Company Encyclopedia

View More

Beer

CP20003.HK

News

View More

Posts

View More

A good company also needs a good price.

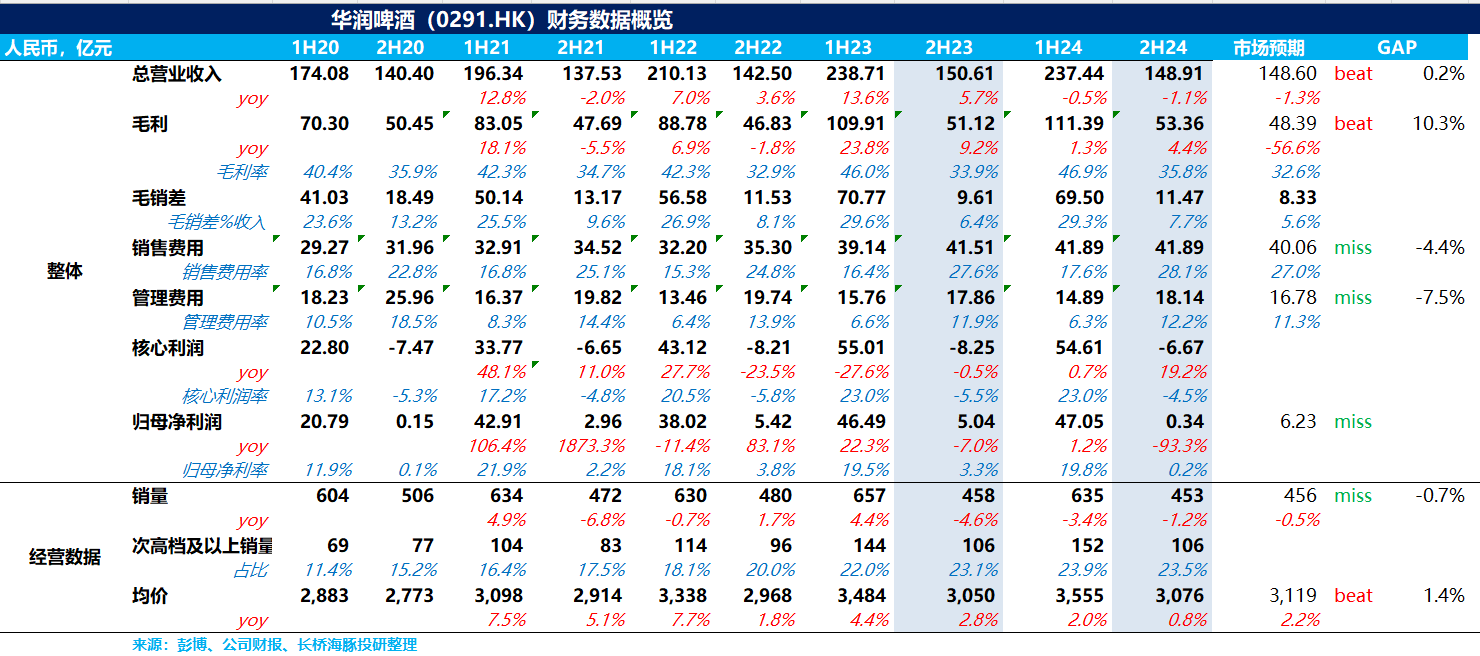

$CHINA RES BEER(00291.HK) Overall, China Resources Beer's performance in 24H2 is in line with expectations under low forecasts. Although the story of premiumization driving ton price increases is stil...

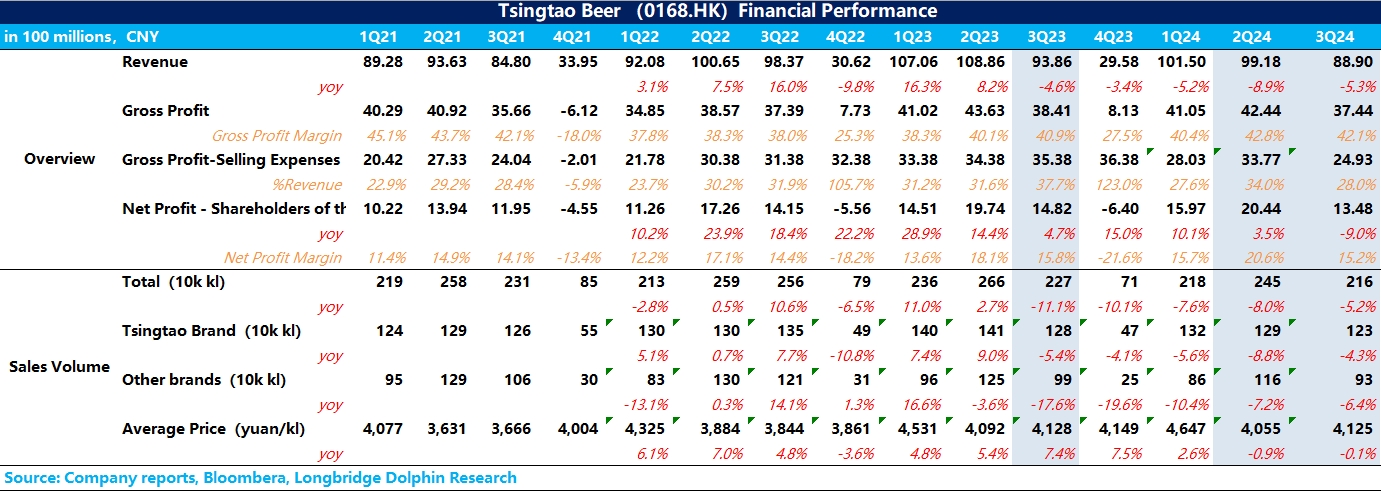

$TSINGTAO BREW(00168.HK) First take: Due to the continued weak macro environment, Tsingtao Brewery's Q3 report still showed declines in both volume and price, but there was some improvement compared t...