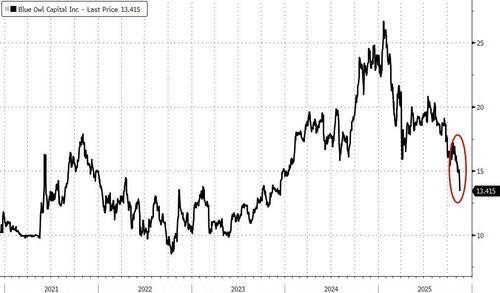

After the "redemption restriction," the popular private equity firm Blue Owl's stock price plummeted, returning to 2023 levels

Alternative asset management giant Blue Owl Capital's stock price plummeted 6%, hitting a new low for the year, due to the suspension of redemptions for its $1.8 billion private fund. The company plans to merge the private fund with a publicly listed entity, but investors will face a 20% paper loss. So far this year, concerns over asset quality, manager selection, and declining profit potential after interest rate cuts have led to a roughly 22% drop in the stock price of Blue Owl's publicly listed fund OBDC

Alternative asset management giant Blue Owl Capital's stock price plummeted to a new low for the year after announcing restrictions on investor redemptions from its funds, adding a new footnote to the already turbulent private credit market.

On Monday, shares of alternative asset management company Blue Owl Capital fell nearly 6%, marking the lowest level since December 2023.

The direct trigger for this round of sell-off was the company's decision to suspend redemptions for one of its private funds, locking investors' capital until next year.

Blue Owl announced this month plans to merge its $1.8 billion private fund, Blue Owl Capital Corporation II (BDC), with its publicly traded entity, Blue Owl Capital Corp. (referred to as OBDC), which has a market size of $17.6 billion.

According to regulatory filings, redemption requests for the private fund surged last month, exceeding the quarterly redemption limit set by Blue Owl.

Ultimately, the company only fulfilled about $60 million in redemption requests, accounting for 6% of the fund's size. Faced with ongoing redemption pressure, merging and suspending redemptions became the company's chosen solution.

Worse still, investors in the private fund will exchange their original shares for OBDC stock. At current prices, due to OBDC's stock trading at a discount of up to 20% to the fund's net asset value, investors may face corresponding paper losses.

Blue Owl's Defense: Technical Pressure, Not Fundamental Issues

In response to the market's negative reaction, Blue Owl defended itself in a regulatory filing submitted on Monday.

The company stated that the proposed merger "provides the strongest long-term results for shareholders by expanding scale, improving financing efficiency, and enhancing returns," emphasizing that the transaction will "provide sufficient liquidity" for investors in the private fund at the time of closing.

Blue Owl also pointed out that investors in the private fund will benefit from OBDC's higher dividend yield in the future. The filing indicated that over the past year, the monthly dividend for the private fund was $0.06 per share, while OBDC's recent quarterly dividend was $0.37 per share.

The company attributed the recent volatility in the non-public business development company sector to "technical market pressures rather than portfolio fundamentals," insisting that its portfolio "remains strong."

To understand Blue Owl's current predicament, one must first understand Business Development Companies (BDC).

BDC is an investment company regulated under U.S. law that primarily provides loans or equity investments to small and medium-sized private enterprises, functioning similarly to an "investment company focused on small and medium-sized enterprise credit." BDCs are mainly divided into two types:

One type is publicly traded BDCs like OBDC that are traded on exchanges, allowing investors to trade freely like stocks, with better liquidity;

The other type is over-the-counter fund BDCs like Blue Owl Capital Corporation II, where investors can only exit by applying for redemption from the fund manager, resulting in limited liquidity.

Blue Owl's merger plan essentially attempts to transfer the illiquid over-the-counter fund BDCs into publicly traded BDCs with market liquidity.

However, the problem is that the market is generally concerned that interest rate cuts will compress their loan yields, while an economic slowdown may increase the default risk of small and medium-sized enterprises, leading to a deterioration in asset quality. This has caused the stock price of OBDC under Blue Owl to drop about 22% year-to-date.

"New Bond King" Warns: Private Credit Market May Be the Source of the "Next Crisis"

Blue Owl's predicament perfectly corroborates the latest warning from Jeffrey Gundlach, founder of DoubleLine Capital and the "New Bond King," regarding the risks in the private credit market.

In a recent media podcast, Gundlach bluntly stated that the $1.7 trillion private credit market is engaging in "junk lending," with speculative behavior comparable to the period just before the 2006 subprime mortgage crisis, and it could trigger the next round of collapse in global markets.

As a seasoned bond investor, Gundlach is particularly concerned about the expansion of private credit funds to retail investors, claiming it creates a "perfect mismatch" between liquidity promises and illiquid assets. He predicts:

The next major crisis in the financial markets will come from private credit, which has characteristics similar to the repackaging of subprime mortgage loans in 2006.

Gundlach's concerns are not unfounded.

Recently, BlackRock directly wrote down the loan value it provided to home improvement company Renovo Home Partners to zero from its face value, while the bankruptcies of auto loan company Tricolor Holdings and auto parts supplier First Brands Group provide new evidence of the risk accumulation in the private credit market.

JP Morgan CEO Jamie Dimon also stated last month that there is never just one "cockroach," and when the economy turns, the pain may be worse than ever. Gundlach summarized:

Private credit has only two prices—100 or 0