Tech stocks, cryptocurrency, and gold face a "triple kill," U.S. stocks fall below key support levels, and the American market experiences a "full-scale sell-off."

The S&P 500 index fell below the key support level of 6,725 points, with the Nasdaq also breaking below the 50-day moving average; Bitcoin dropped below $92,000, forming a "death cross"; gold also fell to the $4,000 level. Behind the sell-off, on one hand, is the market's weakening expectation for a Federal Reserve interest rate cut, with the persistently high interest rate environment suppressing the valuation of risk assets; on the other hand, skepticism about the sustainability of the AI boom has intensified, with concerns spreading from the stock market to the credit market

On Monday, November 17th local time, a severe sell-off swept through the U.S. financial markets, affecting nearly all asset classes from the soaring tech stocks to cryptocurrencies and even gold. Amid growing concerns about the sustainability of the AI boom and the economic outlook, investors rushed to sell risk assets, causing major stock indices to fall below key technical support levels, and market risk aversion surged sharply.

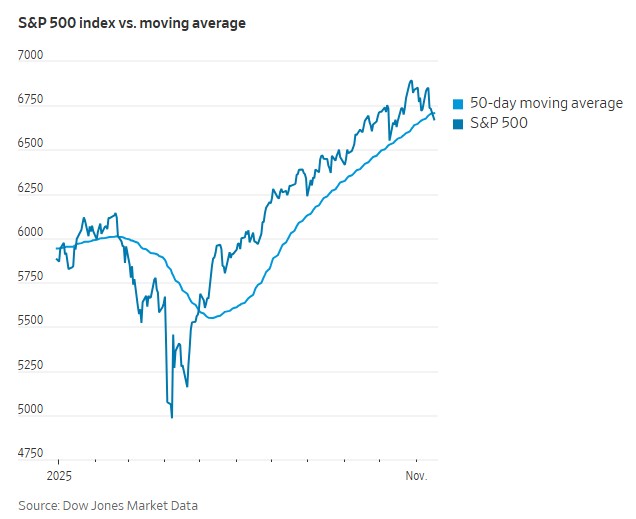

The latest market dynamics show that both the S&P 500 Index and the Nasdaq Composite Index closed below the 50-day moving average for the first time in 138 trading days, breaking the longest consecutive rising streak since May of this year. The Dow Jones Industrial Average experienced its worst three-day performance since April, closing down 1.2% or 557 points on Monday. The Nasdaq Index fell 0.8%, and the S&P 500 Index dropped 0.9%.

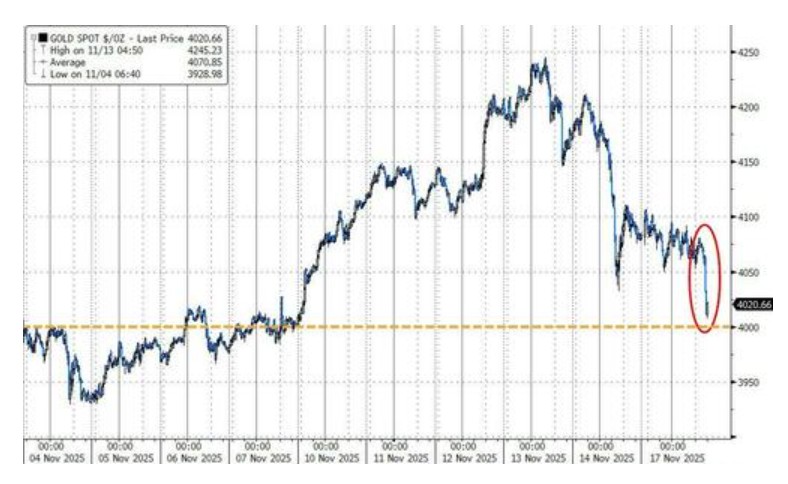

This sell-off was not limited to the stock market. Gold futures, viewed by some analysts as a speculative asset, retreated to $4,068.30 per troy ounce. Spot gold prices fell to around the $4,000 level.

