September non-farm payrolls increase uncertainty, JPMorgan Chase: The Federal Reserve will "skip" interest rate cuts next month, restarting in January and May next year

JPMorgan Chase has become the second major Wall Street investment bank to withdraw its prediction of a Federal Reserve rate cut in December, believing that the September non-farm payrolls increased by 119,000, reaching a record high, but the unemployment rate rose to 4.44%. The data presents conflicting signals, and it is expected that the Federal Reserve will maintain interest rates in December, delaying rate cuts until January and May 2026. The bank's chief economist believes that the mixed report will trigger intense debates within the FOMC, and the decision in December will be extremely close, with the possibility of committee members voting against either a pause or a continuation of rate cuts

Following Morgan Stanley, JPMorgan Chase has become the second major Wall Street investment bank to withdraw its prediction of a Federal Reserve interest rate cut in December, believing that the Fed will choose to pause rate cuts due to mixed signals from employment data, maintaining expectations for rate cuts in January and May next year.

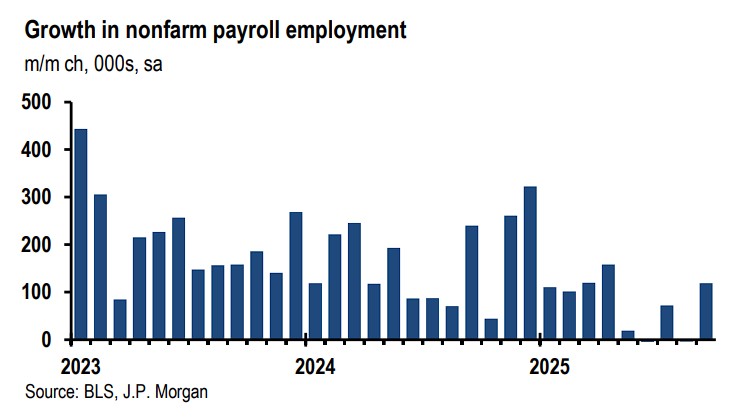

In its latest research report, JPMorgan Chase pointed out that non-farm employment increased by 119,000 in September, the highest since April, and the employment diffusion index surged to 55.6%, the highest level since February. However, the unemployment rate simultaneously rose by 12 basis points to 4.44%, presenting contradictory signals.

Therefore, the bank expects the Fed to choose to keep the current interest rate unchanged in the upcoming meeting, but the process of rate cuts has not completely stopped; instead, it has been postponed to January and May 2026.

The bank's chief economist, Michael Feroli, stated that this "tailored" mixed report will spark intense debate at the next Federal Open Market Committee (FOMC) meeting, with the decision outcome being extremely close, and multiple committee members may vote against either pausing or continuing rate cuts.

JPMorgan Chase believes that Fed Chairman Jerome Powell and the meeting minutes have previously hinted that the committee is looking for reasons to slow down the pace of rate cuts, and the September employment report just provides this opportunity.

Employment Data Presents Contradictory Signals

The report states that the core contradiction in the September non-farm employment report lies in the divergence between quantity and quality.

The business survey shows that non-farm employment increased by 119,000, marking the strongest growth since April. More encouragingly, the previously concerning downward trend in the breadth of employment growth has reversed, with the employment diffusion index jumping from last month's low to 55.6%.

However, the household survey data paints a more cautious picture. The unemployment rate continues to climb, rising by 12 basis points to 4.44% in September, extending the upward trend seen this year. This increase is partially offset by a rise in the labor force participation rate to 62.4%, and the employment-population ratio also increased by 0.1 percentage points to 59.7%.

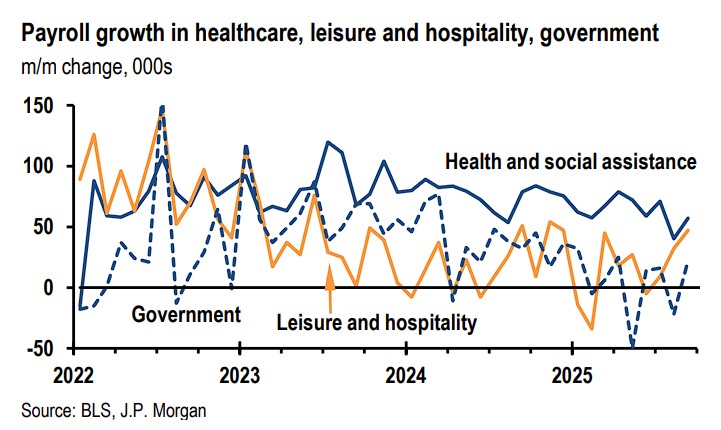

By industry, government employment increased by 22,000, all from state and local governments. In the private sector, construction added 19,000 jobs, the highest in a year; healthcare added 43,000 jobs; and leisure and hospitality added 47,000 jobs, mainly concentrated in food services. Factory employment decreased by 6,000, continuing its decline since April.

Wage data also releases mixed signals. Average hourly earnings increased by 0.2% month-on-month in September, slightly below expectations, but after upward revision, the year-on-year increase was 3.8%, slightly above expectations. The year-on-year growth rate of wages for production and non-supervisory employees was also 3.8%. The average workweek remained unchanged at 34.2 hours It is worth noting that the completion rate of this data collection has jumped to 80.2%, the highest monthly level since the end of 2019. JP Morgan believes this indicates that the additional preparation time has been effectively utilized, increasing the credibility of the preliminary data and reducing the likelihood of significant downward revisions in the future.

Adjusting Federal Reserve Rate Cut Expectations: Pause in December, Cuts in January and May Next Year

JP Morgan admits that the decision at next month's Federal Reserve meeting is "extremely close," making it harder to judge than in September of last year. The report provides ample debate material for both hawks and doves, and regardless of the final decision, it is possible that multiple committee members may vote against it.

The bank believes that Powell and the minutes have previously hinted that the committee wishes to slow the pace of rate cuts, and the September employment report provides a rationale for pausing rate cuts. However, JP Morgan also cautions that it may have underestimated the political factors in the decision-making process and that its judgment may overly rely on the comments of hawkish non-voting members.

The report states that according to the revised forecast path, the Federal Reserve will pause rate cuts in December, followed by cuts in January and May next year, and then enter a wait-and-see period.

JP Morgan indicated that it will closely monitor the statements of voting committee members before the quiet period, and does not rule out the possibility that the final decision may have to wait until the first day of the meeting when the Job Openings and Labor Turnover Survey (JOLTS) report is released