Guojin Strategy: Investment and Consumption, Electricity and Computing Power

Guojin Strategy analyzed the current state of the global financial market, focusing on the contradictions between investment and consumption, as well as power and computing power. The article points out that there are doubts about the returns on AI investments, the impact of supply chain bottlenecks, especially the shortage of power supply on AI infrastructure, and the divergence between U.S. consumer stocks and the S&P 500 reflects concerns about an economic recession

1 Contradictions in Overseas Fundamentals: Investment vs. Consumption, Power vs. Computing Power

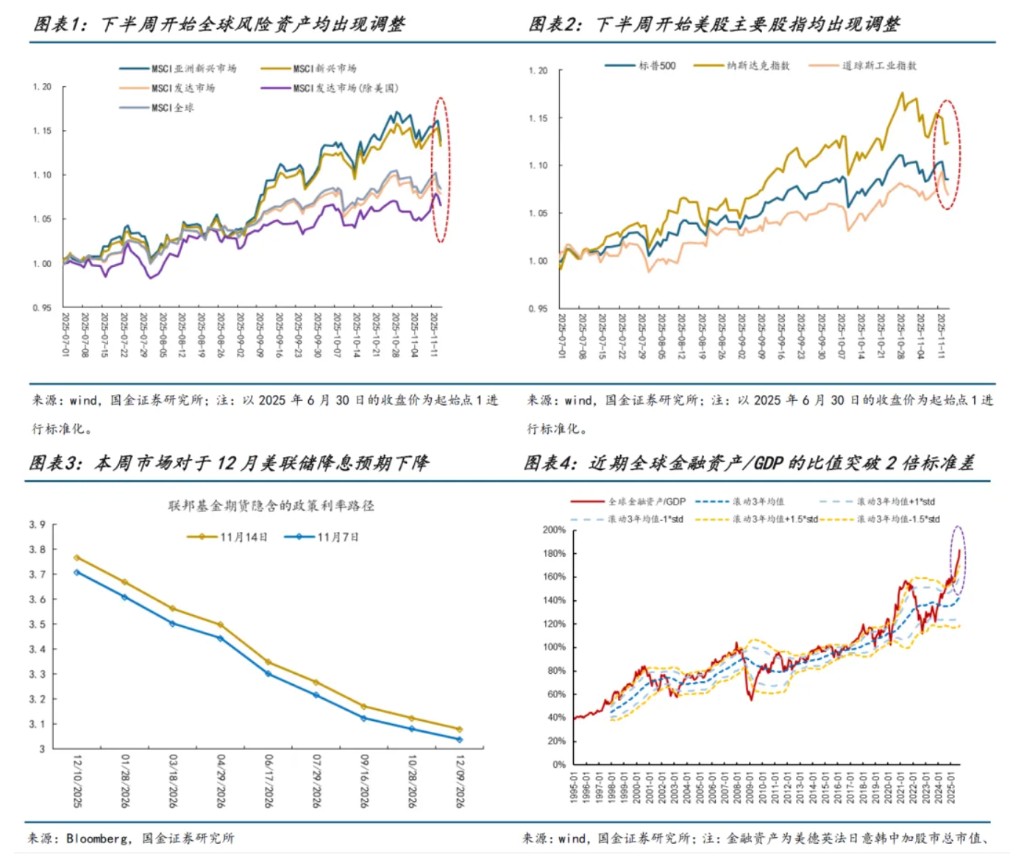

This week, global asset prices have experienced increased volatility, and risk appetite has once again declined. Although the U.S. government has ended its longest shutdown in history, the delayed disclosure of key economic data has left the market in a state of "data deficiency," making it impossible to ascertain the current real economic picture in the U.S. Meanwhile, the hawkish statements from numerous Federal Reserve officials have led the market to a "fifty-fifty" betting state regarding the probability of interest rate cuts in December. For instance, Bloomberg data this week indicated that the implied policy rate from federal funds futures has been adjusted upward. For risk assets, the current ratio of global financial assets to GDP is already at a high level (breaking above 2 standard deviations), and historically, any fundamental changes at this point tend to lead to significant pullbacks in risk assets.

