Alibaba FY2026Q2 Earnings Preview: The Great Pivot from E-Commerce Giant to AI Powerhouse

Alibaba's stock has surged over 88% since early 2025, driven by its strategic pivot towards AI. As the FY2026Q2 earnings approach, expectations include low single-digit revenue growth and a significant drop in earnings compared to 2025Q2, due to increased consumer incentives and AI investments. However, cloud revenue is expected to grow nearly 20% YoY. Alibaba's business segments include China E-commerce, International Digital Commerce, Cloud Intelligence, and others, with AI tools and Quick Commerce as key growth drivers.

Authors: Petar Petrov, Viga Liu

Source: TradingView

Overview

Alibaba investors are having a great year. Since the beginning of 2025 BABA’s stock price went up over 88%, and despite retreating from the peak back in October, it is still outperforming the broad US market (S&P 500 12.7% YTD) and the NASDAQ Golden Dragon China Index (17% YTD). The main driving force behind the price surge is the all-in bet on AI, which we can see in the recent company developments, each of them pushing the price of the e-commerce giant higher and higher.

As the 2026Q2 earnings are approaching, let’s take a deep dive into the company's vast business operations, and understand the investment prospects for those owning BABA shares.

What to Expect in 2026Q2

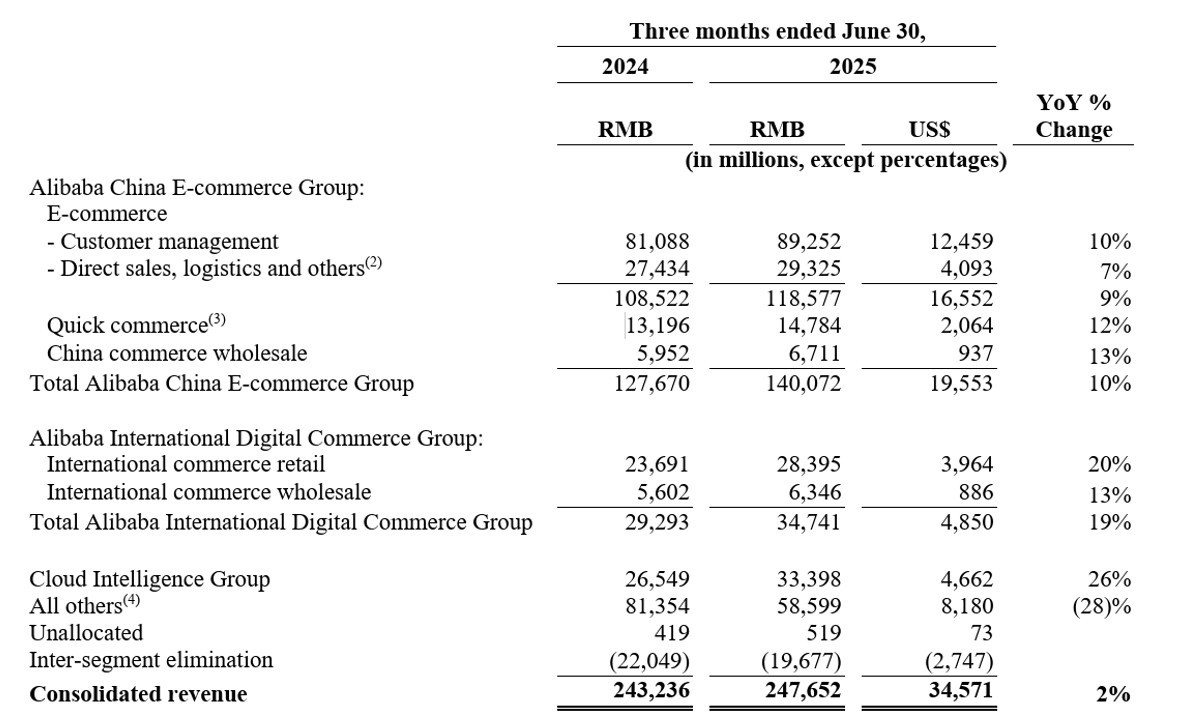

Metric | 2026Q2 Estimate | 2026Q1 Actual | 2025Q2 Actual | YoY Change |

EPADS | USD 0.85 | USD 2.06 | USD 2.15 | -60% |

Revenue | RMB 243.7bn | RMB 247.7bn | RMB 236.5bn | +3% |

Cloud Revenue | RMB 37.8bn | RMB 33.4bn | RMB 29.6bn | +19.6% |

Overall, the market is expecting to see a total revenue growth rate of low single-digit and a significant drop in earnings compared with 2025Q2. This can mainly be attributed to the increased amount of consumer incentives that offset the e-commerce revenue, and the massive investments in infrastructure in AI-tools and Quick Commerce. However, the market is significantly more optimistic about the cloud business, which will likely grow nearly 20% year-over-year, pushed by the increased adoption of AI across the country.

