Alibaba Qianwen APP public beta ignites the software sector: valuation and profitability both bottoming out, AI applications accelerating implementation, industry showing initial signs of recovery!

Alibaba announced that its AI application "Qianwen" has entered public testing, marking the official start of the race for AI applications to transition from the enterprise side to the consumer side. This event has ignited enthusiasm in the capital market for the commercialization of AI applications, leading to a collective surge in the software sector. Analysts believe that the launch of the Alibaba Qianwen APP reflects its AI strategy shifting from heavy asset expansion to a phase of efficient monetization. Huawei will also release breakthrough AI technology to enhance the efficiency of computing resource utilization

With Alibaba announcing the public beta of its AI application "Qianwen," a race for artificial intelligence to transition from the enterprise side (B-end) to the consumer side (C-end) has officially begun. This landmark event not only ignited the capital market's enthusiasm for the commercialization of AI applications but also injected a strong dose of confidence into the software sector, which has long been at a dual bottom in valuation and profitability, signaling that the dawn of industry recovery may be on the horizon.

On November 16, Alibaba officially announced that its flagship AI application was renamed from "Tongyi" to "Qianwen" and opened testing to the public. The market's reaction was immediate. Following the news of the Qianwen app's launch, the AI application sector surged collectively, with multiple software-related stocks hitting their daily limit up. This reflects investors' optimistic expectations for leading AI model companies to accelerate the application landing, while also indicating that, after previous adjustments, the market is actively seeking precise signals of a turning point in the software industry's prosperity.

Analysts believe that the launch of the Alibaba Qianwen app represents a shift in its AI strategy from heavy asset expansion to efficient monetization. Huaxi Securities pointed out in a report: "We believe that with the better-than-expected growth of Alibaba Cloud's AI revenue in the latest quarterly report, AI products are gradually becoming the core driving force behind Alibaba Cloud's growth. The 'Tongyi' app has officially completed its brand upgrade to 'Qianwen,' with the software version upgraded from 3.60.0 to 5.0.0, marking the product's entry into a new development stage. At this point, we believe it is important to focus on Alibaba's breakthrough progress from B to C in AI, as C-end AI applications are expected to become one of the important breakthrough directions in 2026."

Meanwhile, according to China Fund News, Huawei is set to release a groundbreaking technology in the AI field on November 21, aimed at solving the problem of computing resource utilization efficiency. This technology, through software innovation, can significantly increase the utilization rate of computing resources such as GPUs and NPUs from the industry average of 30% to 40% to 70%, thereby greatly unleashing the potential of computing hardware.

It is reported that this technology can achieve unified resource management and utilization of computing power from NVIDIA, Ascend, and other third parties, shielding hardware differences and providing more efficient resource support for AI training and inference.

Notably, Huawei's technology route shares similarities with Israeli AI startup Run:ai. Since its establishment in 2018, Run:ai has focused on GPU scheduling technology, aiming to create a platform that can split and run AI models in parallel. Its core product is a software platform built on Kubernetes, optimizing GPU resource utilization through dynamic scheduling, pooling, and sharding technologies. The company was acquired by NVIDIA for $700 million at the end of 2024, highlighting the strategic value of computing resource scheduling technology in the AI industry.

Alibaba's Strategic Shift, Fully Betting on C-end Super Entry

The launch of the "Qianwen" APP is a significant upgrade to Alibaba's AI strategy. According to media reports, this is another group-level strategic project announced by Alibaba this year, following AI infrastructure and Taobao Flash Sale, personally approved by CEO Eddie Wu, aimed at creating an AI-native super application entry point for consumers.

The renaming from "Tongyi" to "Qianwen" is a carefully planned brand unification action, intended to directly associate the influential "Qwen" model brand within the developer community with consumer-facing products. According to a previous article by Wall Street Insight, insiders revealed that Alibaba plans to integrate multiple AI applications under the "Qianwen" brand to create a one-stop application that consumers prefer, and will gradually add agency-style AI functions in the future to support the shopping experience on platforms like Taobao.

