UBS is optimistic about the continued rise of the Chinese stock market next year, with strategies focusing on "going overseas," "anti-involution," and "global AI stock corrections" as the main risks

UBS released a research report predicting that the Chinese stock market will continue its positive momentum in 2026, with a target of 100 points for the MSCI China Index and 23,000 points for the Hang Seng Index. The market drivers will shift towards improving corporate profitability. The strategy has been adjusted to increase holdings in "going overseas" concept stocks, focusing on the internet, technology hardware, and brokerage sectors. The global AI stock pullback is a major risk, but Chinese AI stocks have more attractive valuations. Profit growth will become the main driving force for the market's rise

After recording strong performance in 2025, can the Chinese stock market "leap again" in 2026?

According to news from the Chase Trading Desk, on November 17, UBS released its latest research report titled "2026 China Equity Strategy Outlook: A Leap Again?" which believes that the Chinese market is expected to continue the positive momentum of 2025 next year.

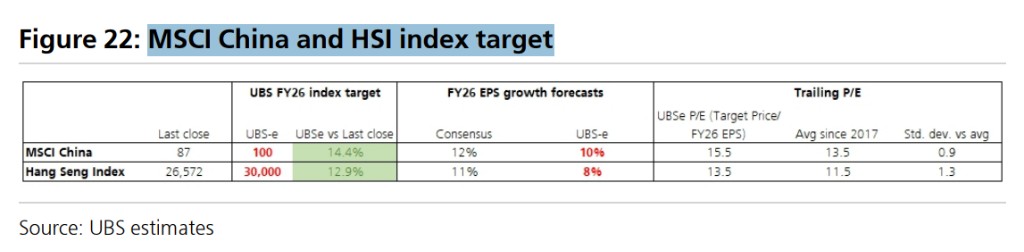

The bank predicts that the MSCI China Index will reach 100 points by the end of 2026, representing a potential increase of about 14% from the closing price at the time of the report's release. At the same time, the target for the Hang Seng Index is set at 23,000 points, with a potential increase of about 13%.

The report points out that the market drivers in 2026 will differ from those in 2025. While positive factors such as AI innovation, a loose policy environment, improved global economic growth, and capital inflows from domestic and foreign investors will continue, their impact on valuation multiples may not be as strong as this year. The market's focus will shift to substantial improvements in corporate profitability.

On the strategic front, UBS has made significant adjustments. The report states that due to the compression of high-dividend stock yields, the bank is removing such stocks from its recommended portfolio and instead increasing holdings in certain "outbound" concept stocks. These companies have "demonstrated resilience in profits and earnings amid this year's tariff uncertainties." At the same time, UBS remains optimistic about the internet, technology hardware, and brokerage sectors.

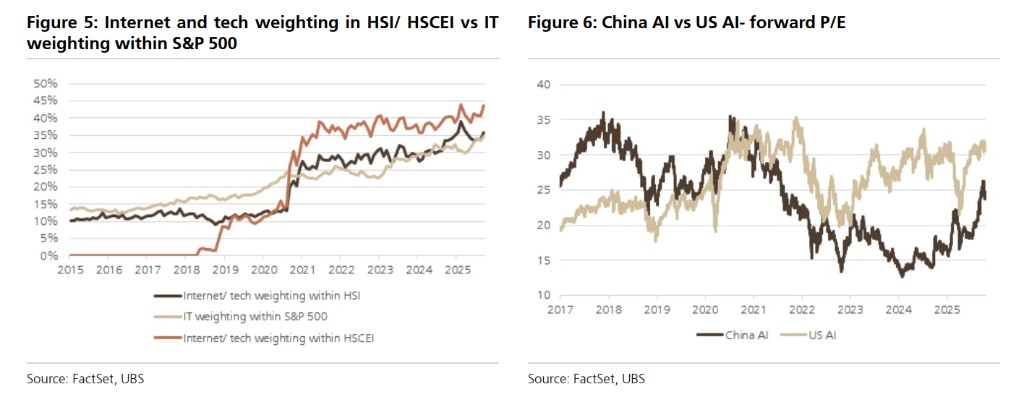

Despite the optimistic outlook, UBS also clearly points out the main risks. The report emphasizes that "the global pullback in AI-related stocks" is a major factor that could weigh on Chinese tech stocks. However, analysts believe that given the lower correlation of Chinese AI stocks with global peers and their more attractive valuations, the potential impact may be mitigated.