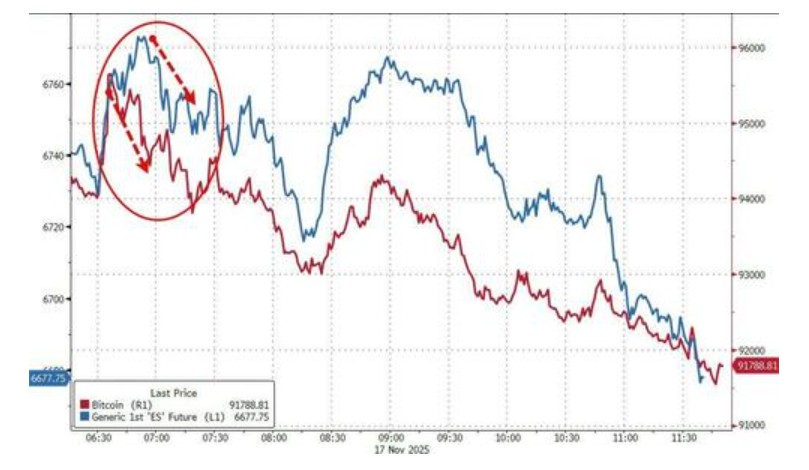

The cryptocurrency market was also hit hard, with Bitcoin prices dropping below $92,000, turning the year-to-date gains negative. The market's panic sentiment pushed the Chicago Board Options Exchange Volatility Index (VIX) to its highest level since April, highlighting the growing concerns among investors.

Behind this market turmoil is a collective tension among investors ahead of key events. This week, Nvidia will announce its earnings, which are seen as a barometer for AI chip demand; meanwhile, the September employment data, delayed due to the government shutdown, will also be released. At the same time, the market is increasingly wary of the tech giants' reliance on massive debt issuance to support capital expenditures, coupled with the ongoing uncertainty surrounding the Federal Reserve's interest rate policy path, forming the macro backdrop for the current "broad sell-off" in the market.

U.S. Stocks Break Key Technical Levels, AI Boom Cools Down

The decline on Monday is an important technical signal for U.S. stocks.

Almost all major indices broke through key technical support levels: the S&P 500 Index, Dow Jones Index, and Nasdaq Index fell below the 50-day moving average, while the RTY Index dropped below the 100-day moving average. Technical analysts typically view a breach of such key moving averages as a signal that the market's short-term trend may reverse.

Technology stocks are the hardest hit in this round of sell-offs. Although Berkshire Hathaway, led by Warren Buffett, disclosed an increase in its stake in Google's parent company Alphabet, driving the latter's stock price up by 3.1%, this did not boost the morale of the entire sector. Due to Berkshire reducing its stake in Apple, Apple's stock price fell by 1.8%. Additionally, most of the "Big Seven" tech giants, including Nvidia, Meta, and Amazon, saw declines, as did AI server suppliers such as Advanced Micro Devices and Dell Technologies, along with companies like Oracle and CoreWeave.

Technology stocks are the hardest hit in this round of sell-offs. Although Berkshire Hathaway, led by Warren Buffett, disclosed an increase in its stake in Google's parent company Alphabet, driving the latter's stock price up by 3.1%, this did not boost the morale of the entire sector. Due to Berkshire reducing its stake in Apple, Apple's stock price fell by 1.8%. Additionally, most of the "Big Seven" tech giants, including Nvidia, Meta, and Amazon, saw declines, as did AI server suppliers such as Advanced Micro Devices and Dell Technologies, along with companies like Oracle and CoreWeave.

Data shows that the index tracking large tech stocks has fallen to its lowest closing level in nearly a month.

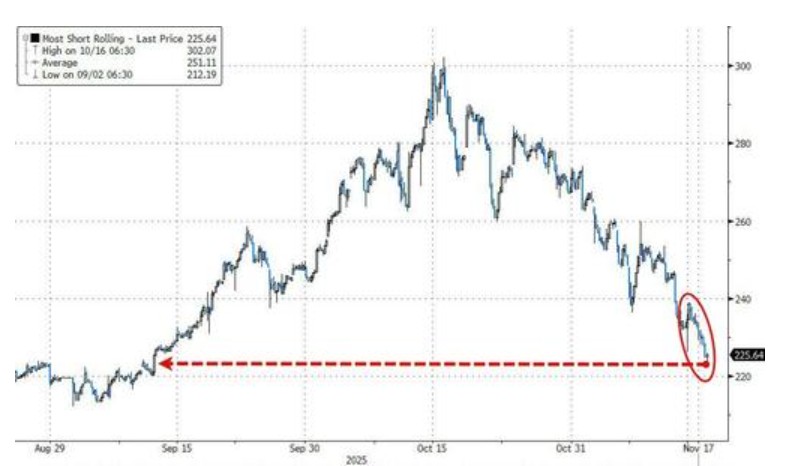

Meanwhile, the "most shorted stocks" index has also dropped to a two-month low, indicating that market confidence in previously popular stocks is waning.

S&P 500 Index Falls Below Key Level - 6725 Points, Market Faces 10% Correction Risk

The S&P 500 Index has not only fallen below the closely watched 50-day moving average but has also dropped below 6725 points. Analysts are concerned that this decline could evolve into a comprehensive correction of at least 10%.

