After six years of planning, QLB aims to establish a solid counter-cyclical "granary"

The county-level financial business that has been continuously fermenting during the downturn cycle is becoming a new value anchor for the banking industry's performance. In the first three quarters, QLB recorded revenue and net profit attributable to the parent

The county-level financial business that has been continuously fermenting during the downturn cycle is becoming a new value anchor for bank performance.

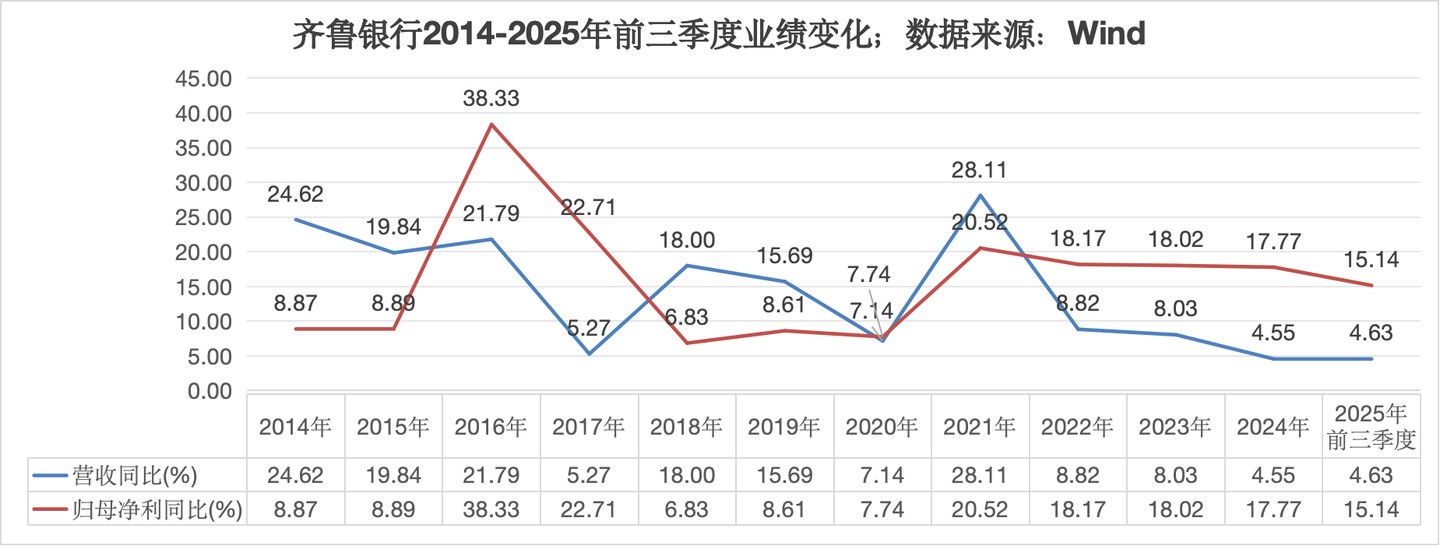

In the first three quarters, QLB recorded revenue and net profit attributable to shareholders of 9.924 billion yuan and 3.963 billion yuan, with year-on-year growth rates of 4.63% and 15.14%, respectively.

Although looking back over a longer period, the bank's revenue and net profit growth rates have been in a downward channel for nearly five years, with a revenue growth rate of 4.63% even hitting a historical low;

However, compared to peers, double-digit profit growth is relatively rare among listed banks.

According to Xinfeng statistics, among the 42 listed banks in A-shares, only 2 institutions have profit growth rates exceeding 15% in the first three quarters, and QLB is one of them.

The current stable performance can largely be traced back to the forward-looking layout made six years ago.

When peers generally focused on urban business, QLB established county-level finance as the core strategy of the entire bank;

Now, its county-level loans and deposits account for about 30% of the bank's total, and the vast sinking market not only provides it with a differentiated competitive advantage but also becomes an important pillar for it to traverse the cycle and achieve stable growth.

Credit Supports Profit

Breaking it down, QLB's high profit growth stems from the balanced development of "volume, price, and risk."

In terms of revenue structure, the contributions of interest income, fee-based income, and investment income to total revenue are 78.24%, 10.44%, and 14.82%, respectively.

The traditional credit business, which is a pillar, has seen both volume and price increase, supporting a 17.31% growth in net interest income, which is key to the positive revenue trend.

On one hand, QLB has maintained a relatively high pace of balance sheet expansion:

In the first three quarters, assets and liabilities grew by 12.93% and 13.22% compared to the beginning of the year, significantly outpacing the overall industry level;

Among them, the growth rates of loans and deposits were 13.60% and 10.35%, respectively, with the loan-to-deposit ratio increasing by 2.27 percentage points compared to the beginning of the year, further improving the efficiency of fund utilization.

Among various businesses, QLB's corporate credit has shown strong momentum, with related loan growth reaching 20.21%, and the proportions and growth rates of loans in leasing and business services, wholesale and retail, manufacturing, and construction are all quite prominent.

On the other hand, QLB's net interest margin has entered an upward channel:

By the end of the third quarter, the bank's net interest margin slightly increased by 1 basis point to 1.54% compared to the end of the previous quarter, which is not outstanding among peers;

However, compared to the same period last year, this figure has increased by 8 basis points, and the recovery speed is undoubtedly in the first tier among peers.

In addition to the simultaneous increase in volume and price, the improvement in asset quality has also provided more room for QLB's profits.

By the end of the third quarter, the bank's non-performing loan ratio decreased by 10 basis points to 1.09% compared to the end of last year;

According to the research team of Zhongtai Securities, in the third quarter, the bank's non-performing loan generation rate has decreased by 59 basis points year-on-year to 0.35%, and the proportion of special mention loans remained stable compared to the previous quarter, further controlling the sources of risk On this basis, QLB's credit impairment losses in the first three quarters decreased by 2.52% year-on-year to CNY 3.254 billion, while other asset impairment losses decreased by 97.69% to CNY 0.003 billion, releasing space for profit growth.

It is worth mentioning that the slight decline in provision allocation did not negatively impact QLB's provision coverage ratio:

By the end of the third quarter, the bank's provision coverage ratio increased instead of decreasing, rising by 29 percentage points compared to the beginning of the year, maintaining a level above 350%, which is relatively superior among peers;

This indirectly indicates that the bank's reduction in provision allocation is not a financial tactic under profit pressure, but rather a normal reduction under sufficient resources.

Unlike the financial industry that actively shrinks balance sheets and reduces costs during a downturn, QLB is currently expanding rapidly, with a strong offensive intent:

First, the speed of balance sheet expansion has consistently maintained above 13%, with the year-on-year growth rate in the first three quarters of this year rebounding to 16%;

Second, it is still actively opening branches, laying out a denser network of "capillaries";

In the past year (from November 10, 2024, to present), the bank has opened 21 new branches, covering Jinan, Dezhou, Liaocheng, Binzhou, Laiyang, and other areas, without closing any branches during the same period, resulting in a net increase in the number of outlets.

Financial data also reflects this trend, with the bank's business management expenses and other business costs in the income statement increasing by 6.79% and 187.77% year-on-year, respectively, demonstrating a significant trend of increased investment.

Xinfeng noted that the bank's capital adequacy ratio at the end of the third quarter was 14.7%, still leaving room to support further expansion. Recently, "QLB Convertible Bonds" triggered mandatory redemption clauses, effectively supplementing core Tier 1 capital;

At the same time, the bank's cost-to-income ratio in the first three quarters has dropped to 25.91%, maintaining a considerable level among listed banks.

County Contribution

Observing data from the past three years, QLB's significant growth has become evident.

Xinfeng selected the compound annual growth rates of net profit, assets, and return on equity of A-share listed banks over the past three years, finding that QLB ranked fourth, third, and sixth among 42 peers, respectively.

Compared to banks in the southern regions of the Yangtze River Delta, QLB is almost the only high-growth "outlier" in the northern region in the past three years.

In QLB's "counter-cyclical" expansion, the power of the counties has long been underestimated.

Zhongtai Securities analyst Dai Zhifeng recently pointed out that QLB's advantage lies in closely grasping Shandong's new and old kinetic energy conversion policy, combined with the province's unique strong county economy, vigorously developing county finance, and achieving differentiated competition.

