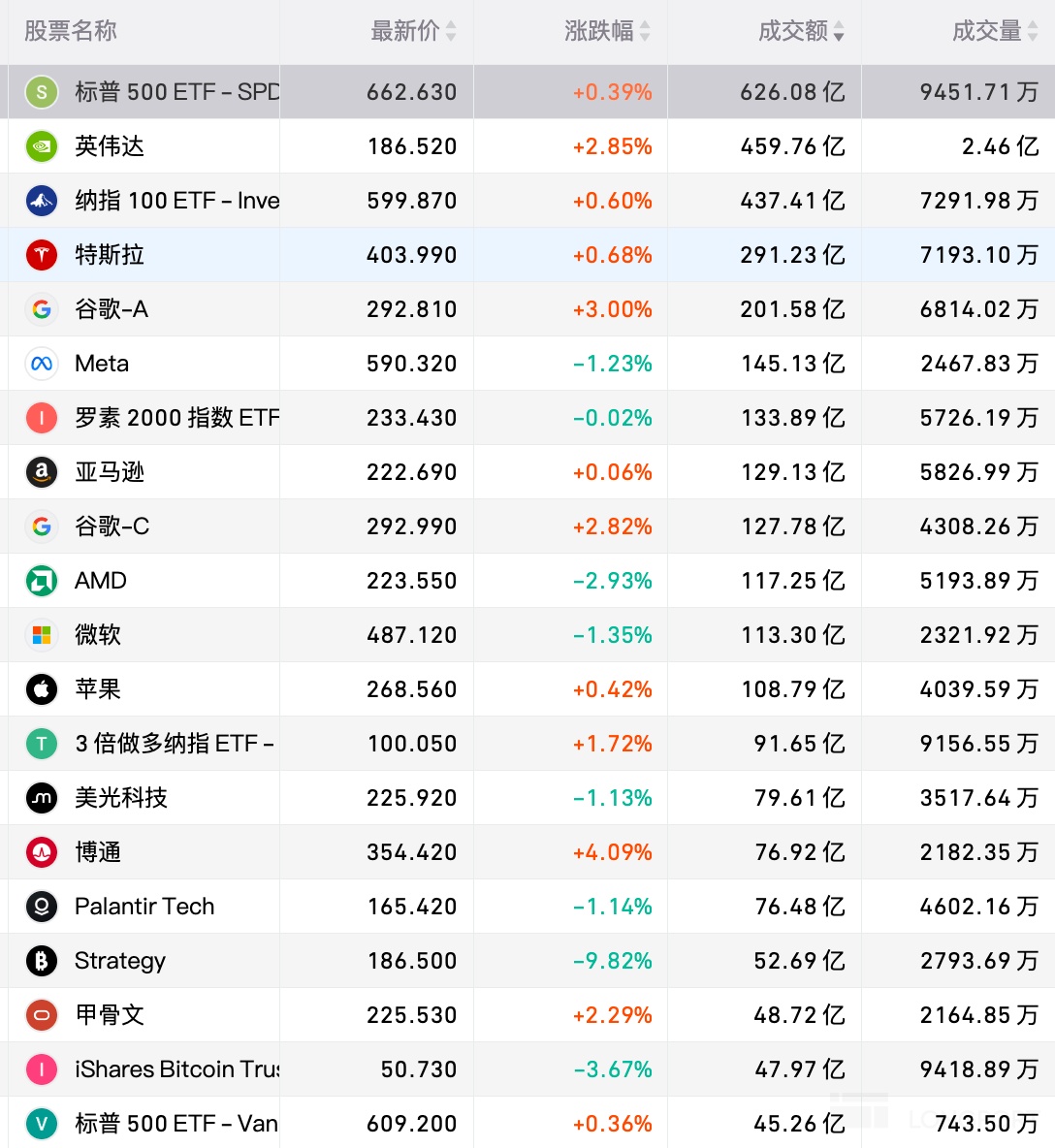

US Stock Fund Activity Rankings | Google up 3%, Gemini 3 Pro tops LMArena chart

Google rises 3%, Gemini 3 Pro tops the "Large Model Arena" LMArena rankings

On November 20th (Thursday), NVIDIA, the second highest in trading volume on the US stock market, rose by 2.85%, with a trading volume of $45.976 billion. After the US stock market closed on Wednesday, NVIDIA released its third-quarter financial report for fiscal year 2026. The report showed that both its revenue and earnings per share exceeded Wall Street expectations, and the guidance for fourth-quarter revenue was also above market expectations.

The company's adjusted earnings per share for the third quarter were $1.30, compared to an expectation of $1.25; revenue was $57.01 billion, against an expectation of $54.92 billion.

NVIDIA expects fourth-quarter revenue to be approximately $65 billion. Analysts expect revenue of $61.66 billion and adjusted earnings per share of $1.43.

The company also emphasized that the robotics sector is one of its most important growth areas. In the third quarter, NVIDIA's automotive and robotics business generated total revenue of $592 million, a year-on-year increase of 32%.

Tesla, ranked fourth, rose by 0.68%, with a trading volume of $29.123 billion. According to media reports on Wednesday, Tesla is suing 10 companies per month in China, bringing its corporate clients to the defendant's bench. Data shows that Tesla has sued more than 30 companies in the past four months.

Alphabet's Class A shares (GOOGL), ranked fifth, rose by 3%, with a trading volume of $20.158 billion. In news, Google's latest large model, Gemini 3 Pro, topped the "Large Model Arena" LMArena rankings. From the latest financial report data, AI has become an important engine for Google's growth. Google Cloud's revenue for the third quarter reached $15.2 billion, a year-on-year increase of 33.5%, with operating profit margin rising to 23.7%. AI-related revenue has reached "tens of billions of dollars per quarter," and revenue from products built on generative AI models has increased by over 200%, demonstrating strong momentum in AI-driven commercialization.

