Luckin Coffee's Q3 net revenue increased by 50% year-on-year, while net profit attributable to common shareholders decreased by 2.7%. The average monthly transacting customers have surpassed 100 million for the first time | Financial Report Insights

More news, ongoing updates

Luckin Coffee continues its rapid expansion route, with Q3 revenue maintaining a growth rate of 50%, and monthly active trading users surpassing 100 million for the first time. However, profitability remains under pressure, primarily due to soaring delivery costs driven by a surge in takeout orders.

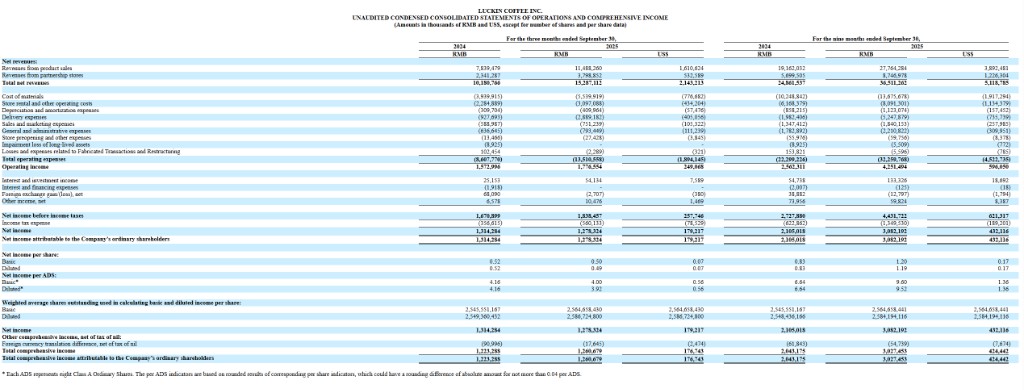

- Q3 total revenue reached RMB 15.3 billion (USD 2.14 billion), a year-on-year increase of 50.2%, with GMV growing 48.1% year-on-year to RMB 17.3 billion.

- Net profit attributable to ordinary shareholders of the company was RMB 1.278 billion, a year-on-year decrease of 2.7%; net profit margin plummeted from 12.9% to 8.4%.

- Operating cash flow was RMB 2.07 billion, a year-on-year increase of 57.2%; cash and cash equivalents reached RMB 9.35 billion, up 57.5% from the beginning of the year.

Core business progress:

- A net increase of 3,008 stores in a single quarter, bringing the total number of stores to 29,214 (18,882 self-operated and 10,332 franchised), a quarter-on-quarter growth of 11.5%.

- Monthly average trading customers surpassed 112.3 million for the first time, a year-on-year increase of 40.6%, marking a milestone of exceeding 100 million.

- Same-store sales growth for self-operated stores reached 14.4%, significantly reversing last year's -13.1% decline.

- Profit margin for self-operated stores narrowed sharply from 23.5% to 17.5%; GAAP operating profit margin fell from 15.5% to 11.6%.

Cost pressure:

- Delivery costs surged by 211.4% to RMB 2.89 billion, mainly due to a spike in orders from third-party delivery platforms.

- Operating expense ratio increased from 84.5% to 88.4%, eroding profit margins.

Rapid Expansion of Self-operated and Franchised Businesses

In Q3, Luckin achieved total net revenue of RMB 15.29 billion (same currency), a year-on-year growth of 50.2%, primarily driven by a significant increase in GMV (+48.1%):

-

Self-operated store revenue: RMB 11.08 billion, a year-on-year increase of 47.7%.

-

Franchised store revenue: RMB 3.799 billion, a year-on-year increase of 62.3%.

-

Fresh beverage sales revenue reached RMB 10.63 billion, accounting for nearly 70%.

The net increase of 3,008 stores in a single quarter is indeed astonishing, bringing the total number of stores to over 29,214, including 18,882 self-operated stores and 10,332 franchised stores.

More notably, same-store sales growth for self-operated stores reached 14.4%, which is a positive signal—at least indicating that the operating conditions of mature stores are improving, completely reversing last year's -13.1% negative growth.

However, the profitability at the store level is deteriorating. The profit margin for self-operated stores plummeted from 23.5% in the same period last year to 17.5%, a decline of 6 percentage points. Although the absolute value of store operating profit increased by 10.2% to RMB 1.94 billion, this was mainly achieved through an increase in the number of stores, with a clear downward trend in single-store profitability The franchise business performed relatively well, with revenue of 3.8 billion yuan, a year-on-year increase of 62.3%, accounting for 24.9% of total revenue.

In the composition of franchise income, material sales were 2.02 billion yuan, delivery service fees were 870 million yuan, and profit sharing and franchise fees were 580 million yuan. The rapid expansion of the franchise model has, to some extent, shared the company's fixed costs.

Delivery Costs Surge Over 2 Times

Notably, in the third quarter, delivery costs surged 211.4% year-on-year, skyrocketing from 930 million yuan in the same period last year to 2.89 billion yuan. This growth rate far exceeds revenue growth and has become the biggest factor dragging down profit margins.

Management attributed this to the "surge in orders from third-party delivery platforms." The proportion of delivery costs to revenue soared from 9.1% last year to 18.9%, almost consuming all profit growth space.

In contrast, other cost controls have been relatively effective.

Material costs increased by 40.6%, lower than the revenue growth rate; store rent and operating costs increased by 35.5%, also showing scale effects. Marketing expenses as a percentage of revenue decreased from 5.8% to 4.9%, and management expenses as a percentage of revenue decreased from 6.3% to 5.2%, indicating that the company has been relatively effective in cost control in these areas.

Average Monthly Trading Customers Exceed 100 Million for the First Time

The average monthly active trading customers reached 112.3 million, a year-on-year increase of 40.6%, surpassing the 100 million mark for the first time.

However, it is important to note that this figure includes customers from franchise stores and those who only use free coupons.

The GMV for Q3 was 17.3 billion yuan. With 112.3 million monthly active customers calculated over three months, the quarterly contribution per customer is approximately 51.3 yuan, averaging about 17 yuan per month.

Updating