XPeng's Q3 revenue doubled, net loss narrowed by nearly 80%, and Q4 delivery and revenue are expected to increase by over 30% year-on-year | Financial Report Insights

More news, ongoing updates

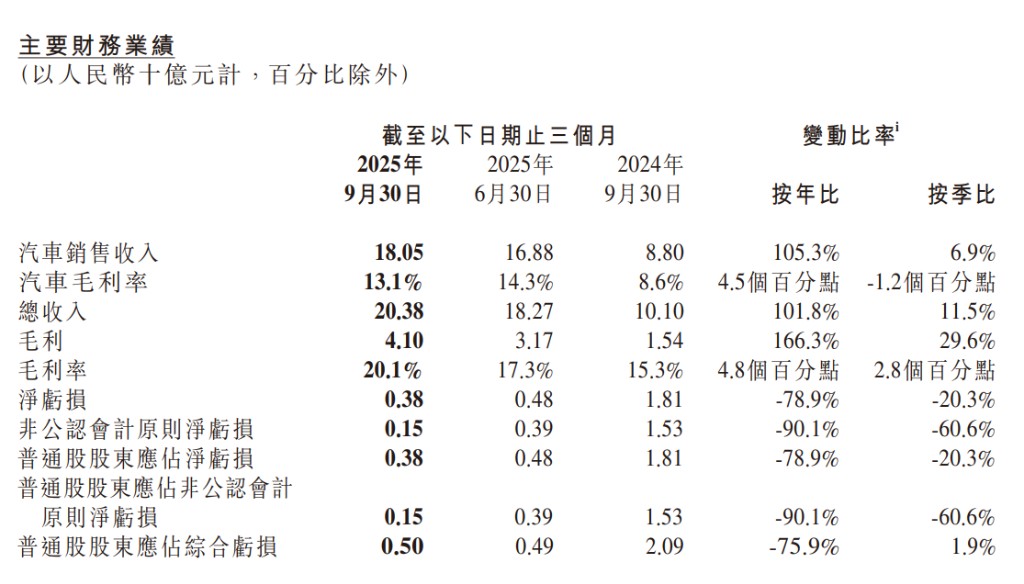

XPeng's Q3 performance key indicators have all reached new highs, with revenue doubling year-on-year, comprehensive gross margin exceeding 20% to set a historical record, and net loss significantly narrowing by nearly 80% year-on-year. It is expected that Q4 deliveries and revenue will both grow by over 30% year-on-year. The company has previously clarified its shift towards positioning as a "global embodied intelligence company," betting on physical AI, Robotaxi, and humanoid robots.

Key Financial Indicators

Q3 total revenue of RMB 20.38 billion, a year-on-year increase of 101.8%;

Automotive sales revenue of RMB 18.05 billion, a year-on-year increase of 105.3%;

Comprehensive gross margin exceeded 20.1% (up 4.8 percentage points year-on-year);

Automotive gross margin at only 13.1% (down 1.2 percentage points quarter-on-quarter);

Net loss of RMB 380 million, a year-on-year narrowing of 78.9%, and a quarter-on-quarter narrowing of 20.3%;

Non-GAAP net loss of only RMB 150 million, a significant year-on-year narrowing of 90.1%;

Cash reserves of RMB 48.33 billion, an increase of RMB 760 million quarter-on-quarter.

Core Business Progress

Q3 delivery volume of 116,007 vehicles, a year-on-year surge of 149.3%;

Service and technology R&D revenue of RMB 2.33 billion, with a gross margin as high as 74.6%, becoming a major support for comprehensive gross margin;

Sales network expanded to 690 stores, with 2,676 charging stations (including 1,623 supercharging stations);

Q4 delivery guidance of 125,000 to 132,000 vehicles, a year-on-year increase of 36.6%-44.3%.

Strategic Transformation

The company is betting on physical AI, Robotaxi, and humanoid robots;

Q3 R&D expenditure of RMB 2.43 billion, a year-on-year increase of 48.7%, and a quarter-on-quarter increase of 10.1%;

Sales and management expenses of RMB 2.49 billion, a year-on-year increase of 52.6%, with the expense ratio still at a high level.

Chairman and CEO He Xiaopeng stated that the company's sales scale and market share are in the early stages of rapid expansion. Vice Chairman and Co-President Gu Hongdi noted that the company's comprehensive gross margin broke through 20% for the first time in the third quarter, thanks to effective cost control and the potential released from technology R&D-related revenues