The Japanese yen and Japanese government bonds hit new lows, raising market concerns about "debt risk," with Takashi Sato feeling "immense pressure."

The Japanese yen fell to 155.37 against the US dollar, hitting a new low since January; the 10-year Japanese government bond yield rose to 1.754%, the highest since June 2008. The market is concerned that the large-scale economic stimulus plan soon to be launched by Prime Minister Kishida Fumio will exacerbate Japan's heavy debt burden and may force the Bank of Japan to delay interest rate hikes. The market is closely watching the meeting between Prime Minister Kishida and Bank of Japan Governor Ueda Kazuo this afternoon

Concerns over Japan's fiscal discipline are causing ripples in the financial markets, putting pressure on both the yen and Japanese government bonds.

On Tuesday, November 18, the yen fell to 155.37 against the dollar, hitting a new low since January; the exchange rate against the euro also dropped below 180, marking the weakest level since the euro's inception in 1999.

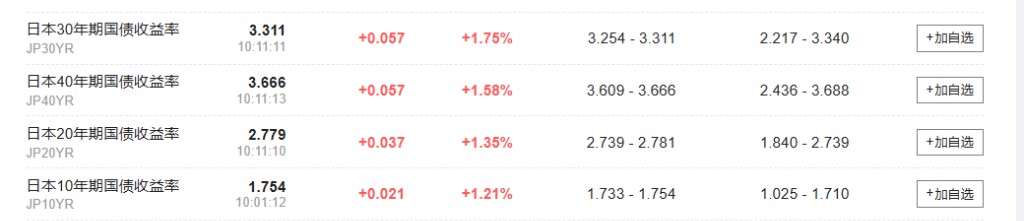

Meanwhile, the Japanese government bond market is facing a sell-off, with the yield on 10-year government bonds rising to 1.754%, the highest level since June 2008, while the yield on 20-year government bonds reached a high not seen since 1999 on Monday.

Behind the market turmoil, is the growing speculation that the government of Prime Minister Fumio Kishida is about to launch a large-scale economic stimulus plan, which will exacerbate Japan's already heavy debt burden and may lead the Bank of Japan to delay interest rate hikes. Investors are closely watching the meeting scheduled for 3:30 PM Tokyo time between Prime Minister Kishida and Bank of Japan Governor Kazuo Ueda for clues about future policy directions.

As the yen fell below the key psychological level of 155, Finance Minister Shunichi Suzuki intensified verbal warnings, stating that he is closely monitoring the market for "one-sided and rapid fluctuations," raising market sensitivity to intervention risks.

Expectations for Fiscal Stimulus Rise, Debt Concerns Weigh on Bond Market

Concerns about Japan's government debt levels are increasingly intensifying, directly reflected in the decline of bond prices. According to a Bloomberg survey, the new spending in the economic measures to be announced by Prime Minister Kishida's government is expected to exceed last year's 13.9 trillion yen. Additionally, local media reported that some members of the ruling Liberal Democratic Party even advocated expanding the stimulus plan to about 25 trillion yen on Monday.

To cover the massive spending, the government may need to issue new debt, which will place greater pressure on this economy, which has the heaviest public debt burden among developed countries. Fawad Razaqzada, a global macro market analyst at FOREX.com, stated that the Japanese government is preparing for large-scale fiscal stimulus while opposing the normalization of the Bank of Japan's monetary policy.

"The market is concerned that the government is mismanaging the economy, thus demanding higher yields when holding Japanese debt, which they perceive as riskier than before."

This sentiment of concern may also affect the demand for the 20-year government bond auction on Wednesday. On November 19, the Japanese Ministry of Finance will auction 800 billion yen of 20-year government bonds.

Weak Economic Data Leaves Kishida in a Dilemma

The justification for the large-scale stimulus plan comes from the latest weak economic data released in Japan. A government report showed that Japan's economy contracted at an annual rate of 1.8% during the summer, marking the first decline in six quarters. Finance Minister Shunichi Suzuki also stated that although consumption and investment increased quarter-on-quarter, exports fell due to U.S. tariffs, "there is clearly enough reason to formulate economic measures." However, this has put Kishi Maki, a supporter of loose monetary policy, in a dilemma. On one hand, weak economic data supports her proposal for a massive spending plan; on the other hand, a large plan reliant on bond issuance, combined with market expectations of the central bank delaying interest rate hikes, is collectively suppressing the yen. The depreciation of the yen will raise the cost of imported goods, which contradicts her efforts to alleviate inflationary pain through cuts in gasoline taxes and utility subsidies.

Kishi Maki's Meeting with Ueda Kazuo Approaches, Interest Rate Path Remains a Mystery

Amid market turmoil, the meeting between Kishi Maki and Ueda Kazuo has become the focus of attention. As a proponent of loose monetary policy, Kishi Maki has hinted that she supports a gradual interest rate hike by the Bank of Japan, which traders see as a "green light" for shorting the yen.

However, the weak yen has raised import costs, hindering her efforts to mitigate the impact of inflation on households. Any statements made by the two after this meeting will be closely scrutinized by the market for clues regarding the timing of the next interest rate hike—most economists predict it will not be later than January next year.

Tsuyoshi Ueno, chief economist at NLI Research Institute, stated, "Kishi Maki must be careful; if she directly calls for a temporary freeze on interest rate hikes, it will easily push the yen past the 160 mark." He predicts that Kishi Maki may subtly suggest her opposition to premature rate hikes, while Ueda Kazuo will reaffirm the central bank's stance on rate hikes.

"Verbal Intervention" Escalates, External Pressure Emerges

In the face of the yen's continued depreciation, the Japanese Ministry of Finance's "verbal intervention" is escalating. Finance Minister Kato Satsuki stated to reporters on Tuesday that she has observed "extreme one-sided and rapid fluctuations in the foreign exchange market" and is "deeply concerned" about this. This has increased speculation in the market that the Ministry of Finance may directly intervene in the market to support the yen.

In addition to internal pressures, Kishi Maki's government is also facing rare external pressure. U.S. Treasury Secretary Janet Yellen urged Kishi Maki's government last month to give the Bank of Japan room to adjust its policies in response to inflation, which is seen as an unusually strong statement from a U.S. Treasury official.

History seems to be repeating itself. Last July, the yen fell to 161.95 against the dollar, the lowest level since 1986, prompting the Japanese government to intervene in the market. A few weeks later, the Bank of Japan unexpectedly raised interest rates, triggering turmoil in global financial markets