September. Kioxia only locked in fourth-quarter orders rather than prices in the third quarter, so the price increases did not reflect in the second fiscal quarter's performance According to public information, starting from the second quarter of this year, the global storage market has entered a new round of price increases. Micron issued a price increase notice at the end of March, SanDisk raised prices by 10% on all products starting April 1, and Samsung reached a DRAM chip price increase agreement with major customers in early May. However, globally, significant price increases for storage began in the third quarter.

Due to the price increase factors, some overseas analysts are optimistic about Kioxia's performance release in the third fiscal quarter (corresponding to the fourth quarter).

Outlook on Price Trends Shows Divergence

With the rapid development of AI computing power driving global storage demand growth, the industry is entering a new prosperity cycle in 2025. Major global manufacturers began raising product prices in the second quarter of this year and implemented comprehensive price increases in the third quarter; product prices in the channels have also risen significantly.

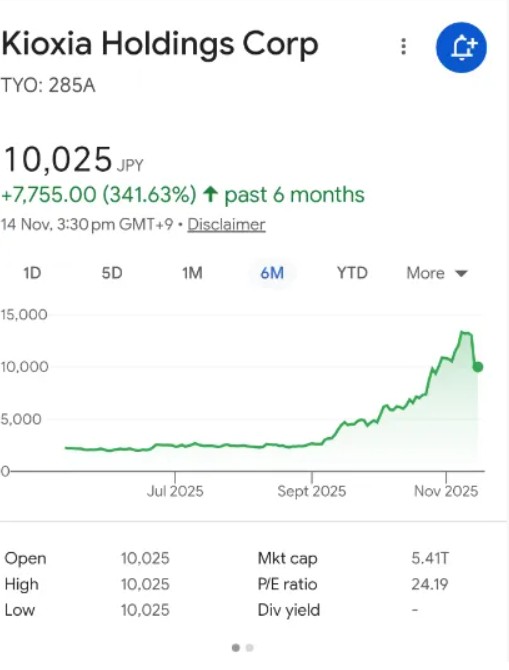

The price increases in storage have also driven a significant rally in the stocks of global storage manufacturers. Even after a sharp decline on the 14th, Kioxia Holdings' stock price has still increased by over 470% year-to-date.

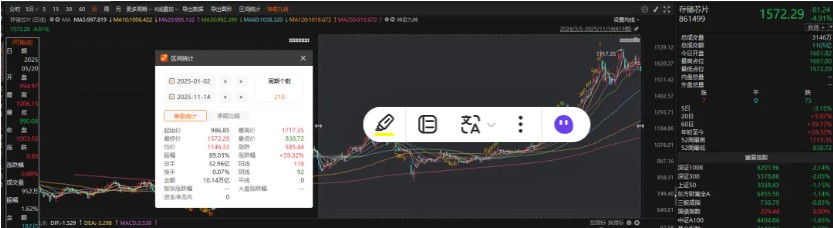

In the A-share market, the storage chip index (861499) has also risen by nearly 60% year-to-date.

However, looking ahead at the subsequent price trends and market demand for storage, divergences are emerging.

"Storage chips are still increasing in price, and there is still room for further increases," said a representative from a storage manufacturer in an interview with the Shanghai Securities Journal. Currently, their company's DRAM prices are three times that of the beginning of the year, NAND prices are twice that of the beginning of the year, and NOR Flash prices are over one time that of the beginning of the year. "There are differences in product prices among different categories and companies, but the overall increase is quite considerable," he emphasized.

On November 14, media reports indicated that due to strong demand from data centers and tight supply, Samsung Electronics raised the prices of some memory chips this month, with increases of up to 60% compared to September prices.

Kioxia also stated in its second fiscal quarter report that in the third quarter of fiscal year 2025 (October to December), the sales prices of NAND products in all application fields will increase. The core driving force behind this price increase is the growth in NAND demand related to AI, such as the significant increase in demand for eSSD due to AI inference workloads, as well as the accelerated demand for traditional server upgrades.

Based on this expectation, Kioxia anticipates record revenue and profit in the third fiscal quarter, with operating revenue expected to be in the range of 500 billion to 550 billion yen, and Non-GAAP operating profit reaching 100 billion to 140 billion yen.

However, due to the growing pessimism about AI globally, the industry has begun to worry that storage demand may not meet expectations "From the supply side, eMMC and DDR5 still seem tight, and the industry is panic-buying; however, from the demand side, terminal demand does not seem to be that hot." In this regard, a domestic channel dealer interviewed by Shanghai Securities News stated that if the U.S. AI industry is short-sold in the short term and the construction of North American data centers falls short of expectations, the demand for storage may not be so optimistic.

In fact, as the capital expenditures announced by the four major cloud providers in North America continue to grow and Nvidia's market value keeps rising, the market has begun to worry about an AI industry bubble, leading to significant divergence in institutional opinions. Recently, "big short" Michael Burry shorted Nvidia, causing Nvidia and a number of "chain" concept stocks to significantly pull back.

"It is still necessary to refer to the performance expectations of Nvidia and AMD, as they are the barometers of the AI market; however, the progress of North American cloud providers (i.e., the actual implementation of data centers) depends on the power supply situation," said the aforementioned storage industry insider. The price of electricity in the U.S. depends on local suppliers, but the actual generation costs are not as high as the market believes. "Building power plants is completely feasible, but it depends on whether there are enough demand scenarios to support such AI investments."

Microsoft CEO Satya Nadella stated that Microsoft has a pile of GPUs, but due to a lack of electricity and space (immediately usable data center shells), they can only sit idle. This has now become a common problem faced by major players in North America's large model sector. For this reason, giants like OpenAI and Nvidia have begun investing in nuclear fusion companies.

However, compared to the U.S., China has a more complete power network resource and a richer power supply.

Source: Shanghai Securities News

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk