This year's peak increase of 30% has been "completely wiped out," and Bitcoin has fallen into a bear market

The price of Bitcoin fell below $93,714 on Sunday, erasing all gains since the beginning of the year and entering a technical bear market. This reversal from the historical high in October is mainly attributed to the waning optimism for pro-crypto policies, a shift in the macro market towards safe-haven assets, and the quiet exit of institutional buyers such as ETFs. Market sentiment is generally pessimistic, leading to the liquidation of leveraged positions, with smaller tokens experiencing even more severe declines

As enthusiasm for the U.S. government's pro-crypto stance wanes and market risk aversion intensifies, Bitcoin is facing severe tests, and the bear market across the entire cryptocurrency market seems to be deepening.

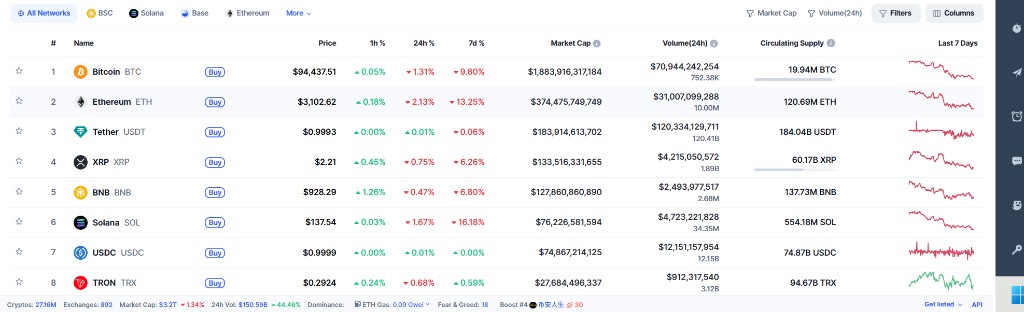

As the highest market capitalization cryptocurrency, Bitcoin's price fell below $93,714 on Sunday, completely erasing all gains made this year. This price level is below its closing price at the end of 2024, indicating that the annual gain of over 30% earlier this year has been "entirely wiped out."

This round of plummet occurred just over a month after the asset reached an all-time high. On October 6, Bitcoin's price soared to a record high of $126,251, but four days later, due to unexpected comments from U.S. President Trump regarding tariffs, global market turmoil ensued, leading Bitcoin into a downward trajectory.

The weakening of institutional participation is one of the core driving forces behind this decline. According to Bloomberg data, Bitcoin exchange-traded funds (ETFs) have attracted over $25 billion in inflows this year, pushing their total assets under management to about $169 billion. These stable funds had previously helped reshape Bitcoin as a diversification tool for portfolios.

However, as large buyers (including ETF allocators and corporate finance departments) quietly exit, the narrative of this "hedging asset" is becoming "fragile again." A typical example is Michael Saylor's Strategy Inc., whose stock price is now close to the value of its Bitcoin assets, indicating that investors are no longer willing to pay a premium for its highly leveraged Bitcoin strategy.

Macroeconomic Headwinds and Leverage Liquidation

The shift in the macroeconomic environment is another key factor. Matthew Hougan, Chief Investment Officer of Bitwise Asset Management, pointed out that "the overall market is in risk-off mode," and "cryptocurrency is the canary in the coal mine, reacting first."

The recent pullback in tech stocks has also led to a decline in overall market risk appetite. Jake Kennis, a senior research analyst at Nansen, stated that this sell-off is a confluence of "long-term holders taking profits, institutional capital outflows, macro uncertainty, and leveraged longs being liquidated." He added that after a prolonged period of consolidation, the market has temporarily chosen a downward direction.

Altcoins Suffer More

The widespread pessimism in the market is exacerbating the sell-off. Matthew Hougan noted that "the sentiment among retail cryptocurrency investors is quite negative," with many choosing to exit early to avoid experiencing another 50% major pullback. This pessimism is even more pronounced in the highly volatile small token (i.e., "altcoin") market.

Reports indicate that a MarketVector index tracking the bottom 50 of the top 100 digital assets has fallen by about 60% this year. Chris Newhouse, research director at the decentralized finance-focused company Ergonia, also observed that the market is generally skeptical about "capital deployment and lacks natural bullish catalysts."