From a deeper perspective, the current market concerns mainly focus on two aspects:

First, there are many doubts surrounding the value of AI itself, such as whether the massive investments in AI can yield corresponding actual investment returns. This week, AI data centers represented by CoreWeave have cut capital expenditures. Despite significant revenue growth, the stock price fell after the earnings report was disclosed. The reason for the capital expenditure cut is that the expenditure recognition has been postponed to 2026; moreover, the surge in backlog orders and delivery delays are primarily due to the lag in the construction of third-party data centers, which has delayed the rollout of related infrastructure. Although the reasons are not due to insufficient demand, the high-leverage model of AI infrastructure-related companies leads participants in the chain to hope that AI productivity can cover their financing costs, while the growth in computing power demand is constrained by hardware supply and power supply. Given the current global supply chain bottlenecks, especially the shortage of power supply, it may be necessary to closely monitor whether other AI data center operators will experience similar delivery issues in the future.

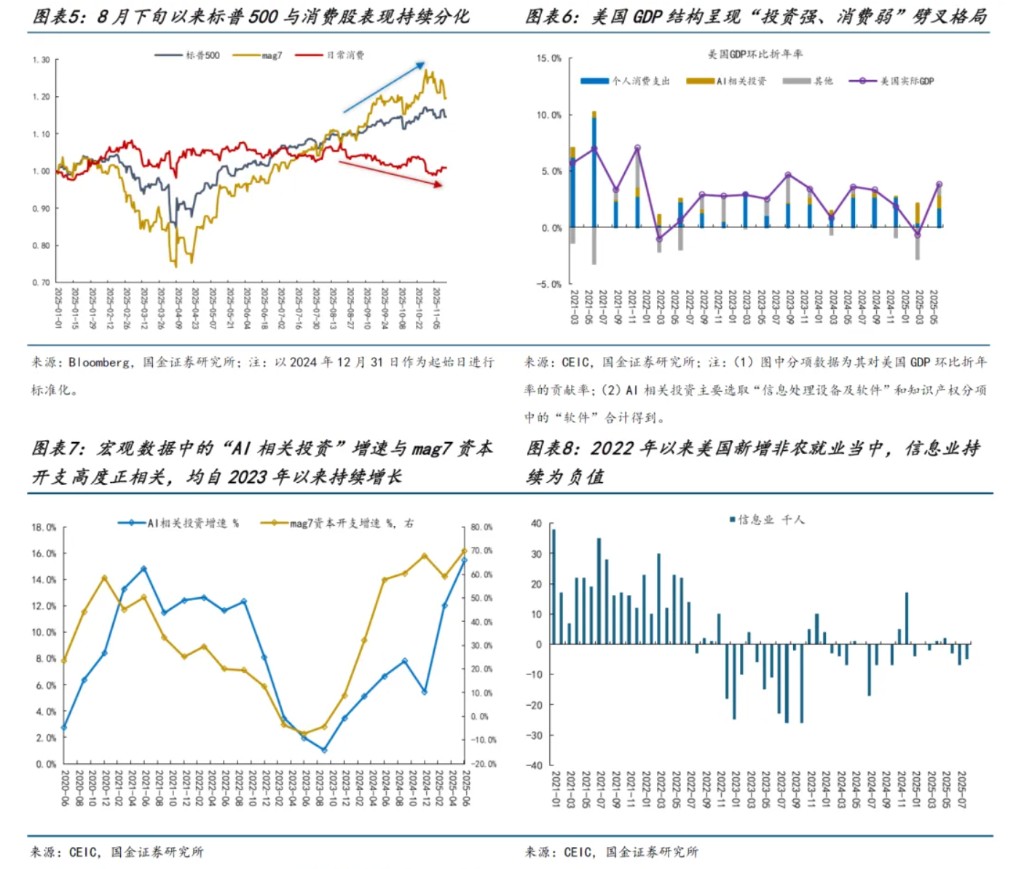

Second, the divergence between U.S. consumer stocks and the S&P 500 stock price trends also reflects the market's concerns about a potential U.S. economic recession. Currently, the U.S. economy is more characterized by the booming AI industry and the marginal weakening of low-end consumption under a K-shaped divergence ("strong investment, weak consumption"). From the perspective of U.S. real GDP, AI-related investments (measured by the sum of "information processing equipment and software" and "software" in the intellectual property category, which account for over 6% of real GDP) are expected to drive an average growth of about 1.4 percentage points in U.S. real GDP in the first two quarters of 2025, surpassing the contribution from private consumption expenditures, which account for nearly 70% of the U.S. economy (averaging a contribution of 1.1 percentage points in the first two quarters). On one hand, AI giants represented by "mag7" are showing strong capital expenditures, and the growth rate of "mag7" Capex is highly positively correlated with the growth rate of "AI-related investments" in macro data, indicating that the development of the AI industry indeed supports the resilience of the U.S. investment side On the other hand, the advancement of AI technology is accompanied by structural layoffs (large tech companies such as Microsoft, Amazon, and Google are all laying off employees), combined with the suppression of the job market by high interest rates, leading to a downward trend in employment and income expectations, which has already resulted in a marginal slowdown in consumption demand among the middle and low-income groups in the United States. This has also been reflected in the earnings reports of consumer companies in the U.S. stock market, as since the second quarter of this year, the "consumer staples" sector within the S&P 500 has shown a continuous divergence in EPS and ROE performance compared to the S&P 500 and "mag7."

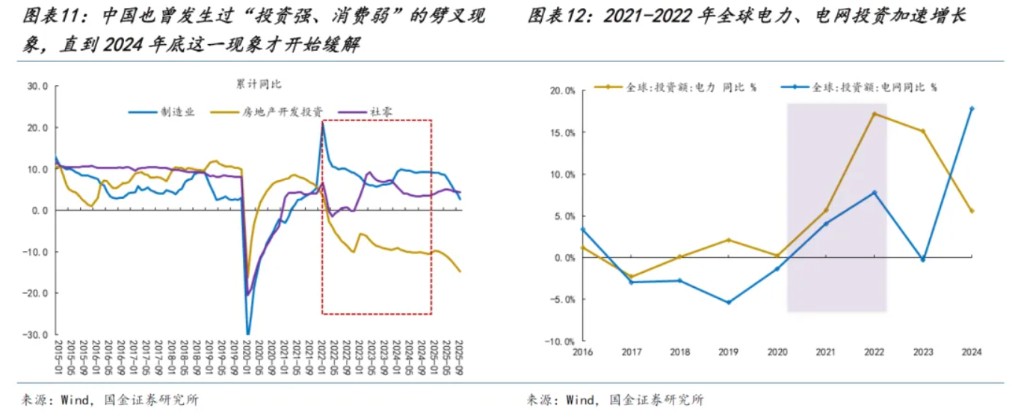