Business Model

Source: Alibaba Webpage

After the recent revenue reclassification, Alibaba reports four business segments:

- Alibaba China E-commerce Group

- Alibaba International Digital Commerce Group

- Cloud Intelligence Group

- All Others

As of 2026Q1, the revenue situation among the segments looks like this:

Source: Company Filings

Alibaba China E-commerce Group

This is the primary revenue driver of Alibaba, representing more than half of the total revenue of the company, and includes the legacy domestic e-commerce business. It consists of three subsegments: E-commerce, Quick Commerce, and China Commerce Wholesale.

E-commerce

The E-commerce subsegment is separated into Customer Management and Direct Sales. Customer Management represents the third-party e-commerce platforms like Taobao, Tmall and Xianyu (second-hand marketplace). The way these platforms generate revenue is mostly through charging merchants for displaying in search results, ads and pages across the website. Alibaba also charges commission take rate on every completed transaction.

On the other hand, we have direct sales, logistics and others. This encompasses mostly Tmall Supermarkets. Unlike in the third-party model where Alibaba does not have ownership of the inventory, in the direct sales business, the company records revenue and cost of goods on a gross basis.

In Q1 the E-commerce business grew 9%. Currently the official estimates imply a growth rate of low-single digit, but the chance for a positive surprise is high. In the past week we saw positive surprises from the direct competitors’ earnings. Pinduduo total sales for the September quarter were +9% year-over-year, while for JD Retail they were up 11%. For Alibaba, specifically, there are several drivers behind the growth in traditional e-commerce:

AI adoption across the board: There is a widespread introduction of AI tools that can help merchants on BABA platform. The more these tools are being adopted, the more positive effect for the e-commerce revenue we will see. For instance, QuanZhanTui (全站推) can automate ad targeting, bidding and optimization across search, feeds and livestreams. Other tools include, but not limited to Zaodian (creating marketing content in the form of images and videos) and Dianxiaomi (shopping assistant, chatbot). These functions are also supported by the Qwen models.

The stage of adoption of these AI tools is still rather early. Also, the more sophisticated these AI tools become, the easier for BABA will be to steal merchants (and users) from its direct competitors.

The main value propositions of the AI tools are 1) more cost savings for merchants; 2) consumers benefitting from better recommendations; and 3) BABA being able to charge higher fees and increase the overall take rate.

Synergies between Quick Commerce and traditional commerce: Another growth driver for BABA e-commerce is the rapid rise of Quick Commerce. For instance, customers who purchases on Ele.me are highly likely to purchase on Taobao too, creating a solid ecosystem effect.

88VIP, the high-spending loyalty user program, also contributes to this synergy. The members who use 88VIP reached 53m last reporting quarter, a double digit growth compared to 2025Q1. It is estimated that 88VIP users spend 20-30% more than ordinary users. Currently, these 53 million 88VIP users are still a small fraction of the billion user base of BABA, and as more ordinary users convert to 88VIP, we will see an improvement of the overall GMV per user, hence higher revenue growth.

Quick Commerce

Aside from Cloud/AI, Quick Commerce is the most important theme for BABA investment thesis. Part of Quick Commerce are Taobao Instant Commerce (淘宝闪购) and Ele.me (饿了么). They originally focus on non-food and food delivery respectively, both within 30-60 minutes of delivery time. Alibaba is currently integrating Ele.me into Taobao Instant Commerce, transforming Ele.me from an independent front-end brand into a backend fulfillment infrastructure, forming a synergistic model of "Taobao front-end traffic acquisition + Ele.me backend fulfillment".

In 2026Q1, the total revenue for Quick Commerce was RMB14.8bn, 12% up year-over-year - a rather modest growth which can be explained by the fact that the subsidies provided are offsetting the revenue (not recorded as an expense). These subsidies include user coupons, merchant incentives and free delivery.