It is reported that Gemini 3 Pro set a new record for comprehensive capability assessment with an Elo score of 1501, with core advantages reflected in multidimensional performance leaps: achieving 100% accuracy in the AIME 2025 US Math Invitational coding execution mode, and scoring 23.4% in the MathArena Apex math competition, far exceeding the general level of below 2% for similar models. Its multimodal processing capability is even more prominent, with a screenshot understanding score of 72.7%, doubling that of competitors, and an error rate of only 0.56% in recognizing 18th-century handwritten manuscripts, approaching expert-level deciphering.

AMD, ranked tenth, fell by 2.93%, with a trading volume of $11.725 billion. Reports indicate that AMD, Cisco, and the Saudi Arabian AI startup Humain are forming a joint venture to build data centers in the Middle East and have already secured their first client.

According to Humain's CEO Tareq Amin, the unnamed joint venture will start with a 100-megawatt data center project in Saudi Arabia, with Cisco providing networking equipment and other infrastructure, while AMD will supply its MI 450 AI chipsThe 15th-ranked Broadcom rose by 4.09%, with a trading volume of $7.692 billion. Reports on Wednesday indicated that Broadcom launched the world's first quantum-safe eighth-generation 128G SAN switch product line.

The 17th-ranked Strategy fell by 9.82%, with a trading volume of $5.269 billion. Documents submitted by the company to the U.S. Securities and Exchange Commission (SEC) on Monday revealed that the company purchased $835.6 million worth of Bitcoin in the seven days ending last Sunday, marking its largest purchase of the cryptocurrency since July. This brought its total Bitcoin holdings to 649,870 coins, valued at approximately $6.17 billion. The company appears to have primarily funded this purchase with proceeds from a euro-denominated preferred stock issuance completed last week. This indicates that the company, led by Michael Saylor, further strengthened its digital asset reserve model during last week's cryptocurrency market crash.