NVIDIA's earnings report ignites a frenzy in AI stocks, "breather rebound" or "valuation reset"?

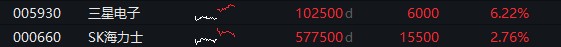

NVIDIA's supplier stock prices soared, with major stock indices in Japan, South Korea, and Taiwan all rising by more than 2.5%. Samsung Electronics surged by 6%, and Taiwan Semiconductor also rose by 4.7%. However, some analysts warn that this increase should not be misinterpreted as a complete elimination of valuation concerns. "Deeper issues remain, such as whether tech giants can effectively monetize their massive AI capital expenditures and how long debt-driven spending can last."

NVIDIA's strong earnings outlook has temporarily dispelled market concerns about a bubble in the artificial intelligence industry, igniting a frenzy of AI concept stocks globally. However, doubts regarding overvaluation and the sustainability of investments still loom over investors.

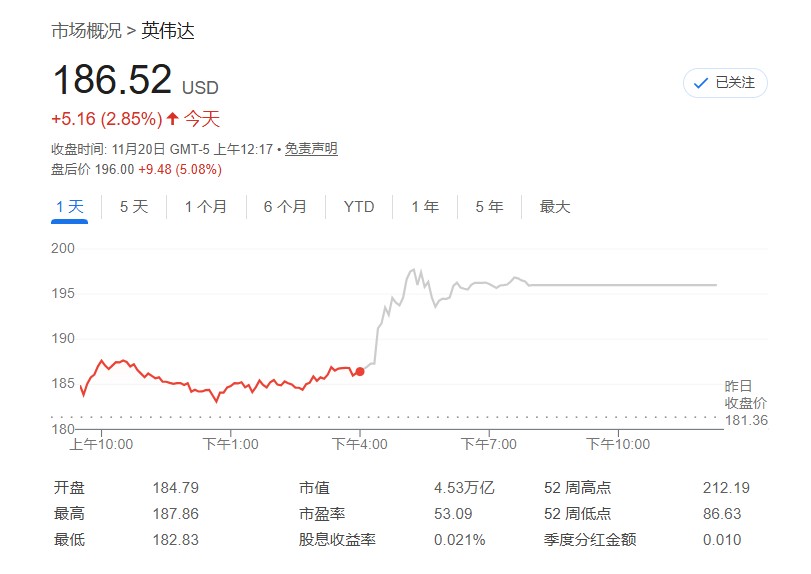

After the release of this highly anticipated financial report, the market breathed a sigh of relief. This American tech giant provided a robust revenue forecast and directly countered the view that the AI industry is in a bubble. Boosted by this, NVIDIA's stock price rose more than 5% in after-hours trading, and S&P 500 futures increased by 1.3% during the Asian session.

Optimism quickly spread to global markets, especially in Asia. Driven by NVIDIA's suppliers, benchmark stock indices in South Korea, Taiwan, and Japan all rose by more than 2.5%, indicating a restoration of market confidence in the AI industry chain.

Specifically, NVIDIA's Japanese chip equipment suppliers, including Tokyo Electron, Advantest, and Lasertec, all saw significant rebounds. South Korean memory chip manufacturers SK Hynix and Samsung Electronics both rose, with Samsung Electronics surging 6%. Taiwan Semiconductor also jumped 4.7%, propelling the Taiwan Weighted Index to its largest single-day gain since April 23.

Gary Tan, a portfolio manager at Allspring Global Investments, stated that NVIDIA's performance indicates that "the momentum of AI infrastructure spending remains strong," providing clear guidance for investors assessing "whether to continue holding exposure to AI infrastructure next year."

"Breather Bounce" or "Valuation Reset"?

Despite the generally optimistic market sentiment, some strategists warn against misinterpreting this rise as a complete elimination of valuation concerns.

"I think this is more of a 'breather bounce' rather than a full reset of valuation worries," said Dilin Wu, a strategist at Pepperstone Group. "NVIDIA delivered the performance the market expected, but deeper issues remain, such as whether tech giants can effectively monetize their massive AI capital expenditures and how long debt-driven spending can last."

This cautious perspective suggests that while NVIDIA's financial report provides a reason to buy and spreads positive sentiment to other AI-related sectors, fundamental concerns in the market still persist

Focus Shifts to Macroeconomics and New Supply Chains

Beyond the noise of earnings season, macroeconomic factors are once again becoming the focus of investors. Due to the uncertain outlook for the labor market, market bets on a Federal Reserve interest rate cut are weakening.

"The current market is more about alleviating concerns rather than seeking new positive factors," noted Vey-Sern Ling, Managing Director at Union Bancaire Privée. "The next focus will be on the Federal Reserve's interest rate outlook."

Meanwhile, some analysts see new investment clues from NVIDIA's performance. Tan from Allspring pointed out that the earnings results indicate, "the industry bottleneck is shifting from chip supply to power, cooling systems, and heavy equipment." He believes, "this shift may present opportunities for traditional industrial suppliers, with suppliers in South Korea and China particularly well-positioned."