After the recent pullback, what is the valuation of "AI shovel stocks"?

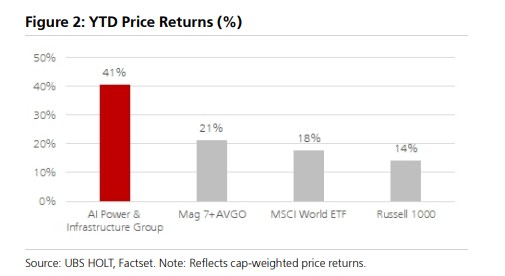

The return rate of industrial stocks related to providing infrastructure for the AI boom has reached 41% so far this year, significantly outperforming the broader market and nearly doubling the performance of tech giants such as the "Seven Tech Giants + Broadcom." According to UBS data, the economic price-to-earnings ratio (Economic P/E) of these companies has expanded from about 25 times a year ago to nearly 35 times currently. This level gives them a significant premium compared to the broader market, but it is still lower than the valuations of leading tech giants

After experiencing a significant rise, the "picks and shovels" companies providing infrastructure for the AI boom have recently faced a sharp market correction. However, analysts believe this has not changed their outstanding performance supported by strong fundamentals this year.

According to news from the Chasing Wind Trading Desk, a recent report from UBS pointed out that although the valuations of these industrial stocks have expanded, the market's expectations for their long-term growth remain relatively moderate, contrasting with the high expectations for tech giants.

In a report released on November 14, UBS compiled a portfolio of about 60 global AI-related industrial stocks, which generally corrected on the previous trading day, with an average decline of about 5%, and some individual stocks even falling by 10-20%.

However, this correction has not reversed the strong momentum for the year. On a market-capitalization-weighted basis, the portfolio's return rate has reached as high as 41% year-to-date, significantly outperforming the broader market and nearly doubling the performance of tech leaders such as the "Seven Tech Giants + Broadcom." Behind this round of increases is a substantial improvement in corporate operating performance, including a surge in cash flow return on investment (CFROI) and accelerated asset growth.

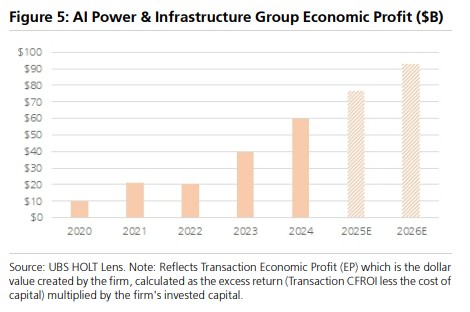

Strong stock price performance has driven valuation expansion. UBS data shows that the economic price-to-earnings ratio (Economic P/E) of this portfolio has expanded from about 25 times a year ago to nearly 35 times currently. This level gives it a significant premium compared to the broader market, but it is still lower than the valuations of leading tech giants, highlighting the market's optimistic sentiment regarding the future profit growth of these AI infrastructure suppliers.

Strong Fundamentals Support Stock Price Performance

The excellent performance of AI infrastructure stocks is not built on sand; it is backed by real demand and performance growth. The UBS report emphasizes that the AI boom remains the dominant long-term theme driving the performance of the industrial sector, with capital expenditures from large tech companies being its most direct driving force.

The report cites data indicating:

Meta has raised its 2025 capital expenditure expectations from $66-72 billion to $70-72 billion and stated that capital expenditure growth in 2026 will be "significantly greater than in 2025."

Alphabet has also raised its 2025 capital expenditure expectations from $85 billion to $91-93 billion and expects "significant growth" in 2026.

Microsoft has also indicated that due to accelerating demand, its capital expenditure growth for the fiscal year 2026 will exceed that of fiscal year 2025. The total free cash flow of these three companies in just one quarter reached $60.8 billion.

Amit Mehrota, head of UBS's industrial sector, pointed out that there are no signs of a slowdown in AI-related capital expenditures, which is a positive for all AI concept companies across industrial sectors.

The breadth of demand is also expanding. In addition to data center hardware such as racks, cables, and cooling solutions, the enormous power demand of AI is becoming a new growth point. According to the International Energy Agency (IEA), global data center electricity consumption is expected to double by 2030 This has brought opportunities for traditional industrial companies, from data center equipment leader Vertiv (VRT) to Caterpillar (CAT), which has become a beneficiary of AI through its turbine business.

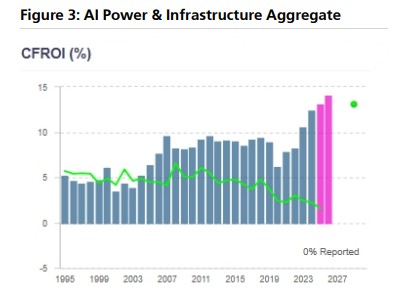

Corporate-level data shows that the operating conditions of this batch of AI infrastructure industrial stocks have reached an inflection point. Overall, the CFROI of this portfolio has soared from the mid-single digits in the early 21st century to over 10% recently.

At the same time, its Economic Profit has grown at a compound annual growth rate of over 50% over the past four years. More than half of the companies rank high in annual improvements in CFROI, and the vast majority rank high in the "growth factor" that measures future cash flow growth potential.

Valuation Expansion and Market Expectations

Accompanied by strong stock prices and fundamental improvements, the valuation multiples of these AI "picks and shovels" stocks have indeed expanded. UBS's HOLT model shows that the economic P/E of this stock portfolio, weighted by market capitalization, has expanded from about 25 times in November 2023 to nearly 30 times in November 2024, and is currently approaching 35 times.

Although this valuation level is still lower than that of the "Tech Seven + Broadcom" portfolio, it is significantly higher than the broader market benchmark, reflecting investor optimism about future growth. However, behind the high valuation, how much growth expectation has the market actually digested?

UBS used its HOLT framework for reverse deduction and found that the market's long-term growth expectations for these companies are not as aggressive as their stock price performance suggests. Analysis shows that the market is currently pricing the long-term (4 to 10 years) average annual compound sales growth rate (sales CAGR) for these approximately 60 industrial stocks at an average of 6%.

In comparison, applying the same framework to analyze the "Tech Seven + AVGO" portfolio, the market is pricing its average long-term sales growth rate at 9%. This indicates that, relative to direct AI technology companies, the market has more conservative long-term growth expectations for industrial companies providing infrastructure.

Stock Differentiation: High Expectations vs. Low Expectations

Despite the moderate average expectations, there are significant differences in market expectations among different companies, showing clear differentiation. UBS's report focuses on three cases: Bloom Energy (BE), First Solar (FSLR), and Schneider Electric (SCHN)

Bloom Energy (BE): A representative of high expectations. Due to its solid oxide fuel cells providing on-site power quickly for data centers under grid stress, BE's stock price has soared over 400% this year. The market is pricing in a long-term average annual sales growth rate of about 14%, which is significantly high within the entire portfolio. This indicates that investors have high hopes for BE's future, while also facing the risk of those expectations not being met.

First Solar (FSLR): An extreme of low expectations. Despite also benefiting from clean energy demand and U.S. energy policies, the market is pricing FSLR's long-term average annual sales growth rate at nearly zero (below 1%). This reflects concerns about its historical performance instability and the potential volatility of future profit margins due to changes in tax credit policies. Such a low growth expectation may provide opportunities for investors who believe its growth potential is underestimated.

Schneider Electric (SCHN): A moderate expectation centrist. As a leading provider of AI data center infrastructure and power solutions in the European market, SCHN derives about 20% of its revenue from data centers. The company has a good track record of creating value. The market is pricing in a long-term average annual sales growth rate of about 5%, which is at a "mid-level" within the portfolio. This expectation appears relatively neutral compared to its solid industry position and strategic partnerships (such as with Nvidia and Microsoft)