Lee Coppersmith of Goldman Sachs previously pointed out that falling below the 6725-point level could prompt quantitative trend-following funds known as CTAs (Commodity Trading Advisors) to switch from buyers to sellers.

John Roque, head of technical analysis at 22V Research, noted that the Nasdaq Composite Index is flashing some "ugly" signals. He stated that the number of components in the index hitting 52-week lows has exceeded those hitting 52-week highs, which is a sign of internal weakness in the market, indicating limited potential for further rebounds. Roque expects the Nasdaq index to continue its downward trend, with declines possibly expanding to 8%.

The deterioration in market breadth has heightened analysts' concerns. Dan Wantrobski, a technical strategist at Janney Montgomery Scott, stated, "Market breadth is very poor, and the stock market is in a fragile position." He predicts that by the end of December, the S&P 500 Index's correction could reach 5% to 10%.

Credit Market Alarm Sounds, Amazon's Bond Issuance Cools

The weakness in the stock market is echoed by the increasing pressure in the credit market. Data shows that **the credit spreads of investment-grade and high-yield corporate bonds are widening at an accelerating pace, even exceeding the increase in the VIX index. This indicates that investors' concerns about corporate default risks are intensifying **

Amazon's $15 billion bond issuance on Monday has become a litmus test for the market's assessment of credit health. Despite reportedly receiving substantial subscriptions, the final pricing spread of these bonds was higher than existing bonds, indicating that investors are demanding a higher risk premium. Behind this phenomenon is the market's scrutiny of tech giants' massive borrowing to support AI infrastructure development.

Osman Ali, Co-Head of Global Quantitative Investment Strategies at Goldman Sachs Asset Management, stated: “There should be winners in the (AI) space, but at the same time, it’s clear that some companies will not be able to compete in this new world.”

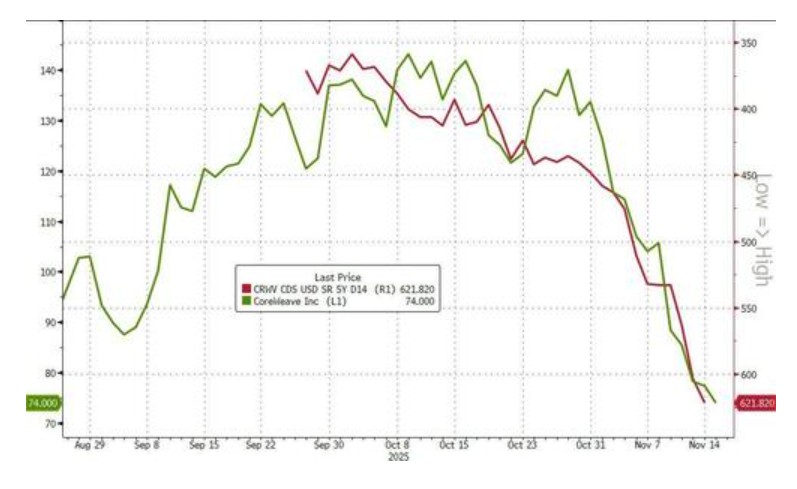

Concerns about the creditworthiness of AI-related companies are spreading. The credit default swap (CDS) spreads of "hyperscale computing companies," including Oracle and cloud service provider CoreWeave, continue to widen.

Among them, CoreWeave's spreads have surged significantly, while Oracle's spread trend is viewed by the market as an "ominous sign."

Bitcoin Forms "Death Cross," Gold Loses Safe-Haven Appeal

Outside of traditional risk assets, assets that should provide a hedge have also not been spared.

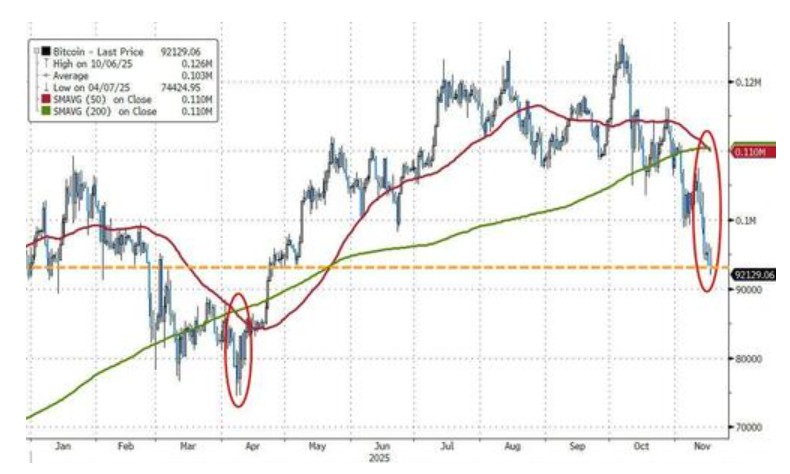

Bitcoin's price plummeted significantly on Monday, falling below the $92,000 mark, erasing all gains for 2025, and its 50-day moving average has crossed below the 200-day moving average, forming a "death cross" technical pattern. Notably, when Bitcoin triggered a death cross in April, it also set a new low for the phase.

