The Nasdaq rebounded on Friday, "temporarily halting" large-scale liquidations, Bank of America: "Bottom-fishing" can wait for the next wave of CTA liquidations

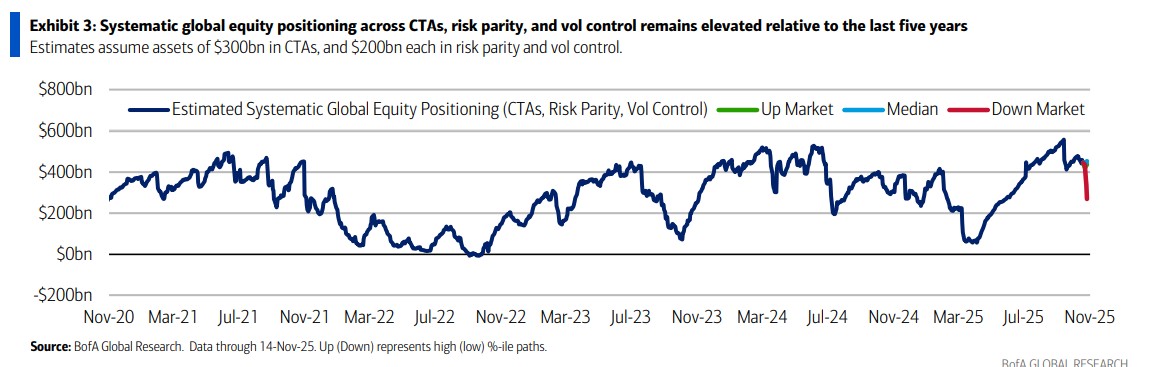

Bank of America pointed out that last week, the risk of CTA stock positions was a core theme in the U.S. stock market. The Nasdaq 100 index experienced significant volatility, and although Friday's rebound temporarily alleviated the CTA liquidation pressure, a weakening of buying on dips could lead to larger-scale systemic liquidations, exacerbating the decline in the Nasdaq

Bank of America:

Last week, the risk of CTA stock positions remained a core theme in the U.S. stock market.

Large-cap tech stocks showed signs of weakness, with the Nasdaq 100 index experiencing two instances of a 2% single-day fluctuation, marking the first such severe volatility since the "Liberation Day" in April. The initial rebound provided a buffer for CTA positions, but Thursday's decline put the liquidation trigger points to the test again. Although the price movements before Friday's opening suggested that CTAs might accelerate liquidation, strong buying on dips after the market opened may have allowed most risk exposures to be maintained.

However, if the buying on dips weakens, the ability of CTA funds to maintain their excessively high long positions will be limited. If the U.S. stock market fails to stabilize, it could force larger-scale systematic liquidations, exacerbating the decline in the Nasdaq.