AH shares opened high and then fell, the ChiNext Index dropped 0.52%, bank and real estate stocks surged, lithium mining stocks were repeatedly active, the Hang Seng Index fell more than 1%, and new energy vehicles continued to weaken

The three major A-share indices opened higher but fell back, with the ChiNext Index down 0.52%. Bank stocks strengthened, with China Bank's stock price hitting a new historical high, and lithium mining stocks surged again. Hong Kong stocks were mixed, with the Hang Seng Index up 0.14% and the Hang Seng Tech Index down 1.01%. Baidu Group rose 2.34%, and Kuaishou rose 1.81%; XPeng fell 4.55%. Commodity prices were mixed, and the bond market showed a divergent performance

The three major A-share indices opened higher but fell back, with the ChiNext Index down 0.52%. Bank stocks strengthened, with China Bank's stock price reaching a new historical high. Lithium mining stocks surged again, while sectors such as real estate and Hainan Free Trade Zone led the gains; aquaculture, beauty care, food, and dairy sectors led the declines.

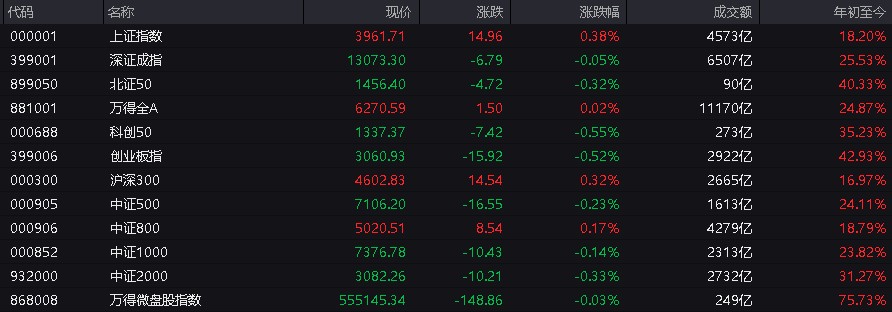

On November 20, the A-share market opened higher in the morning but retreated, with mixed performance among the three major indices. At the midday close, the Shanghai Composite Index rose 0.38%, the Shenzhen Component Index fell 0.05%, and the ChiNext Index dropped 0.52%. Bank stocks collectively strengthened, with Industrial and Commercial Bank of China and China Bank both reaching new highs. Lithium mining stocks remained active, with Dawei Co. and Weiling Co. hitting the daily limit. Real estate stocks showed unusual movements near the midday break, with Shilianhang and Wo Ai Wo Jia hitting the daily limit. On the downside, consumer stocks such as food and beauty care fell, with Yike Food dropping over 10%. Overall, more stocks declined than rose, with over 3,000 stocks in the Shanghai, Shenzhen, and Beijing markets in the red, and a total transaction volume of 1.12 trillion in the morning session. The core indices are as follows:

The Shanghai Composite Index closed at 3961.70 points, up 0.38%.

The Shenzhen Component Index closed at 13073.30 points, down 0.05%.

The ChiNext Index closed at 3060.93 points, down 0.52%.

The CSI 300 closed at 4602.83 points, up 0.32%.

The STAR 50 closed at 1337.37 points, down 0.55%.

The CSI 500 closed at 7106.20 points, down 0.23%.

The CSI 1000 closed at 7376.78 points, down 0.14%.

In terms of news, CITIC Securities pointed out that the industry interest margin stabilized in the third quarter, and the significant value space implied by low valuations is conducive to catalyzing the market as it enters a long-term capital allocation period at the end of the year. Guosen Securities believes that listed insurance companies will achieve high growth in performance in the first three quarters of 2025, benefiting from the recovery of the capital market on the investment side, while the liability side has also improved in quality through product structure optimization.

Informed sources say that China's decision-makers are considering a new round of support policies to reverse the sluggish sentiment in the real estate market and prevent further industry weakness from affecting the stability of the financial system.

Hong Kong stocks showed mixed performance, with the Hang Seng Index up 0.14% and the Tech Index down 1.01%. Automotive and lithium battery stocks weakened, while domestic property stocks rose. XPeng fell 4.55%, and Trip.com Group fell 3.57%. On the upside, Baidu Group rose 2.34%, and Kuaishou rose 1.81%.

Commodity prices were mixed at midday, with Shanghai silver up 1.31% and international copper up 0.55%; coking coal fell 2.74%, and the shipping index (European line) fell 1.01%.

The bond market showed mixed performance at midday, with the 30-year main contract down 0.14%, the 10-year main contract up 0.04%, the 5-year main contract up 0.03%, and the 2-year main contract unchanged.