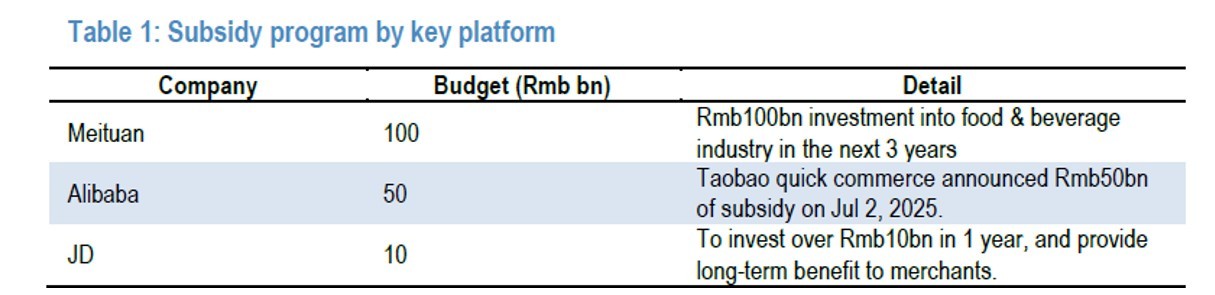

The subsidies are just one part of the RMB 50bn program BABA is planning to spend in Quick Commerce. The rest of this will be allocated towards marketing campaigns for user acquisition, riders’ incentives (reflected in the P/L statement) and investments in lightning warehouses and logistics (Capex).

All these heavy investments reflect the very intense competition between BABA, Meituan and JD. But why is there such intense competition in the first place?

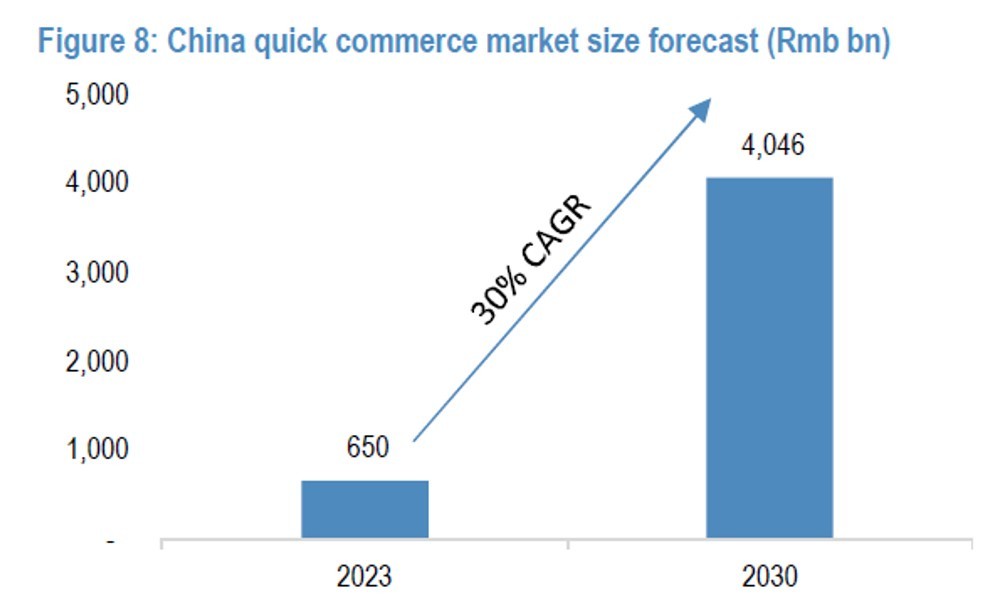

JP Morgan estimates China's quick commerce industry to reach 22% of China retail sales or RMB4 trillion in GMV and RMB81 billion industry profit in 2030. Alibaba’s goal is to grab a huge portion of this. The only way to monetize in this industry is to create an economy of scale with as many users, merchants, riders and orders as possible, and the only way to do this is to provide incentives and lower prices. Alibaba is well-positioned in this battle.

Source: JP Morgan

Firstly, Alibaba is already the largest traditional e-commerce platform with 1 billion users. They can leverage that user base by improving the synergy between Taobao and Tmall on one side, and the quick commerce platforms on the other side. The growing number of premium users with 88VIP membership further improves the users’ stickiness. Also, Quick Commerce can utilize the Cainiao logistics infrastructure, implying that BABA does not need to invest in logistics all from scratch.