The version released for public testing not only features Alibaba's most powerful Qwen3-Max model but also adopts a minimalist design and has the online search function enabled by default to ensure the timeliness of information, attempting to address the inherent "hallucination" problem of large models. This move signifies that Alibaba is fully participating in the competition with applications like ByteDance's "Doubao" and Tencent's "Yuanbao," vying for the scarce user attention entry point in the AI era.

Industry Recovery, Performance Exceeds Expectations Alleviating Market Concerns

Previously, the "AI devouring software" rhetoric sparked by reports from Bloomberg, Reuters, and other foreign media had cast a shadow over the computer software sector, intensifying investors' wait-and-see sentiment. However, the latest industry financial report data is effectively dispelling this concern.

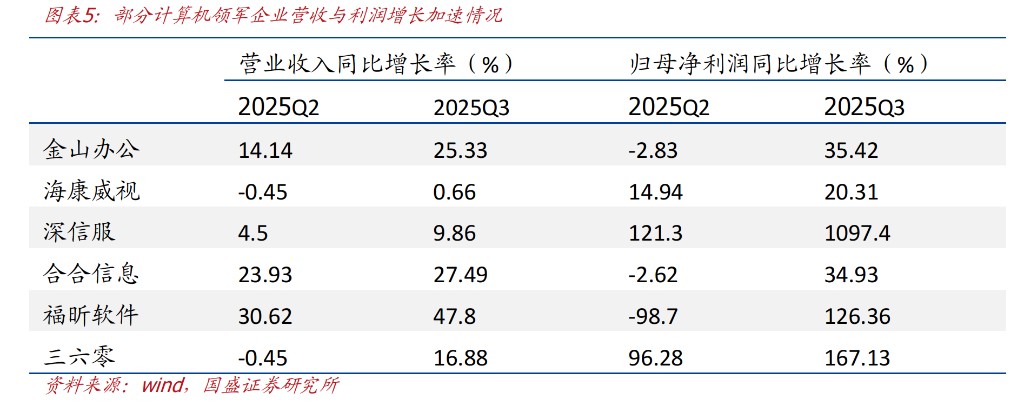

According to a research report by Guosheng Securities, several leading computer companies performed excellently in the third quarter of 2025, with significant acceleration in growth. The report shows that companies such as Kingsoft Office, Hikvision, Sangfor Technologies, and Hehe Information have all seen a noticeable increase in their year-on-year revenue or net profit attributable to shareholders in the single quarter compared to the second quarter. For instance, Kingsoft Office's net profit attributable to shareholders in Q3 2025 grew by as much as 35.42% year-on-year, far exceeding Q2's -2.83%, mainly benefiting from the rollout and promotion of new AI products and the acceleration of its Xinchuang business. This indicates that for companies with core competitiveness and strong execution capabilities, AI is not a "devourer," but rather an "enabler" driving growth.

Institutional Allocation at Low Levels, Policies and Regulatory New Rules Constitute Potential Catalysts

From the perspective of capital allocation, the software industry is at a favorable starting point. According to the data on heavily held stocks in fund reports for the third quarter, the computer sector accounted for only 2.68% of the total market value of heavily held stocks in Q3 2025, which is at a relatively low level in recent years and has declined for two consecutive quarters. Meanwhile, the industry's growth rate has also lagged behind other technology sectors such as communications and electronics since the beginning of the year

Guosheng Securities believes that this "underweight" state may usher in a turning point. The China Securities Regulatory Commission recently solicited opinions on the "Guidelines for Performance Benchmarking of Publicly Raised Securities Investment Funds," aiming to strengthen the binding effect of performance benchmarks and limit excessive deviations in fund investment styles.

Analysis suggests that once this new regulation is implemented, it will benefit sectors such as computers that are currently underweighted, potentially guiding funds back. In addition, policies such as the "Action Plan for Deepening Smart City Development and Promoting Comprehensive Digital Transformation" issued by the National Development and Reform Commission and other departments, as well as the State Council's executive meeting's deployment to accelerate scenario cultivation, also provide solid support for the continued recovery of industry prosperity.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk