Company Encyclopedia

View More

Tokyo Electron

TOELY.US

Tokyo Electron Limited, together with its subsidiaries, develops, manufactures, and sells semiconductor and flat panel display (FPD) production equipment in Japan, Europe, North America, Taiwan, China, South Korea, Southeast Asia, and internationally. The company offers coaters/developers, etch systems, surface preparation systems, deposition systems, test systems, wafer bonders/debonders, wafer edge trimming, SiC epitaxial CVD systems, gas cluster ion beam system, and cleaning systems. It also provides plasma etch/ash systems for use in the manufacture of FPDs, as well as inkjet printing systems for manufacturing OLED displays. In addition, the company offers delivery, facility management, and non-life insurance services; sells semiconductor products, board computer products, software, and other electronic components; sells and supports network/storage/middleware related solutions; and develops, manufactures, and sells magnetic annealing systems.

1.191 T

TOELY.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

TSMC 2nm secrets leak: Tokyo Electron said it has found no evidence of any leak of confidential TSMC information to a 3rd party, nor any directive to its (former) employee implicated in the leak to ga.........

Tokyo Electron (TEL), Japan's biggest chip equipment vendor, has fired one employee over alleged trade secret theft at customer TSMC, and said it is fully cooperating with the investigation, Nikkei As.........

TSMC 2nm trade secret theft: Shares of Japan chip equipment giant Tokyo Electron were down 3.6% in early trade on reports some TSMC employees left for Tokyo Electron to leak 2nm trade secrets meant to.........

Tokyo Electron 2Q25

- WFE underperformance play- Unlike Lam, TEL is bit cautious on WFE investment with Intel/Samsung capex cuts, cautious NAND spent, China scale back, DDR5 transition delay, HBM inves......Tokyo Electron has $110B WFE forecast for CY25 (flat y/y) and DD% growth for CY26.

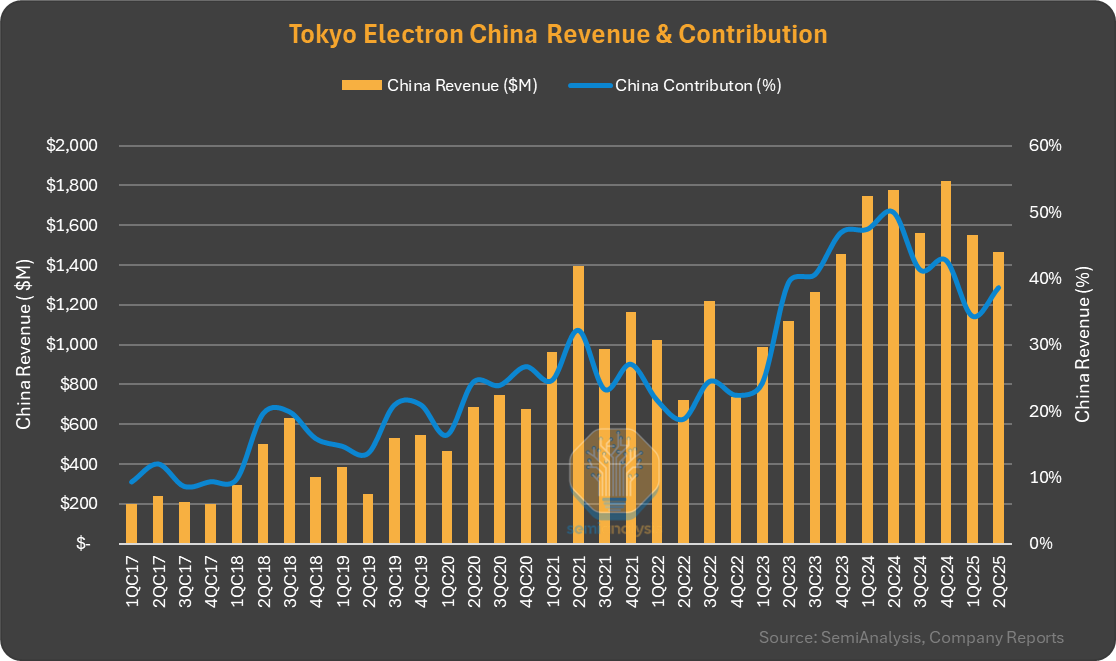

CY24 WFE proportion: adv. logic 20%; DRAM 17%; NAND 5%; China: 45%; Others: 13%CY25: adv. logic 20%; DRAM 20%; NAND 10......