Is a Wall Street consensus emerging? JP Morgan has just drawn a "key defense line," and Goldman Sachs also warns that 6,725 points for the S&P is the dividing line between bulls and bears

Goldman Sachs views the 6725 points of the S&P 500 as a key boundary. Once it falls below this level, it will trigger a trend reversal and may lead to systematic selling by CTAs. Wall Street warns that important support levels for U.S. stocks are under continued pressure, with the Russell 2000 already breaking down. Funds are shifting from technology to defensive sectors such as healthcare, and Nvidia's volatility has significantly increased. As earnings reports and employment data approach, the market may face deeper adjustment risks

As market sentiment becomes increasingly cautious, top investment banks on Wall Street are drawing a new "bull-bear dividing line" for investors. Goldman Sachs' latest report clearly indicates that the 6725-point level of the S&P 500 index is a critical technical inflection point; if breached, it could signal the formal end of a positive market trend that has lasted for several months.

According to a report released on Sunday by Goldman Sachs derivatives strategist Brian Garrett, the 6725-point level is "very important" for the S&P 500 index, and falling below this level would mark the second time since February this year that the index's trend turns negative. The last occurrence of this was during a trading day in October.

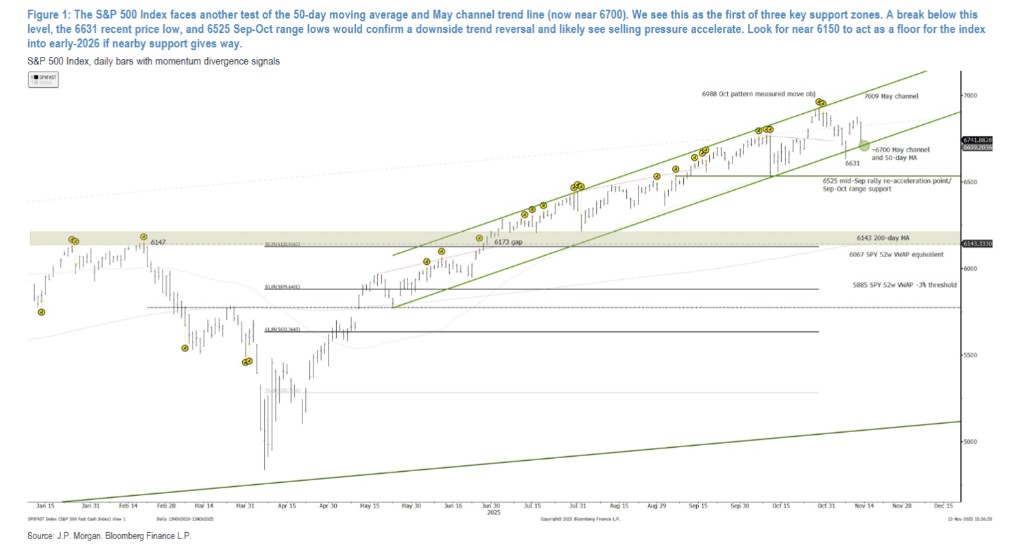

Warnings about U.S. stocks seem to be becoming a "consensus" on Wall Street. According to an article from Wall Street Journal, JPMorgan stated that U.S. stocks face a "critical defense line." If the S&P 500 index successively falls below the three defense lines of 6700, 6631, and 6525 points, it will confirm the entry into a downward trend. Meanwhile, the Russell 2000 index, which represents small-cap stocks, has shown the "most concerning" breakdown pattern. If key support levels are fully breached, market adjustments may continue until early 2026.

As this round of warnings is issued, the market is preparing for a critical data week. Nvidia, the world's most valuable company, will release its earnings report, with market expectations of its market value volatility potentially reaching $300 billion. Additionally, the market will also receive the first U.S. government employment report in two and a half months. These events will undoubtedly provide new guidance for the market's direction.

6725 Points: Systematic Sell-off Imminent?

The report emphasizes that the market's technical structure is becoming precarious, especially as algorithm-driven Commodity Trading Advisor (CTA) funds may become the main force behind the next phase of selling. Brian Garrett noted in the report that investors should "put the 6725-point level of the S&P 500 index on your launch pad," as it is the key to a trend reversal.

Goldman's analysis shows that the short-term momentum thresholds for the Nasdaq 100 index and the Russell 2000 index were breached last week. The bank's model indicates that, assuming the market consolidates, CTA funds are expected to sell about 20% of their positions in NDX and RTY within the next week.

More concerning is the next critical level. The report states that the mid-term momentum threshold for CTAs is 6442 points. If the market falls below this level, it will have to absorb over $32 billion in sell orders within a week, which could trigger more severe market turbulence.

On the 14th, JPMorgan also released a research warning, stating that several key indices of U.S. stocks are under continuous pressure at their support levels. If these "defense lines" are breached, it will confirm that the market has entered a downward trend, with adjustments potentially lasting until early 2026.

Among them, the S&P 500 index is testing the first support level around 6700 points. If this position, the recent low of 6631 points, and the lower range of 6525 points are successively breached, it will confirm a bearish trend reversal, with a downward target near 6150 points. Among all benchmark indices, the technical pattern of the Russell 2000 index is "the most concerning," having breached key pattern support, confirming a bearish trend reversal and opening up space for further adjustments

Defensive Rotation Intensifies

Goldman Sachs' report provides multiple dimensions of evidence indicating that funds are continuously flowing from growth sectors to defensive sectors. The bank pointed out that defensive fund flows are still ongoing, with the panic index VIX briefly surpassing 23 during intraday trading last week, marking the fourth time since April.

Specifically, in the technology, media, and telecommunications (TMT) sector, short selling exceeded long buying; while in defensive sectors such as healthcare and consumer staples, long buying surpassed short selling. Notably, despite this defensive trend, the overall equity exposure has not shown a significant decline.

Data from the bank's cash trading department (One-delta) also corroborates this observation, reporting that technology stocks are facing significant supply, with “Thursday afternoon marking the peak of panic sentiment,” while the healthcare sector attracted strong demand, even witnessing a “chase” trend from long-term funds.

Surge in Hedging Demand for Tech Stocks, Spillover Risks Under Scrutiny

Despite nearly 50% of respondents in a Goldman Sachs sentiment survey expecting TMT to lead the market in the next 12 months, there is strong hedging demand for large tech stocks, which resonates with the selling pressure observed in the TMT sector by prime brokerage and cash trading departments. Data shows that the implied volatility spread between the Nasdaq 100 index and the S&P 500 index is nearing a one-year high.

A concerning sign is that NVIDIA has recently exhibited volatility even higher than the average level of the small-cap index Russell 2000 without any special catalysts. The report warns that NVIDIA's market capitalization (approximately $4.6 trillion) is about 2,500 times the average market capitalization of Russell 2000 constituents ($1.7 billion), and its liquidity is far from comparable to the latter.

In addition to sector rotation and concerns about tech stocks, the sharp pullback of the momentum factor has also become a significant risk point in the market. Last week, one of Goldman Sachs' momentum indices plummeted 750 basis points in a single day on Thursday, marking one of the worst trading periods for this factor in a decade.

Goldman Sachs' derivatives team expressed concerns about this situation, believing it could “spread into a more unstable scenario.” However, despite the poor performance of the momentum factor and rising market anxiety, investors' exposure to this factor remains “very high.” This indicates that once the sell-off continues, it could trigger a broader deleveraging and asset repricing