Earnings season difficult to become an emotional turning point? Barclays: U.S. software stocks lack "safe assets," and funds only recognize infrastructure in the short term

Barclays believes that there are two core concerns in the market: the threat of AI to application software and the excessive capital expenditures of cloud service providers. At the same time, channel surveys indicate a slowdown in growth for Q3, with industry data being cautious. In the infrastructure sector, Barclays is more optimistic about MongoDB, believing that its potential for outperforming expectations and growth momentum for next year are both higher than the highly sought-after Snowflake

The upcoming Q3 earnings season for US software companies may become a turning point for market sentiment? Barclays: Not necessarily!

On November 18th, according to news from the Chasing Wind Trading Desk, Barclays stated in its latest research report that the upcoming Q3 earnings season is unlikely to become a positive turning point for market sentiment, mainly due to the persistence of the market's core "dual concerns":

First, there are worries about the unclear specific benefits for application software companies in the AI wave (i.e., "AI overhang"); second, there are concerns about the excessive capital expenditures of hyperscalers.

Barclays believes that even if these concerns may be exaggerated, the Q3 earnings report is unlikely to provide sufficiently strong data to completely dispel doubts. This directly leads to a risk-averse sentiment in the market, with funds continuing to cluster in infrastructure software stocks viewed as "safe targets," while remaining cautious about application software.

Barclays clearly stated that in the infrastructure sector, they are more optimistic about MongoDB, believing that its potential for exceeding expectations and growth momentum for next year are higher than the highly sought-after Snowflake.

Market Fog: Two Major Concerns Looming, Earnings Season Hard to Break Through

Barclays pointed out at the beginning of the report the current dilemma in investing in software stocks: the market seems to find few "safe" investment targets.

The report states that this sentiment stems from two core concerns:

AI Threat Theory: Investors are generally worried that the disruptive power of AI will impact existing application software companies, creating what is known as "AI overhang."

Capital Expenditure Concerns: The market is also worried that to support AI development, the capital expenditures (CapEx) of those hyperscale cloud service providers have already been too high, which may affect future investments and ecosystems.

Although Barclays analysts do not agree with these two viewpoints, they acknowledge in the report that the upcoming Q3 earnings data may not provide strong new evidence to completely overturn these market concerns. Therefore, the most direct consequence is that investors seeking certainty will continue to shelter in the safe haven of infrastructure software in the short term.

Weak Macro Signals: Channel Surveys and Data Indicate Caution

To support its judgment, Barclays cited several macro and industry-leading indicators, with an overall cautious tone.

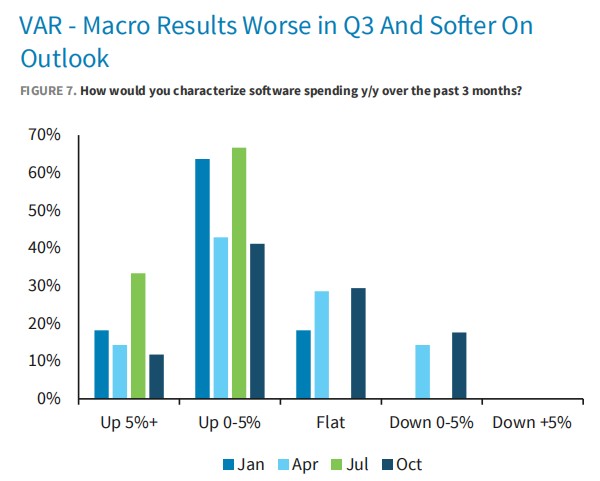

The bank pointed out that its latest value-added reseller (VAR) channel survey shows a slight slowdown in growth expectations for Q3. Although Q3 is typically a seasonal off-peak period, this undoubtedly puts greater pressure on the outlook for Q4.

This means that investors will pay more attention to companies' guidance for future performance rather than the performance numbers for Q3 itself.

Regarding the outlook for the next quarter, the survey results are also cautious. Although all respondents still expect year-on-year growth, the proportion of those expecting growth of 10-20% dropped from 25% in the previous quarter to 0%, while the proportion expecting growth of 0-10% rose from 75% to 100% In addition, other charts in the report also show a weaker trend compared to Q2:

Employment Data: The bank stated that job postings in the tech industry decreased month-on-month, with the year-on-year growth rate of total software engineering job postings slowing compared to the second quarter, down 1% year-on-year in October. Although the year-on-year growth of software engineering job postings from S&P 500 companies is positive, it has been quite volatile from August to October. The year-on-year growth of contact center job postings remained stable in September and October but is still in the negative growth range.

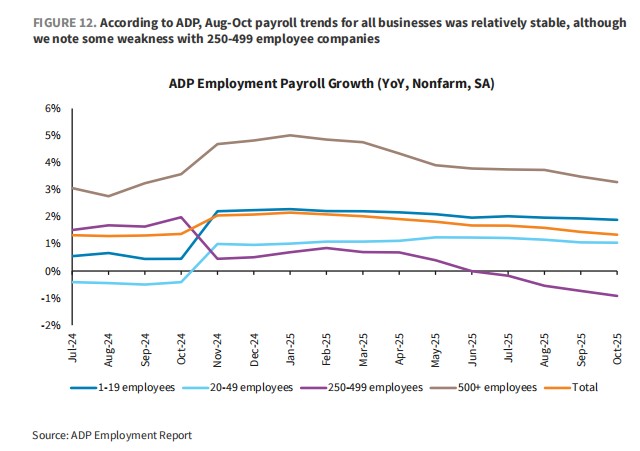

ADP employment wage growth data shows that wage trends for all businesses were relatively stable from August to October, but companies with 250-499 employees showed some signs of weakness.

Business Confidence: Barclays pointed out that both the NFIB Small Business Optimism Index and the Paychex Small Business Employment Index show signs of weakness.

Barclays stated that the only bright spot comes from a survey targeting Salesforce (CRM), which shows an increased urgency among customers to adopt AI. However, this is more of a "hope for the future" and is unlikely to have a substantial impact on Q3 financial reports.

The customer interest survey regarding the Agentforce AI product shows:

86% of respondents indicated that customers have "significant interest" (a notable increase from 63% in the previous quarter), and 100% of respondents stated that customers plan to adopt it within 12 months, with 86% expecting to adopt it within 3-6 months (up from 63% in the previous quarter).

Infrastructure Showdown: Why MDB is Preferred Over SNOW?

In the infrastructure sector favored by funding, Barclays conducted a focused comparison of two star stocks, Snowflake and MongoDB, and expressed a clear preference: more optimistic about MDB in the short term.

Snowflake: The bank believes this stock is undoubtedly a success story this year, with a 60% increase in stock price year-to-date (compared to a 7.3% increase in the IGV index during the same period). Barclays recognizes its industry position in data integration to empower AI.

However, the research report states that the core issue is that market expectations have significantly increased, making it more difficult for the stock price to continue rising sharply after the financial report.

MongoDB: The research report states that MDB has also staged a comeback story this year.

Barclays believes its advantages are:

Barclays believes its advantages are:

- Performance expectations are easier to exceed: Current market expectations remain low enough to provide space for the company to achieve robust performance exceeding expectations in the second half of the year.

- Clear growth momentum: The company will enter a better enterprise advanced (EA) renewal cycle next year, which is expected to drive accelerated revenue growth structurally.

- New CEO's debut: This will be the new CEO's first appearance at the earnings report conference. Given their good reputation in the industry, this is seen as an additional positive signal.

Based on the above judgments, Barclays raised MDB's target price from $345 to $390, and SNOW's target price from $255 to $290, to reflect the market's preference sentiment for high-growth infrastructure software