Storage chip prices are skyrocketing, hurting PC and server manufacturers! Morgan Stanley: For every 10% increase, OEM gross margins decline by 45-150 basis points

Morgan Stanley warns that storage chip prices are skyrocketing unprecedentedly due to AI demand and supply shortages, with DRAM spot prices soaring 260% in two months. Dell, HP, and others are seen as the most vulnerable groups due to the high proportion of DRAM costs; Apple has a stronger ability to withstand pressure due to its strong supply chain bargaining power; Lenovo's PC business is more oriented towards the enterprise market, making it easier to pass on costs

An unprecedented "super cycle" of storage chips is sweeping the global technology hardware industry, casting a shadow over the profit outlook for personal computer (PC) and server manufacturers.

According to news from the Chase Trading Desk, Morgan Stanley warned in a report released on November 16 that the uncontrolled surge in storage chip prices will severely erode the profit margins of hardware original equipment manufacturers (OEMs). The ratings of several global hardware OEMs and original design manufacturers (ODMs) have been downgraded.

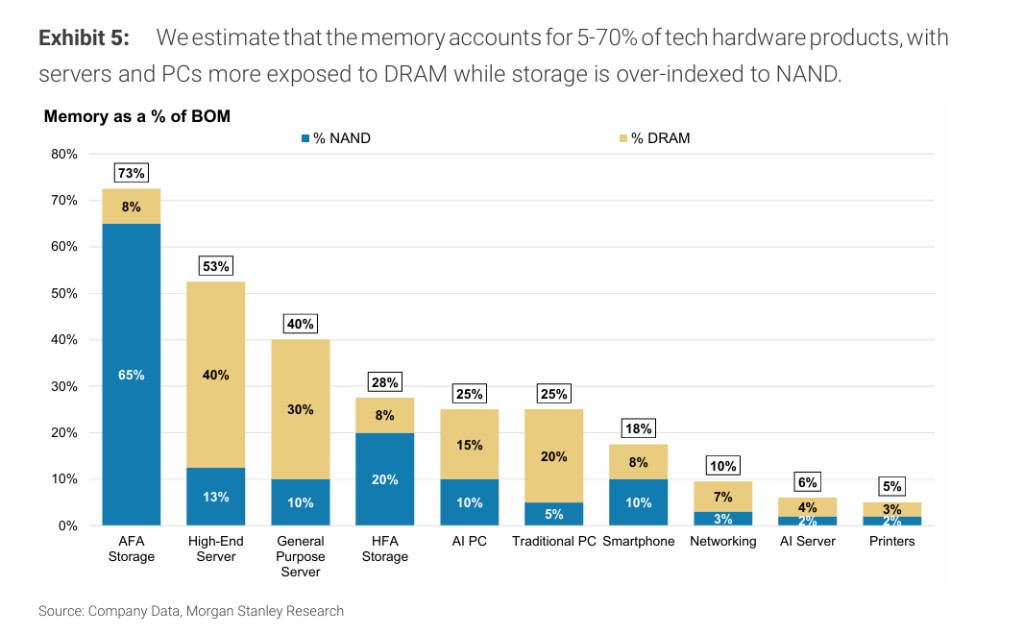

The report states that the soaring prices of storage chips (NAND and DRAM) are key components for products such as PCs and servers, with their costs accounting for 10%-70% of the bill of materials (BOM) for some high-end products. Morgan Stanley's model estimates that without any hedging measures, a 10% increase in storage chip prices will put downward pressure of 45 to 150 basis points on hardware OEMs' gross margins. This forecast sharply contrasts with the market's general expectations, as the bank's earnings per share (EPS) forecast for hardware manufacturers in 2026 is already 11% lower than the market consensus.

This round of price turmoil is driven by a surge in demand brought about by artificial intelligence, a technological shift towards high bandwidth memory (HBM), and insufficient investment in NAND flash memory. However, unlike previous cycles, the current price increases are more rapid and may last longer. Additionally, the current demand environment for non-AI hardware terminals is far weaker than it was during 2016-2018. This suggests that this cycle may lead to more severe profit squeezes or demand shrinkage than the last one, posing a significant downside risk to hardware manufacturers' profit forecasts.

