Company Encyclopedia

View More

US Infrastructure

CP00014.US

News

View More

Posts

View More

$Caterpillar(CAT.US) - TRUMP: CATERPILLAR HAS BEEN INCREDIBLE

*EU TO WARN LUTNICK AGAINST EXPANDING SCOPE OF US STEEL TARIFFS

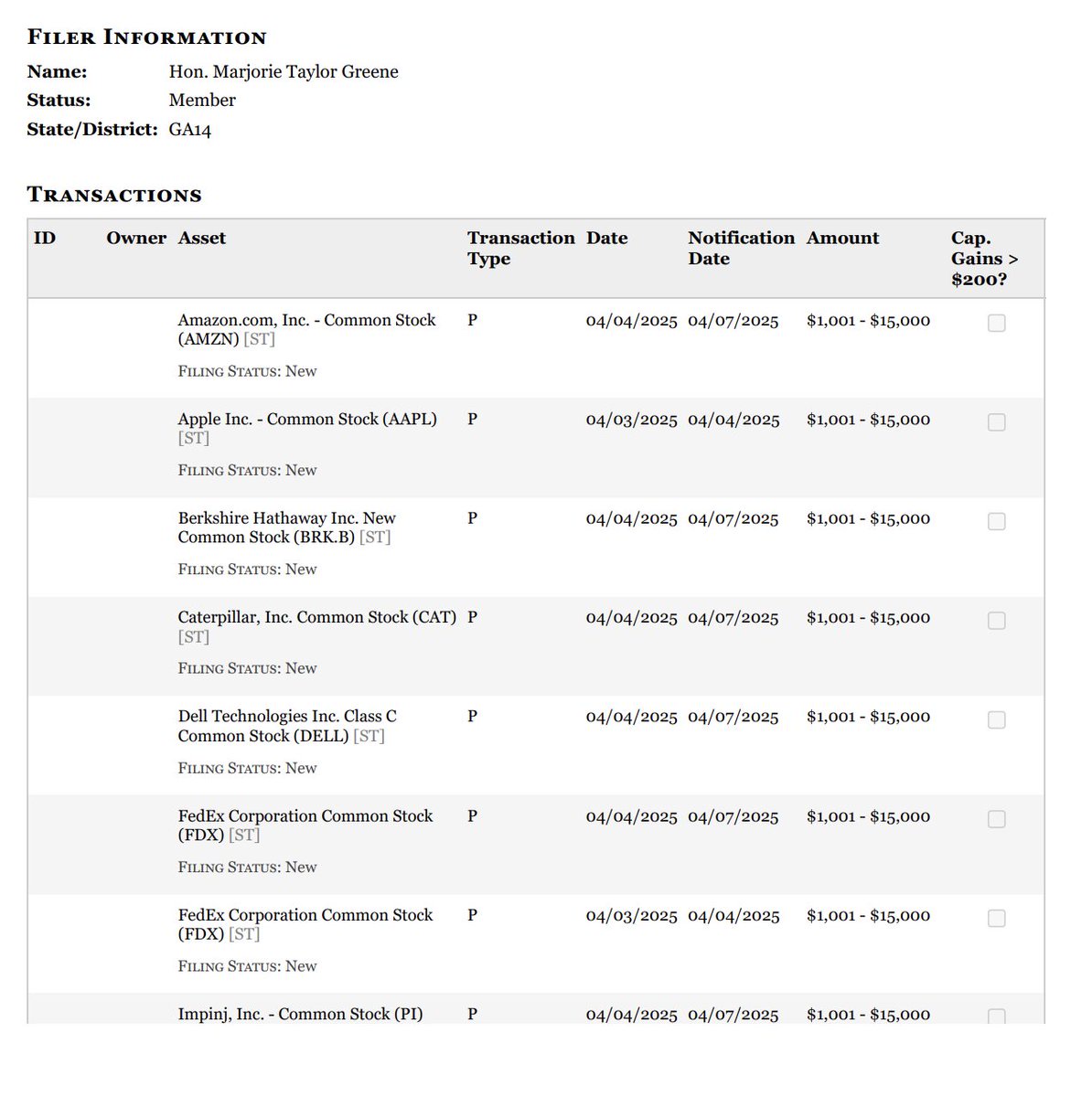

Breaking 🚨: Marjorie Taylor Greene is buying the dip, again

She just disclosed up to $275K of new stock buysIncluding $RH(RH.US), $Nike(NKE.US), $CrowdStrike(CRWD.US), $Apple(AAPL.US), $Caterpillar(CA.........Biden Administration Reportedly Delays New Nippon Steel Acquisition Ban, US Steel Stock Price Hits Nearly One-Month High

On Monday, US Steel's stock price hit a nearly one-month high, rising over 6% to...............