PDD's Q3 revenue growth slowed to 9%, net profit increased by 17% year-on-year, and management warned that financial volatility will persist | Earnings Report Insights

PDD's Q3 revenue was 108.28 billion yuan, a year-on-year increase of 9%, marking the first time in recent years that the company's revenue growth rate has fallen to single digits. Net profit attributable to shareholders was 29.33 billion yuan, a year-on-year increase of 17%, while Non-GAAP net profit was 31.38 billion yuan, a year-on-year increase of 14%. CFO Liu Jun warned, "As we increase support for merchants and ecological investments, financial results may continue to fluctuate quarter by quarter."

PDD's revenue for the third quarter was 108.28 billion yuan (approximately 15.209 billion USD), a year-on-year increase of 9%. This growth rate has significantly slowed compared to previous quarters, marking the first time in recent years that the company's revenue growth has fallen to single digits. The net profit attributable to shareholders was 29.33 billion yuan, a year-on-year increase of 17%, while the Non-GAAP net profit was 31.38 billion yuan, a year-on-year increase of 14%.

CFO Liu Jun warned, "The continued slowdown in revenue growth reflects the evolution of the competitive landscape and external uncertainties," and stated that "as we increase support for merchants and ecosystem investments, financial results may continue to fluctuate quarter by quarter."

On the 18th, PDD announced its Q3 financial report:

- Revenue of 108.28 billion yuan, estimated at 107.59 billion yuan, a year-on-year increase of 9%.

- Net profit attributable to shareholders of 29.33 billion yuan, a year-on-year increase of 17%, Non-GAAP net profit of 31.38 billion yuan, a year-on-year increase of 14%.

- Adjusted operating profit of 27.08 billion yuan, estimated at 24.46 billion yuan.

- Adjusted earnings per ADS of 21.08 yuan, estimated at 16.86 yuan.

Revenue Growth Significantly Slows, Net Profit Achieves Double-Digit Growth

Financial report data shows that PDD's 9% revenue growth in the third quarter marks a significant slowdown in its growth momentum. The company's total revenue was 108.28 billion yuan, compared to 99.35 billion yuan in the same period last year.

Revenue growth mainly came from two core businesses, but the growth rates were not high. Among them, online marketing services and other income were 53.35 billion yuan, a year-on-year increase of 8%. Transaction service revenue was 54.93 billion yuan, a year-on-year increase of 10%. CFO Liu Jun commented: “The continued slowdown in revenue growth reflects the ongoing evolution of the competitive landscape and external uncertainties.” She also warned that as the company launches more merchant support initiatives and ecosystem investments, quarterly financial performance may continue to fluctuate.

Despite facing cost pressures and growth challenges, PDD's profitability remains resilient. The financial report shows that the net profit attributable to common shareholders was 29.33 billion yuan, a year-on-year increase of 17%. Under Non-GAAP, the net profit attributable to common shareholders was 31.38 billion yuan, a year-on-year increase of 14%.

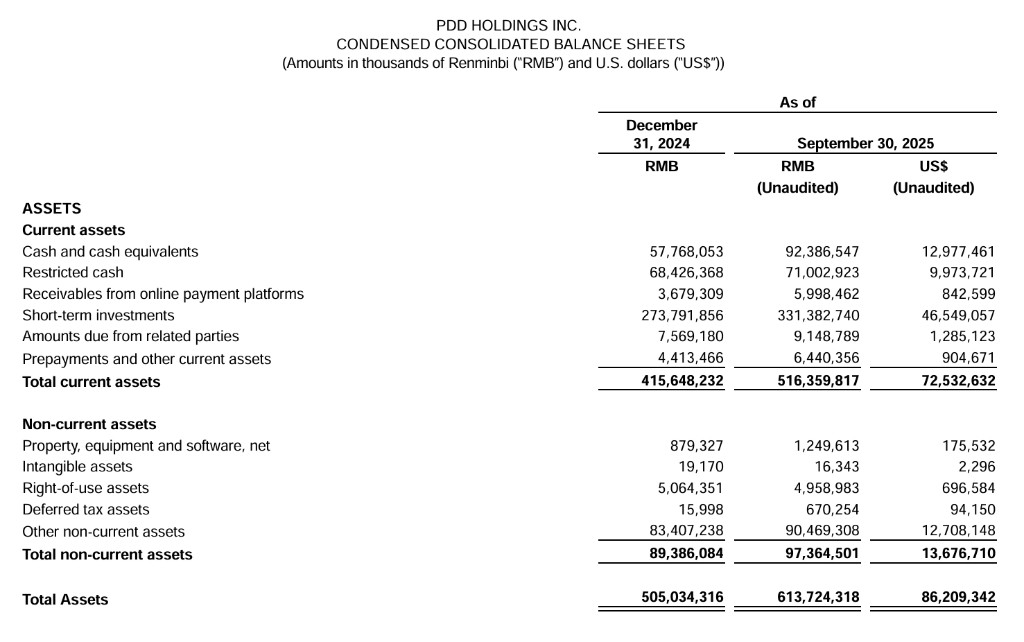

Profit growth is also reflected in earnings per share. The diluted earnings per ADS were 19.70 yuan, higher than 16.91 yuan in the same period last year. In addition, the company's cash flow performance was strong, with net cash generated from operating activities in the quarter amounting to 45.66 billion yuan, up from 27.52 billion yuan in the same period last year, mainly due to the increase in net profit and changes in working capital. As of September 30, 2025, the company held a total of 423.8 billion yuan in cash, cash equivalents, and short-term investments.

Surge in Costs and Increased R&D Investment

While revenue growth is slowing, PDD's costs and expenses are significantly increasing. The financial report shows that the total revenue cost for the third quarter was 46.84 billion yuan, a year-on-year increase of 18%, which is twice the revenue growth rate. The company stated that this was mainly due to increased fulfillment costs, bandwidth and server costs, and payment processing fees.

In terms of operating expenses, the surge in research and development investment is particularly notable. R&D expenses in the third quarter reached 4.33 billion yuan, a substantial year-on-year increase of 41%, mainly used for employee-related costs and investment in technological infrastructure. In contrast, sales and marketing expenses remained basically flat at 30.32 billion yuan. The rise in costs and expenses led to stagnation in quarterly operating profit, which was 25.03 billion yuan, a slight increase compared to 24.29 billion yuan in the same period last year.

Sales and marketing expenses were 30.32 billion yuan, basically flat compared to 30.48 billion yuan in the same period last year. The gross profit margin decreased from 60.0% in the same period last year to 56.7%.

Management: Focus on Long-term Value, Financial Volatility Will Continue

In the face of slowing growth, PDD's management collectively conveyed signals of focusing on long-term value, taking on more social responsibility, and actively responding to competition. Chairman and Co-CEO Chen Lei stated on the occasion of the company's tenth anniversary:

"Looking ahead, as we scale up, we are prepared to take on greater social responsibility and continue to serve the broader public interest and the long-term prospects of the entire e-commerce ecosystem."

Co-CEO Zhao Jiazhen stated that the company will adhere to long-termism and continue to invest in merchant support programs to promote industry upgrades and the long-term sustainable development of the platform.

CFO Liu Jun warned investors:

"As we roll out more merchant support measures and ecosystem investments, financial results may continue to fluctuate quarter by quarter."

After the financial report was released, PDD's U.S. stock turned down in pre-market trading, having previously risen nearly 4%.