The Arrival of the Storage "Super Cycle," with Unprecedented Price Increases

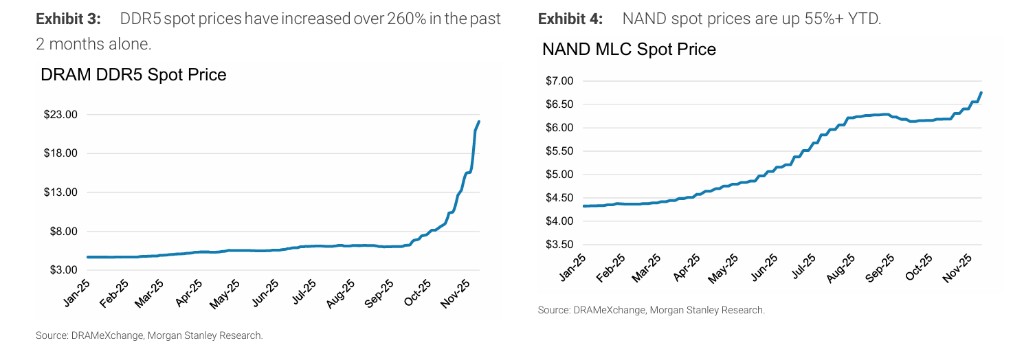

The storage chip market is experiencing an "unprecedented cycle." Morgan Stanley data shows that the spot price of DRAM (Dynamic Random Access Memory) has surged over 260% in just the past two months, while the spot price of NAND flash memory, the core of solid-state drives (SSDs), has also risen over 50% since the beginning of the year.

The driving forces behind this round of price surges mainly come from several aspects. First, large cloud service providers are accelerating procurement due to AI infrastructure construction; second, the demand for high bandwidth memory (HBM) for AI accelerators has exploded, squeezing the capacity of mainstream DRAM; in addition, the industry has severely underinvested in NAND capacity over the past few years, exacerbating supply tightness. Reports indicate that the order fulfillment rate for storage chips in the next two quarters may drop to as low as 40%.

Morgan Stanley points out that although most OEM manufacturers procure through contracts rather than the spot market, contract prices are also under significant upward pressure. The bank expects that both NAND and DRAM contract prices may achieve double-digit percentage growth in every quarter before 2026. The speed and magnitude of these price increases far exceed those of the previous cycle (2016-2018)