Secondly, Alibaba is at the forefront of AI development. A lot of the AI tools and functionalities we discussed in the traditional commerce section will also apply in the Quick Commerce - better customer targeting, better way for merchants to advertise and be visible.

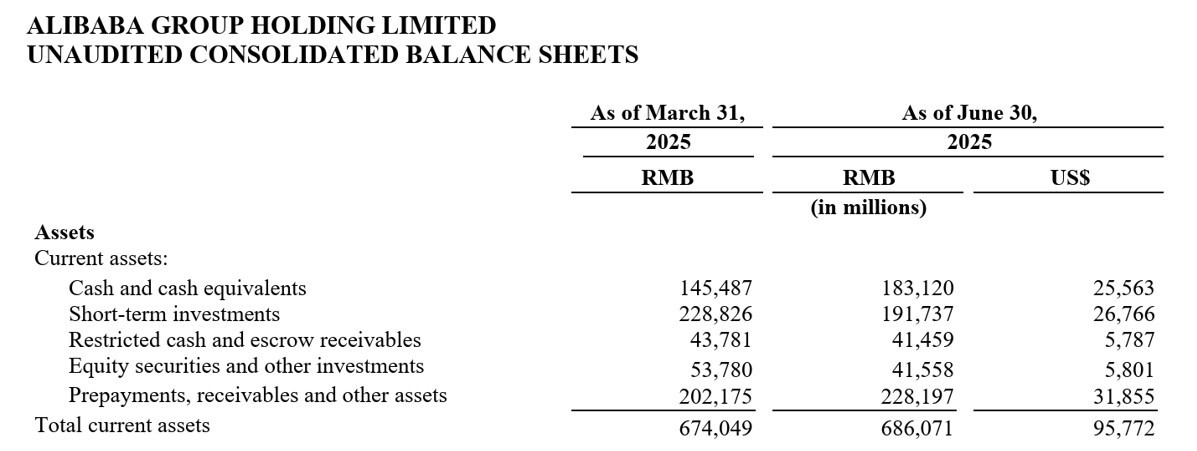

Thirdly, Alibaba has a strong balance sheet and cash flow statement. As of June, BABA has over RMB 450bn in cash, cash equivalents, short-term investment and restricted deposits. For comparison, for the same period, BABA has slightly more than RMB 230bn in bank borrowings, senior notes and convertible bonds, significantly less than the cash position. This creates a solid shield for the company, which can be used in case the competition remains intense for longer.

Source: Company Filings

Competition

It is a well-known fact that competition in quick commerce (food delivery/grocery delivery/non-food goods delivery) is very intense, as players try to grab as much market shares as possible with all these generous incentives and investments. The competition is not to be underestimated. We have Meituan, who is currently the market leader with 50-60% market share, and we also have JD with one of the most established logistics networks.

However, BABA is catching up quickly. Its merchant supply is already around 80% of Meituan, from 50-60% range post-COVID. Also Eleme has 4mn riders vs Meituan’s 7mn.

Player | Food Delivery Arm | Non-Food Delivery Arm | Market Share | Key Strengths |

Meituan | Meituan Waimai | Meituan Instashopping | 60-70% | Well-established dominance in food delivery; Large rider base; Deep penetration; |

Alibaba | Taobao Instant Commerce (Formerly Ele.me) | Taobao Instant Commerce | 20-25% | Biggest traditional e-commerce platform; AI-powered tools; Cainiao logistics network; |

JD.com | JD Food Delivery | JD Now/JD Daojia | 5-10% | Strong logistics advantages; Expertise in premium goods; |

*Market share numbers are more of estimates

All the three players increased their budget for subsidies and investments in 2025. Alibaba’s RMB 50bn is lower than Meituan’s RMB 100bn, but higher than JD’s RMB 10bn.

Source: JP Morgan, Company Filings

China Commerce Wholesale

BABA domestic B2B commerce revenue comes from 1688 primarily. Despite being a small fraction of the total E-commerce revenue, 1688 has very high margins (70-80% EBITDA Margin) mostly because it generates revenue from membership fees and there is no need for the company to spend on marketing and consumer incentives there.

The segment grew +12% in Q1 but the growth in Q2 may slow down due to customers who engage in export may have less business because of the tariffs.

Alibaba International Digital Commerce Group

This segment consists of both retail and wholesale operations outside China, and it includes platforms such as AliExpress (cross-border retail), Trendyol (Turkey), Lazada (Southeast Asia) and Daraz (South Asia). As we can see, a large portion of the revenue from overseas is from regions where e-commerce is at a much less mature stage, hence the growth rates are higher.

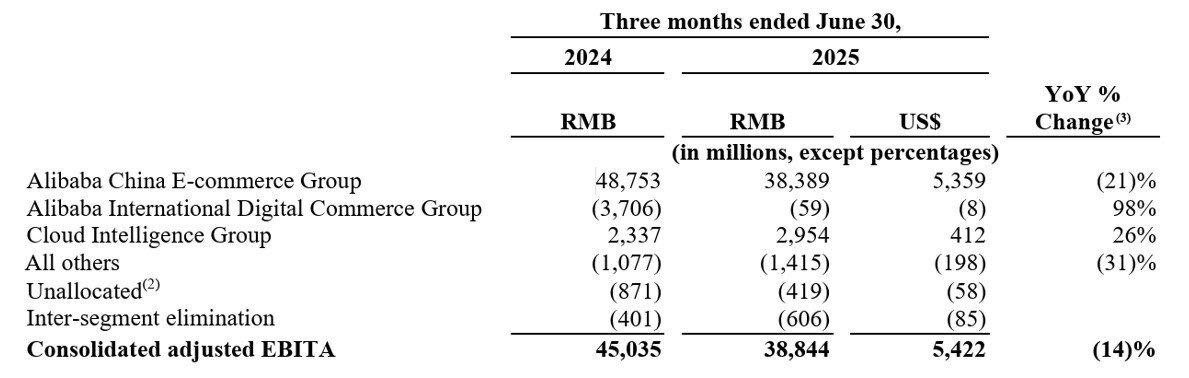

However, this comes with a downside too. Overseas e-commerce expansion requires intense investments in infrastructure, and that’s why the segment hasn’t breakeven yet. In fact, in 2026 Q1 the EBITA of the segment was just negative RMB 59 million,a significant improvement from negative RMB 3.7bn in 2025Q1.

In terms of outlook, we expect the double-digit growth rate to be maintained in Q2 driven by platform expansion. Also, the e-commerce-related AI tools discussed above will be a tailwind. For instance, automated sourcing, translation, and compliance for cross-border merchants will help merchants and will drive both GMV and Revenue. In terms of profitability, in Q2 we might see a positive EBITA, but in the short-run it will take a while before we see a significant ramp up in profit, mostly due to continuous investments.