Profit Growth as the Key Engine, UBS Predicts 14% Increase in MSCI China

UBS's optimistic view on the Chinese stock market in 2026 is based on the core logic that profit growth will replace valuation repair as the main driving force for market increases. The bank's target of 100 points for the MSCI China Index is based on "a projected price-to-earnings ratio of 15.5 times for the fiscal year 2026 and a 10% profit growth."

This prediction is based on a series of core assumptions. First, on the earnings front, UBS expects the revenue of MSCI China Index constituents to grow by 5% in 2026, which is generally consistent with the bank's forecast for nominal GDP growth; while earnings per share (EPS) growth is expected to reach 10%. This 10% growth comes not only from profit recovery due to "de-involution" but also from a decrease in depreciation and amortization expenses resulting from reduced corporate capital expenditures. UBS estimates that the latter alone could provide about a 1 percentage point boost to the EPS of MSCI China Secondly, in terms of valuation, UBS expects a 4% valuation uplift in the market. The impetus for this revaluation mainly comes from three sources of capital inflow: domestic institutional investors, retail investors seeking higher returns due to the low interest rate environment, and overseas institutional investors looking for diversification and relatively cheap assets.

The report believes that several positive factors in the current Chinese market will continue to support the market in 2026, including:

- Innovation: Especially in the field of artificial intelligence (AI), China is one of the few markets outside the United States that can provide a wide range of AI investment opportunities.

- Loose policies: Supportive policies for enterprises and capital markets will continue.

- Ample liquidity: Ongoing fiscal expansion and a loose monetary policy environment. UBS expects global economic growth to accelerate to 3.1% in 2026, while the Federal Reserve will cut interest rates by 50 basis points, and the People's Bank of China may also cut rates by 20 basis points, creating a favorable environment.

- Potential capital inflow: Inflows from domestic and foreign institutional investors.

UBS expects listed companies' revenue to grow by 5% in 2026, which is basically in line with the bank's forecast for nominal GDP growth.

"Anti-involution" as the Key to Profitability

Among the many driving factors, UBS particularly emphasizes the boosting effect of "anti-involution" on corporate profitability. The report points out that despite challenges in the macro economy, "anti-involution" measures aimed at alleviating disorderly price competition in industries are becoming key factors in improving corporate profit prospects.

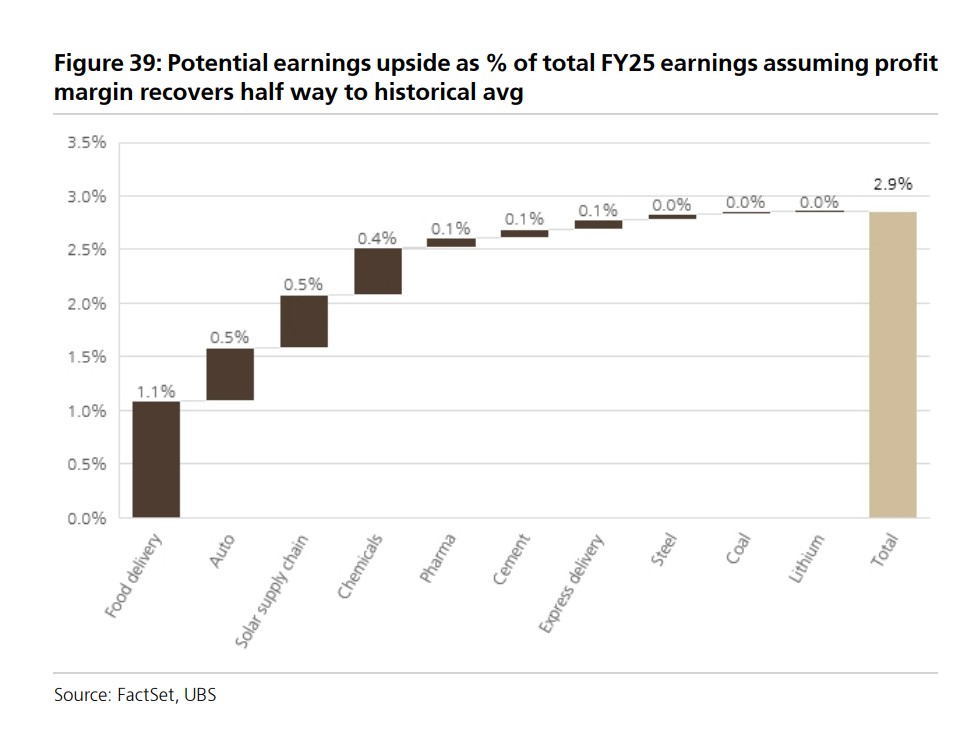

The report observes that there are already "early signs" of industry price recovery in sectors such as solar energy, lithium batteries, express delivery, and aviation. UBS's quantitative analysis suggests that if the profit margins of these "involution"-related industries can recover to half of their historical average levels, it could bring a "3 percentage point boost" to the overall earnings per share of MSCI China.

