Company Encyclopedia

View More

Lasertec Corporation

LSRCY.US

Lasertec Corporation engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally. The company offers semiconductor related products, which includes mask related systems for extreme ultraviolet and deep ultraviolet solutions, and wafers inspection and review systems; and FPD photomask inspection systems. It also provides laser microscopes, electro-chemical reaction visualizing confocal, and coating thickness scanning system; and in-situ observation at ultra high temperature confocal scanning laser microscope. The company was formerly known as NJS Corporation and changed its name to Lasertec Corporation in 1986.

1.173 T

LSRCY.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

Samsung actively localizing their mask blank supply chain, as they aim to reduce reliance on Japan's #Hoya ($7741)

Korea's S&S Tech ($101490) is poised to be a big winner here, and likely has the knowl............Idea Generation Hack.

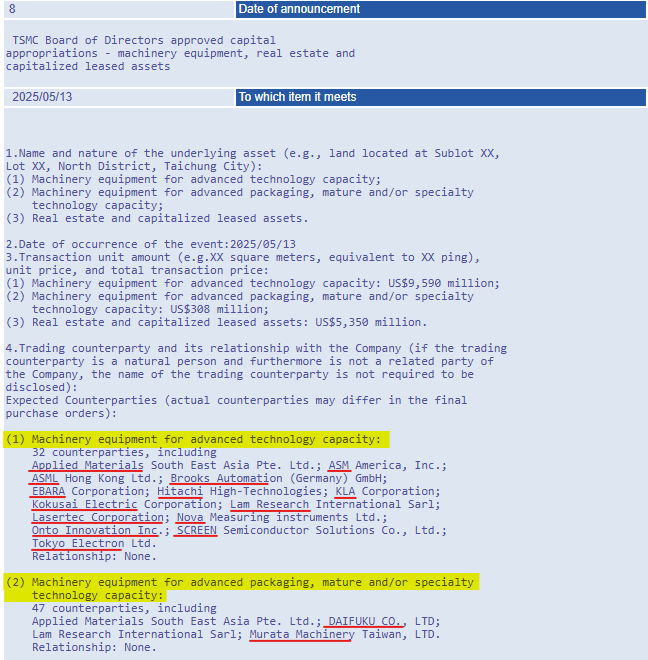

$Taiwan Semiconductor(TSM.US) discloses major equipment vendors a few times a year. This is a great way to identify key enabling companies and generate new investment ideas. The f...........................