11:14

A-share and Hong Kong property stocks showed unusual upward movements.

In Hong Kong, Sunac China rose over 9%, Country Garden rose over 5%, and Vanke and Shimao Group rose over 3%

A-share Wo Ai Wo Jia hit the daily limit, with Te Fa Service, Shi Lian Hang, Guang Da Jia Bao, Shen Shen Fang A, Vanke A, and others all surging.

In terms of news, informed sources say that China's decision-making body is considering a new round of support policies to reverse the sluggish sentiment in the real estate market and prevent further industry weakness from affecting the stability of the financial system.

According to informed sources, the Ministry of Housing and Urban-Rural Development and other departments are weighing a series of options, including providing interest subsidies for new personal housing loans nationwide for the first time. One informed source indicated that other measures being considered include increasing the special deduction for personal income tax for mortgage borrowers and further reducing the deed tax on housing transactions. Due to the confidentiality of the matters, the informed sources requested anonymity.

Informed sources said that discussions on new policies began at least in the third quarter of this year, when housing sales and prices continued to be sluggish. They added that the specific implementation timeline and policy details remain uncertain.

Fitch pointed out last month that the bleak outlook for the real estate market and the weakening ability of households to repay mortgages mean that the asset quality of banks may deteriorate next year. Data from the National Financial Regulatory Administration shows that the balance of non-performing loans at commercial banks reached 3.5 trillion yuan at the end of the third quarter, hitting a historical peak.

11:00

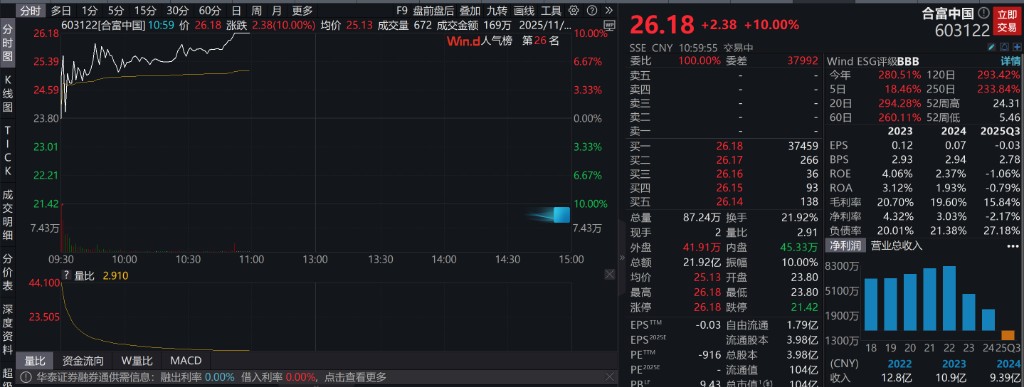

He Fu China hit the daily limit again, with a cumulative increase of over 290% in 15 trading days.

10:43

The lithium mining concept has erupted again.

In terms of news, yesterday, the main contract for lithium carbonate futures broke 100,000 yuan/ton during trading today, reaching a new high since June 2024. Analysts pointed out that the recent rise in lithium carbonate prices is mainly driven by the explosive demand for energy storage and the steady growth of the new energy vehicle market.

Zhong You Securities pointed out that the price of lithium carbonate has fluctuated significantly recently, and the market is optimistic about the demand for energy storage next year. Haibo Innovation and CATL signed a "Strategic Cooperation Agreement," committing to purchase no less than 200 GWh of electricity from 2026 to 2028, further validating the prosperity of the energy storage market. The core driving force behind the high growth of the domestic energy storage industry comes from the transformation of the energy structure. With the exit of mandatory energy storage, independent energy storage is rapidly rising. Cumulative energy storage demand will exceed 2000 GWh, with an average annual demand reaching the hundred GWh level. From a future perspective, China's energy storage industry has established a continuous growth cycle of 3-5 years. AI is driving explosive growth in data center scale, with AI data centers having extremely high and volatile power requirements, necessitating energy storage to smooth out grid impacts and serve as backup power to support computing power peaks. In the next two to three years, the annual growth rate of overseas energy storage is expected to reach 40%-50% Becoming the main growth driver of lithium carbonate demand.

10:30

Hong Kong stocks opened high and then fell, with the Tech Index down over 1%, XPeng down over 4%, Leapmotor down more than 2%, and Nio down nearly 2%.

10:30

The three major indices collectively turned negative, with the ChiNext Index previously rising nearly 2%. Sectors such as tourism and hotels, food, retail, and textiles and apparel saw the largest declines, with nearly 4,000 stocks in the Shanghai, Shenzhen, and Beijing markets falling.

10:23

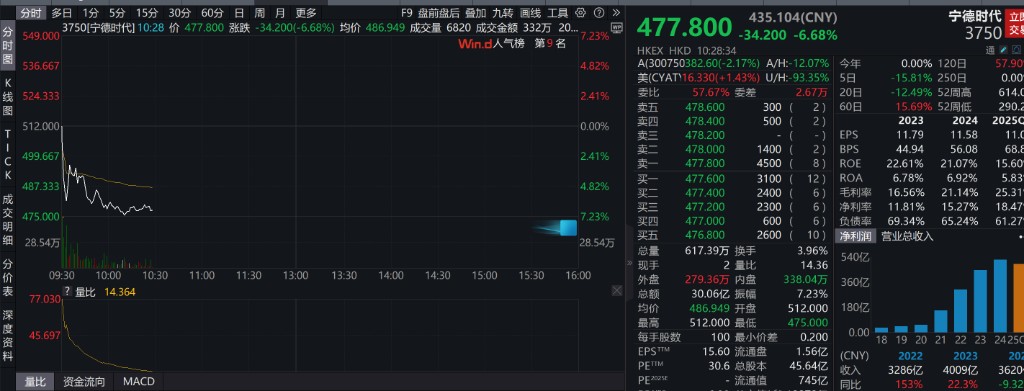

Contemporary Amperex Technology Co., Limited's Hong Kong stock came under pressure and fell 6.68%.

In terms of news, starting from November 20, nearly 50% of H-share IPO locked shares will be unlocked, involving about 77.5 million shares.

JP Morgan mentioned that the short selling ratio of Contemporary Amperex Technology Co., Limited's H shares is extremely high, with the utilization rate of the stock lending pool reaching 95%. The bank maintains a "neutral" rating on the H shares of Contemporary Amperex Technology Co., Limited, lowering the target price from HKD 600 to HKD 575. The bank expects that after the IPO unlock, the unusually high premium of H shares over A shares will tend to narrow.

9:43

A-share bank stocks continued to strengthen, with Bank of China rising over 4%, the stock price reaching a new historical high, and the total market value exceeding 2 trillion yuan. Postal Savings Bank, China Everbright Bank, China Construction Bank, and China CITIC Bank saw significant gains.

9:29

The China Convertible Bond Index opened up 0.2%. Huamao Convertible Bonds rose nearly 4%, Outong Convertible Bonds rose nearly 3%, Weidao Convertible Bonds, Huicheng Convertible Bonds, and Guocheng Convertible Bonds rose over 2%; Taiping Convertible Bonds fell over 1%.

9:29

Government bond futures opened mixed, with the 30-year main contract down 0.04%, the 10-year main contract flat, the 5-year main contract up 0.03%, and the 2-year main contract up 0.01%.

9:25

The Shanghai Composite Index opened at 3960.70 points, up 0.35%.

The Shenzhen Component Index opened at 13215.07 points, up 1.03%.

The ChiNext Index opened at 3131.84 points, up 1.79%.

The CSI 300 opened at 4619.54 points, up 0.68% The Sci-Tech Innovation 50 opened at 1362.85 points, up 1.34%.

The CSI 500 opened at 7174.10 points, up 0.72%.

The CSI 1000 opened at 7429.70 points, up 0.58%.

9:20

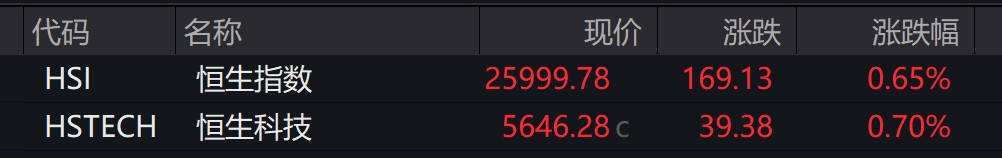

The Hang Seng Index opened up 0.65%, and the Hang Seng Tech Index rose 0.7%. Baidu and Hua Hong Semiconductor rose over 3%, while Kuaishou, Lenovo, BYD Electronics, and SMIC rose over 2%.

9:17

The central parity rate of the RMB against the USD was reported at 7.0905, down 33 points; the previous trading day's central parity rate was 7.0872, the previous trading day's official closing price was 7.1096, and the night session closed at 7.1135.

9:00

Commodity futures opened, with LU fuel oil, fuel oil, and soda ash main contracts down over 2%, while container shipping European routes, pulp, coking coal, glass, crude oil, ethylene glycol, and alumina fell over 1%. Lithium carbonate, polysilicon, and Shanghai silver rose over 1%.