After a 36% drop, POP MART still receives strong support from Wall Street: Labubu will launch version 4.0 next year, and its value has not yet been fully realized

After a 36% pullback in stock price, POP MART still received a "Buy" rating reaffirmed by Citigroup, with a target price indicating an upside potential of 91.8%. The bank pointed out that the company's core IP Labubu has not yet fully realized its value—its version 4.0 is confirmed to be launched in 2026, and Sony Pictures has obtained the film adaptation rights for this IP. Additionally, the diverse IP matrix such as SKULLPANDA and progress in overseas expansion together constitute growth momentum

For investors focusing on the consumer sector, the latest developments from POP MART are worth paying close attention to. Citigroup pointed out that the market's concerns about the sustainability of POP MART's growth and the risks associated with a single IP are overstated, and the company's core value lies in its unparalleled IP incubation and operational capabilities.

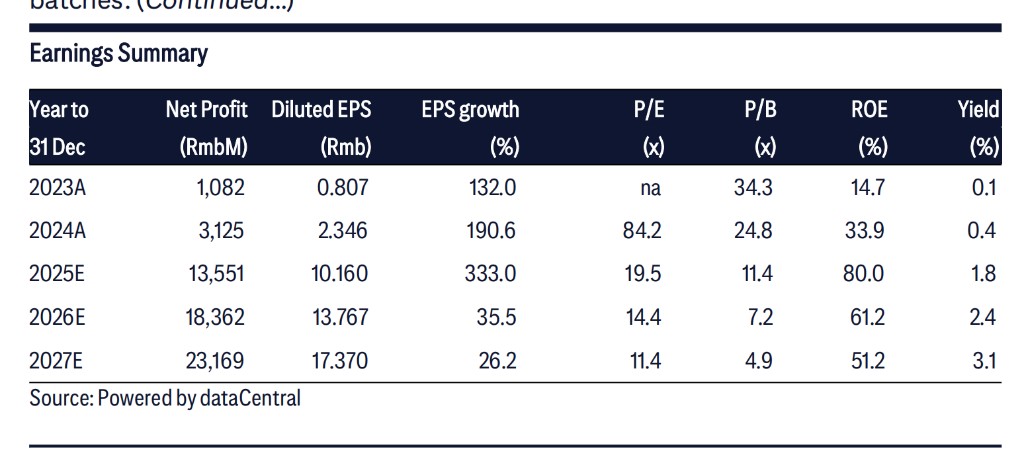

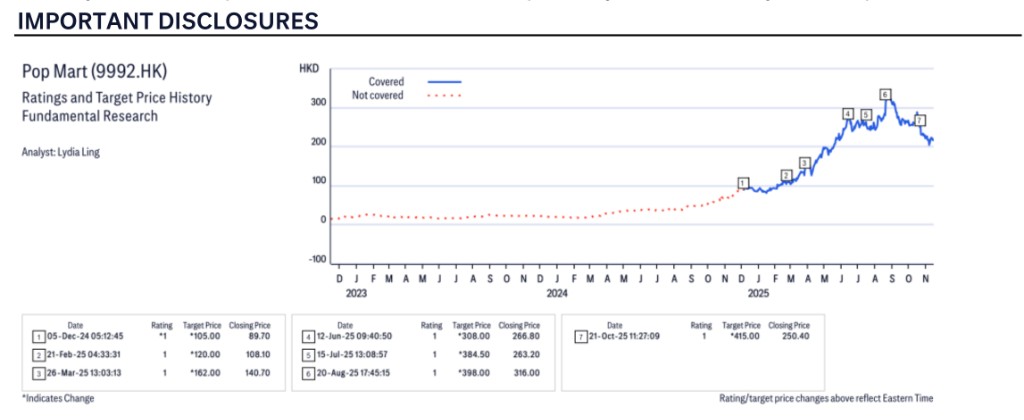

Despite the recent pullback in POP MART's stock price, according to Wind Trading Desk, on November 16, Citigroup reiterated its "Buy" rating for POP MART in a research report, setting a target price of up to HKD 415.00, representing a potential upside of 91.8% compared to the closing price of HKD 216.40 on November 14.

Specifically, the impact on investors is mainly reflected in the following points:

Strong vitality of flagship IP: The value of the core IP Labubu has not yet been fully realized, with the release of its 4.0 version postponed to 2026. There are also rumors that Sony Pictures has acquired the film adaptation rights, which may further open up the IP ceiling.

Diversification of growth engines: The company is actively adjusting the scale of online pre-sales to achieve sustainable operation of its IP, rather than experiencing a slowdown in growth. In addition to Labubu, a matrix of leading IPs such as SKULLPANDA and CRYBABY has formed, effectively diversifying risks.

Globalization progress exceeds expectations: The overseas markets, especially the United States and Japan, are performing strongly. The company is accelerating its global store layout and channel deepening through optimized operations and localization strategies.

Attractive valuation: At the current stock price level, the risk-reward ratio is highly attractive. With the upcoming sales peak season, stock price momentum is expected to rebound.

The value of Labubu has not yet been released, and Sony Pictures may bring it to the big screen

The report first dispelled market doubts about the vitality of the flagship IP Labubu, clearly stating that its value "has not yet been fully released."

Citigroup revealed that POP MART has developed a series of plans to maintain the popularity of this IP. A key piece of information is that the originally planned release of the Labubu 4.0 version in 2025 has been postponed to 2026 due to the need to prioritize capacity allocation to meet the huge demand for Labubu 3.0. This indirectly confirms the current product's popularity.

In addition, the company plans to launch more new products and designs in 2026 and enrich its content ecosystem by introducing more members of the Labubu family. A highly imaginative catalyst is that, according to a report by Forbes on November 14, Sony Pictures has obtained the film adaptation rights for Labubu and plans to develop a feature film Citi expects that this move will greatly enhance Labubu's IP recognition globally and open up new space for long-term commercialization value.

Skepticism about sustainable growth is excessive, diversified IP matrix takes shape

In response to market concerns about the slowdown in Bubble Mart's quarterly growth momentum and reliance on a single IP, the report considers this to be "excessive worry." The report explains that the company actively controlled the scale of online pre-sales in the fourth quarter of 2025, aiming for the "sustainability" of IP operations. This may partially offset seasonal sales strength, but it is a strategic adjustment rather than weak demand. Citi expects sales momentum to rebound in the important months of November and December.

In terms of diversifying IP risks, Bubble Mart has achieved significant results. The report emphasizes that, in addition to Labubu, other iconic IPs such as SKULLPANDA, CRYBABY, TWINKLE TWINKLE, HIRONO, etc., are also emerging as new growth drivers. The company continues to incubate top IPs based on its integrated IP ecosystem, with each IP having its unique growth timeline.

However, the report also pragmatically points out that the current key challenge lies in how to address quality control issues arising from rapid scale increases and to avoid similar live-streaming incidents that could damage brand assets. The company is working to improve product quality by optimizing operational processes, hiring more professionals, and frequently collecting market feedback.

Strong momentum in overseas expansion, globalization operations continue to deepen

Globalization is the key story for Bubble Mart's future growth. The report notes that the company has strong momentum in overseas expansion, especially achieving robust growth in the U.S. market by 2025, prompting the company to transform operations in marketing, store operations, and recruitment, and has replaced the logistics head for the U.S. market.

Specific store expansion plans include:

United States: Plans to operate over 60 stores by the end of 2025 (currently over 50), while raising store opening standards, such as requiring larger store areas.

Canada: Plans to open several stores by the end of 2025.

Latin America: Has entered the Mexican market through Amazon and plans to open physical stores in Mexico in 2026, with future expansion to Argentina and Brazil.

Middle East: The newly opened store at Doha Airport marks the official entry into the Middle East market, with plans to open more stores in 2026.

Japan Market: Performed excellently in 2025, becoming one of the top three markets in the Asia-Pacific region.

To support globalization, the company insists on localized operations, including localized IP collaborations, designs, and discovering local artists to create new IPs.

Supply chain and product innovation: flexible strategies and forward-looking layout

To respond to the rapid growth in demand, Bubble Mart is optimizing its supply chain strategy. The current strategy deployed by the company is to produce 70% of the expected sales for the first batch, and then flexibly replenish inventory based on market dynamics With the accumulation of experience and online data, the accuracy of sales forecasts is expected to improve.

In terms of overseas supply chains, to cope with the uncertainty of U.S. tariffs in April, the company has accelerated its overseas supply chain expansion, with 10-20% of blind box production capacity now in Vietnam. At the same time, the company plans to establish more local warehouses for overseas markets by 2026. In terms of product innovation, POP MART has set up a raw material research and development center in Dongguan, aimed at providing creative inspiration for artists, demonstrating its long-term commitment to product innovation.

Valuation and Risks: Attractiveness Under High Growth Expectations

Citi has set a target price of HKD 415.00 for POP MART, based on 28 times the expected P/E ratio for 2026. The report believes that given the company's continuously improving growth prospects and execution capabilities, it should receive a premium of 10% above the 4-year historical average P/E. Although its valuation is higher than global peers, Citi believes this is reasonable, as POP MART's overseas expansion brings faster growth rates.

The report also clearly points out potential downside risks, including: 1) intensified competition in the Chinese toy market; 2) global expansion falling short of expectations; 3) insufficient IP commercialization capabilities; 4) failure to renew licenses; 5) stricter regulatory policies. Although Citi's quantitative system rates the stock as "high risk," analysts believe that considering qualitative factors such as the company's execution capabilities and growth status, this rating is unnecessary.