Alibaba Cloud Intelligence Group

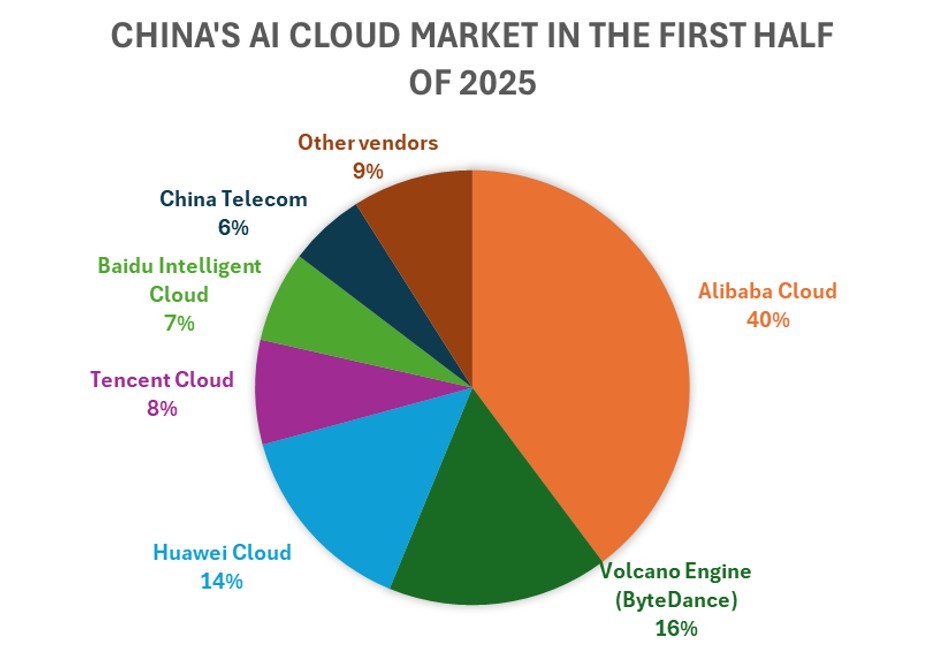

Alibaba Cloud and its AI business have demonstrated significant acceleration over the past year. Cloud revenue growth has reached its highest point in nearly three years, while the strategic focus has expanded from enterprise-level services to simultaneous advancement across both B2B and B2C segments. According to Omdia data, Alibaba held a 35.8% market share in China's AI cloud market in the first half of 2025, exceeding the combined share of the second through fourth-ranked competitors, establishing a formidable moat in the enterprise AI application sector.

Source: Omdia, TradingKey

The industry growth outlook warrants close attention. Omdia forecasts China's AI cloud market will reach 51.8 billion yuan in 2025, more than doubling from 20.8 billion yuan in 2024. By 2030, the overall market is projected to expand to 193 billion yuan, representing a compound annual growth rate of 26.8%. The Model-as-a-Service (MaaS) segment shows particularly exceptional growth, with projected compound growth rates exceeding 72%, making it the most elastic segment in the industry chain. Alibaba Cloud has continuously increased investment in full-stack capabilities and MaaS platform deployment in recent years, currently possessing the industrial conditions to benefit as a priority player.

Full-Stack Integration

Alibaba Cloud's acceleration logic in this cycle is rooted in its comprehensive integration from computing power and cloud platforms to large language models and application layers. This full-stack capability can be understood as achieving vertical integration of AWS and OpenAI's technology systems within a single enterprise. On the computing power front, Alibaba has gradually developed differentiation through self-developed chips from its Pingtou Ge semiconductor division, with notable improvements in both AI inference and general computing performance. The Bailian MaaS platform at the middle layer currently integrates over 100 mainstream large language model APIs, with Tongyi Qianwen, Llama, ChatGLM and others available on the platform, supporting rapid enterprise customization, experimentation and application deployment.

The Tongyi Qianwen (Qwen) model series serves as the fulcrum of this ecosystem. From a technical metrics perspective, Qwen 2.5 through the latest Max version have approached or surpassed GPT-4o and Llama 3.1 performance in multiple benchmarks. More critically, the open-source ecosystem has expanded rapidly—as of September, over 140,000 derivative models based on Qwen existed on Hugging Face, ranking first globally. This open-source strategy has lowered enterprise adoption barriers and accelerated model deployment velocity in vertical industries. From a commercialization pathway perspective, this capability set has demonstrated initial validation of effectiveness and ROI in certain enterprise scenarios.

Cloud International Expansion

Overseas expansion has been a key focus in the second half of this year. Alibaba Cloud currently covers 29 regions and 91 availability zones, with 8 new data centers added in 2025, including previously uncovered markets like Brazil, France, and the Netherlands. Plans call for expansion to 30 regions and 95 availability zones in the second half.

This expansion wave exhibits two characteristics: first, filling coverage gaps in South America and Western Europe, a necessary move to benchmark against AWS and Azure; second, configuring dedicated computing resources for key industries like intelligent manufacturing and cross-border e-commerce. From customer validation perspective, AstraZeneca's use of Alibaba Cloud's European nodes for drug discovery AI platforms resulted in over 3x efficiency improvements—such cases carry strong persuasive power for enterprise markets. However, international expansion also introduces new challenges, including significant variations in local compliance requirements and time needed to build local operational teams.

Consumer Market Push

On November 16, Alibaba officially launched the Qwen App public beta, marking a milestone in Alibaba's extension from B2B to B2C. Qwen's predecessor was the Tongyi Qianwen app launched in September 2023. In late 2024, Alibaba transferred the product team from Alibaba Cloud to the Intelligent Information Business Group, placing it at the same organizational level as Quark—this structural adjustment already signaled the consumer market push.

On one hand, consumer market data feedback is crucial for model iteration; even solely to maintain B2B technical leadership, sufficient user volume and usage scenarios on the consumer side are necessary. On the other hand, according to Sullivan data for the first half of 2025, Alibaba's Tongyi accounted for 17.7% of daily model API calls in China, ranking first, followed by ByteDance's Doubao at 14.1% and DeepSeek at 10.3%. With this foundation established, the timing for launching consumer services has matured.

The Qwen App is positioned as an AI assistant that can handle tasks, not merely conversation—it aims to integrate office, mapping, health, shopping and other daily life scenarios, targeting to become a super portal for the AI era. On the technical level, Qwen is based on the Qwen3 model, supporting 119 languages and dialects, integrating image generation, AI photo editing, real-time translation, voice calling and other functions. Market response has been strong—on the second day after launch, it reached fourth place on the Hong Kong App Store free charts and fifth in mainland China.

Alibaba CEO Eddie Wu has given the AI+Cloud segment top-level strategic positioning, viewing it as the most promising track in the technology field for the next decade. The group currently maintains sustained investment in both major consumer and AI cloud initiatives, with business priorities gradually shifting from a singular enterprise market focus toward coordinated advancement across both enterprise and consumer segments. Within this, the enterprise AI segment follows a relatively stable commercialization path with high revenue visibility; the launch of the consumer-facing Qwen App opens new spaces for future product ecosystem development and large-scale applications.

In the near term, the entire segment will continue facing profit pressure due to high-intensity capital expenditures. Overseas expansion presents practical challenges around compliance and local team building. The consumer market remains intensely competitive, and Qwen's subsequent user stickiness and actual conversion rates require further observation. Overall, Alibaba's strategic direction has become relatively clear, with the advancement pace of core businesses and new products remaining generally steady. As technical capabilities continue improving and ecosystem deployment progressively unfolds, future growth potential remains worth anticipating—key milestones still require monitoring actual implementation results and market feedback.

All Others

Here is where the rest of the business ventures of Alibaba are piled in. Among the more prominent business here are Cainiao (logistics), Freshippo (盒马) (offiline retail), Alibaba Health and Amap. Some of these businesses are profitable (like Alibaba Health and Amap) but some are still loss-making (Freshippo and Cainiao).

We expect to see a negative growth in Q2 mostly from the disposal of Sun Art, and that will also be the case up until 2027Q1. Profitability will also be on the negative side simply because many of the businesses are not in a mature stage and require a significant amount of investments to scale up (Freshippo). However, these losses will partially be offset by AI efficiencies from Amap and media.

Source: Company Filings

Simply speaking, Alibaba business model can be described as traditional e-commerce being the major cash cow financing the other fast growing businesses, and we can see this from the Adjusted EBITDA numbers from Q1, where China E-commerce Group represents almost all the profit, followed by the cloud business.

This status quo won’t change anytime soon. However, in 2026Q1 we saw a 21% drop in Adjusted EBITA of China E-commerce Group, which was mostly because of investments within the Quick Commerce business. 2026Q2 may present the peak of this cash burn cycle, thus we expect significantly lower-than-usual EBITA and margin.

The drop in margin is more of a short-term phenomenon rather than a structural issue, as we expect to see the AI implementation and the loss-cutting in Quick Commerce as the main tailwinds for the Adjusted EBITA, Net Profit and EPADS to go up.

Narrative Just As Important

A big factor for the future direction of the BABA stock, especially at the earnings, will be closely tied to the general narrative.

Investors will closely scrutinize any information with regards to competition, price wars, and the general consumer sentiment.

A potential negative connotation related to these factors may impact the stock movement in the short term, but in the long term, it is the strong fundamentals that will differentiate BABA from the competition.

Risks

Risks can come from several directions.

Firstly, we have competition risks. The intense competition among players in both e-commerce and quick commerce brings a degree of uncertainty. As mentioned before, BABA has the tools to dominate in the future, but other companies have their own advantages too.

Secondly, BABA is in a delicate position, where it has to keep a balance between not overspending and not underspending on growth (whether it be AI tools or subsidies). If BABA overspends, it can strain the balance sheet and suppress margins, but if they underspend, then they may lose market share to the competition.

Thirdly, as a truly global e-commerce player, Alibaba also faces regulatory risks from various parts of the world, especially in the context of geopolitical uncertainty. We saw this with Pinduoduo in America. Risks may be either in the form of tariffs, trade restrictions or even bans. In addition to that, as global e-commerce become increasingly significant part of the Alibaba’s business operations, the company will also be more prone to forex risks.

Find out more