However, it is worth noting that overseas tech giants are still making significant capital investments, and there are currently no signs of cooling down. In this context, it is premature to assert that the U.S. economy is about to fall into recession solely based on the "weak performance" of U.S. consumer company earnings data; further observation of more economic data is still needed. In fact, this phenomenon of "strong investment, weak consumption" has also occurred in China from 2022 to 2024: as real estate investment demand continues to be suppressed and the growth rate of real estate investment declines, the wealth effect combined with weakening income expectations has led to a persistent lack of effective internal demand; in contrast, under the backdrop of domestic transformation towards high-quality development and resilient external demand, the growth rate of China's manufacturing investment has remained resilient, thus continuously contributing positively to GDP growth. Additionally, it is worth mentioning that, similar to the late-stage new energy construction from 2019 to 2021 (which also faced global electricity shortages from 2020 to 2022), global investments related to electricity and power grids saw a significant increase in 2021-2022. As the shortage of overseas power systems becomes a core contradiction restricting the development of the AI industry, we believe it is more important to focus on the potential transmission of investments towards electricity and physical investments during the accelerated development of the AI industry. The real core question is: is it the power shortage that is hindering the development of computing power, or is it the wave of computing power that is driving the investment in electricity?

However, it is worth noting that overseas tech giants are still making significant capital investments, and there are currently no signs of cooling down. In this context, it is premature to assert that the U.S. economy is about to fall into recession solely based on the "weak performance" of U.S. consumer company earnings data; further observation of more economic data is still needed. In fact, this phenomenon of "strong investment, weak consumption" has also occurred in China from 2022 to 2024: as real estate investment demand continues to be suppressed and the growth rate of real estate investment declines, the wealth effect combined with weakening income expectations has led to a persistent lack of effective internal demand; in contrast, under the backdrop of domestic transformation towards high-quality development and resilient external demand, the growth rate of China's manufacturing investment has remained resilient, thus continuously contributing positively to GDP growth. Additionally, it is worth mentioning that, similar to the late-stage new energy construction from 2019 to 2021 (which also faced global electricity shortages from 2020 to 2022), global investments related to electricity and power grids saw a significant increase in 2021-2022. As the shortage of overseas power systems becomes a core contradiction restricting the development of the AI industry, we believe it is more important to focus on the potential transmission of investments towards electricity and physical investments during the accelerated development of the AI industry. The real core question is: is it the power shortage that is hindering the development of computing power, or is it the wave of computing power that is driving the investment in electricity?