The report believes that as more "anti-involution" related policy guidance is introduced in the next 1-2 years, the normalization of profit margins and valuation increases in related industries will lead to upward-biased returns.

"Going Abroad" as a New Focus

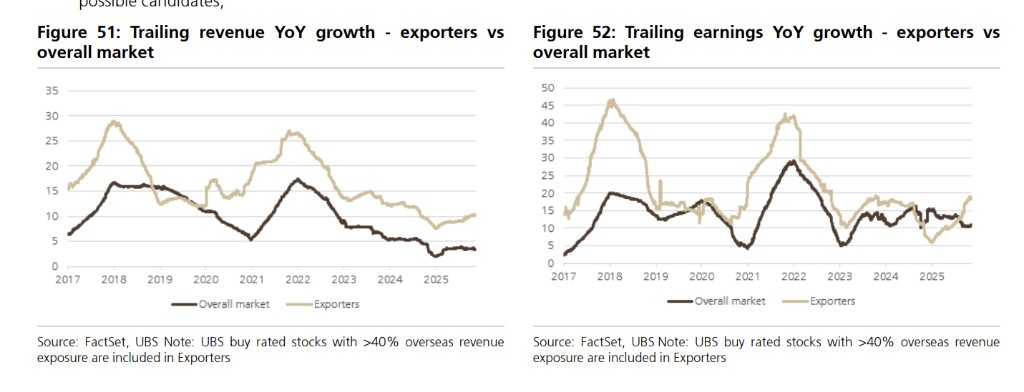

While the bank is optimistic about sectors such as solar energy that benefit from "anti-involution" and global energy transition demands, it emphasizes the need to pay attention to certain "going abroad" stocks that still show resilience in profits and earnings under tariff uncertainties, especially those high-quality exporters with overseas revenue accounting for more than 40%.

The reason is that the yields of many high-dividend stocks have been compressed after several years of increases, for example, "it is no longer possible to find financial stocks that can provide a 6% or higher dividend yield."

In contrast, some high-quality exporters are expected to see "revenue and earnings growth accelerate in 2025, exceeding the overall market level." The report **anticipates that global economic growth will accelerate in 2026, which also provides a favorable macro backdrop for the "going abroad" strategy **

Tech stocks remain favored, but beware of global AI pullback risks

The technology and internet sectors continue to be favored by UBS for 2026. The report states that China is "one of the few markets outside the United States that can offer such a wide range of investment opportunities," making it attractive to global investors seeking diversification. Additionally, Chinese AI stocks still have a valuation discount compared to their American counterparts.

Regarding the choice between A-shares and H-shares, UBS indicated no strong preference but pointed out the different drivers for both: H-shares are seen as the "highest quality and cheapest" channel for positioning in China's AI platforms and applications, benefiting from foreign investment and southbound capital inflows; while A-shares may gain more liquidity from retail capital inflows, and their earnings may benefit more from "de-involution."

However, the report lists "the pullback of global AI-related stocks" as a major downside risk for the Chinese market. UBS analyzes that the market rebound since early 2025 has been primarily driven by AI themes and innovation, and a weakening of global AI investment sentiment could lead to a valuation adjustment in the Chinese market.

Nevertheless, UBS also proposed three major buffering factors:

- Chinese AI stocks have "lower correlation with global tech stocks like those in the U.S. than with other emerging markets like South Korea."

- The "domestic substitution process in the tech sector is unlikely to be hindered by any global tech slowdown."

- "The valuations of Chinese tech stocks are still lower than their global peers."

The report also points out through scenario analysis that in the worst-case "AI bust" scenario, market valuations could return to levels seen before the AI boom in early 2025.

The above exciting content comes from the Wind Trading Platform.

For more detailed interpretations, including real-time analysis and frontline research, please join the【Wind Trading Platform ▪ Annual Membership】

Risk warning and disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account individual users' specific investment objectives, financial conditions, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk