Is the Japanese bond crisis re-emerging? Concerns over fiscal stimulus intensify, leading to a triple kill in Japan's "stocks, bonds, and currency," with long-term bond yields reaching new highs

The Japanese bond market faced a sell-off due to concerns that the high-profile government of Prime Minister Sanna Marin would implement a large-scale fiscal expansion plan, with the 40-year yield soaring to a new high since 2007, and the 20-year and 30-year yields also rising by at least 4 basis points each. The yen fell below the key psychological level of 155, and the Nikkei 225 index closed down 3.2%. The market expects the scale of stimulus to exceed expectations, with pressure even within the ruling party calling for a supplementary budget of 25 trillion yen

Concerns over a new round of large-scale economic stimulus plans are stirring up a storm in the Japanese bond market. As investors worry that the fiscal expansion of the Kishi government will harm Japan's already fragile public finances, the resulting sell-off is pushing Japan's long-term government bond yields to historic highs and intensifying downward pressure on the yen exchange rate, putting simultaneous pressure on Japan's financial markets in terms of stocks, bonds, and currency.

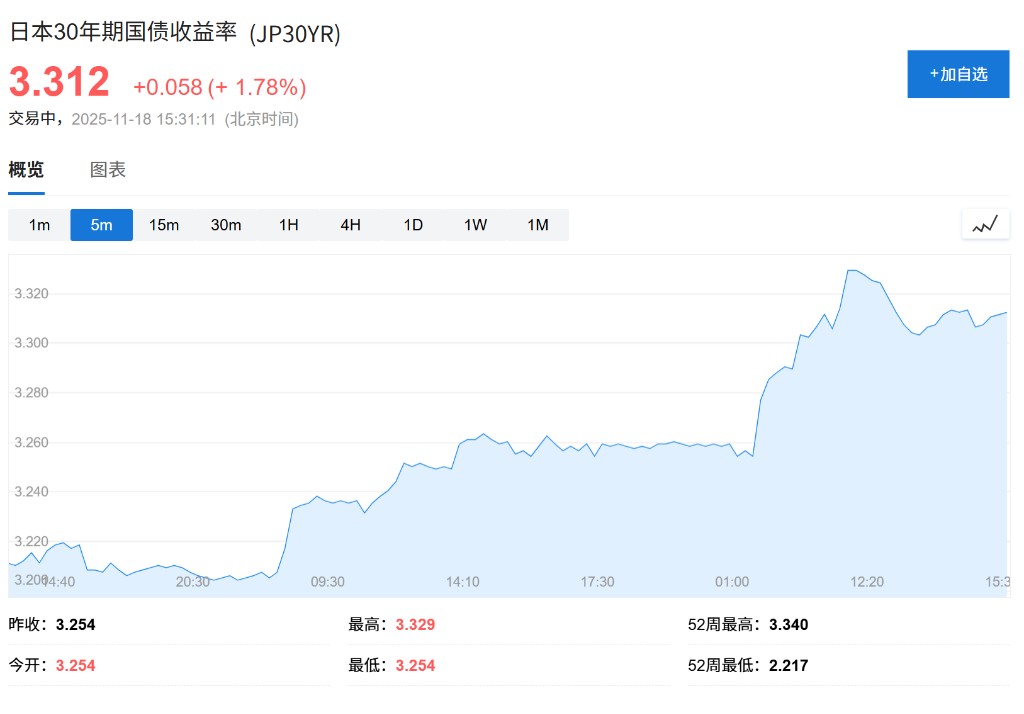

On Tuesday, prices of Japanese long-term government bonds plummeted further. The yield on 40-year bonds surged by 8 basis points to 3.68%, marking the highest level for this bond type since its issuance in 2007. Meanwhile, the yields on 20-year and 30-year bonds both rose by at least 4 basis points, with the 30-year yield just a step away from its historical peak.

The yen exchange rate was also affected, with the USD/JPY rate falling below the key psychological level of 155 earlier on Tuesday, and the EUR/JPY rate hitting a historic low of 180.

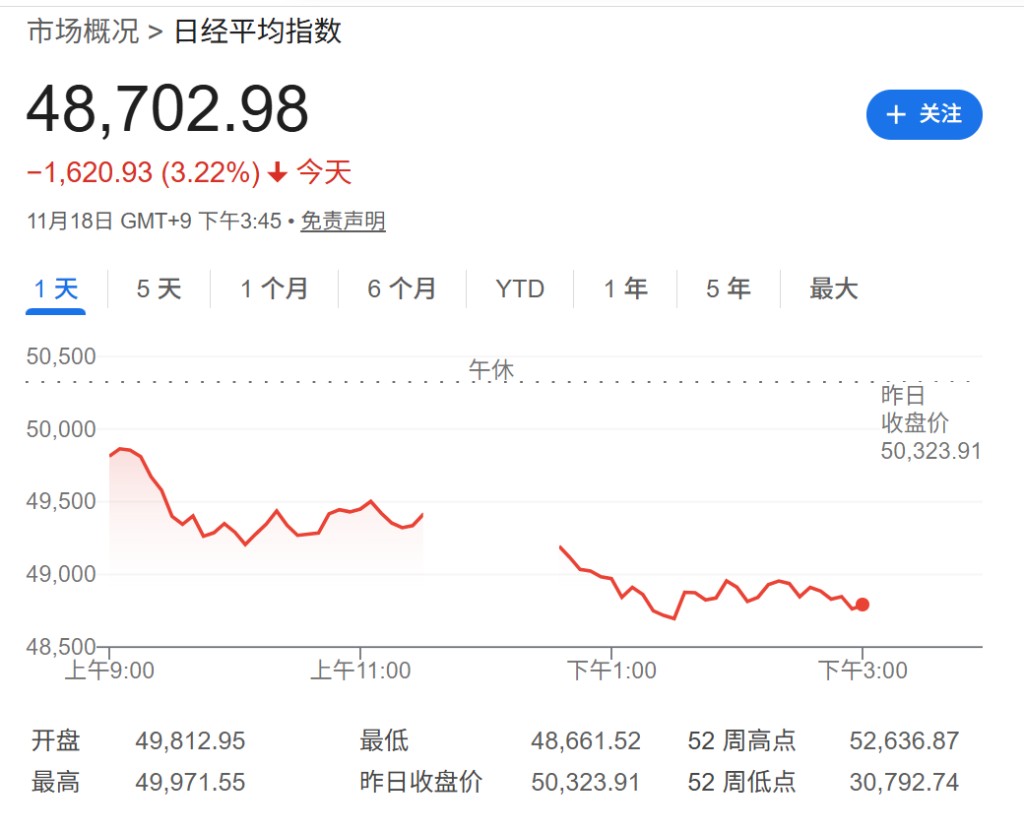

The Nikkei 225 index closed down 3.2%, at 48,702.98 points. The Tokyo Stock Exchange index fell by 2.9%.

The core of the market turmoil lies in speculation about the scale of the economic stimulus plan that the Kishi cabinet is about to announce. According to surveys, the market generally expects the scale of the plan to exceed last year's 13.9 trillion yen (approximately 89.8 billion USD). Japanese Finance Minister Satsuki Katayama stated on Tuesday that while details cannot be disclosed at this stage, the plan "has already expanded in scale so far", a statement that heightened investor anxiety, fearing that larger new debt issuance could threaten market stability.

Expectations for Fiscal Expansion Heat Up, Huge Pressure for New Debt Issuance

At the heart of the market turmoil is concern over the actual scale of the Kishi government's economic stimulus plan. Surveys indicate that the market expects this plan to exceed the previous fiscal year's level of 13.9 trillion yen (approximately 89.8 billion USD). This expectation was partially confirmed on Tuesday when Finance Minister Satsuki Katayama stated that while details cannot be commented on at this stage, the stimulus plan "has become quite large so far."