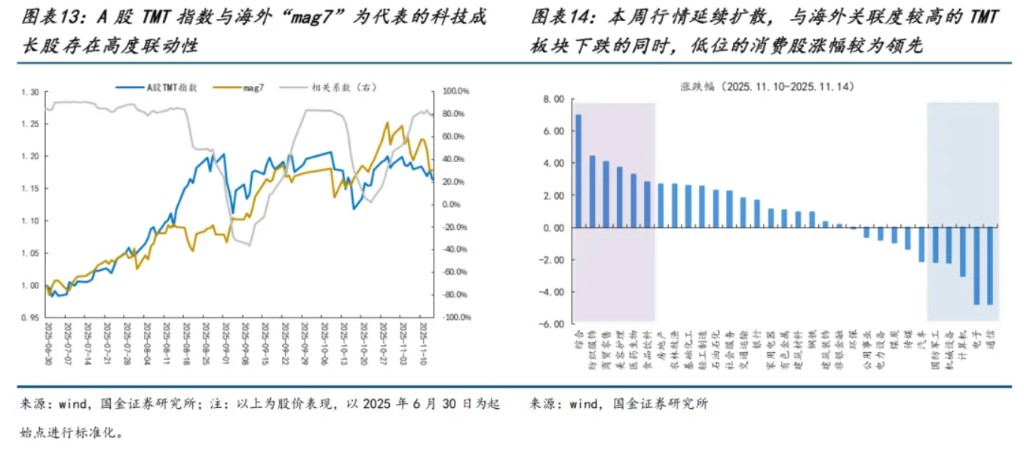

Reflecting on the A-share market: the style continues to rebalance. While core assets, U.S. tech stocks, are hovering, the domestic TMT sector, as their satellite assets, continues to adjust, and the market trend has spread from the previous AI+ and general AI (such as storage and electricity) to low-performing consumer stocks. On one hand, the TMT sector, which is highly correlated with overseas markets, continues to decline, while the amplification of asset price fluctuations has even extended to the electricity sector, causing certain fluctuations in the stock prices of the general AI sector represented by electrical equipment in the latter half of the week On the other hand, consumption, which is highly correlated with the traditional economy and represents pro-cyclical assets, is currently undervalued (which itself implies pessimistic expectations for the fundamentals). During the process of capital rebalancing, there is instead a demand for catch-up.

