Global risk sentiment deteriorates: Japan's stocks, bonds, and currency all suffer losses, Nasdaq futures drop 1%, Bitcoin falls below the $90,000 mark, and gold prices continue to decline

This round of selling reflects investors' ongoing concerns about interest rate prospects and the valuations of technology stocks. Nvidia will announce its earnings report on Wednesday, and the market will use this to assess whether the high valuations in the artificial intelligence sector are justified. The September employment report, released on Thursday, will provide important clues for the direction of Federal Reserve policy

Global markets experienced widespread selling on Tuesday, with U.S. stock futures continuing to decline and cryptocurrencies remaining under pressure as investors significantly withdrew from risk assets ahead of key events such as Nvidia's earnings report and U.S. employment data, amid ongoing concerns about interest rate prospects and technology stock valuations. In the Asia-Pacific markets, Japan faced a triple whammy of falling stocks, bonds, and currency, with heightened worries about government spending, alongside a sell-off in tech stocks and geopolitical factors dragging down the Japanese market.

Core market trends:

Nasdaq 100 futures fell by 1%, Dow futures dropped by 0.5%, and S&P 500 futures declined by 0.7%;

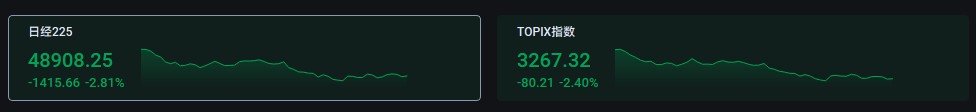

The Nikkei 225 index fell more than 3% at one point, while the Tokyo Stock Exchange's TOPIX index dropped by 2.4%;

The MSCI Asia-Pacific index fell by 2% to 221.28 points, breaking below the 50-day moving average for the first time since April;

The Seoul Composite Index in South Korea fell by more than 3%;

Spot gold fell to the $4,000 mark, hitting a low of $4,005.03; spot silver dropped by more than 1%;

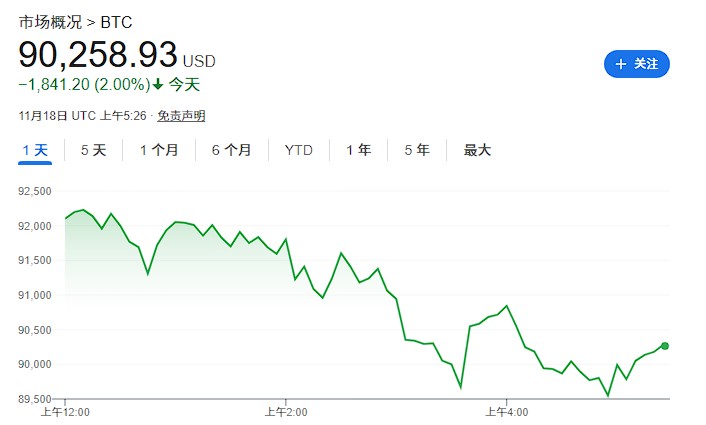

Bitcoin fell below the $90,000 mark again, while Ethereum dropped below $3,000.

In the Asia-Pacific market, Japan faced a triple whammy of falling stocks, bonds, and currency: both the Nikkei 225 index and the TOPIX index fell by more than 2%.

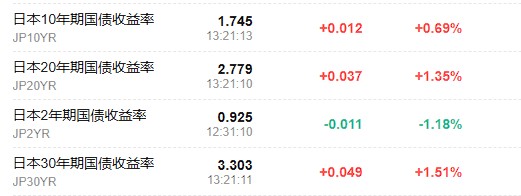

At the same time, the yen and Japanese bonds also fell: the yen against the dollar dropped to 155.37, a new low since January; the exchange rate against the euro fell below 180, the weakest level since the euro's inception in 1999. Yields on Japan's 10-year, 20-year, and 30-year government bonds all rose, with the 10-year yield climbing to 1.754%, the highest level since June 2008.

Invesco's global market strategist Tomo Kinoshita stated that concerns over government spending and the decline in tech stocks are interwoven, leading to a triple whammy in Japan's stock, bond, and currency markets. Kinoshita noted that escalating geopolitical risks and worries about the new government's economic stimulus plan could undermine foreign investor confidence. In recent months, foreign investors have been the main force driving the rise of the Japanese stock market, and if their buying falters, it could also dampen domestic investors' confidence, exacerbating the stock market decline.

According to an article from Wall Street Insight, the turmoil in Japan's stock, bond, and currency markets is increasingly speculated to be linked to the impending announcement of a large-scale economic stimulus plan by the government of Prime Minister Fumio Kishida, which could exacerbate Japan's already heavy debt burden and potentially delay interest rate hikes by the Bank of Japan. Investors are closely watching the meeting scheduled for 3:30 PM Tokyo time between Prime Minister Kishida and Bank of Japan Governor Kazuo Ueda for clues on future policy directions. Analysts point out that this round of selling reflects investors' ongoing concerns about interest rate prospects and technology stock valuations. Nvidia will announce its earnings on Wednesday, and the market will use this to test whether the high valuations in the artificial intelligence sector are justified. The September employment report, released on Thursday, will provide important clues for the Federal Reserve's policy direction.

Hebe Chen, an analyst at Vantage Markets, stated: "This is the kind of broad and anxious sell-off that erupts when visibility collapses. From Bitcoin to soaring tech stocks, the rapid withdrawal from risk assets reflects a defensive instinct against the 'unknown unknowns,' and volatility will remain the norm until visibility improves."

The divergence of views among Federal Reserve officials has intensified market concerns. Federal Reserve Vice Chairman Philip Jefferson believes the labor market faces downside risks but warns that policymakers need to proceed with caution. Federal Reserve Governor Christopher Waller supports a rate cut in December, citing weak employment data.

Traders are currently pricing in about a 40% probability of a rate cut by the Federal Reserve next month. Pepperstone Group strategist Dilin Wu wrote in a research report: "Federal Reserve officials continue to express concerns about stubborn inflation, emphasizing that the current information vacuum makes it difficult to assess the true momentum of the economy."

13:15

U.S. stock futures continue to decline, with Dow futures down 0.3%, Nasdaq 100 futures down 0.6%, and S&P 500 futures down 0.5%.

Analysts warn that technical indicators suggest U.S. stocks may face at least a 10% correction risk. The S&P 500 index has fallen 3.2% since reaching a record high on October 28 and has broken below the 50-day moving average for the first time in 139 trading days.

John Roque, head of technical analysis at 22V Research, pointed out that the Nasdaq Composite Index is sending "ugly" signals. Among the approximately 3,300 constituent stocks of the index, the number of stocks hitting 52-week lows exceeds those hitting new highs, indicating internal weakness in the market and limited potential for further gains.

Bitcoin has fallen below $90,000, hitting a seven-month low, deepening a month-long decline. This drop has erased all gains for Bitcoin in 2025, severely impacting the sentiment in the entire digital asset market. Ethereum is down 0.9% to $2,978.73.

Homin Lee, senior macro strategist at Lombard Odier, stated that volatility in the cryptocurrency space is spreading to other risk assets, and the market's recalibration of the probability of a Federal Reserve rate cut in December has also intensified the tension. "This tension will persist until the September employment report provides more clarity. Weak labor market data or Nvidia's earnings significantly exceeding expectations could help." "