In just six weeks, the cryptocurrency market has "evaporated" $1.2 trillion

The current round of sell-off began due to concerns over the overvaluation of technology stocks and the direction of U.S. interest rate policy. Data provider CoinGecko reported that the total market capitalization of over 18,000 cryptocurrencies fell by 25% during this period. High-risk small-cap tokens bore the brunt of the impact. Analysts warn that under the prevailing gloomy sentiment, Bitcoin at $75,000 may not be far off

The cryptocurrency market is undergoing a severe adjustment, with a total market value plummeting by more than $1.2 trillion over the past six weeks.

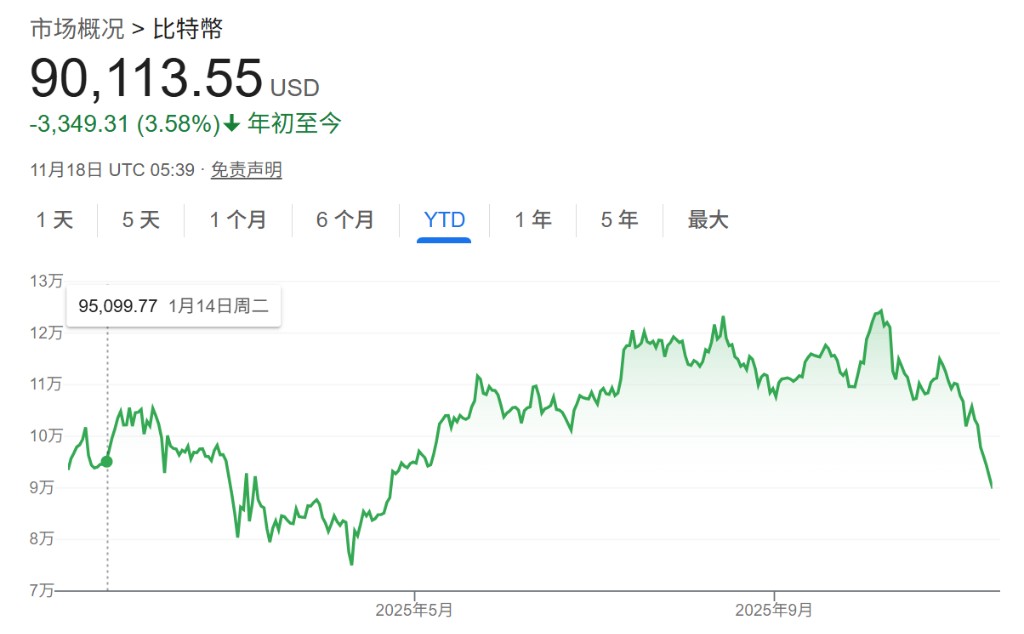

This round of selling began due to concerns over the overvaluation of tech stocks and the direction of U.S. interest rate policy. The price of Bitcoin has fallen more than 28% from its peak on October 6, reaching its lowest level since April, completely erasing its gains for the year. According to data provider CoinGecko, the total market value of over 18,000 digital currencies has decreased by 25% during this period.

New doubts about whether the Federal Reserve will cut interest rates in December have intensified market concerns. Lower interest rates typically enhance the appeal of cryptocurrencies and other risk assets, as they reduce the returns for investors holding short-term U.S. government bonds.

Matthew Dibb, Chief Investment Officer of Astronaut Capital, warned that under the current gloomy sentiment, $75,000 for Bitcoin may not be far off:

The sentiment in the cryptocurrency market is quite bleak, and it has been so since the leverage ratio plummeted in October.

The next support level is $75,000, and if market volatility remains high, it could reach that price point.

Leverage Liquidation Triggers Chain Reaction

The market crash on October 10 became a turning point for this round of decline. According to trading platform Coinbase, $20 billion in cryptocurrency leverage positions were liquidated that day, marking the largest single-day liquidation on record.

Ryan Rasmussen, Head of Research at Bitwise Asset Management, stated:

Cryptocurrency investors love leverage;

We see traders taking excessive risks time and again, believing this time will be different.

David Namdar, CEO of CEA Industries, described the current market conditions as "the continuing aftershocks of the October liquidation event":

This round of selling is different in scale because the positions are larger, the leverage is deeper, and the liquidation takes longer.

Small Coins Hit Hard

Higher-risk small-cap tokens have borne the brunt of the impact.

The MarketVector Digital Assets 100 Small Cap Index has fallen to its lowest level since November 2020, indicating a sharp decline in investors' risk appetite for speculative assets.

Among the top 20 cryptocurrencies by market capitalization, six have fallen more than 40% this year, with Dogecoin, Sui, and Avalanche each down about 50%. Over the past five years, the small-cap coin index has dropped nearly 8%, while the large-cap coin index has surged about 380%.

Pratik Kala, Portfolio Manager at Apollo Crypto, stated:

The rising tide cannot lift all boats, it can only lift quality boats