Investors are focusing on the "actual expenditure" figures in the plan to assess whether new debt issuance will threaten the stability of the Japanese market. Kishi has repeatedly indicated her willingness to increase spending to stimulate growth when necessary, a stance that has directly driven up bond yields and weakened the yen Kazuya Fujiwara, a fixed income strategist at Mizuho Securities, stated:

"Bond purchases may continue to be limited before the government announces its economic plan on November 21."

He added that investors are also reluctant to buy longer-term bonds ahead of the 20-year government bond auction.

Pressure from the ruling party may stimulate a scale far exceeding expectations

Pressure from within the ruling Liberal Democratic Party may push Prime Minister Fumio Kishida to adopt more aggressive fiscal measures. According to reports, a group of lawmakers within the LDP, known as the "Core Group for Responsible Expansionary Fiscal Policy," submitted a proposal to Kishida on Tuesday, calling for the drafting of a supplementary budget worth approximately 25 trillion yen (about 161 billion USD) to support the upcoming stimulus measures.

This figure far exceeds the previously reported supplementary budget of about 14 trillion yen and the total scale of the 17 trillion yen plan. Akira Yoshii, a member of the group, told reporters after the meeting:

"The Prime Minister did not mention a specific amount, but she said she hopes to come up with a plan that satisfies us."

Meanwhile, the group stated in its proposal that concerns about the potential loss of confidence in Japanese government bonds and rising yields are "exaggerated and not supported by data or global consensus."

However, according to media reports on Monday, a private sector member of an important government group, Goushi Kataoka, also called for Japan to formulate a stimulus plan of about 23 trillion yen. Amid calls for expansionary fiscal policy, there are also some opposing voices. Kishida's special advisor, Takashi Endo, told reporters on Tuesday that Japan will establish an agency similar to the U.S. Department of Efficiency (DOGE) next week to discuss cutting unnecessary expenditures.

Market confidence is weak, key auction is imminent

Market sentiment has become extremely pessimistic ahead of the upcoming 20-year government bond auction. On Wednesday, Japan's Ministry of Finance will auction approximately 800 billion yen (about 5.16 billion USD) of 20-year bonds, and analysts generally expect demand to be very weak.

Naoya Hasegawa, chief bond strategist at Okasan Securities, stated:

"The market was initially optimistic about Takaichi's spending plan, but later found that the scale of the economic stimulus plan seems to be continuously expanding."

He believes that for the 20-year government bond auction, "this is a bad time," and "if demand is weak, yields may rise further."

The yield curve of Japanese government bonds is steepening sharply, reflecting that investors are pricing in a spending plan that far exceeds expectations and the central bank's further delay in interest rate hikes. The yield on the 10-year benchmark government bond rose 1.5 basis points to 1.745% on Tuesday, having earlier touched the highest point since June 2008 at 1.755%.

The steepening of the yield curve—where long-term yields rise significantly more than short-term yields—reflects a complex market expectation: on one hand, the government's large-scale borrowing will push up long-term risk premiums, while on the other hand, the central bank may delay further interest rate hikes due to economic fundamentals and the government's fiscal stance.

The steepening of the yield curve—where long-term yields rise significantly more than short-term yields—reflects a complex market expectation: on one hand, the government's large-scale borrowing will push up long-term risk premiums, while on the other hand, the central bank may delay further interest rate hikes due to economic fundamentals and the government's fiscal stance.

Currently, Japan's 2-year government bond yield fell slightly by 0.5 basis points to 0.925% on Tuesday, while the 5-year yield remained flat at 1.255%, in stark contrast to the surge in long-end yields. Under the immense pressure of fiscal expansion, how the central bank balances the dual objectives of price stability and financial market stability will be key to determining the future direction of the Japanese market