As of the end of 2024, the bank's county branches had loan and deposit balances of CNY 99.933 billion and CNY 134.414 billion, respectively, accounting for about 30% of the bank's total loans and deposits; As early as a year ago, the proportion of the bank's county-level outlets had already exceeded 40% of the total outlets.

Looking back, QLB was one of the earlier banks in Shandong to invest in county-level finance:

In 2017, the bank established the Inclusive Finance Department at the head office level, which set up the County Finance Management Department to coordinate county financial work;

By 2019, county finance had risen to a strategic level for the entire bank, systematically promoting it from multiple aspects such as institutions, resources, and assessments.

Today, QLB, which has been increasing its investment in county areas for many years, has formed a mature strategy of "dual-wheel drive" between urban and county areas;

The bank stated that it is vigorously promoting the construction of county-level institutions, accelerating the sinking of financial services, and enhancing the contribution and influence of county areas.

Such a strategy has also strengthened QLB's resilience in coping with the downward cycle:

During a period of housing price adjustments, depreciation of residents' assets, and a significant decline in consumer willingness, the sinking market has demonstrated strong risk resistance:

For example, many county residents are insensitive to interest rates, and the cost of liabilities in county areas is relatively low. Additionally, the small loan amounts contributed by dispersed farmers and micro-enterprises, along with the risk diversification, provide good asset quality assurance;

Even the "return home tide" under the squeezing effect of first-tier cities in recent years has also spurred the rise of the county economy;

A typical case is that among state-owned banks, the Agricultural Bank's main battlefield in the county market has become a safety cushion for it to counter fluctuations during economic downturns.

Xinfeng statistics found that over the past few years, the sinking market has become one of the indispensable core forces for QLB's balance sheet expansion:

From 2021 to 2024, the loan growth rates of its county branches were 40.55%, 32.35%, 26.18%, and 15.49%, respectively. Although there is a downward trend, they still generally lead the overall level of the bank;

During the same period, deposits grew by 33.44%, 43.04%, 20.23%, and 16.87%, becoming an important support for stabilizing interest margins.

As of the end of 2024, QLB had reached 83 county branches, with 62 inclusive finance centers established based on these branches, increasing the coverage rate in the province's county areas to 64%;

In addition, QLB has also initiated the establishment of 12 village and town banks, with 44 operating outlets and total assets reaching 16.026 billion yuan.

Xinfeng noted that after years of iteration and development, QLB has developed unique characteristics in its county business:

For example, it has created a "one county, one product" model, formulating differentiated models based on the operational modes and funding needs of advantageous industries in each county. By the end of 2024, it has launched 80 products;

It has deeply cultivated the "three rural" market, innovating a segmented scenario-based agricultural product model from the perspective of industrial finance and ecological circles, forming a product system covering all links such as planting, storage, circulation, processing, and breeding, and launched products like Abalone Loan and Sea Cucumber Loan.

At the same time, it has strengthened its digital foundation, focusing on process optimization and business upgrades, enhancing the level of online, bulk, and precise marketing. In 2023, the "Quanshin Rights" platform reached 45 million customer touches, with online inclusive loans increasing by more than 40%.

However, it is still necessary to be vigilant that the rapid expansion of the balance sheet will eventually come to an end. Currently, the loan and deposit growth rates of the county branches of the bank have shown a downward trend, and the gap between them and the overall level of the bank continues to narrow.

According to Xinfeng's calculations, by the end of 2024, the gap in loan growth rates between the county branches of the bank and the overall bank has reduced from 14.48 percentage points in 2021 to 3.18%.

Although this is also related to the continuous increase in the proportion of county loans, the ongoing decline in county growth rates and the leading advantage still indicate that the incremental support that the county market can provide is becoming increasingly limited.

Qilu Bank continues to deepen its efforts in the county market. On one hand, it needs to broaden its reach by continuously expanding branches to enhance business coverage; on the other hand, it needs to dig deeper by strictly controlling risk while pursuing growth, to avoid a rebound in non-performing loan rates.

This means that in the future, the bank not only needs to maintain adequate capital at all times but also needs to be prepared to face confrontations with regional rural commercial banks during its offensive.

Currently, the bank's coverage rate in the provincial counties is only around 60%, indicating that there is still room for growth.

Whether Qilu Bank can continue to achieve results in the future and whether its aggressive strategy can withstand the test of the economic cycle will require time to provide answers