Morgan Stanley's major outlook: 2026 is the "year of risk reboot," with strong earnings in U.S. stocks and a resonance of the AI investment cycle, the S&P 500 may rise to 7,800 points!

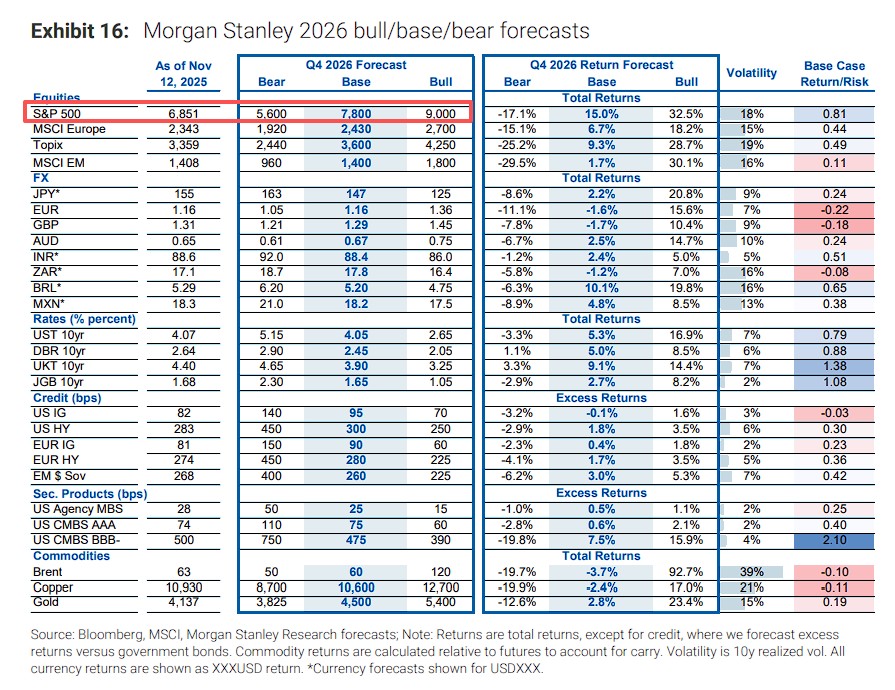

Morgan Stanley defines 2026 as the "Year of Risk Reboot," with market focus shifting from macro to micro. The rare fiscal, monetary, and regulatory "policy trio" resonates with the AI investment cycle, driving strong corporate profit growth and pushing the S&P 500 Index to 7,800 points, an increase of about 15%, based on an expected 17% growth in corporate profits

Morgan Stanley released its 2026 Global Strategic Outlook, expecting a strong year for risk assets driven by the resonance of triple policy stimulus and the AI investment cycle, along with robust corporate earnings growth, with U.S. stocks likely to lead the global market.

On November 17th, according to news from the Wind Trading Desk, Morgan Stanley defined 2026 as "The Year of Risk Reboot," believing that the market focus will shift from macro uncertainty to micro fundamentals, creating a strong upward environment for risk assets.

Morgan Stanley believes that the "policy triumvirate" of fiscal policy, monetary policy, and regulatory easing will form a rare pro-cyclical combination in 2026, creating a favorable environment for risk assets. Meanwhile, the capital expenditure cycle related to AI is still in its early stages and is expected to provide sustained momentum for corporate earnings.

The bank's chief U.S. equity strategist, Michael Wilson, raised the year-end target price for the S&P 500 index in 2026 to 7,800 points, an increase of about 15% from current levels, making it one of the most optimistic voices on Wall Street, mainly due to strong earnings growth, AI-driven efficiency improvements, and supportive policy environments.

Morgan Stanley expects the U.S. Treasury yield curve to experience significant "bullish steepening" in the first half of 2026, with short-term rates declining sharply due to Federal Reserve rate cuts. The bank anticipates significant differentiation in the credit bond market in 2026, with high-yield bonds likely to outperform investment-grade bonds. The surge in financing demand related to AI will increase supply pressure on investment-grade bonds and widen spreads.

Morgan Stanley has made a significant shift in its view on the U.S. dollar, no longer extremely bearish, expecting weakness in the first half and a rebound in the second half. In the commodities sector, it prefers metals over energy, with gold remaining the top choice, setting a gold target price of $4,500 per ounce (an upside potential of about 9%).

"The Rare Cooperation of the Policy Triumvirate"!