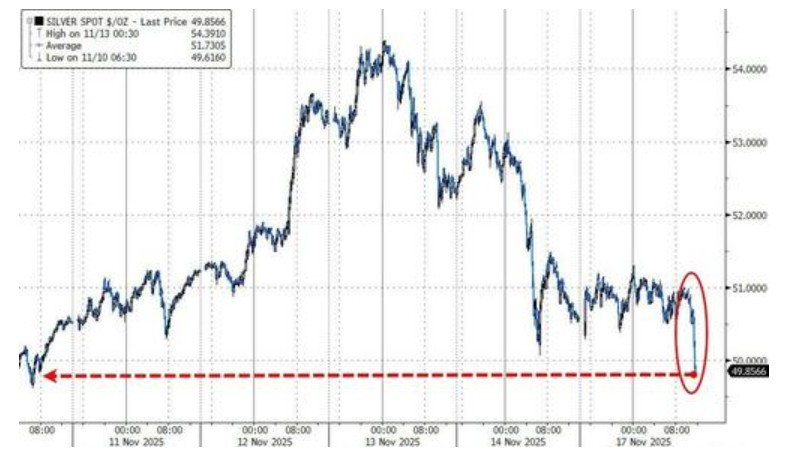

The stock price of cryptocurrency exchange Coinbase also fell sharply by 7.1%. Some market analysts pointed out that Bitcoin's initial decline in Monday's early trading may have acted as a leading indicator dragging down the overall stock market At the same time, gold has also lost its safe-haven aura. According to The Wall Street Journal, some analysts believe that gold's recent trading pattern resembles that of a speculative stock rather than a traditional safe asset. On Monday, spot gold prices fell to around the $4,000 level. Silver prices also plummeted, breaking below the critical $50 mark.

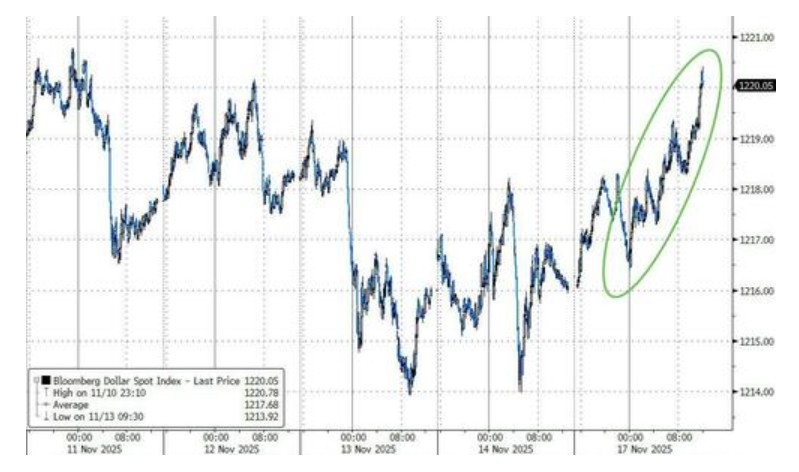

Against the backdrop of widespread declines in various assets, the US dollar index emerged as one of the few winners, recording a strong rebound.

Macroeconomic Fog Thickens, Investors Await Key Guidance

The current market's pessimistic sentiment is rooted in the high uncertainty surrounding the macroeconomy and monetary policy. On one hand, the Federal Reserve's policy path remains unclear. Traders have reduced their bets on a rate cut in December. Federal Reserve Vice Chairman Philip Jefferson stated on Monday that "we need to proceed slowly" regarding rate cuts, and his remarks did not provide clear direction for the market.

On the other hand, investors are facing complex economic data. According to data from the U.S. Department of Commerce, non-residential construction spending fell month-on-month in August, but data center construction was one of the few bright spots. Other data showed that New York State's manufacturing survey exceeded expectations, and overall construction spending unexpectedly surged, which in turn lowered market expectations for a Federal Reserve rate cut.

Additionally, concerns about the private credit market have also surfaced. Asset management company Blue Owl saw its stock price plummet due to restrictions on investor redemptions in its non-traded funds.

Notable investor Jeffrey Gundlach warned that the $1.7 trillion private credit market is creating "junk loans," comparing it to subprime mortgages before the 2008 financial crisis, stating that "the next major financial market crisis will come from private credit." These factors have intensified investors' cautious mindset as they await Nvidia's earnings report and key employment data