JP Morgan traders: "Liquidity pressure" is the main reason for the sharp decline in U.S. stocks in November

JP Morgan believes that despite the noise surrounding the artificial intelligence narrative, the core factor driving the stock market decline is the tightening liquidity, which has intensified the pressure on leveraged funds to liquidate positions due to limited cash acquisition capabilities. The market has now reached an index level where further declines could trigger "mechanical" selling, pushing the market down another notch. In the current environment, closely monitoring technical support levels and trigger points will be very important

Overnight U.S. stocks fell below key support levels, with the S&P 500 index dropping below the critical support level of 6725 points, and both the Nasdaq and S&P 500 failing to hold their 50-day moving averages, while the Dow experienced its worst three-day performance since April.

Marissa Gitler, a macro futures and options sales trader at JP Morgan, recently pointed out that pressure in the repurchase market is the main reason for the reversal in the stock market this month. Despite the noise surrounding the artificial intelligence narrative, liquidity tightening is the core factor driving the stock market decline, as the ability of leveraged funds to obtain cash is limited, leading to increased pressure to close positions.

The reopening of the U.S. government is seen as a key turning point to alleviate pressure in the repurchase market. Due to the combined effects of the government shutdown, the increase in the Treasury General Account (TGA), and quantitative tightening (QT), the U.S. Treasury had previously absorbed a large amount of capital, resulting in a deterioration in cash accessibility within the system. Although the government restart may not completely resolve the issue, it will help relieve liquidity pressure.

The market's technical situation remains critical. JP Morgan's tactical positioning monitoring indicators show that the market has not yet reached attractive "buy" setup conditions and is approaching index levels that may trigger systemic trader sell-offs, making the performance of technical support levels crucial.

Repurchase Market Tension Impacts Stock Market

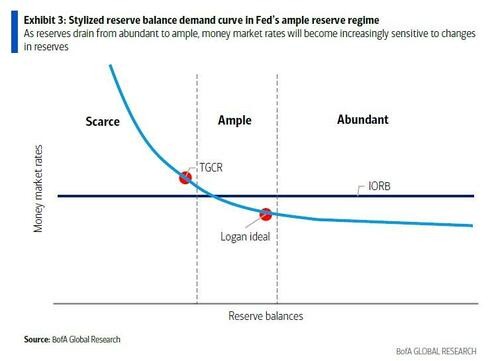

Gitler emphasized in her analysis that when the Secured Overnight Financing Rate (SOFR) is under pressure, the risk-bearing capacity of leveraged funds declines. The concepts discussed at the November 12th New York Fed meeting indicate that during the current pressure period, private sector repurchase rates have risen above the Interest on Reserve Balances (IORB). This suggests that the supply of reserves in the banking system is below recent total demand, intensifying competition for reserves.

This situation arises because financial institutions that do not qualify for IORB (such as money market funds and hedge funds) will raise rates in the repurchase market to attract cash. Gitler further pointed out that pressure on SOFR rates likely means that leveraged funds are receiving information from counterparty banks that they cannot obtain the same repurchase amounts as before.

The ability of leveraged funds to obtain cash through repurchase transactions is limited, which is a key tool for them to gain leverage. The lack of cash accessibility can lead to position liquidations, thereby suppressing investment velocity. After the financing pressure intensified at the end of October and the end of the quarter, the JP Morgan Beta Factor Index and highly concentrated AI-related stocks experienced declines, which is likely not a coincidence.

Liquidity Indicators Show Signs of Pressure Relief

JP Morgan believes that repurchases are the lifeline to ensure the normal operation of the US dollar money market. As SOFR falls relative to the federal funds rate, this is a positive signal indicating that the degree of liquidity scarcity is decreasing.

Functionally, the Effective Federal Funds Rate (EFFR) is the unsecured lending rate between banks, while SOFR is the secured rate between banks and funds. Generally, the secured rate should be lower than the unsecured rate. Although there is still pressure (otherwise SOFR would be below EFFR), the current downward trend of SOFR is a positive dynamic change.

As of last Friday, the Treasury's cash balance rose to $961.9 billion, an increase of $19 billion from the previous day. With the release of the TGA and the impending end of quantitative tightening, liquidity pressure in the system is expected to ease, allowing investors to refocus on investment rather than liquidity management.

The market still needs to cross technical thresholds

Despite signs of improvement in liquidity conditions, the risk landscape is not yet fully optimistic. JP Morgan's positioning intelligence team believes that the market has a way to go before triggering an attractive "buy" setup.

The bank's tactical positioning monitoring indicator is currently at the 65th percentile, with a four-week change of -0.8 standard deviations (while triggering an attractive setup requires -1.5 standard deviations). Meanwhile, the market is testing or approaching levels that could trigger systematic trader sell-offs.

The market has reached such an index level that if further declines occur, "mechanical" selling will push the market down another notch. Gitler summarizes that in the current environment, closely monitoring technical support levels and trigger points will be very important.