How to view the correlation between gold prices and the Nasdaq index moving up and down together?

Since November, gold prices and the Nasdaq Index have risen and fallen together multiple times, raising market concerns about deeper risks. The article suggests that this increased correlation may be related to concerns about Federal Reserve tightening under recovery expectations, rather than liquidity shocks. It is recommended to pay attention to fundamental data to assess future trends

Summary

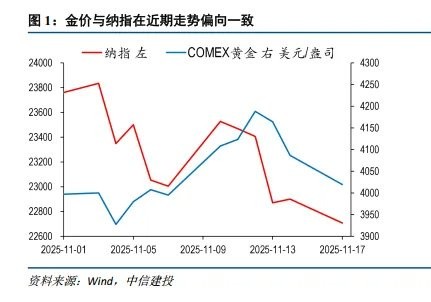

Since November, gold prices and the Nasdaq index have repeatedly risen and fallen together. The two belong to safe-haven and risk assets, respectively, and their rising correlation has raised concerns about deeper risks.

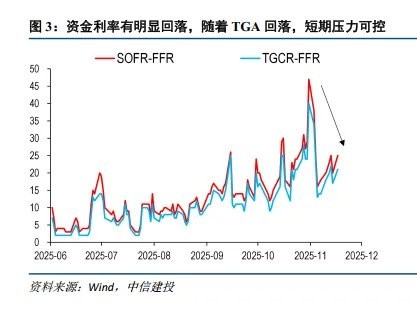

Liquidity shocks in the money market are unlikely to be the main reason. Recently, as month-end disturbances and government shutdown factors have faded, funding rates have fallen, alleviating marginal pressure.

The underlying driver may be concerns about Federal Reserve tightening under recovery expectations. Directional changes in Federal Reserve policy often lead to a unified trend in major asset classes in the short term. Recently, expectations of recovery and re-inflation (tax cuts, interest rate reductions, trade easing, etc.) have emerged, and expectations for interest rate cuts have converged. Coupled with technology companies facing debt financing doubts, both gold and the Nasdaq have suffered negative impacts, leading to increased correlation.

Therefore, there is no need to worry about a larger hidden crisis for now. After adjustments, the simultaneous movement of the two may not last. Future attention should be paid to fundamental data; if improvements materialize, gold prices may face short-term upward resistance, and the risk to U.S. stocks is low; conversely, U.S. stock volatility will continue.

Main Text

Since November, the positive correlation between the Nasdaq index and gold prices has strengthened, frequently showing simultaneous rises and falls, attracting market attention.

Since November, gold prices and the Nasdaq have repeatedly shown simultaneous rises and falls. As the two belong to safe-haven and risk assets, their rising correlation has raised market concerns about deeper risks. For example: On November 4, the Nasdaq fell by 2%, and gold fell by 1.8%; on November 10, the Nasdaq rose by 2.3%, and gold rose by 2.8%; on November 13, the Nasdaq fell by 2.3%, and gold fell by 0.6%; on November 17, the Nasdaq fell by 0.8%, and gold fell by 1.6%.

In fact, the aforementioned phenomenon is not limited to gold and the Nasdaq; the overall tendency of major assets has also strengthened recently. Selecting commonly traded global assets such as stocks, bonds, and currencies, the correlation levels show that since October, the overall positive correlation level of assets has continued to rise, remaining at a relatively high level compared to the past two years and above the historical average. Therefore, the simultaneous rises and falls of the Nasdaq and gold may not be an isolated phenomenon but rather a more widespread occurrence.

The liquidity shock caused by tightening in the money market and rising funding rates is unlikely to be the main reason. In the first week of November, U.S. stocks began to adjust, and gold was not spared. The market generally attributed the cause to a liquidity crisis, as short-term funding rates saw a significant rise, and the government shutdown led to a surge in fiscal deposits and a sharp drop in commercial bank reserves. However, daily fluctuations in short-term rates are unlikely to trigger sell-offs in other major asset classes, and starting from the second week of November, funding rates have stabilized, the government has reopened, and reserve pressures are likely to ease. Using liquidity shortages to explain the convergence of gold and the Nasdaq is flawed

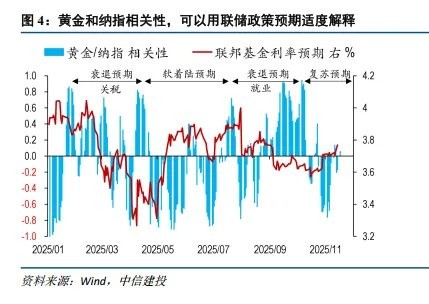

The behind-the-scenes driver may be concerns about Federal Reserve tightening under recovery expectations. From an economic fundamentals perspective, the driving directions of gold and the Nasdaq index are normally opposite. To find factors that cause them to change in the same direction, it is likely necessary to start from a higher-level policy dimension. Directional changes in Federal Reserve policy often lead to a unified trend in major asset classes in the short term.

Reviewing the correlation between gold prices and the Nasdaq index this year, changes in Federal Reserve interest rate cut expectations, and the driving factors behind Federal Reserve changes, we can find:

(1) From the beginning of the year to April: Tariff shocks, rising recession expectations, and strengthened Federal Reserve interest rate cut expectations. At this time, gold prices are favorable, but due to the significant impact of tariffs on the multinational operations of technology leaders, the recession expectations caused by tariffs are negative for tech stocks, leading to a reverse relationship between the Nasdaq index and gold, with a noticeable decline in correlation.

(2) Second quarter: The impact of tariffs is minimal, the market recovers soft landing expectations, interest rate cut expectations decline, but there are no recovery and tightening expectations. At this time, the policy has little impact on the Nasdaq index and gold, and both follow their own logic, primarily showing a negative correlation.

(3) Third quarter: The job market deteriorates rapidly, recession expectations rise, and Federal Reserve interest rate cut expectations strengthen. This round of easing expectations is based on weak employment, and since technology companies are not closely related to the job market, both the Nasdaq index and gold benefit from declining interest rates, with a noticeable increase in correlation.

(4) November: Economic recovery and re-inflation expectations emerge (tax cuts, interest rate cuts, trade easing, etc.), interest rate cut expectations tighten, coupled with recent doubts about technology companies already deeply mired in debt financing, both gold and the Nasdaq index experience negative factors, with increased correlation.

If the above understanding is correct, then the recent simultaneous rise and fall of the Nasdaq index and gold may not necessarily reflect a deep liquidity crisis or other risks behind it. After the market adjustment, the situation of both running in the same direction may not last long. Future attention should be paid to the trend of fundamental data: if improvements are confirmed and recovery trading continues, gold prices may face obstacles in breaking upward in the short term, and the overall risk of U.S. stocks is not significant; conversely, U.S. stock volatility will continue.

Risk warning and disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at their own risk