Arbitrum’s RWA market hits $1.02B, yet ARB prices stall – Here’s why

Arbitrum's RWA market reached $1.02B, but ARB prices are stagnant due to decreased on-chain activity. Robinhood's expansion to the ARB chain could boost prices and activity, especially in the RWA sector. Despite long-term growth, short-term outlook is weak with declining active addresses and transaction volume. Robinhood's involvement may lead to future price and activity increases, but current market weakness poses challenges.

Key Takeaways

Why is Arbitrum down in the short term?

Price was down due to decreased on-chain activity over the last month.

What’s the impact of Robinhood’s expansion to the ARB chain?

ARB prices and activity could surge, especially in the RWA category of the chain.

With Robinhood’s recent institutional involvement, Arbitrum [ARB] is progressively growing.

The Layer 2 (L2) blockchain on the Ethereum [ETH] mainnet is seeing growth over the long term, but the short-term outlook is lagging both on-chain and numerically.

Mixed sentiments over the long-term and short-term

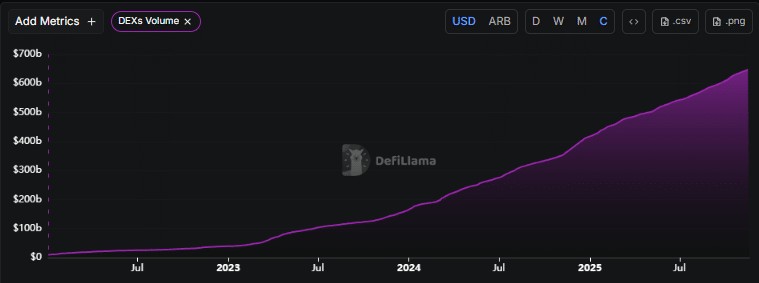

Arbitrum showed consistent growth in on-chain activity over the period starting in 2022. The DEX volume grew by about 7X and was slightly above $647 billion, at press time.

The Total Value Locked (TVL) had also grown to $8.18 billion, but has since declined to $6.23 billion over the past month of market weakness.

In the past 24 hours, TVL had grown by less than a percent, indicating inconsistencies in the smaller scales.

Source: DefiLlama

Meanwhile, stablecoin supply rose to $4.05 billion, marking a 2.27% increase over the past seven days.

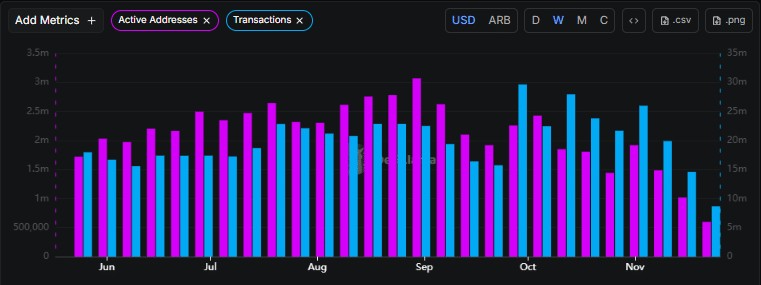

Zooming in on weekly trends, activity on the Arbitrum blockchain has been declining, which helps explain its sluggish price performance over the past month.

Active addresses fell from 1.02 million to 596,000, while transaction volume dropped from 14.6 million to 8.55 million, both down by roughly 1.5x in the past week.

Source: DefiLlama

The activity has been declining on average by about 1.5X since the beginning of October, and so has the price.

Worth noting is the potential for this to flip. This follows a Robinhood expansion to Arbitrum for tokenization.

Robinhood’s expansion: ARB price and TVL reaction

The charts were bearish in structure, but still forming a potential reversal pattern. Reversals typically transpire following consolidation, and the current descending trend channel aligns perfectly with this pattern.

Bulls have consistently responded whenever the price reached the channel’s demand zone. Currently, bears have been unable to push the price back to that zone, signaling strengthening bullish momentum.

Both the RSI and CMF were below neutral, as of writing, suggesting capital outflows. However, a bullish RSI divergence reveals an underlying imbalance, hinting at potential upward movement.

Source: TradingView

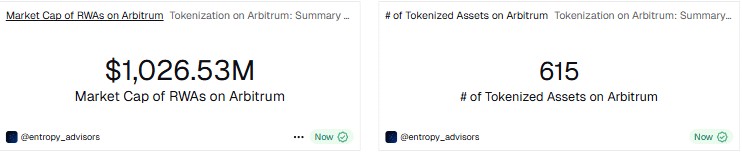

The expansion of the RWA sector on Arbitrum has the potential to significantly impact the market. Robinhood announced plans to expand its 800+ European tokenized stock offerings on the L2 chain.

They aimed for full DeFi interoperability by 2026, and the date could be when the impact is felt in price action and on-chain activity. This is because Robinhood brings in about 23 million users who would be leveraging Arbitrum to access these tokenized stocks.

The TVL of tokenized RWAs on Arbitrum, which stood at $490 million, could also grow after this Robinhood onboarding. The market cap of RWAs on ARB, which is at $1.026 billion, is expected to follow suit.

Source: Dune

Notably, the impact of this institutional involvement may not be instant but will be impactful in the long run. Currently, the general market weakness poses a threat to increased activity and the price of assets.