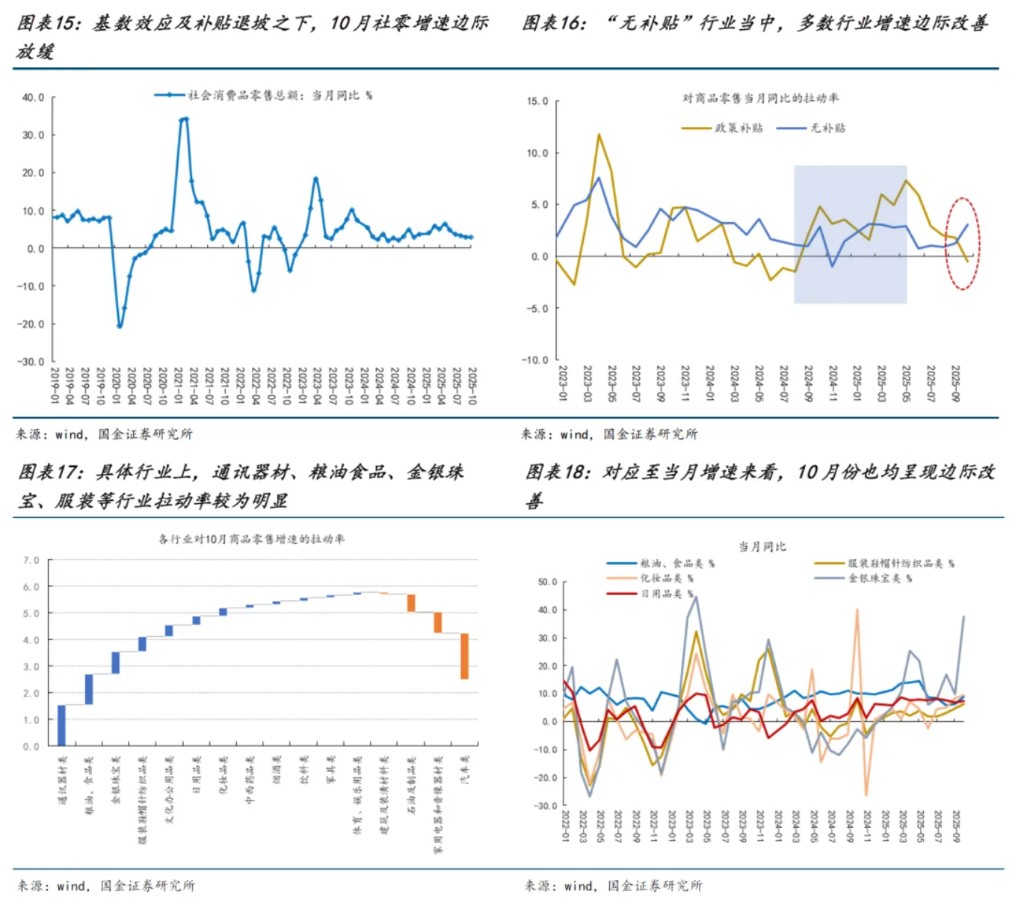

2 China’s Domestic Demand: The Stabilizer in the Portfolio

This week, domestic economic data has been gradually disclosed, showing that total consumption data remains weak, with further marginal slowdown in retail sales growth. The underlying reasons are the high base effect from last year and the tapering of consumption policy subsidies. However, at the structural level, most domestic demand industries are showing signs of marginal improvement: when breaking down the retail sales structure, the "policy subsidy" (corresponding to industries supported by the "trade-in" policy) and "non-subsidy" industries have seen a reversal in their contribution to retail sales. The "policy subsidy" industries have begun to make a negative contribution to retail sales of above-limit goods (mainly due to the drag from home appliances and automotive-related categories); meanwhile, the contribution from "non-subsidy" industries has shown marginal improvement, possibly driven by the impact of "Double Eleven" on related consumer categories. Specifically, the most noticeable improvements are concentrated in the grain and oil food, clothing, daily necessities, and gold and jewelry industries.

At a time when the overseas fundamentals are in a "fuzzy stage," the improvement in domestic demand industries forms the basis for the resilience of Chinese asset performance, and there may be two scenarios in the future:

(1) The resilience of Chinese exports over the past few years has allowed exporters to accumulate a large amount of unconverted foreign exchange under the environment of Federal Reserve interest rate hikes and a strong dollar. This process has occurred against the backdrop of declining domestic inflation and weakening domestic demand. According to the latest data, this phenomenon may be reversing; in September, the bank's customer settlement and sales rate was significantly higher than the average level of the past five years. Meanwhile, the surplus in bank customer settlement and sales under goods trade has continued to expand this year, indicating that exporters are more inclined to convert foreign exchange income into RMB assets. From a medium-term perspective, the upcoming global manufacturing cycle recovery during the Federal Reserve's interest rate cut cycle may bring sustained prosperity to exports, likely continuing to create more demand for currency conversion. Historical experience shows that when exporters convert more of their export income into RMB assets through currency conversion, it usually drives domestic price levels to bottom out and rebound, thereby providing more support for domestic demand recovery. In this context, leading consumer companies representing domestic demand recovery may become an important source for investors to obtain excess returns.

(2) Even in the scenario of an overseas economic recession, the short-term recovery of exports may be hindered due to the phase suppression of global manufacturing demand. However, due to the significant outflow of financial capital in the past (such as the continuous expansion of the bank's customer settlement and sales deficit under capital and financial projects from 2022 to 2024), in the event of extreme risks, it may instead accelerate the return of unconverted funds, and the domestic demand industry in China still has the momentum for recovery In this situation, the resilience of the domestic demand sector will highlight its defensive value, making it a relatively stable allocation choice amid global asset price fluctuations.