History Repeats? Lessons from the 2016-2018 Period

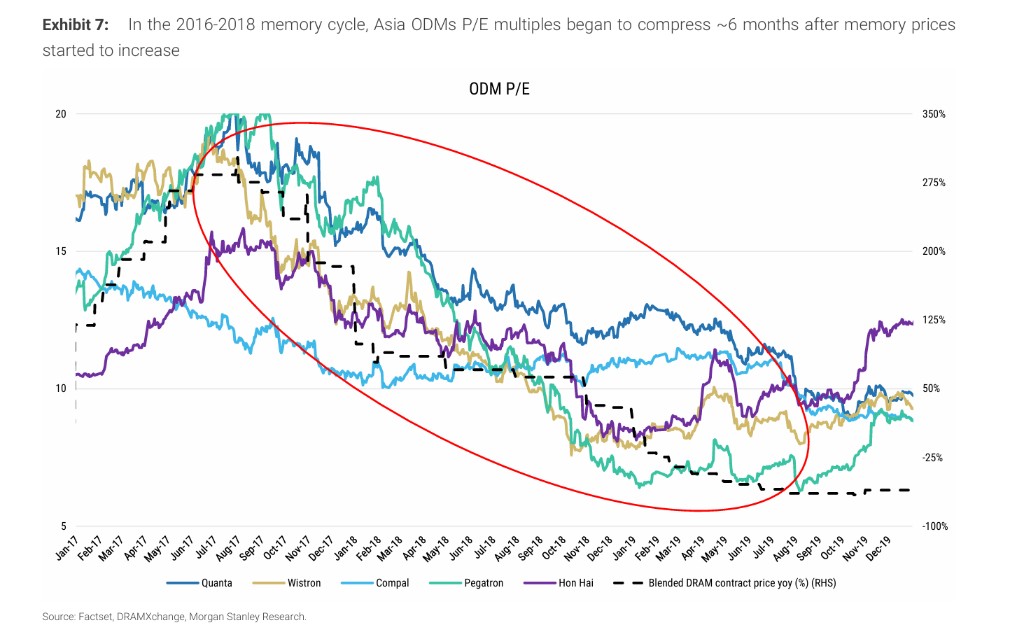

Looking back at the storage supercycle that began in 2016 can provide important references for the current situation. At that time, about 6 to 12 months after storage prices began to rise, the gross margins and stock valuation multiples of OEM manufacturers began to come under pressure simultaneously. Although manufacturers attempted to pass on costs through price increases, it was still insufficient to fully offset the impact, leading to a year-on-year decline in gross margins for most companies for 4 to 5 consecutive quarters.

However, there are two key differences between this cycle and the last one. First, the price increase is more rapid and may last longer. Second, the current demand environment for non-AI hardware terminals is far weaker than it was during 2016-2018. Morgan Stanley's CIO survey shows that corporate hardware budgets are growing weakly, and most corporate executives indicate that if equipment prices rise, they would prefer to reduce procurement rather than increase spending budgets.

This combination of “cost surge” and “weak demand” suggests that this cycle may lead to more severe profit squeeze or demand contraction than the last one, posing significant downside risks to hardware manufacturers' profit forecasts.

Morgan Stanley Downgrades Ratings, Several Giants Face Profit Warnings

Based on the above judgments, Morgan Stanley has downgraded several global hardware giants, believing that their profits and valuations will face dual pressures.

- Dell Tech: Rating downgraded from "Overweight" to "Underweight," target price lowered from $144 to $110. The report believes that Dell is one of the OEMs most severely affected by rising storage costs, and although its AI server business is strong, the profit pressure on its core business (PCs, storage) will drag down overall performance.

- HP: Rating downgraded from "Market Perform" to "Underweight," target price lowered from $26 to $24. The recovery in the PC market is offset by margin pressure, while its printing business continues to face challenges.

- Hewlett Packard Enterprise: Rating downgraded from "Overweight" to "Market Perform," target price lowered from $28 to $25. Analysts believe that there is uncertainty in the integration path after its acquisition of Juniper Networks, combined with storage cost pressures, leading to a lack of strong catalysts in the short term.

- ASUS: Rating downgraded from "Market Perform" to "Underweight," target price lowered from NT$625 to NT$500. Its PC business is highly dependent on the more price-sensitive consumer market, with limited ability to pass on costs

- Lenovo Group: Rating downgraded from "Overweight" to "Market Perform." The report believes that over 60% of Lenovo's PC business is aimed at the enterprise market, which is easier to pass on cost increases compared to the consumer market.

Who is more vulnerable? PC and server manufacturers have the largest risk exposure

Morgan Stanley's analytical framework shows that different types of hardware manufacturers are in varying situations during this round of impact. Overall, PC and server manufacturers that rely more on DRAM have a greater risk exposure than storage device manufacturers that rely more on NAND.

The report lists Dell, HP, ASUS, and Acer as the "most vulnerable" group of companies. These companies either have a high proportion of DRAM costs in their material lists, or their PC businesses are highly concentrated in the price-sensitive consumer market, or their own operating profit margins are relatively low, leading to insufficient buffering capacity.

In contrast, companies like Apple and Pure Storage are considered "more resilient." Apple, with its strong supply chain bargaining power, cost control, and brand effect, can better withstand rising costs. Meanwhile, storage specialists like Pure Storage benefit from relatively moderate NAND price increases and stronger pricing power.

It is worth noting that this storm has also created beneficiaries on the other end. Morgan Stanley states that memory chip manufacturers such as Micron Technology, SK Hynix, and Samsung Electronics will be direct winners in this super cycle