Morgan Stanley first pointed out in the report that risk assets will see strong performance in 2026, with the driving force shifting from the global macro narrative that dominated 2025 (such as trade tensions and policy uncertainty) to micro and specific asset stories.

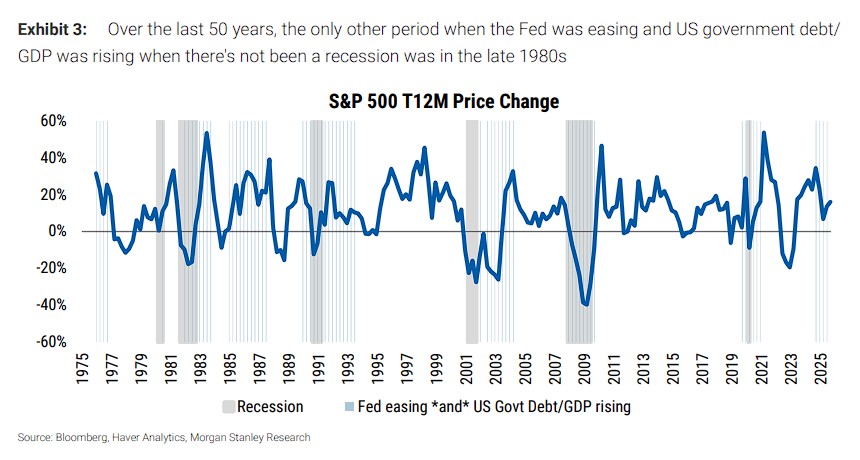

The key catalyst for this shift is the rare "policy triumvirate," where fiscal policy, monetary policy, and regulatory easing will work together in a pro-cyclical manner, which is quite rare during periods when the economy is not in recession. Specifically:

Fiscal Policy: The report expects that the U.S. "One Big Beautiful Bill Act (OBBBA)" will reduce corporate taxes by $129 billion in 2026-27

Monetary Policy: The Federal Reserve is expected to further cut interest rates by 50 basis points in the first half of 2026 to respond to a stable macro environment, thereby easing financial conditions.

Regulatory Easing: The U.S. government will prioritize regulatory easing, especially in the energy and financial sectors.

Morgan Stanley believes that this combination will jointly boost market sentiment and the so-called "Animal Spirits."

The report emphasizes that this combination of fiscal, monetary, and regulatory policies acting in a pro-cyclical manner during a non-recessionary economic period is extremely rare, with the last similar occurrence dating back to the late 1980s. This unique policy combination will inject a strong stimulus into risk markets, allowing investors to focus more on corporate earnings, AI investments, and other micro fundamentals.

Core Driver: AI Investment Contains Huge Growth Potential

AI is one of the most important micro themes for 2026.

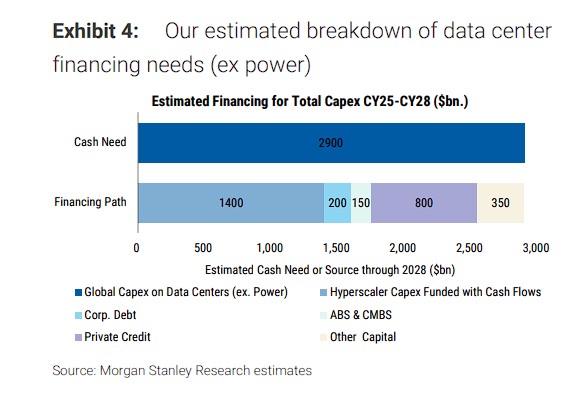

Morgan Stanley believes that AI-related capital expenditures are long-term and not affected by business cycle fluctuations. Of the projected nearly $3 trillion in data center-related capital expenditures, less than 20% has been deployed so far, indicating that most investment spending is still ahead.

How will this massive investment be financed? The report estimates that while about half of the funds will come from the operating cash flow of tech giants, there remains a financing gap of up to $1.5 trillion. This gap needs to be filled through various credit channels, including:

-

Public Credit Markets: Morgan Stanley expects a significant net issuance of investment-grade (IG) corporate bonds in the U.S. and Europe in 2026, primarily from "hyperscalers" in the AI sector.

-

Securitized Credit Markets: The supply of data center asset-backed securities (ABS) will also increase significantly.

Despite strong demand for high-quality credit products, such a massive supply pressure is expected to lead to a moderate widening of credit spreads for investment-grade bonds and data center ABS.

U.S. Stocks Stand Out, S&P 500 Index Target 7800 Points

Against the backdrop of "risk re-opening," Morgan Stanley clearly states that U.S. stocks will outperform other global markets.

In addition to the policy environment and the AI investment cycle, Morgan Stanley's most core logic for being bullish on U.S. stocks comes from earnings per share (EPS) growth that exceeds market consensus.

The firm predicts that the S&P 500 index will have an EPS of $272 in 2025 (a 12% increase), $317 in 2026 (a 17% increase), and $356 in 2027 (a 12% increase) This forecast is based on the four pillars outlined by Wilson:

Improved corporate pricing power, efficiency gains driven by artificial intelligence, loose tax and regulatory policies, and a stable interest rate environment. These factors will collectively drive the S&P 500 index to achieve earnings per share growth of 17% and 12% over the next two years.

Although Morgan Stanley acknowledges in the report that U.S. stock valuations are high (with a CAPE ratio of 38 times, close to historical highs), it believes that high valuations can persist under strong macroeconomic drivers.

The S&P 500 index has risen 14% year-to-date, with gains exceeding 20% in the previous two years. Coupled with Morgan Stanley's latest forecast target, this means the S&P 500 index will achieve double-digit growth for the fourth consecutive year.

Notably, this strategist maintained a bullish stance when U.S. tariffs were comprehensively raised in April this year, leading to a market downturn, and was ultimately proven correct by the market.

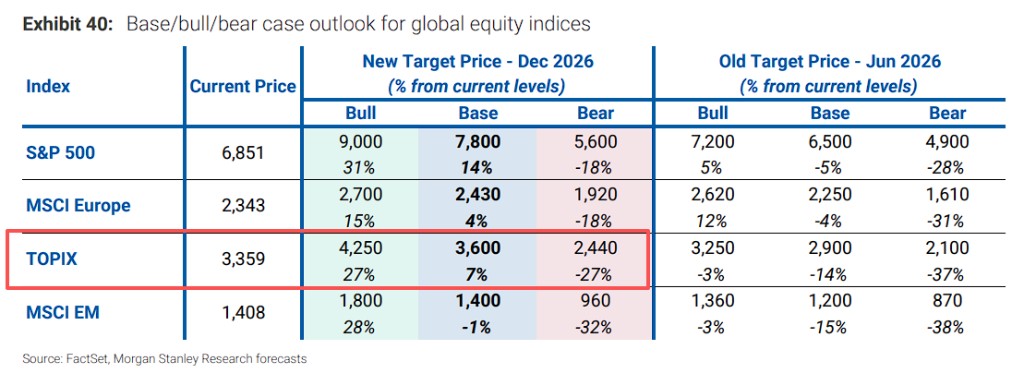

The firm is also optimistic about the Japanese stock market while being relatively cautious about Europe and emerging markets.

- The Japanese market will benefit from rising inflation and corporate governance reforms. Under the fiscal and regulatory reforms promoted by the new Prime Minister, Kishida Fumio, the outlook for improving corporate ROE in Japan is optimistic. Domestic capital inflows into the stock market, including buybacks and the NISA 2.0 plan, will also provide structural support for the market. Morgan Stanley has set a target price of 3600 points for the TOPIX, a 7% increase from current levels.

(It is worth noting that NISA is a personal investment tax exemption system established by the Japanese government, modeled after the UK's system, evolving into a small investment tax exemption system with Japanese characteristics. Typically, profits from investments in Japan are subject to a 29% tax. After the establishment of the NISA system, profits from investments in NISA accounts can enjoy tax exemption.)

- The European market faces structural challenges. The firm points out that the old economy accounts for a high proportion in Europe, and the outlook for profit growth is relatively bleak. Although European stocks are expected to benefit from the spillover effect of rising U.S. stocks, the growth mainly comes from valuation expansion rather than profit improvement.

- Emerging market performance is expected to be differentiated. With expectations of a stable dollar, the firm holds a neutral stance on emerging markets overall but is optimistic about specific markets such as India (benefiting from strong domestic credit growth and tax cuts), Brazil (where presidential elections may affect market trajectories), and the UAE.