3 Style Rebalancing in the Sino-U.S. Mirror Period

With the accelerated development of the AI industry in recent years: while technology companies are making significant capital investments, layoffs are also on the rise. The U.S. economy is gradually moving towards a bifurcated pattern of "strong investment, weak consumption," which is consistent with China from 2022 to 2024. Whether the power shortfall is hindering the development of computing power or whether the wave of computing power is driving the investment in power, we believe that global power-related assets remain an important investment theme. Conversely, whether China's industrial advantages can establish a cycle of export-consumption to reverse the past weak consumption pattern is also worth looking forward to.

The Sino-U.S. mirror may be opening up, with the U.S. entering a scenario of strong investment + weak consumption, while China is reconstructing the production + consumption cycle. Recommendations:

First, physical assets related to the recovery of manufacturing activity and accelerated investment after overseas interest rate cuts; overseas power shortages are a catalyst for physical demand: upstream resources (copper, aluminum, lithium, oil, coal), the demand for replenishing physical assets may recover, pay attention to oil transportation; with PPI rebounding, opportunities in the midstream sector are gradually emerging, including basic chemicals and steel.

Second, food and beverages, aviation, and clothing under stabilized domestic prices and recovering domestic demand.

Third, as the "shovel seller" of the global industrial chain, the realization of advantageous industries overseas: capital goods (construction machinery, power grid equipment, heavy trucks).

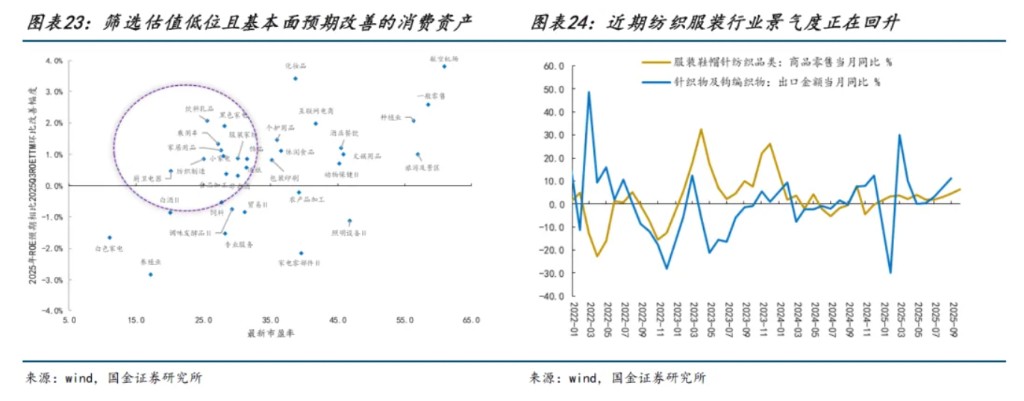

In this week's industry recommendations, we have added textiles and apparel in the consumer sector, with the new rationale being: in the recent style rebalancing, the internal logic of the market continues to spread, and some cyclical assets with low valuations have shown a demand for catch-up. Currently, most domestic demand sectors in China are indeed showing marginal improvements, and the future return of foreign exchange settlement funds may continue to drive the recovery of domestic demand sectors, which will maintain the allocation value of domestic demand assets represented by consumption during the style rebalancing process. From the perspective of the fundamentals of the textile and apparel industry, both the growth rate of domestic clothing consumption and the growth rate of external demand exports are maintaining a state of improving prosperity.

Article author: Guojin Strategy Team, source: [Yiling Strategy Research](https://mp.weixin.qq.com/s?__biz=MzI2MDkzOTc3Nw==&mid=2247546097&idx=1&sn=42d3b212092f1cdd147dc84a216f70b7&chksm=eb84972839dd0c45dd71d51df36e352223988c0150fc0196297c08c260673614b6ec0e4dbb92&mpshare=1&scene=23&srcid=111604s0zf4vq3VVxWF6GwlT&sharer_shareinfo=50dfb3f2dcd0cbc55cdb7d25c69c77ec&sharer_shareinfo _first=50dfb3f2dcd0cbc55cdb7d25c69c77ec#rd), Original title: "Investment and Consumption, Electricity and Computing Power | Guojin Strategy"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk