Why did U.S. stocks experience a massive drop overnight? Goldman Sachs provides nine reasons

Goldman Sachs analysis pointed out that this is not due to a single factor, but a storm triggered by nine major "causes," including the "good news fully priced in" for NVIDIA, concerns over private credit, the collapse of cryptocurrencies, and key technical pressures such as systematic selling by CTA funds and market liquidity depletion. Against the backdrop of extremely fragile market sentiment, investors are preparing for the largest-ever November options expiration

A celebration that should have been ignited by impressive financial reports and ideal data unexpectedly turned into a brutal sell-off. Overnight, the U.S. stock market experienced the most dramatic intraday reversal in months, catching investors off guard.

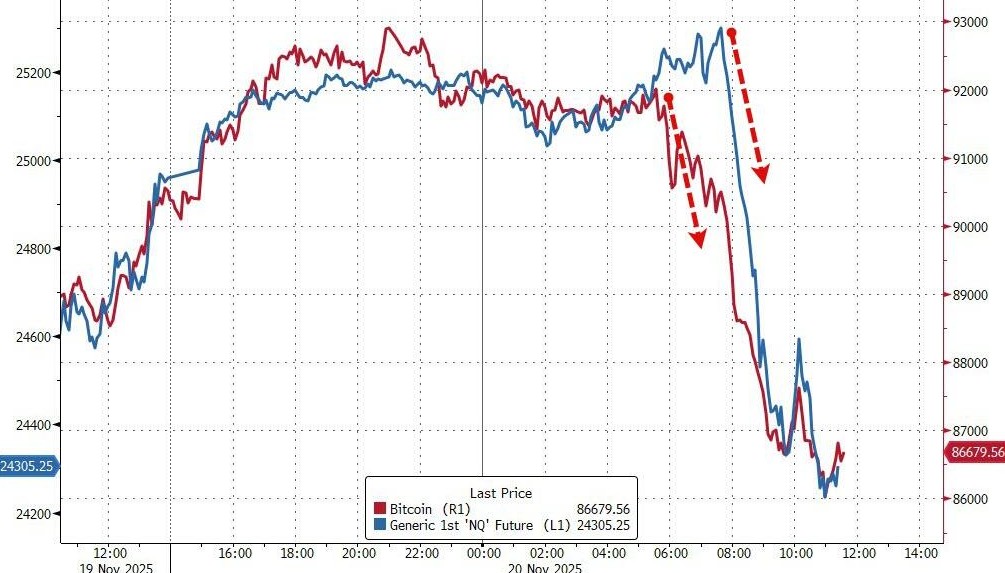

On Thursday, buoyed by the chip giant NVIDIA's better-than-expected earnings report and a "Goldilocks" non-farm payroll report, U.S. stocks opened significantly higher. The S&P 500 index surged 1.9% within the first hour of trading; however, the optimistic sentiment did not last. The market took a sudden turn, with the index reversing direction and ultimately closing down 1.5%, erasing over $2 trillion in market value from the intraday high to the low. NVIDIA's stock price fell from a peak increase of over 5% to a closing decline, while Bitcoin dropped below $90,000, putting pressure on risk assets across the board.

This marked the largest single-day intraday volatility since the turmoil in the U.S. stock market in April, with the fear index VIX briefly soaring above 26. The sudden plunge left traders bewildered, with the market filled with various explanations, ranging from doubts about the Federal Reserve's interest rate cut prospects to concerns about private credit risks.

However, according to Goldman Sachs, a single catalyst is not enough to explain this dramatic reversal. Goldman partner John Flood bluntly stated in a report to clients: "The market is currently battered." He pointed out that investors have fully entered "profit and loss protection mode," overly focused on hedging against crowded market risks.

He believes that NVIDIA's strong earnings report did not serve as the "all-clear signal" for risk appetite that traders expected; instead, it prompted them to seek hedges to guard against further losses.

Nine Causes: A Comprehensive Review by Goldman Traders

Regarding why the market reversed sharply, Goldman traders pointed out nine interconnected factors in a report, which together formed the backdrop for this sell-off.

- NVIDIA's "Good News Fully Priced In": Despite the earnings report exceeding expectations, NVIDIA's stock opened high but closed down 3%, failing to play the role of a "clear bullish signal" as the market had hoped. Top Goldman trader John Flood commented, "When real good news goes unrewarded, it’s usually a bad sign."

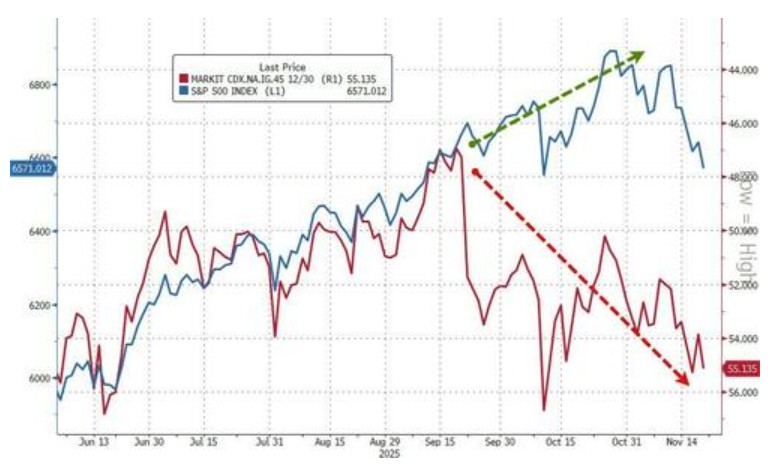

- Concerns Over Private Credit: Federal Reserve Governor Lisa Cook publicly warned of "potential asset valuation vulnerabilities" in the private credit sector and the risks that its complex connections to the financial system could pose, raising market vigilance. Overnight, the credit market deteriorated, with spreads on investment-grade and high-yield bonds widening.

- Employment data fails to provide clarity: The September non-farm payroll report, while overall robust, did not provide a clear direction for the Federal Reserve's interest rate decision in December, with the probability of a rate cut only slightly rising to 35%.

- Cryptocurrency crash: Bitcoin has fallen below the psychological threshold of $90,000, triggering a broader sell-off of risk assets.

-

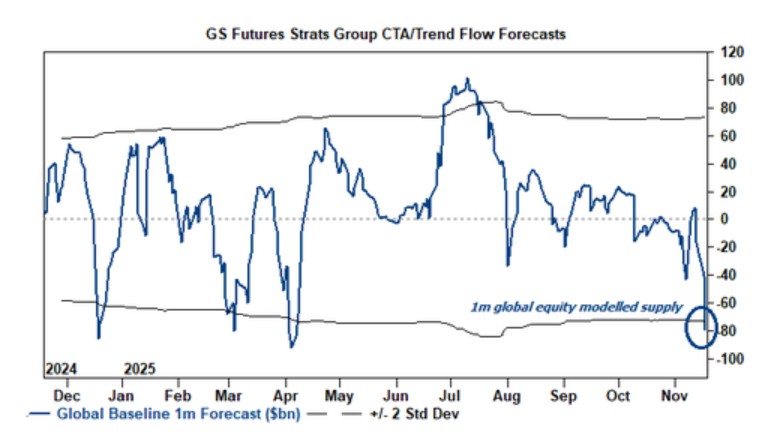

Accelerated CTA selling: Commodity Trading Advisor (CTA) funds were already in an extremely long position, and as the market broke below short-term technical thresholds, their selling began to accelerate. The market is closely watching the mid-term key level of 6456 points, where most of the selling pressure is concentrated.

-

Shorts re-entering the market: As market momentum reverses, short positions are becoming active again.

-

Poor performance in overseas markets: The weak performance of key tech stocks in Asia, such as SK Hynix and SoftBank, has failed to provide a positive external environment for U.S. stocks.

-

Market liquidity drying up: Market depth has significantly deteriorated. According to Goldman Sachs data, the liquidity of top buy and sell orders for the S&P 500 index has dropped to about $5 million, far below the average level of about $11 million this year, making the market more susceptible to the impact of large trades.

-

Macro trading dominates the market: The trading volume of exchange-traded funds (ETFs) has surged to account for 41% of the total market volume, well above the year-to-date average of 28%, indicating that market trading is driven more by macro factors rather than individual stock fundamentals.

Technical alerts: Liquidity exhaustion and CTA selling pressure

In addition to the nine factors mentioned above, Goldman Sachs' technical analysis further reveals the fragile technical structure of the market, which is a key reason for the amplified downward trend.

First is the systematic selling pressure from Commodity Trading Advisor (CTA) funds. According to Goldman Sachs' model predictions, regardless of how the market evolves in the coming week, CTA funds will be net sellers. Traders are closely monitoring the mid-term key level of 6457 points for the S&P 500 index; a break below this level could trigger larger-scale programmatic selling.

Secondly, there is a severe lack of liquidity. The liquidity of top buy and sell orders for the S&P 500 index has dropped to around $6 million, placing it below the 20th percentile of the past year. This "zero liquidity" state means the market's ability to absorb sell orders is extremely poor, and even small-scale sell-offs could lead to significant price fluctuations Finally, the surge in ETF trading volume has also raised a red flag. When the market declines, the proportion of ETF trading volume rises to 40%, which usually indicates that passive and macro-driven funds are dominating the market, exacerbating the overall downward momentum.

Market Sentiment Weak: A Complete Collapse from Large Tech Stocks to Cryptocurrencies

Thursday's market clearly demonstrated the extreme fragility of market sentiment, with the sell-off rapidly spreading from one asset class to another.

Large tech stocks were hit hardest. Thanks to NVIDIA's earnings report, U.S. tech giants—the "Mag7"—initially surged at the open, but as the European market approached closing, selling began, ultimately performing in line with the broader market's decline, showcasing a typical "rise then fall" scenario.

Meanwhile, "Meme stocks" and high-momentum stocks favored by retail investors suffered heavy losses, with related portfolios recording their worst single-day performance since the "Tariff Liberation Day Crash."

All major U.S. stock indices, after breaking through the 50-day moving average at the open, are currently testing (or falling below) the 100-day moving average.

More notably, the collapse of the cryptocurrency market seems to have preceded the stock market. According to Bloomberg data, Bitcoin was heavily sold off after breaking below the psychological threshold of $90,000, with its decline leading the sharp drop in U.S. stocks, suggesting that the transmission chain of risk sentiment may have begun in this high-risk area.

Massive Options Expiration Approaches, Market on High Alert

The complexity of the market is further exacerbated by the upcoming massive options expiration. Goldman Sachs predicts that this Friday will see the largest November options expiration in history, with an estimated $3.1 trillion in nominal value of options expiring, including $1.7 trillion in SPX index options and $725 billion in individual stock options

Large options expirations often bring market volatility and may have a "gravitational" effect on the prices of underlying assets. From the perspective of capital flows, the market's defensive mentality is also confirmed. According to data from Goldman Sachs' trading platform, long-only funds (LOs) tended to sell throughout the day, while hedge funds (HFs) shifted from a net buying position of 10% at the opening to a net selling position by the close, indicating a rapid turn of smart money during the day.

For investors, this sharp intraday reversal serves as a stern reminder: in a market with a fragile technical structure and tense investor sentiment, mere positive fundamentals may not be sufficient to support a sustained price increase. In the coming days, the market will closely monitor the movements of CTAs, the impact of options expirations, and whether liquidity conditions will further deteriorate