Fixed Income Market: U.S. Treasury Curve "Bull Steepening"

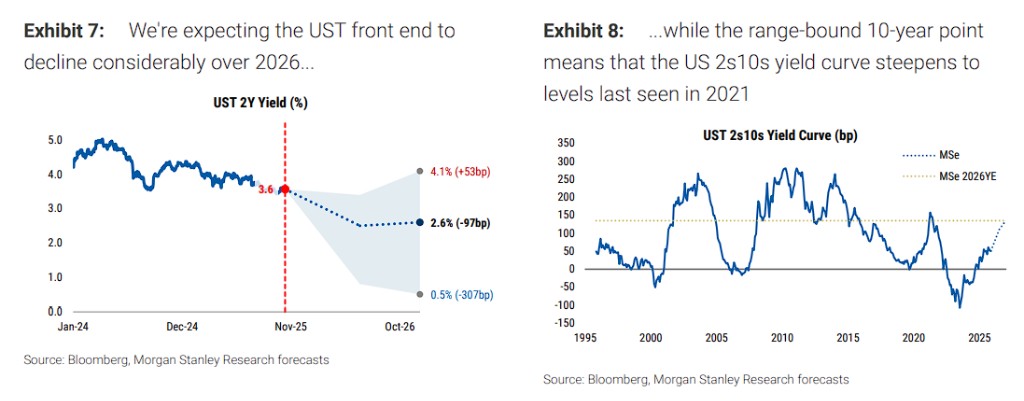

Morgan Stanley's core view is that the U.S. Treasury yield curve will experience significant "bull steepening" in the first half of the year, as the market has not fully priced in the Federal Reserve's future rate cut expectations and the tail risks of economic slowdown.

Morgan Stanley expects that as the Federal Reserve cuts rates, short-term yields at the front end of the curve will decline significantly, while long-term yields will remain range-bound.

The firm anticipates that by the end of 2026, the yield on the 2-year U.S. Treasury is expected to drop to 2.60%, while the yield on the 10-year Treasury will settle at 4.05% This means that the yield spread between 2-year and 10-year government bonds will widen to 145 basis points, the steepest level since 2021. However, unlike the "bear steepening" caused by soaring long-term rates in 2021, this time it will be driven by declining short-term rates.

Foreign Exchange Market: The US Dollar Weakens in the First Half and Rebounds in the Second Half

Morgan Stanley has made a significant shift in its view on the US dollar, no longer being extremely bearish.

Morgan Stanley's forecast for the US dollar shows a clear "two halves" characteristic. It is expected that the US dollar index will continue to weaken to 94 in the first half of 2026, followed by a rebound to 99 in the second half, remaining roughly flat for the year.

This forecast is based on changes in the US interest rate cycle and risk appetite. In the first half, as the Federal Reserve continues to cut interest rates and global risk sentiment improves, the negative risk premium on the dollar will drive it weaker. However, in the second half, with the US economy recovering and long-term rates rebounding, the dollar is expected to strengthen again.

The euro against the dollar is expected to rise to 1.23 before falling back to 1.16. The European Central Bank is forced to lower interest rates into a loose range, with a growing divergence from US policy. The British pound faces greater pressure, as the Bank of England significantly cuts rates, which will notably weaken the pound's yield advantage.

The yen's movement will roughly follow the US bond market. The dollar against the yen is expected to fall to 140, then rebound to 147. Risk currencies like the Australian dollar are expected to perform well in the first half, benefiting from optimistic risk sentiment and supportive local factors.

Credit Bond Market Divergence: High-Yield Bonds Outperform Investment Grade

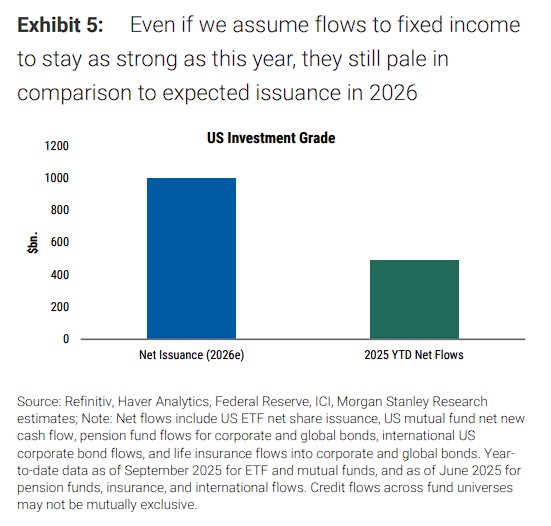

Morgan Stanley expects significant divergence in the credit bond market in 2026, with high-yield bonds likely to outperform investment-grade bonds. This is mainly due to the surge in financing demand related to AI, which has a differentiated impact on various credit segments.

The investment-grade corporate bond market will face supply pressure. The firm expects net issuance of US investment-grade bonds to increase by 60%, primarily driven by AI and data center-related financing demand. Although demand remains strong, the large supply is expected to widen investment-grade bond spreads to 95 basis points.

In contrast, the high-yield bond market has a more balanced technical outlook. New issuances from increased LBO (leveraged buyout) and merger and acquisition activities will be offset by the removal of existing portions from strategic acquisitions, resulting in a relatively stable overall supply-demand balance. The firm expects US high-yield bond spreads to widen moderately to 300 basis points The European credit bond market is expected to outperform the United States. The recovery of the "animal spirits" among European companies is relatively moderate, with less supply pressure. At the same time, factors such as relatively stable GDP growth, central bank interest rate cuts, and the diffusion of EPS growth will support European credit.

Structured products will benefit from regulatory easing. The expected regulatory easing in the United States and the European Union will release capital for banks and insurance companies, increasing demand for structured products. The bank recommends increasing holdings in agency mortgage-backed securities (MBS) and shifting from investment-grade credit to high-quality structured products.

Commodities: Metals outperform energy, gold is the top choice

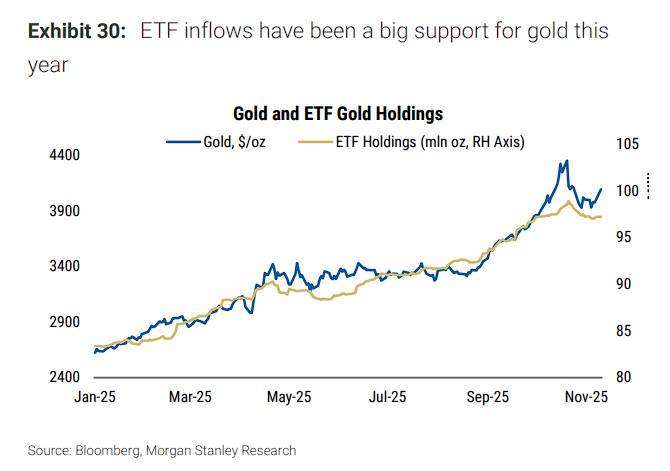

Morgan Stanley prefers metals over energy in the commodities sector, with gold remaining the top choice. The bank has set a target price for gold at $4,500 per ounce, expecting an upside potential of about 9%.

The demand structure for gold continues to improve. ETF inflows have largely reversed the four-year trend of net outflows, central bank gold purchases, although slowing, are still ongoing, and jewelry demand shows signs of stabilization. The demand for physical assets to hedge against inflationary risks and ongoing economic uncertainty provides additional support for gold prices.

The supply side of base metals faces challenges. Copper mining is affected by issues such as earthquakes, mudslides, and declining grades, with a 5% tolerance for disruption already reached in 2025. This is expected to lead to a slight shortage in 2025, with the gap anticipated to further widen to 600,000 tons in 2026. The target price for copper in 2026 is expected to be $10,600 per ton.

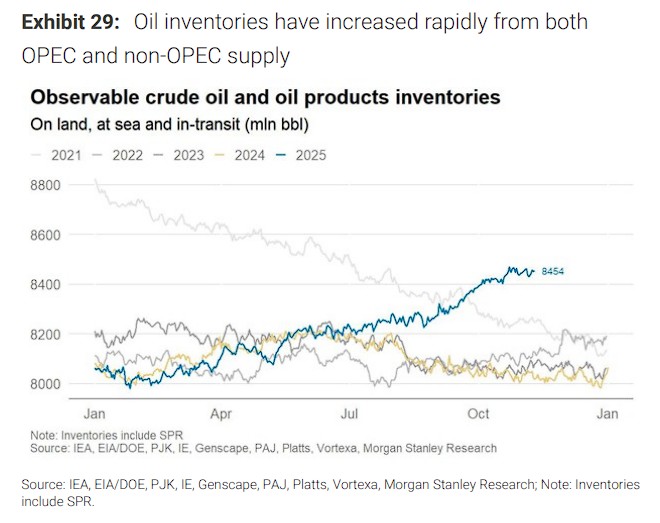

The outlook for the energy market is relatively bleak. Brent crude oil faces multiple pressures from weak demand, non-OPEC supply growth, and high OPEC production levels. The bank expects oil prices to fluctuate around $60 per barrel, with limited potential for significant increases.